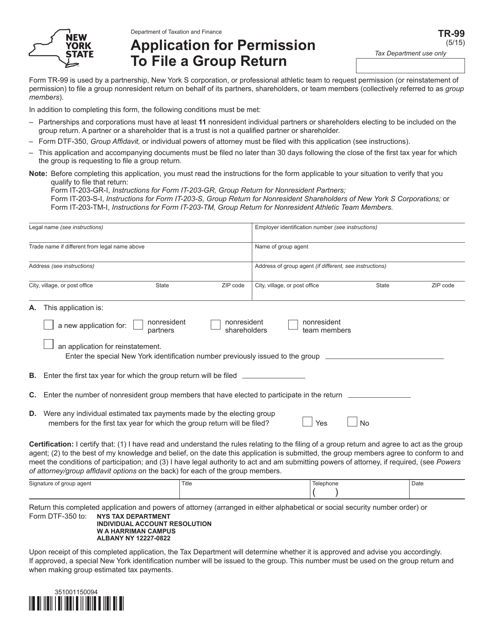

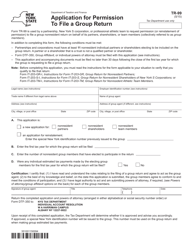

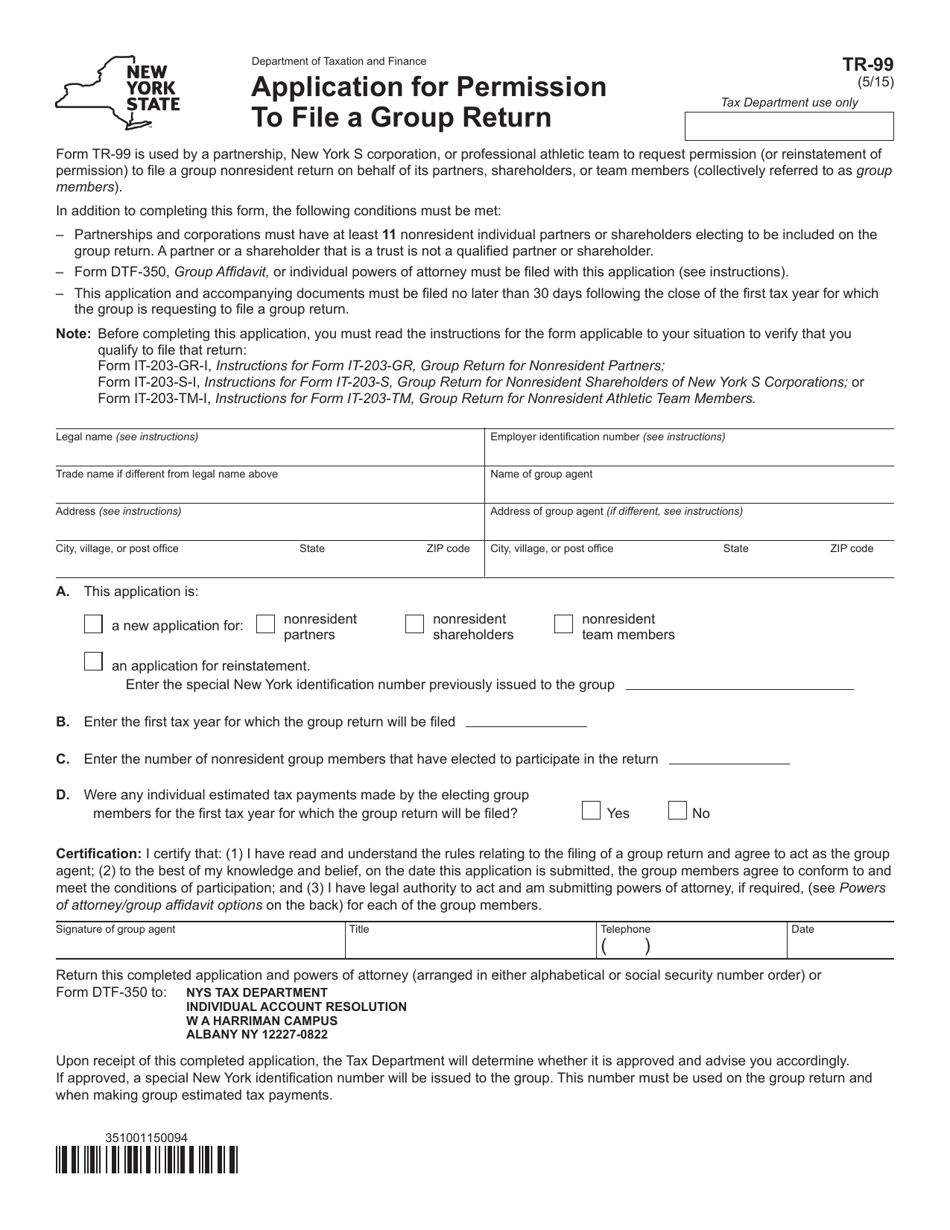

Form TR-99 Application for Permission to File a Group Return - New York

What Is Form TR-99?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-99?

A: Form TR-99 is an application for permission to file a group return in New York.

Q: Who needs to fill out Form TR-99?

A: Any organization or association that wants to file a group return in New York needs to fill out Form TR-99.

Q: What is a group return?

A: A group return is when multiple organizations or associations file a single tax return.

Q: Why would an organization file a group return?

A: Organizations may choose to file a group return to consolidate their tax reporting and potentially reduce administrative burdens.

Q: Are there any fees associated with filing Form TR-99?

A: There are no fees associated with filing Form TR-99.

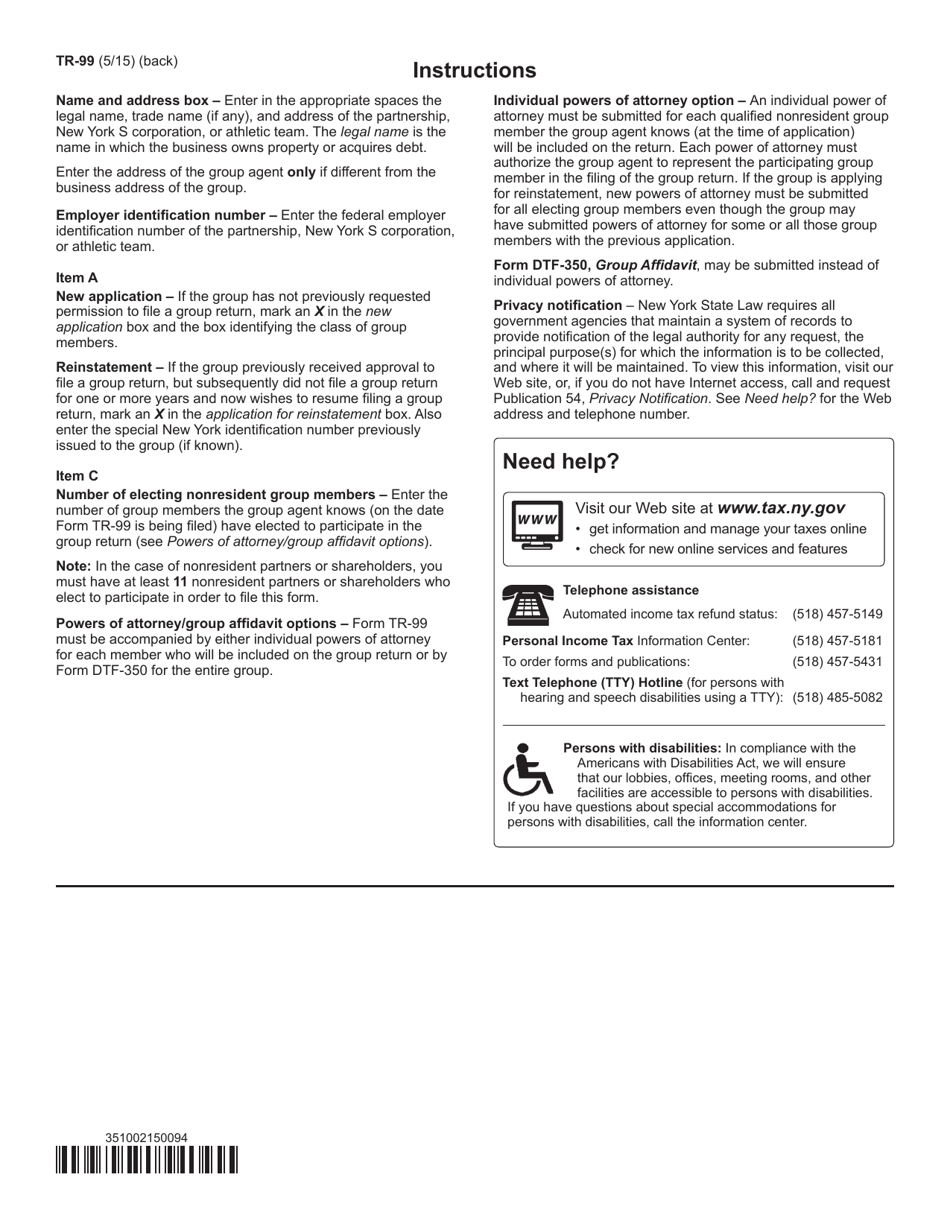

Q: Are there any eligibility requirements for filing a group return?

A: Yes, there are eligibility requirements outlined in the instructions for Form TR-99.

Q: What information do I need to provide on Form TR-99?

A: You need to provide information about each organization included in the group return, including their EIN, name, address, and other relevant details.

Q: Can I file Form TR-99 electronically?

A: No, Form TR-99 must be filed by mail or in person.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TR-99 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.