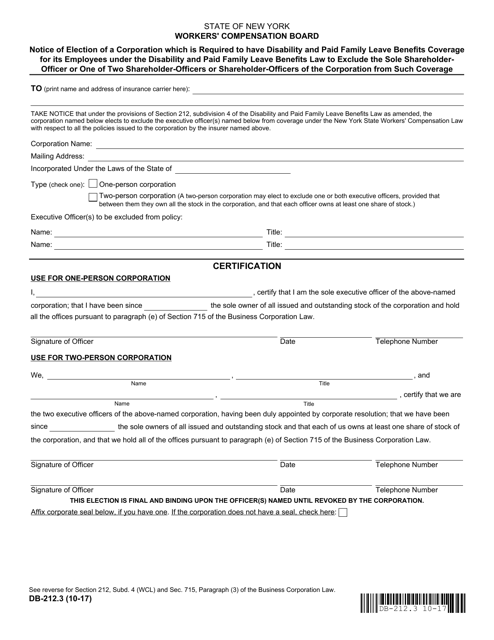

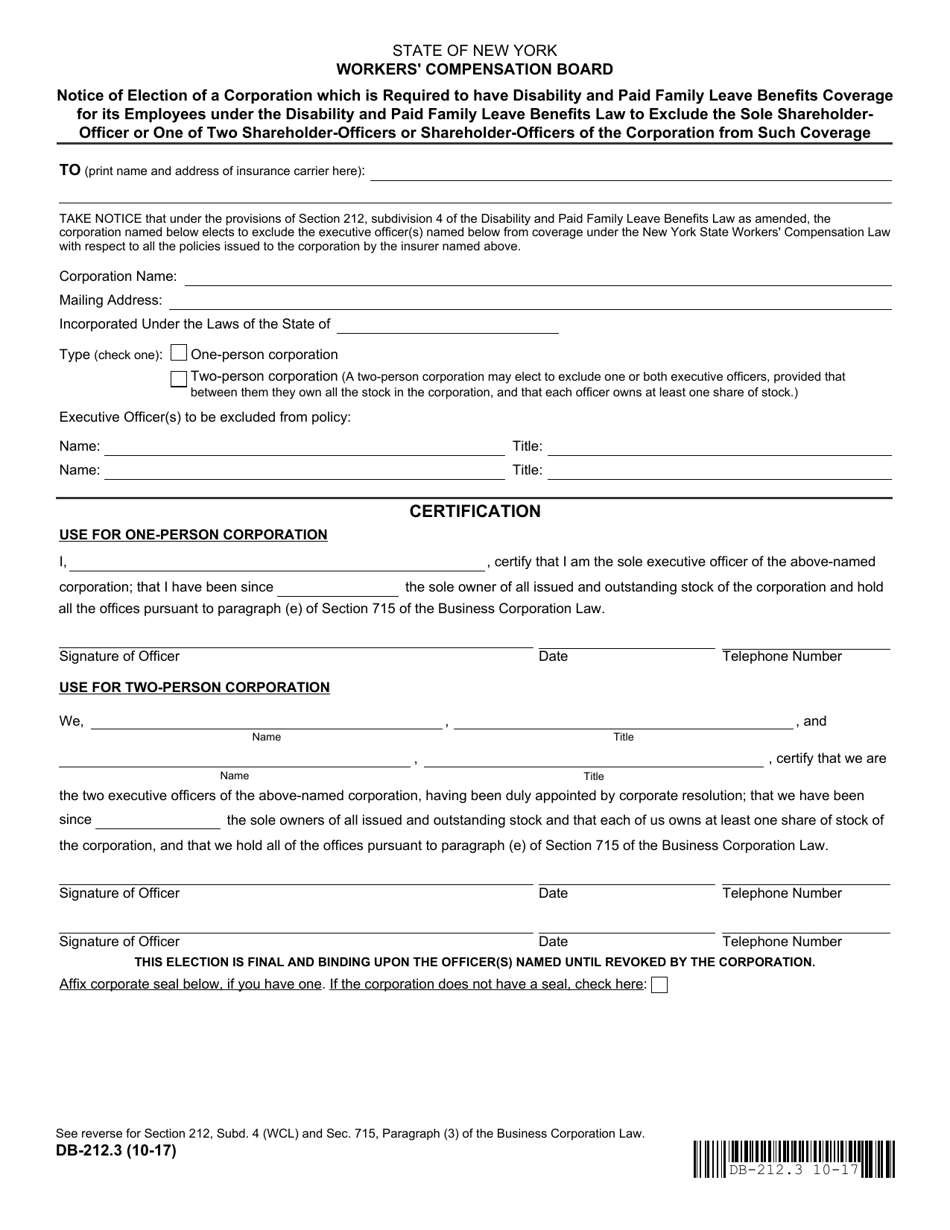

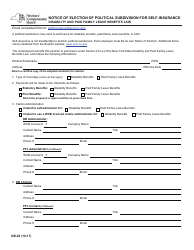

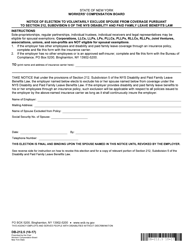

Form DB-212.3 Notice of Election of a Corporation Which Is Required to Have Disability and Paid Family Leave Benefits Coverage for Its Employees Under the Disability and Paid Family Leave Law to Exclude the Sole Shareholder-Officer or One of Two Shareholder-Officers or Shareholder-Officers of the Corporation From Such Coverage - New York

What Is Form DB-212.3?

This is a legal form that was released by the New York State Workers' Compensation Board - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DB-212.3?

A: DB-212.3 is a notice form for corporations in New York to elect to exclude certain shareholders from disability and paid family leave benefits coverage.

Q: Who is this form for?

A: This form is for corporations in New York that are required to have disability and paid family leave benefits coverage for their employees.

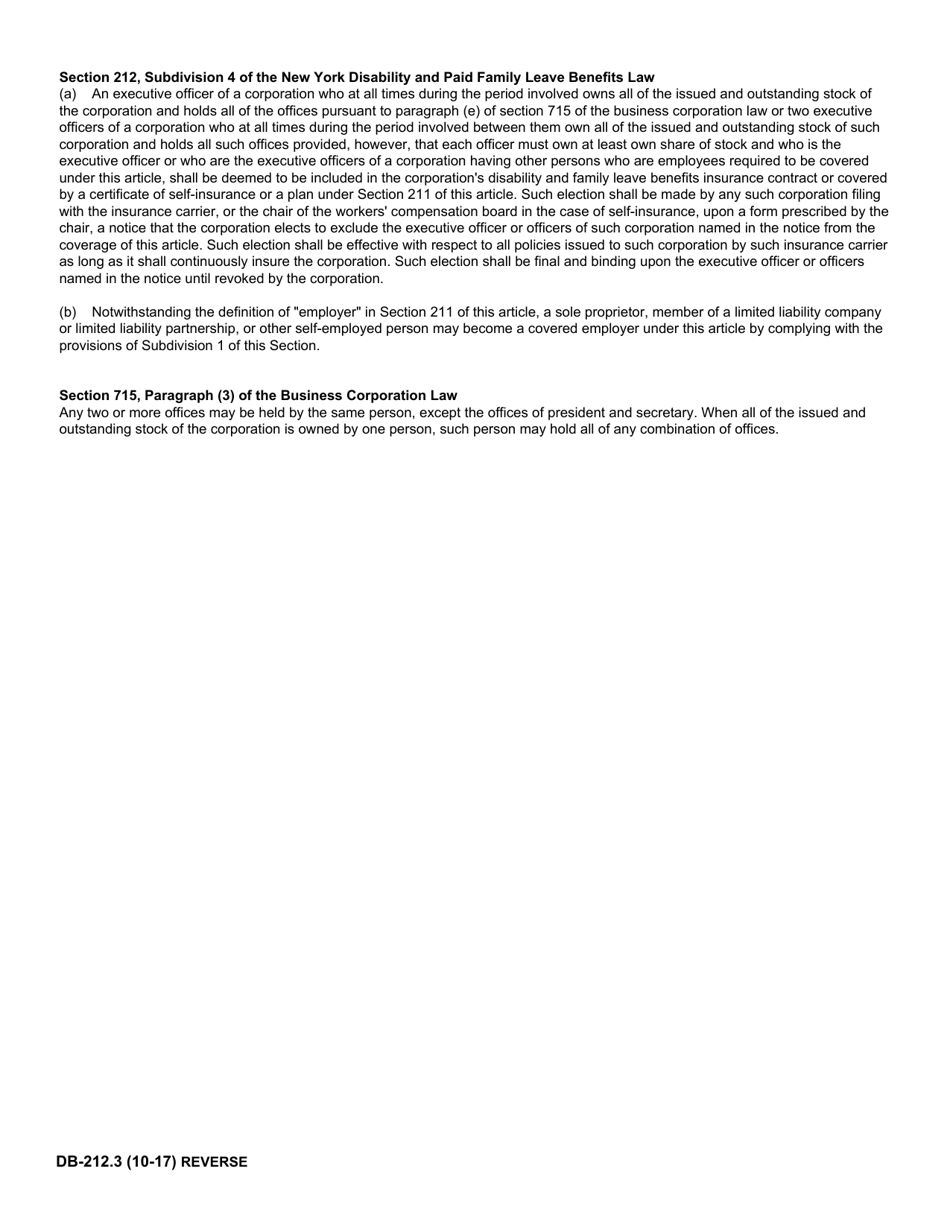

Q: What does the form allow corporations to do?

A: The form allows corporations to exclude the sole shareholder-officer or one of two shareholder-officers or shareholder-officers of the corporation from disability and paid family leave benefits coverage.

Q: What is the purpose of excluding these shareholders from coverage?

A: The purpose is to provide flexibility for the corporation in managing its disability and paid family leave benefits coverage.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the New York State Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DB-212.3 by clicking the link below or browse more documents and templates provided by the New York State Workers' Compensation Board.