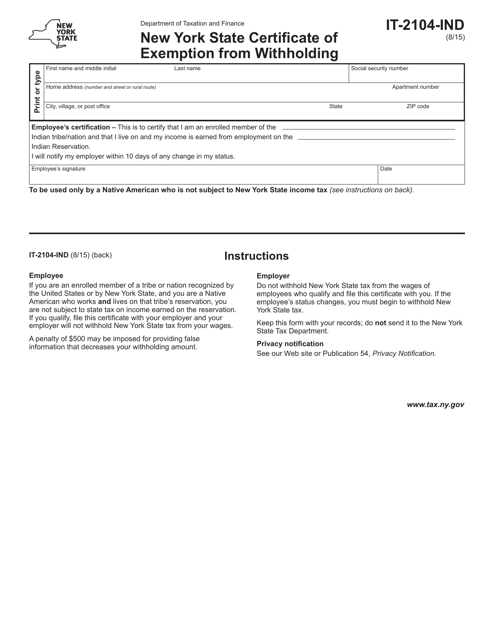

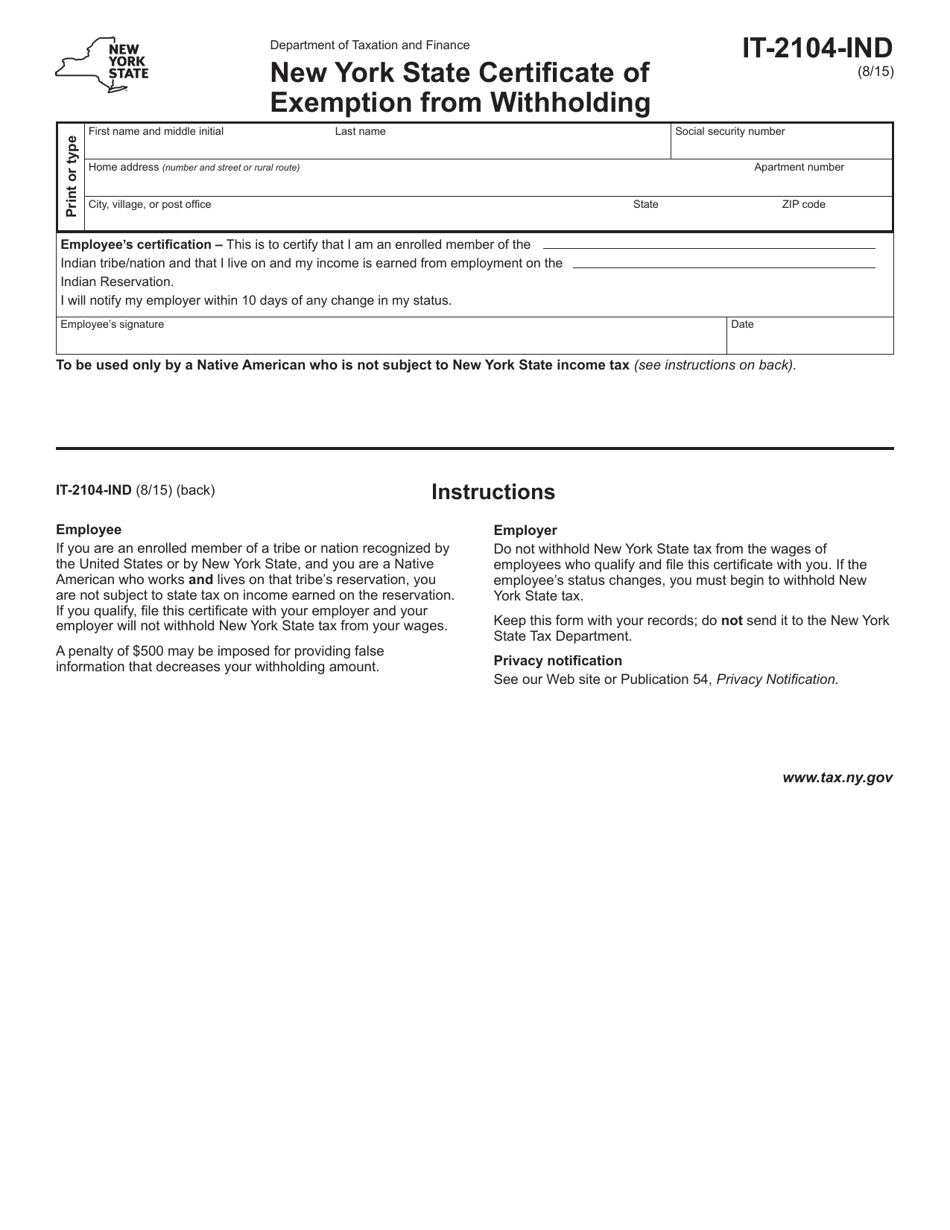

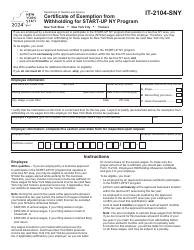

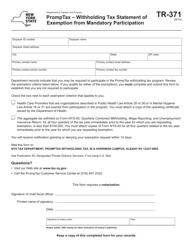

Form IT-2104-IND New York State Certificate of Exemption From Withholding - New York

What Is Form IT-2104-IND?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-2104-IND form?

A: The IT-2104-IND form is the New York State Certificate of Exemption From Withholding form.

Q: Who is eligible to use the IT-2104-IND form?

A: Individuals who are claiming exemption from New York State income tax withholding may use the IT-2104-IND form.

Q: What is the purpose of the IT-2104-IND form?

A: The IT-2104-IND form is used to certify that an individual is exempt from New York State income tax withholding.

Q: What information do I need to provide on the IT-2104-IND form?

A: You will need to provide your personal information, including your name, address, Social Security number, and the reason for your exemption.

Q: How long is the IT-2104-IND form valid for?

A: The IT-2104-IND form is valid for one year from the date it is signed, unless there is a change in your exemption status.

Q: Can I claim exemption from New York City income tax using the IT-2104-IND form?

A: No, the IT-2104-IND form is only for claiming exemption from New York State income tax withholding, not New York City income tax withholding.

Q: Can I claim exemption from federal income tax using the IT-2104-IND form?

A: No, the IT-2104-IND form is only for claiming exemption from New York State income tax withholding, not federal income tax withholding.

Q: Do I need to submit the IT-2104-IND form to my employer?

A: Yes, you must submit the IT-2104-IND form to your employer so they can adjust your income tax withholding accordingly.

Q: What should I do if my exemption status changes?

A: If your exemption status changes, you must notify your employer and submit a new IT-2104-IND form with the updated information.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-IND by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.