This version of the form is not currently in use and is provided for reference only. Download this version of

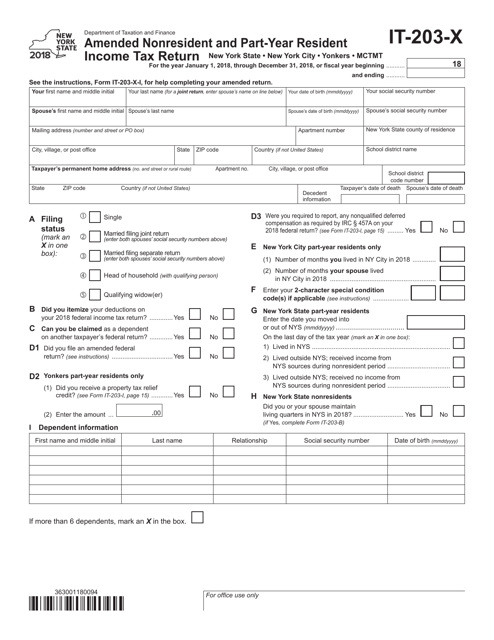

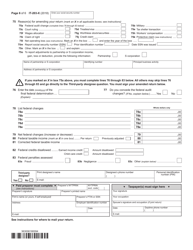

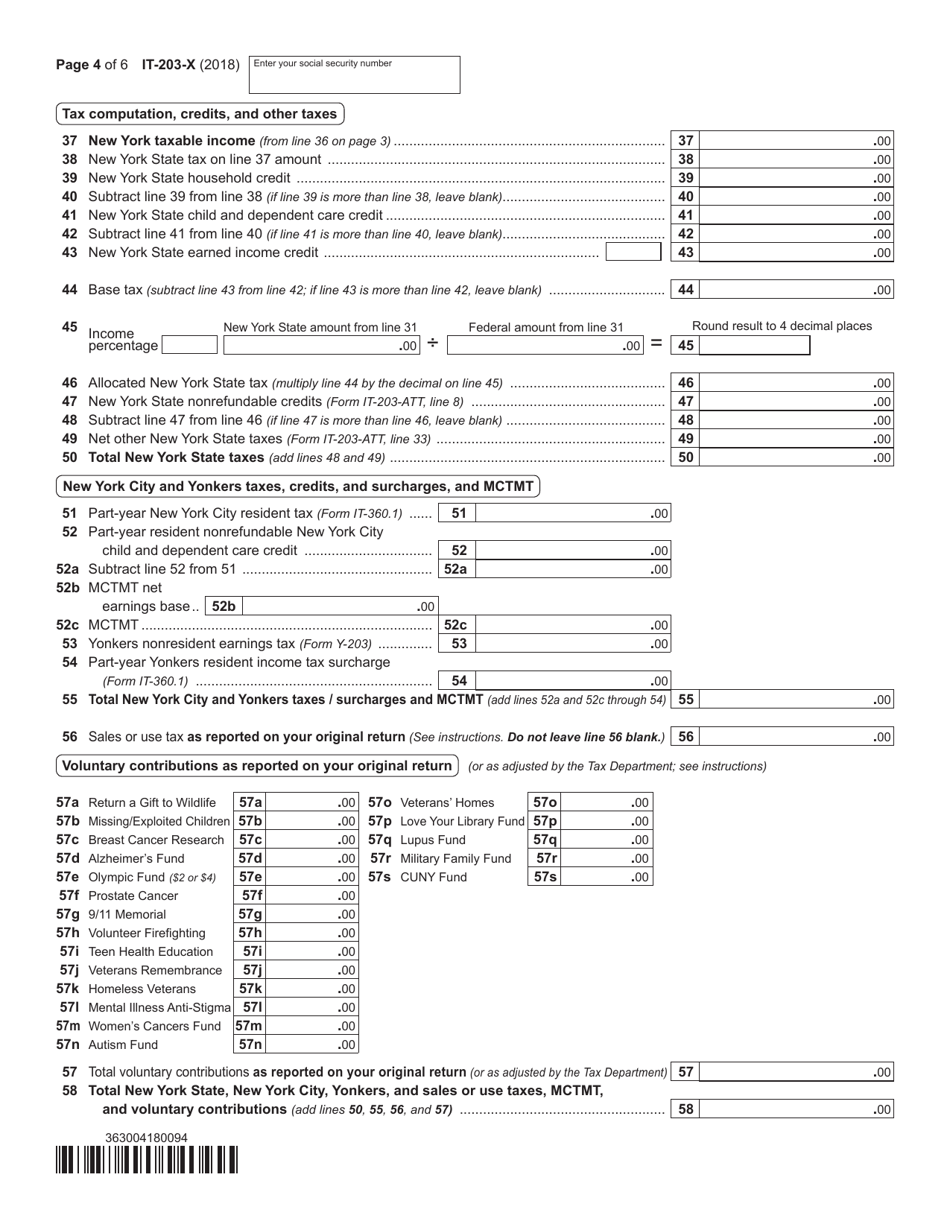

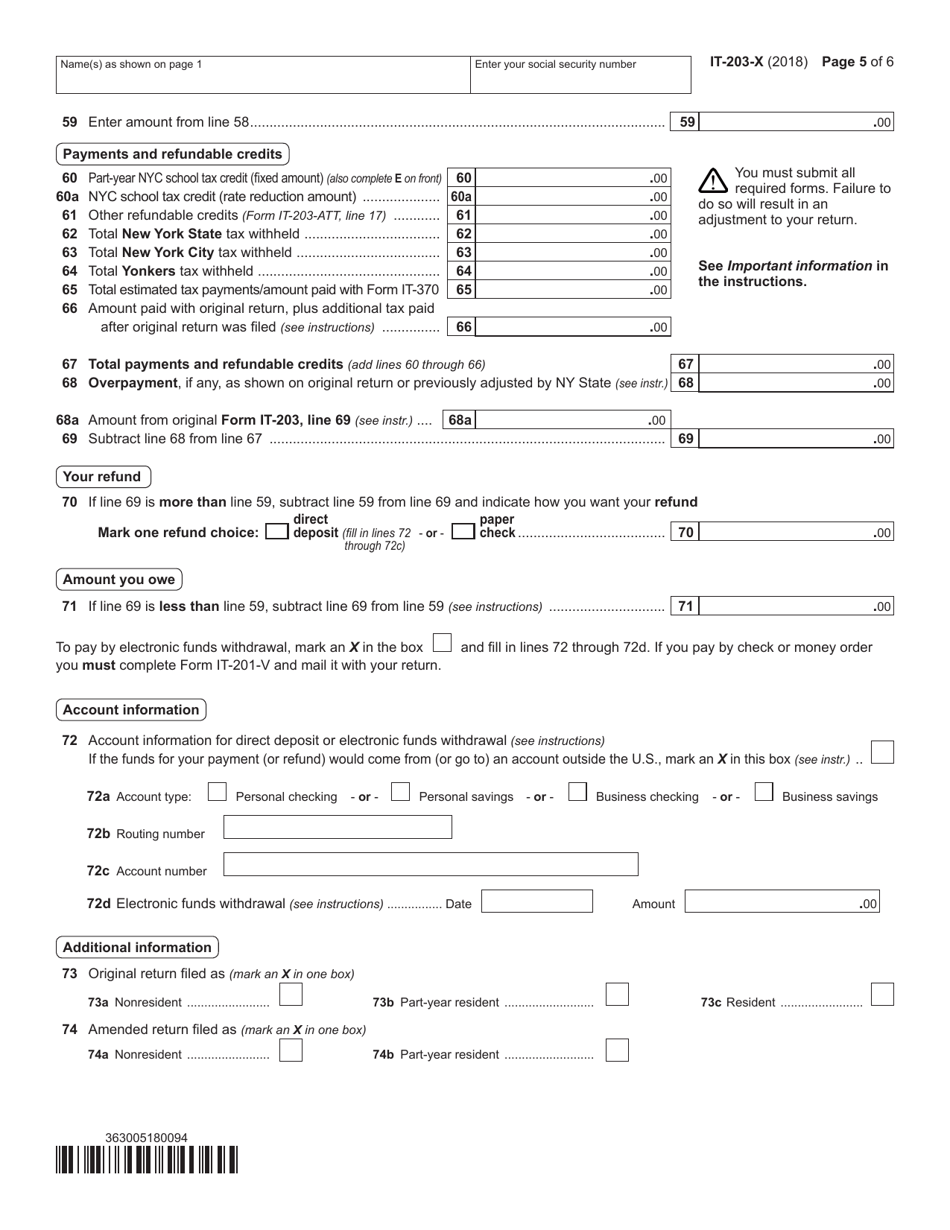

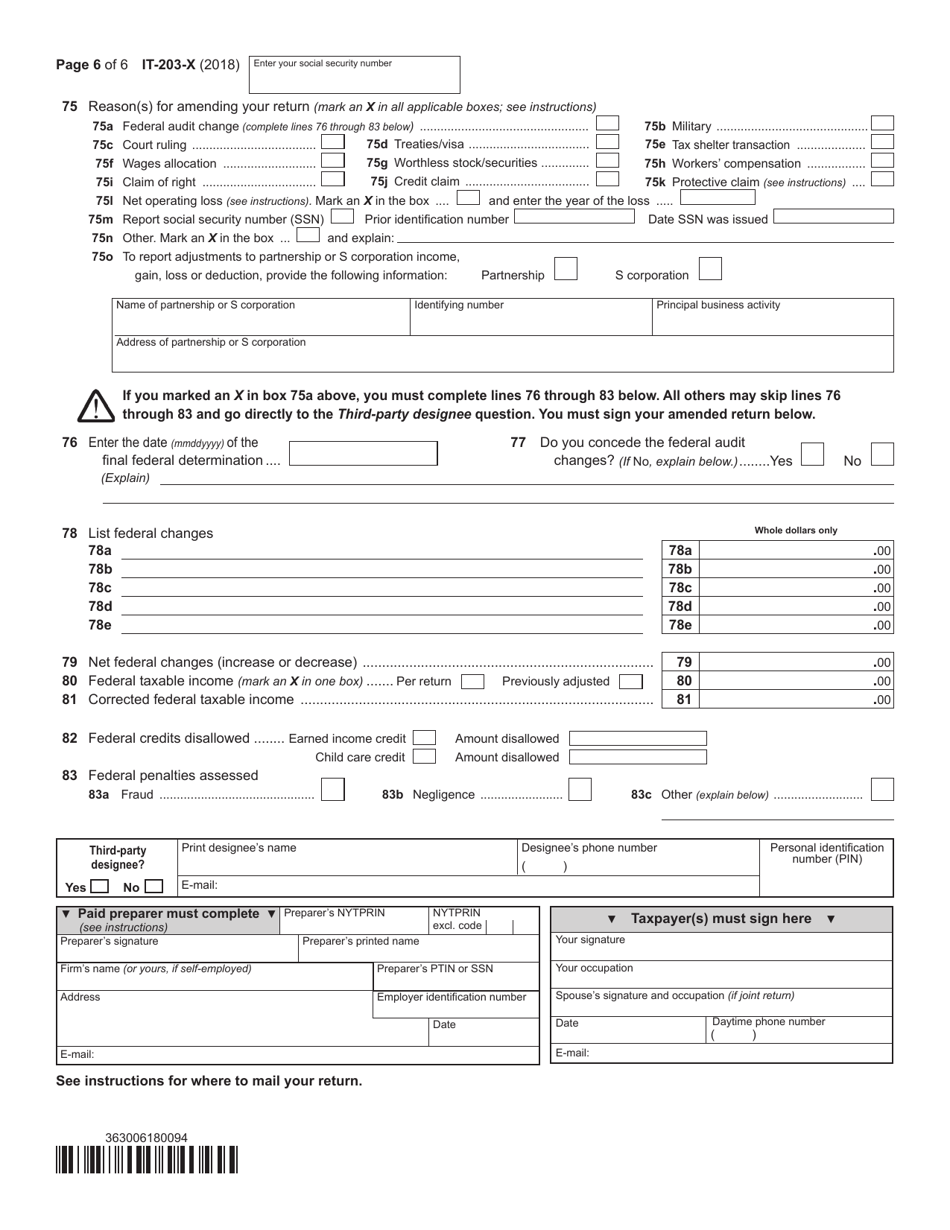

Form IT-203-X

for the current year.

Form IT-203-X Amended Nonresident and Part-Year Resident Income Tax Return - New York

What Is Form IT-203-X?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-X?

A: Form IT-203-X is the Amended Nonresident and Part-Year Resident Income Tax Return for New York.

Q: Who needs to file Form IT-203-X?

A: Form IT-203-X is for individuals who need to amend their previously filed Nonresident and Part-Year Resident Income Tax Return in New York.

Q: What does Form IT-203-X allow you to do?

A: Form IT-203-X allows you to make corrections to your previously filed Nonresident and Part-Year Resident Income Tax Return in New York.

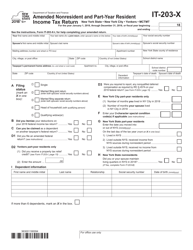

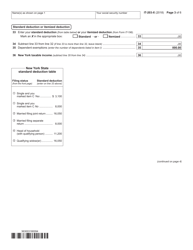

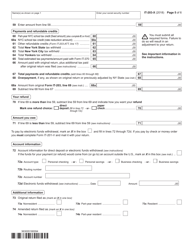

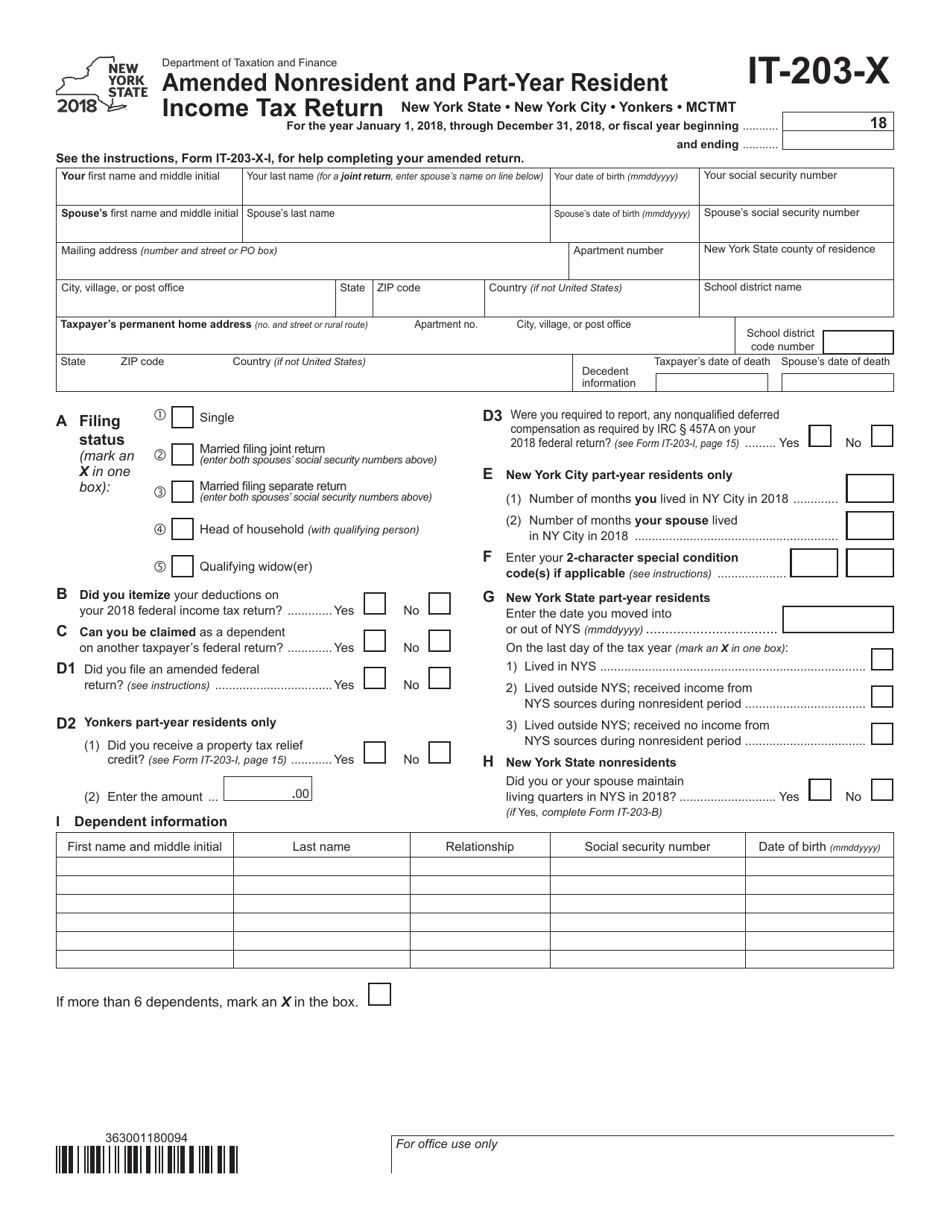

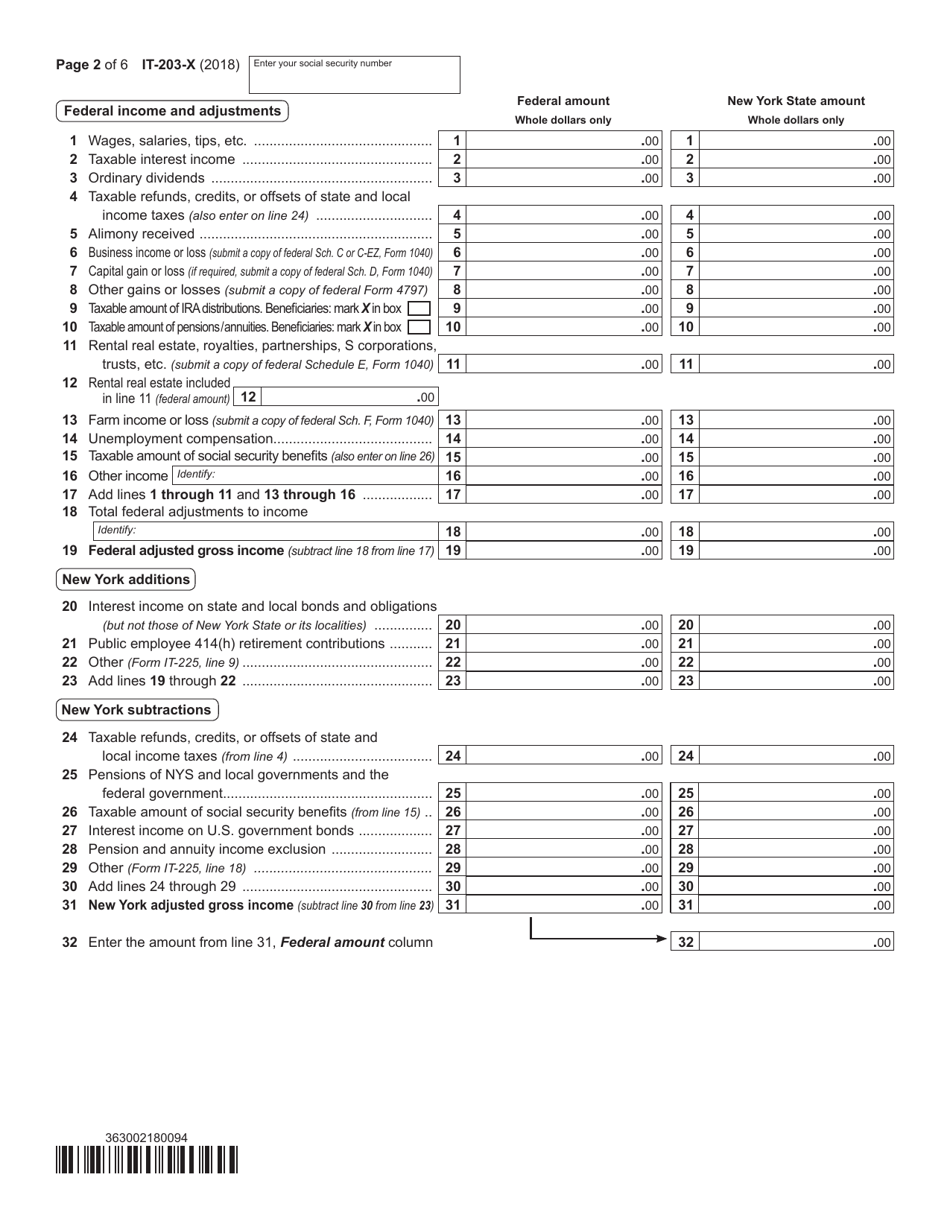

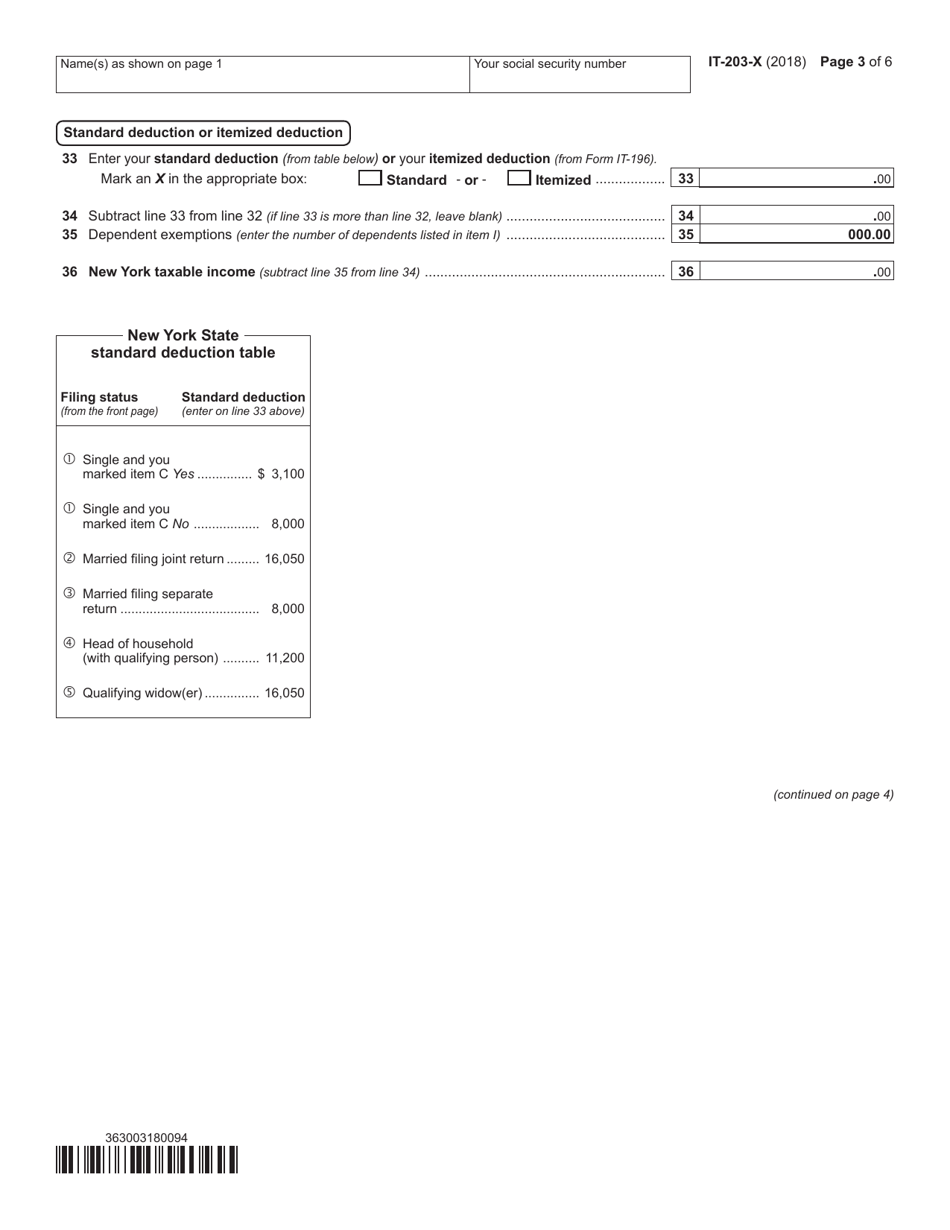

Q: How do I fill out Form IT-203-X?

A: You should follow the instructions provided by the New York State Department of Taxation and Finance to correctly fill out Form IT-203-X.

Q: Can I e-file Form IT-203-X?

A: No, you cannot e-file Form IT-203-X. It must be filed by mail.

Q: What if I need help with Form IT-203-X?

A: If you need assistance with Form IT-203-X, you can contact the New York State Department of Taxation and Finance or consult a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-X by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.