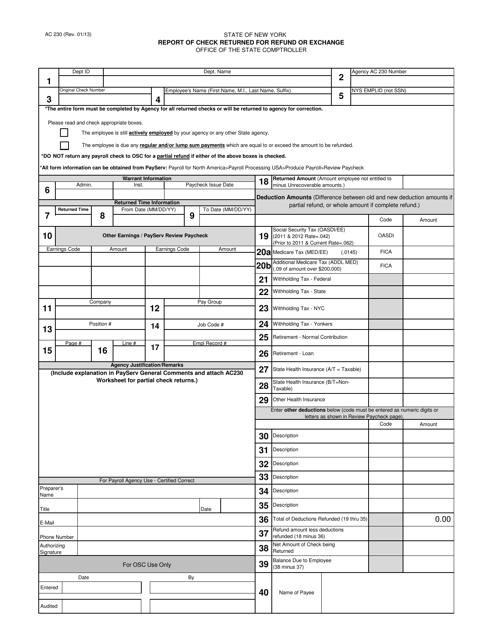

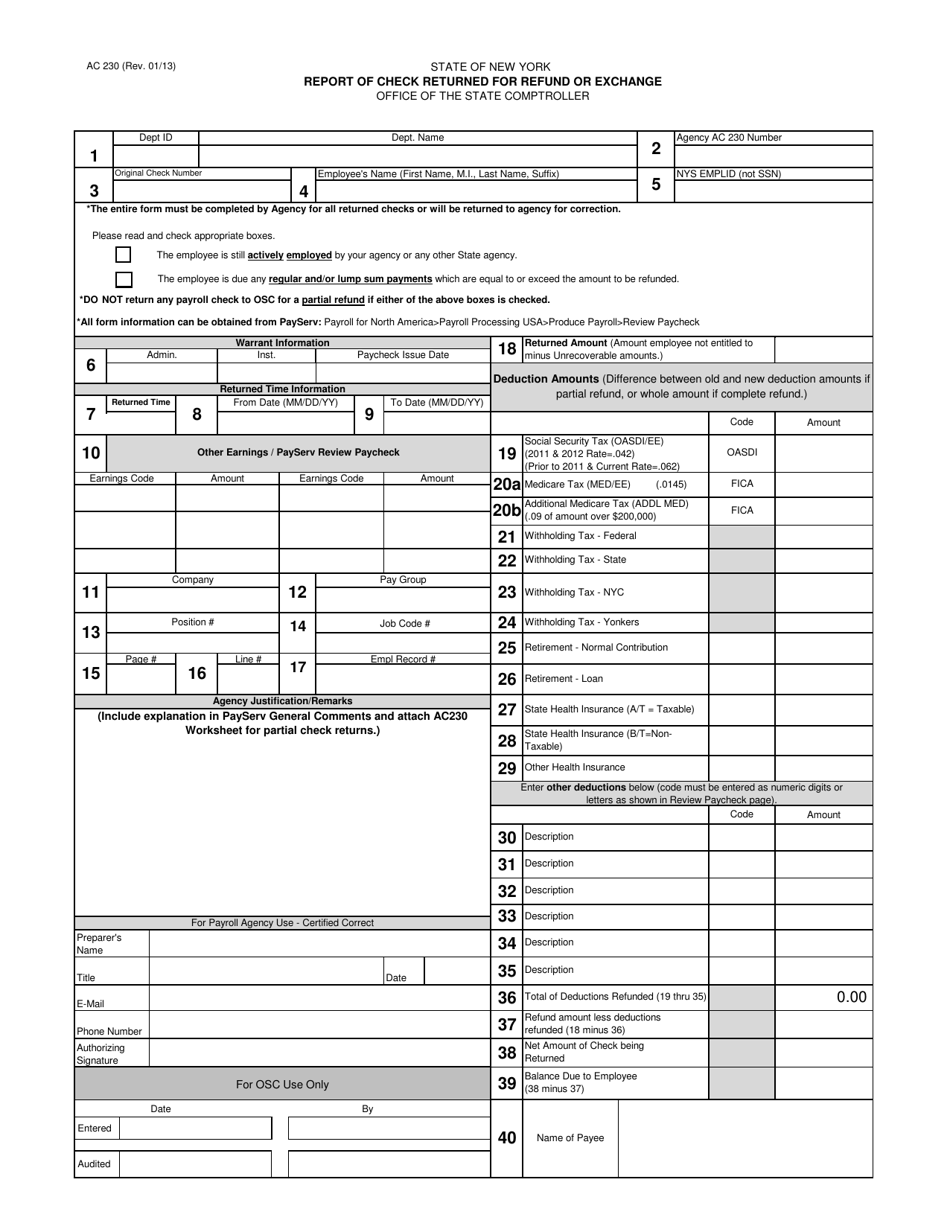

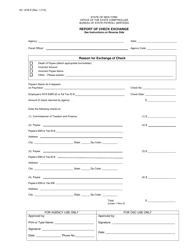

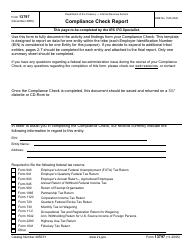

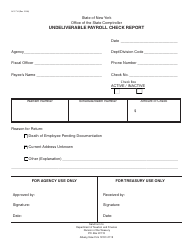

Form AC230 Report of Check Returned for Refund or Exchange - New York

What Is Form AC230?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AC230?

A: Form AC230 is a report used to request a refund or exchange for a returned check in New York.

Q: Who needs to use Form AC230?

A: Anyone in New York who wants to request a refund or exchange for a returned check needs to use Form AC230.

Q: When should I use Form AC230?

A: You should use Form AC230 when you have a returned check and want to request a refund or exchange in New York.

Q: What information do I need to fill out Form AC230?

A: You will need to provide your contact information, details about the returned check, and information about your refund or exchange request.

Q: Is there a deadline for submitting Form AC230?

A: Yes, you must submit Form AC230 within 90 days of the date on the notice of the returned check.

Q: What happens after I submit Form AC230?

A: After you submit Form AC230, the New York Department of Taxation and Finance will review your request and process it accordingly.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AC230 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.