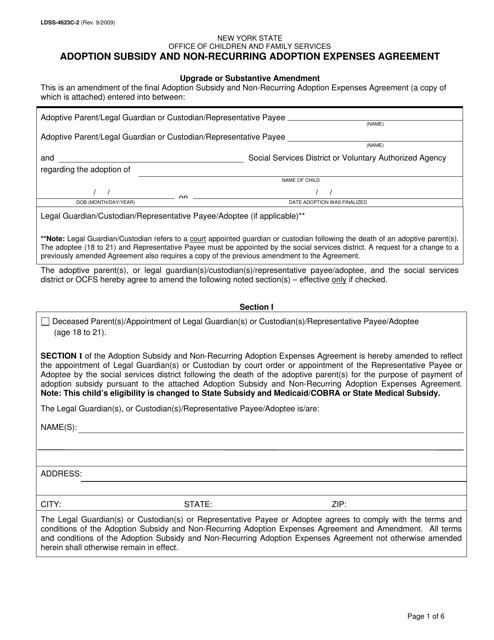

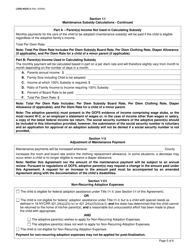

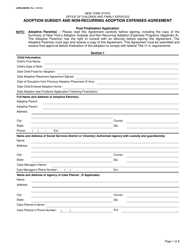

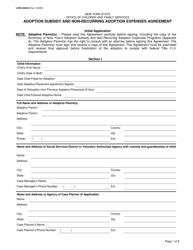

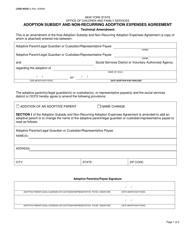

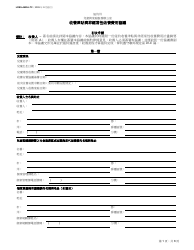

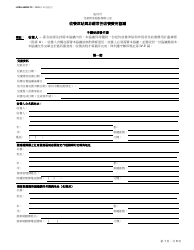

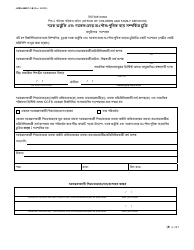

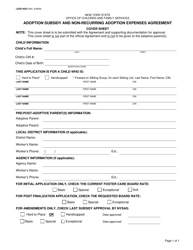

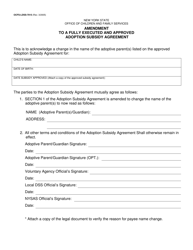

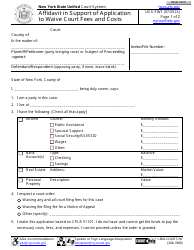

Form LDSS-4623C-2 Adoption Subsidy and Non-recurring Adoption Expenses Agreement - New York

What Is Form LDSS-4623C-2?

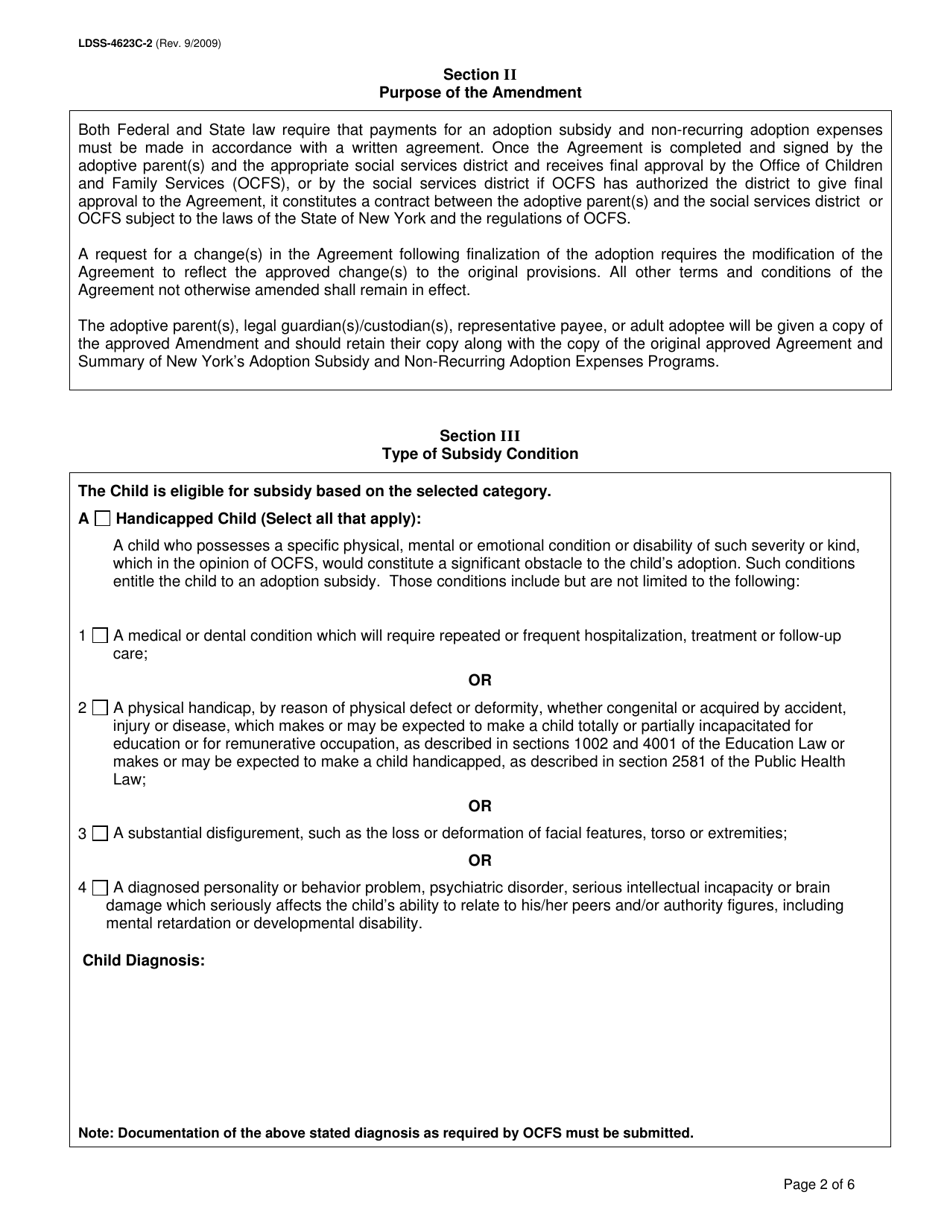

This is a legal form that was released by the New York State Office of Children and Family Services - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LDSS-4623C-2?

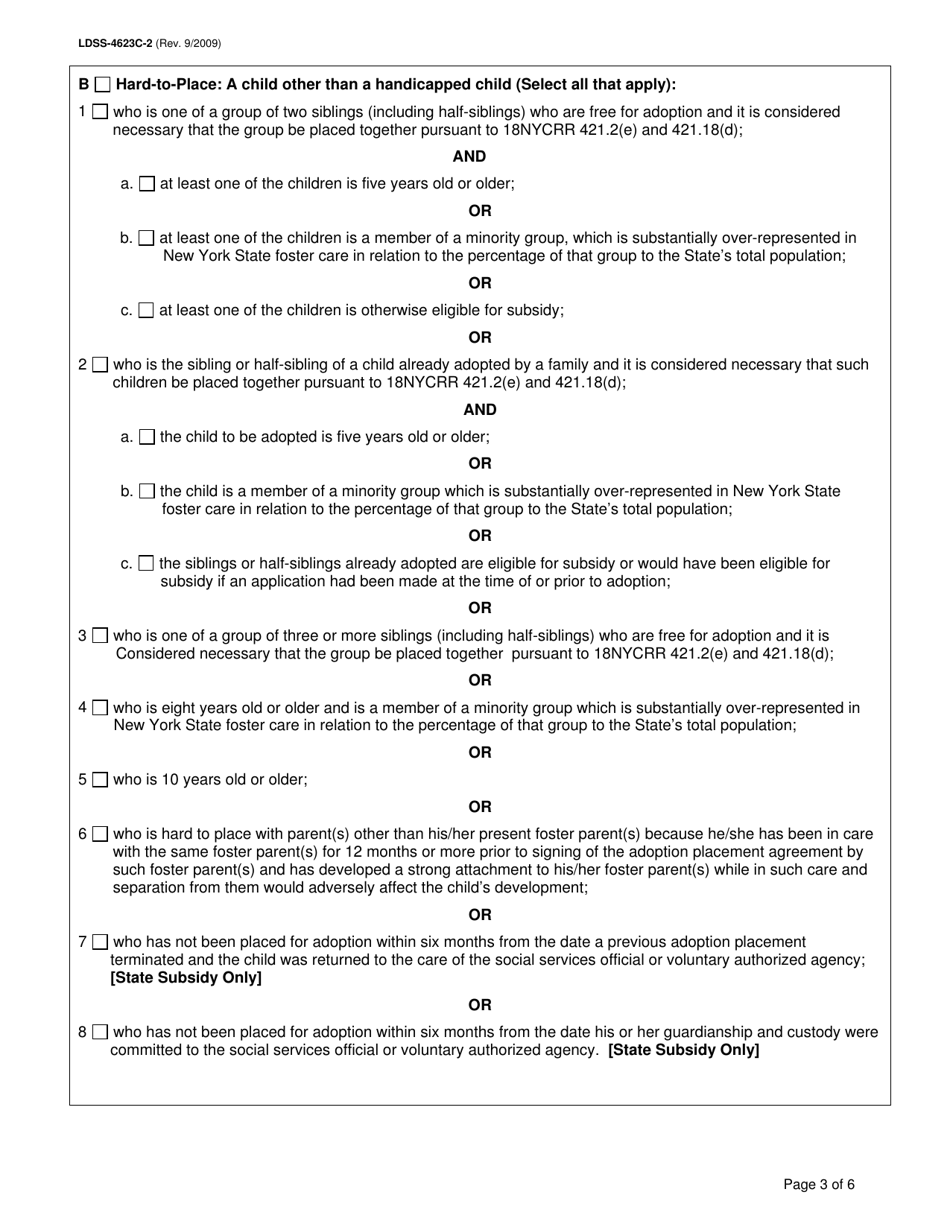

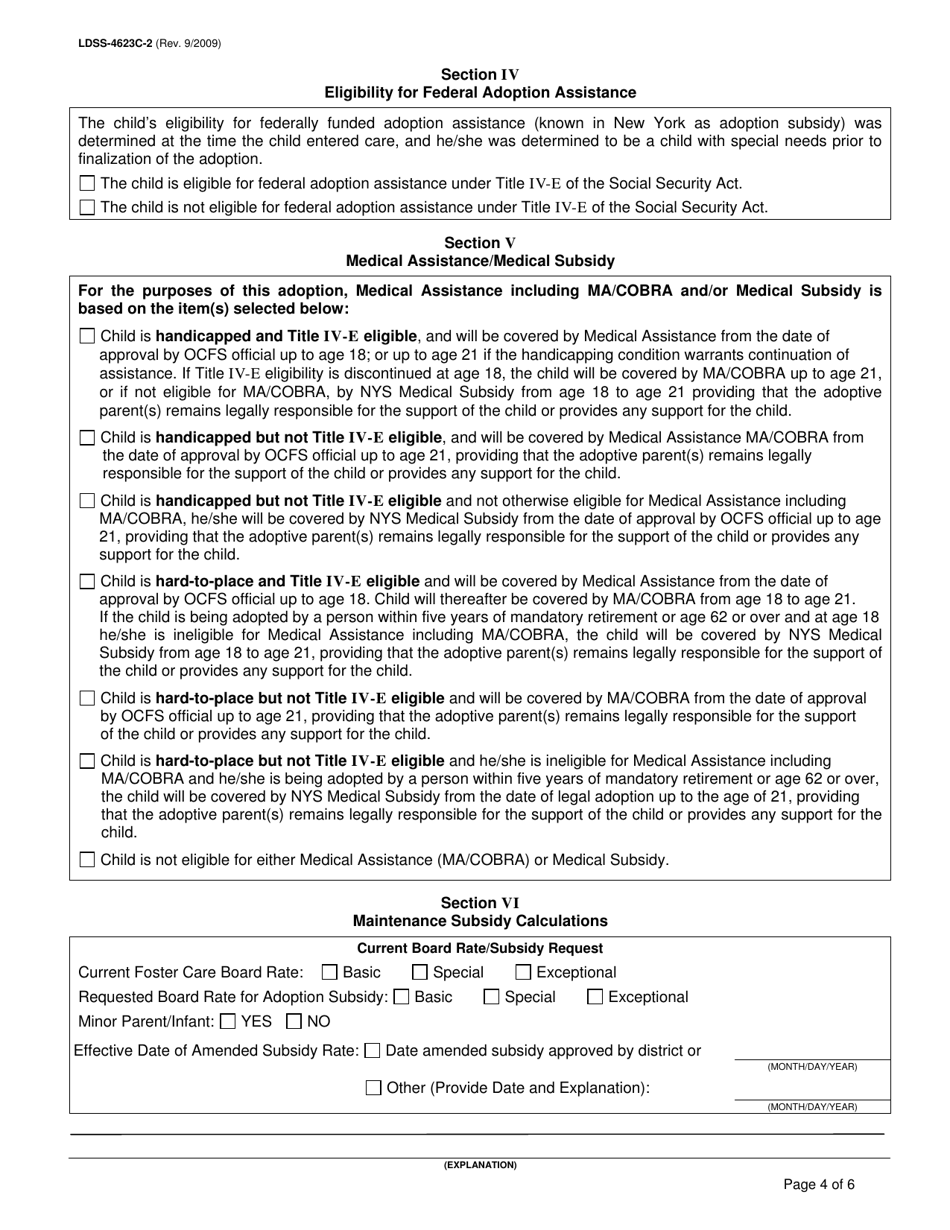

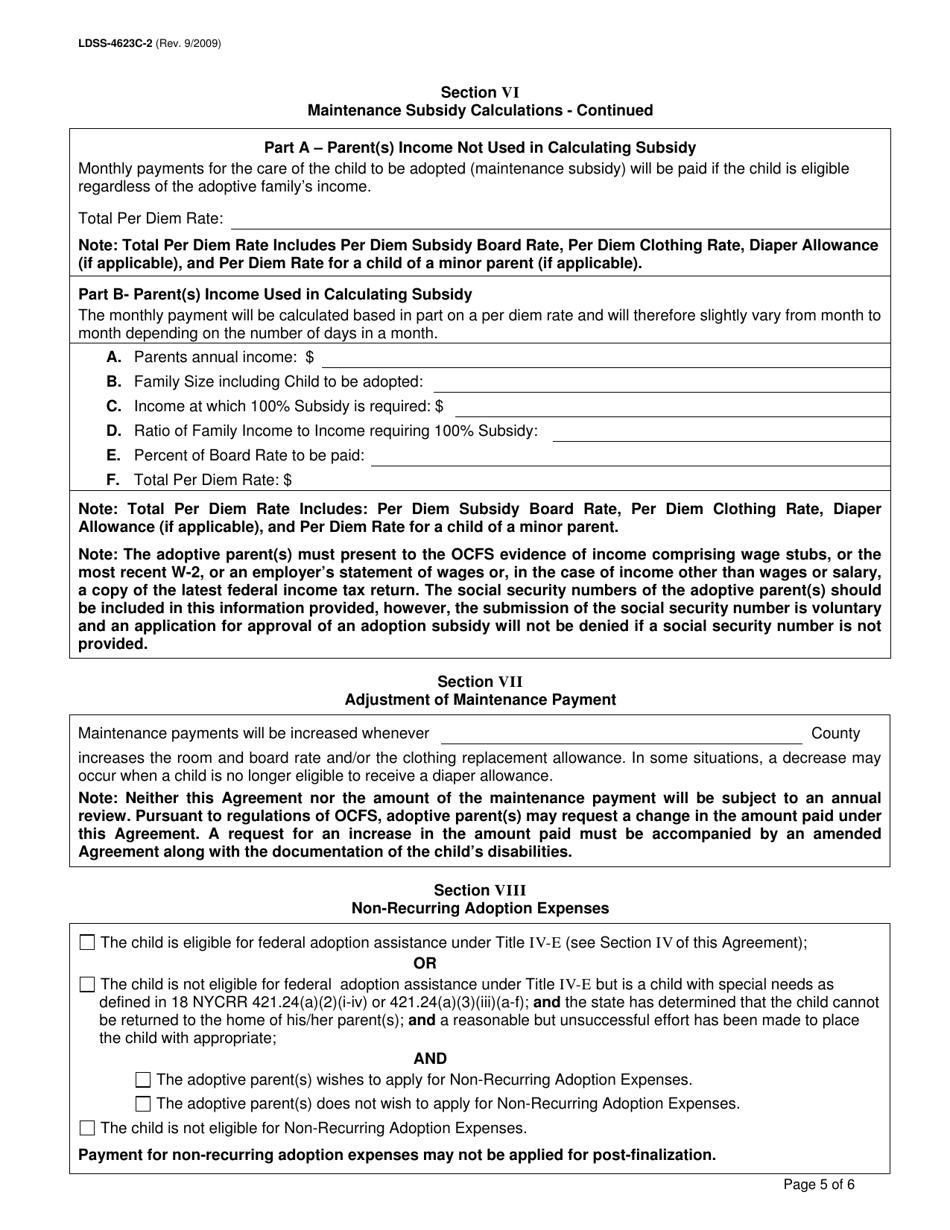

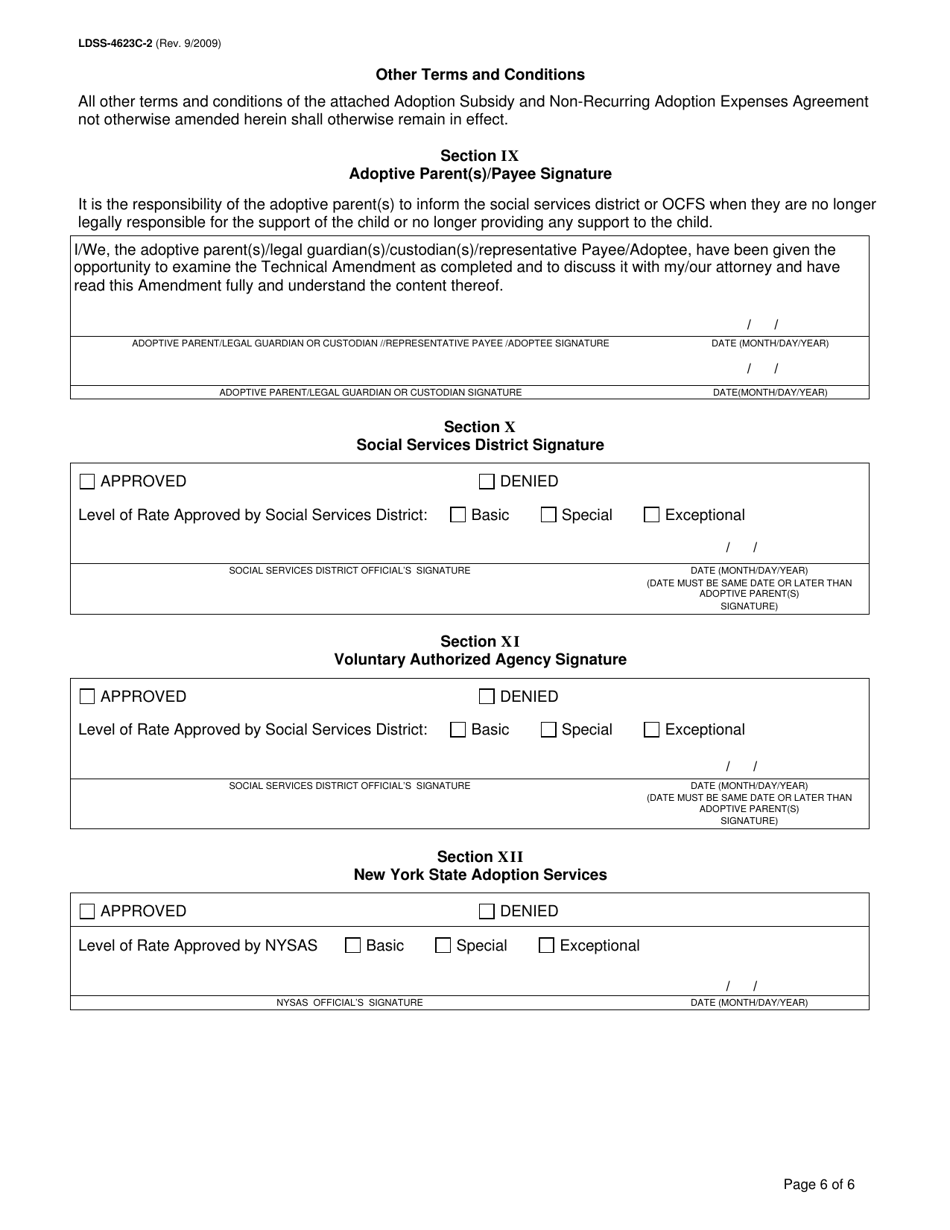

A: Form LDSS-4623C-2 is the Adoption Subsidy and Non-recurring Adoption Expenses Agreement.

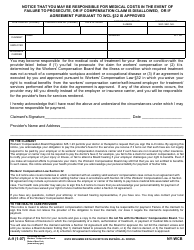

Q: What is the purpose of Form LDSS-4623C-2?

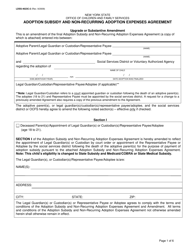

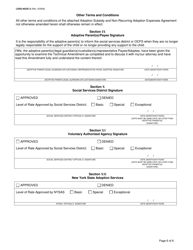

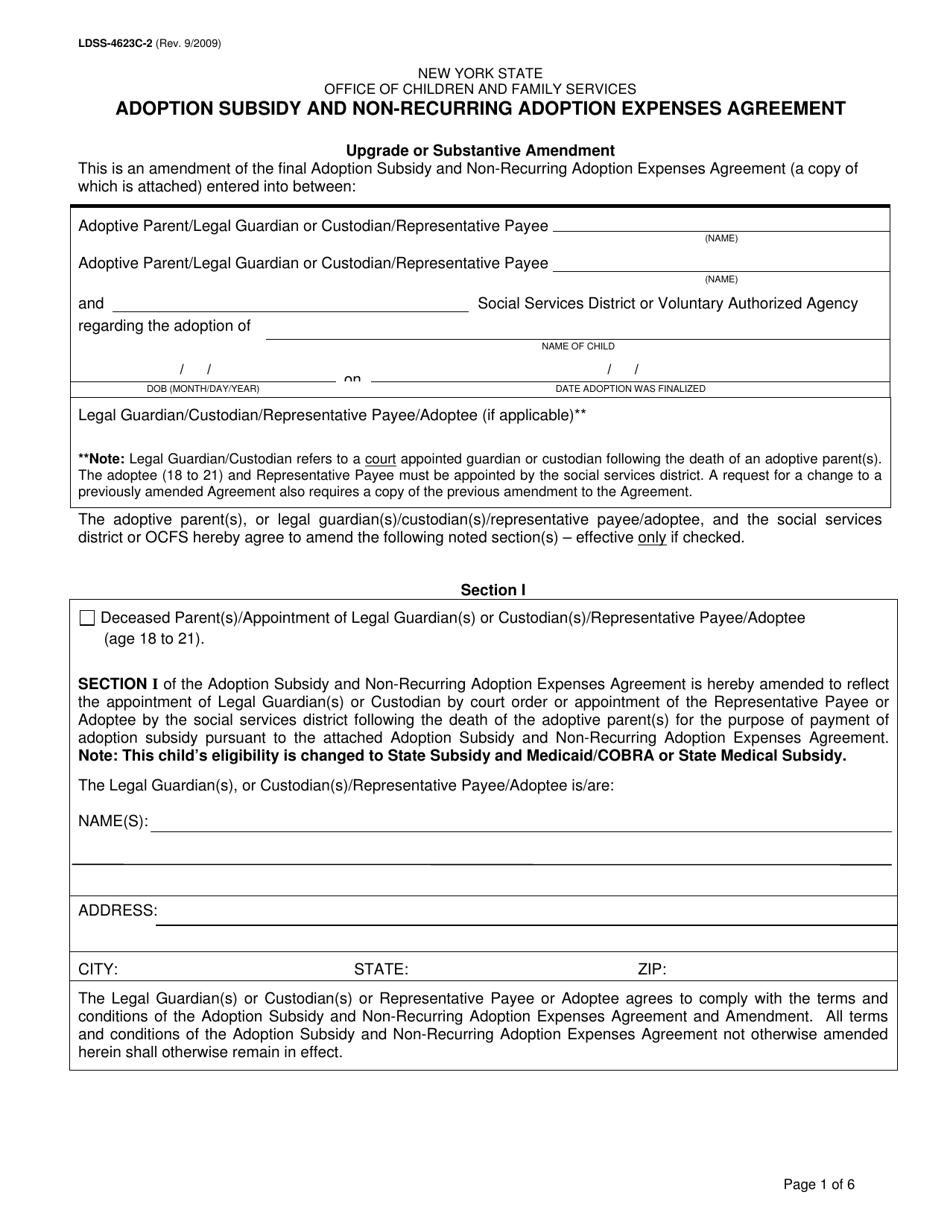

A: The purpose of Form LDSS-4623C-2 is to establish the terms and conditions for adoption subsidies and non-recurring adoption expenses in the state of New York.

Q: What are adoption subsidies?

A: Adoption subsidies are financial assistance provided to adoptive parents to help cover the costs of raising a child who has special needs.

Q: What are non-recurring adoption expenses?

A: Non-recurring adoption expenses are one-time costs associated with the adoption process, such as legal fees and travel expenses.

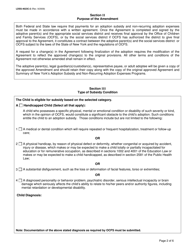

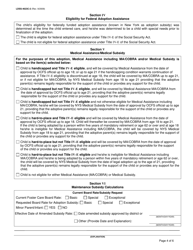

Q: Who is eligible for adoption subsidies in New York?

A: Eligibility for adoption subsidies in New York is based on the child's special needs and the adoptive parents' ability to meet those needs.

Q: Can I receive both adoption subsidies and non-recurring adoption expenses?

A: Yes, adoptive parents may be eligible to receive both adoption subsidies and non-recurring adoption expenses.

Q: Are there any requirements for reporting changes in circumstances?

A: Yes, adoptive parents are required to report any changes in circumstances that may affect their eligibility for adoption subsidies or non-recurring adoption expenses.

Q: Are adoption subsidies taxable?

A: Adoption subsidies are generally excluded from taxable income, but it is recommended to consult with a tax professional for specific guidance.

Form Details:

- Released on September 1, 2009;

- The latest edition provided by the New York State Office of Children and Family Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LDSS-4623C-2 by clicking the link below or browse more documents and templates provided by the New York State Office of Children and Family Services.