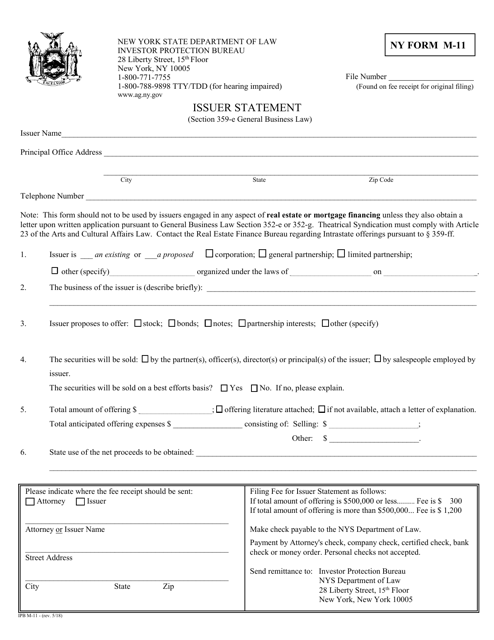

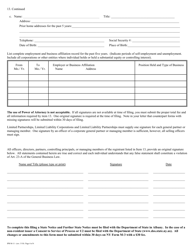

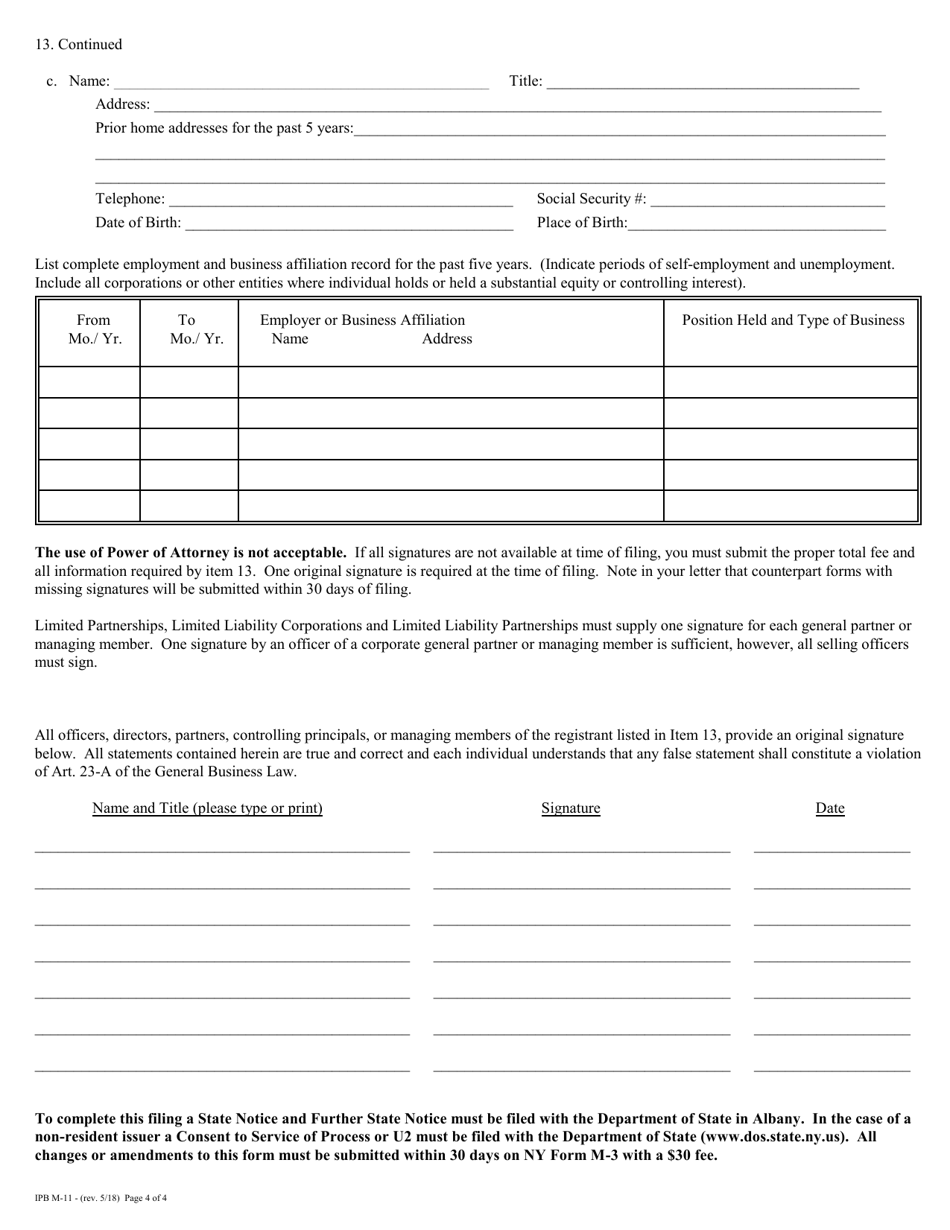

Form M-11 Issuer Statement - New York

What Is Form M-11?

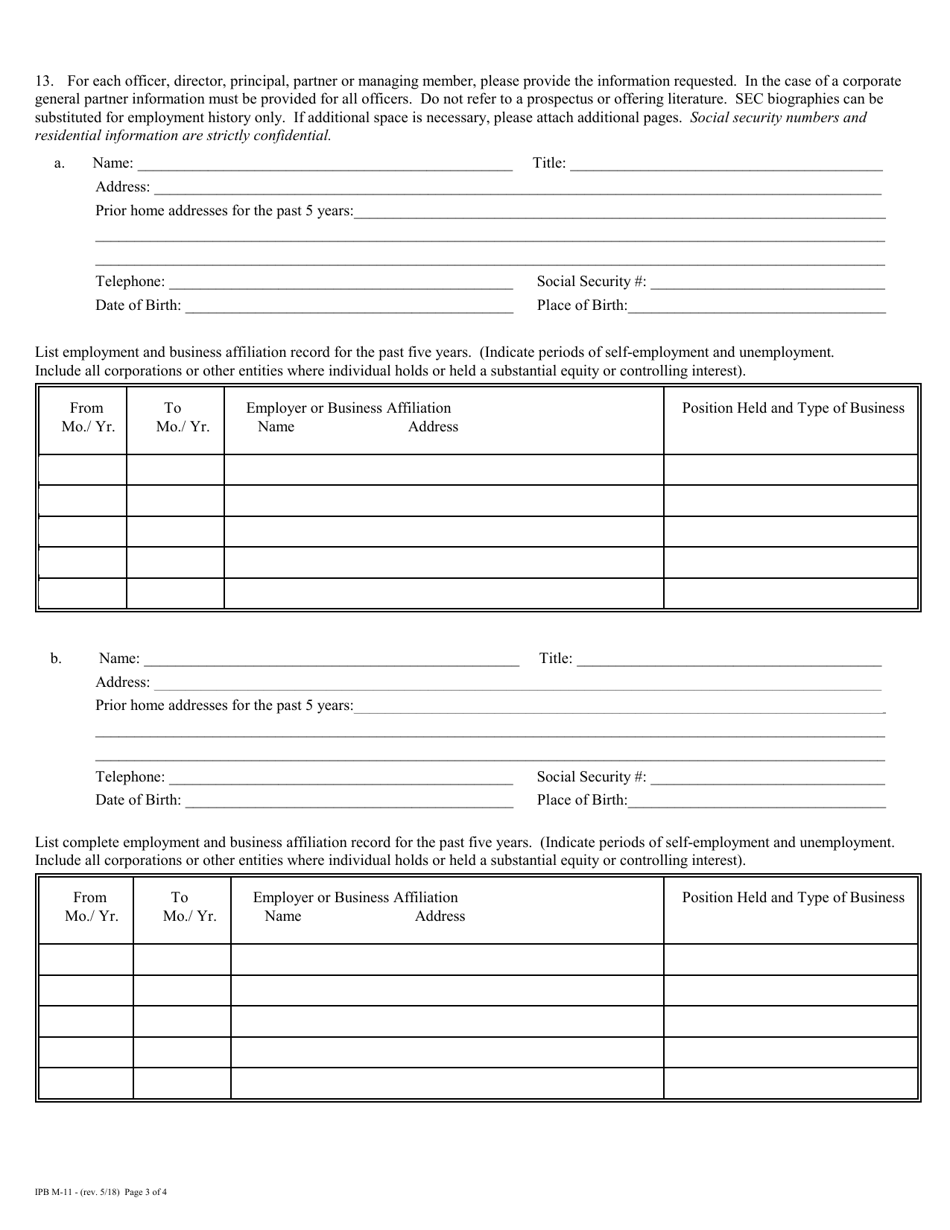

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-11?

A: Form M-11 is an issuer statement required in the state of New York.

Q: Who needs to file Form M-11?

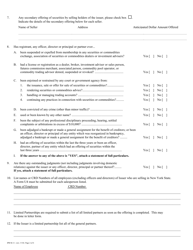

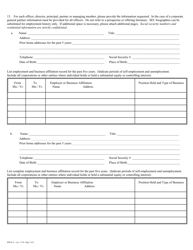

A: Individuals or entities that are issuers of securities in New York need to file Form M-11.

Q: What is the purpose of filing Form M-11?

A: The purpose of filing Form M-11 is to provide information about the issuer and the securities being offered for sale.

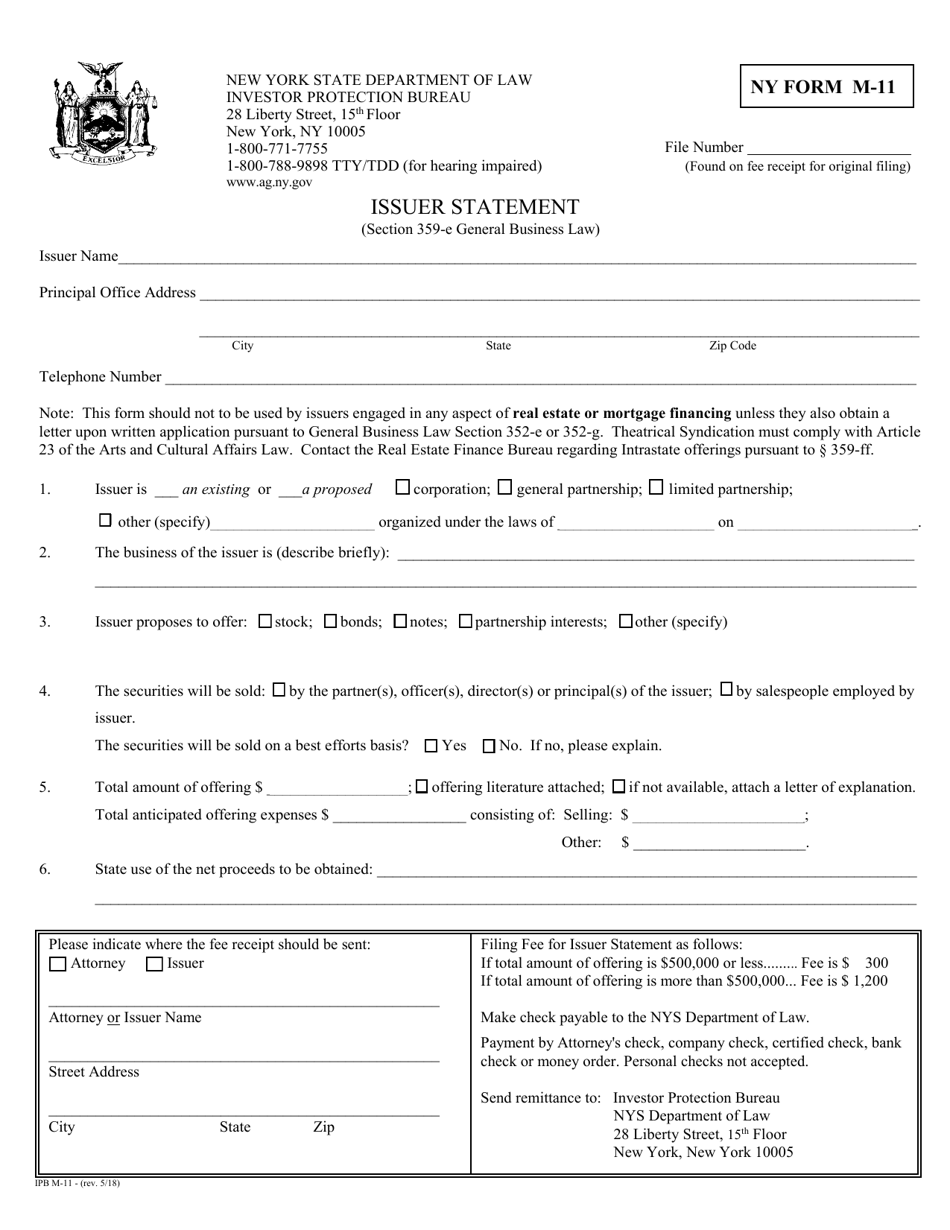

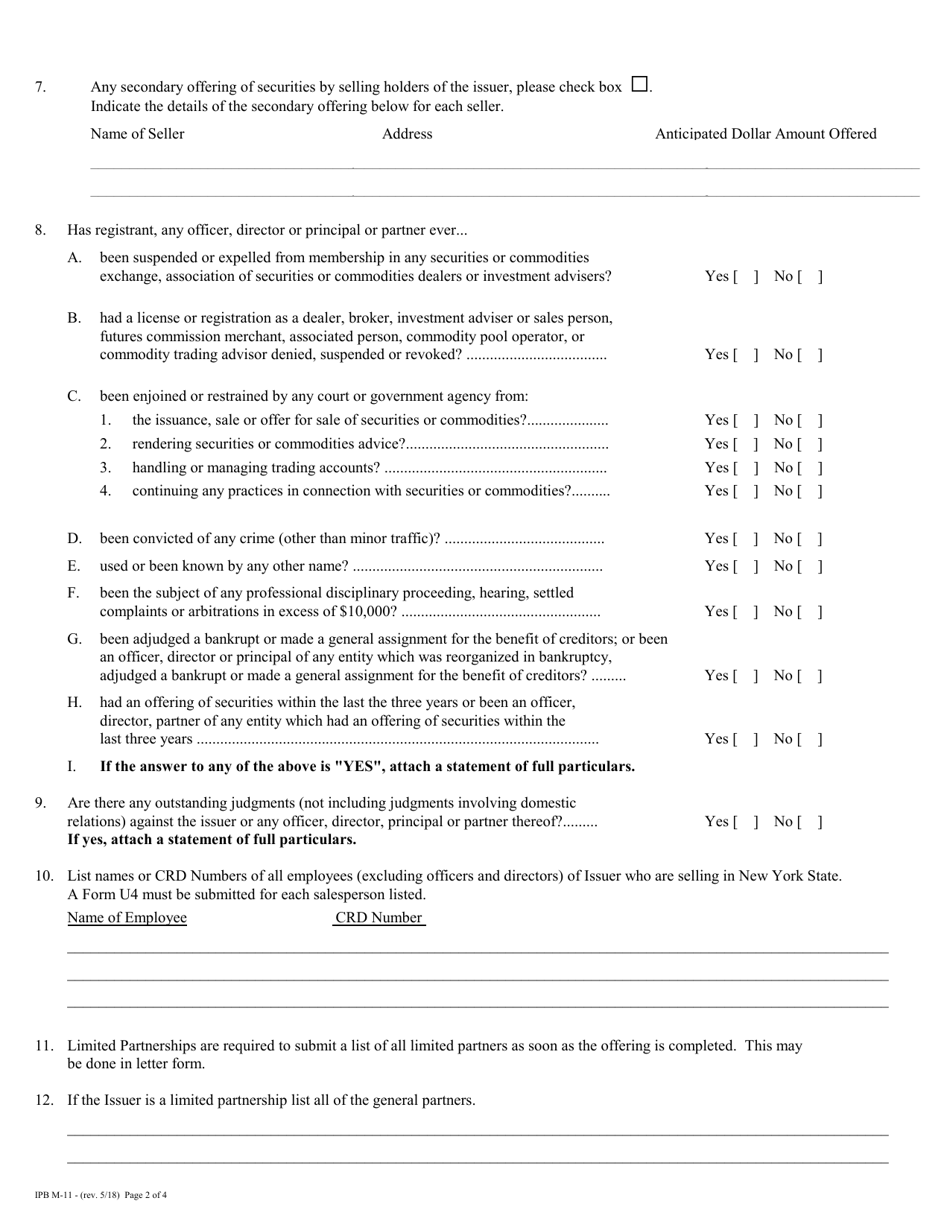

Q: What information is required on Form M-11?

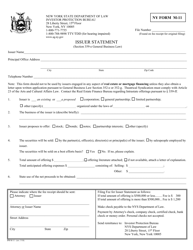

A: Form M-11 requires information about the issuer's business, the securities being offered, and any prior offerings.

Q: When is Form M-11 due?

A: Form M-11 is generally due at least 10 days before the securities are offered for sale in New York.

Q: Are there any fees associated with filing Form M-11?

A: Yes, there are fees associated with filing Form M-11. The fee amount depends on the total value of the securities being offered.

Q: What happens if I fail to file Form M-11?

A: Failure to file Form M-11 may result in penalties and legal consequences, including the suspension of the offering of securities.

Q: Can I amend Form M-11 if there are changes?

A: Yes, you can amend Form M-11 if there are changes in the information provided. An amended form should be filed as soon as possible.

Q: Is Form M-11 specific to New York?

A: Yes, Form M-11 is specific to the state of New York and is not required in other states.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-11 by clicking the link below or browse more documents and templates provided by the New York State Attorney General.