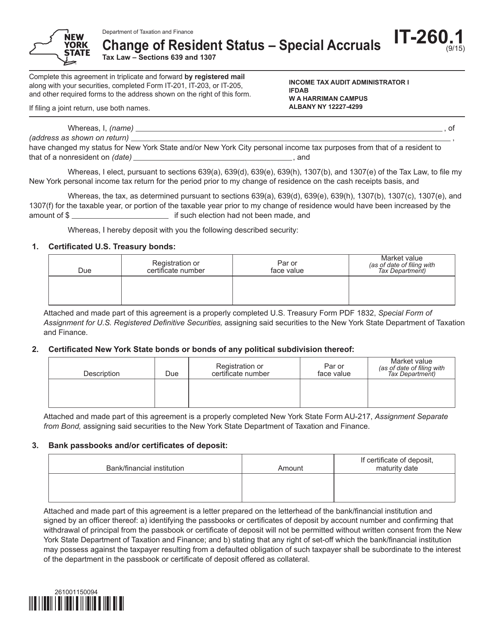

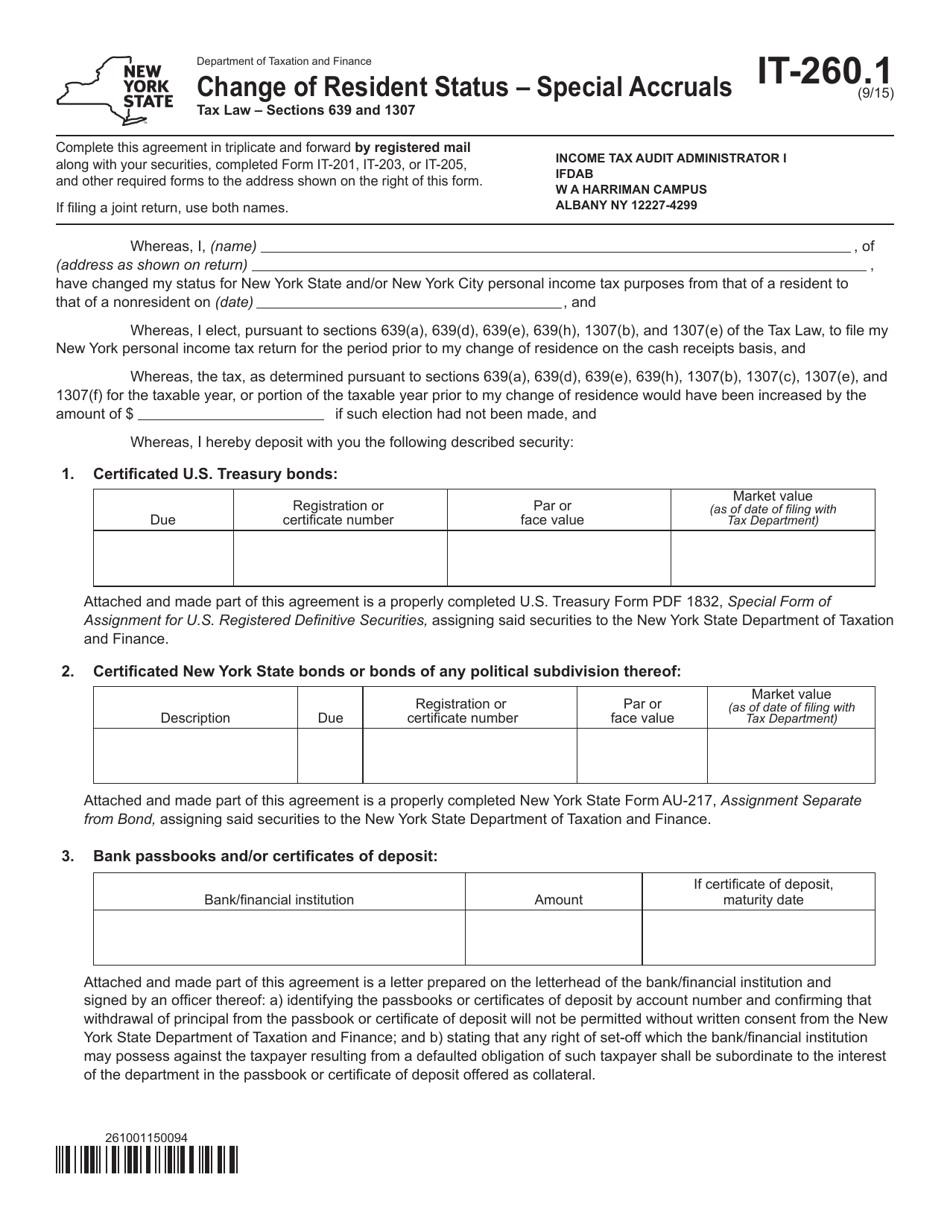

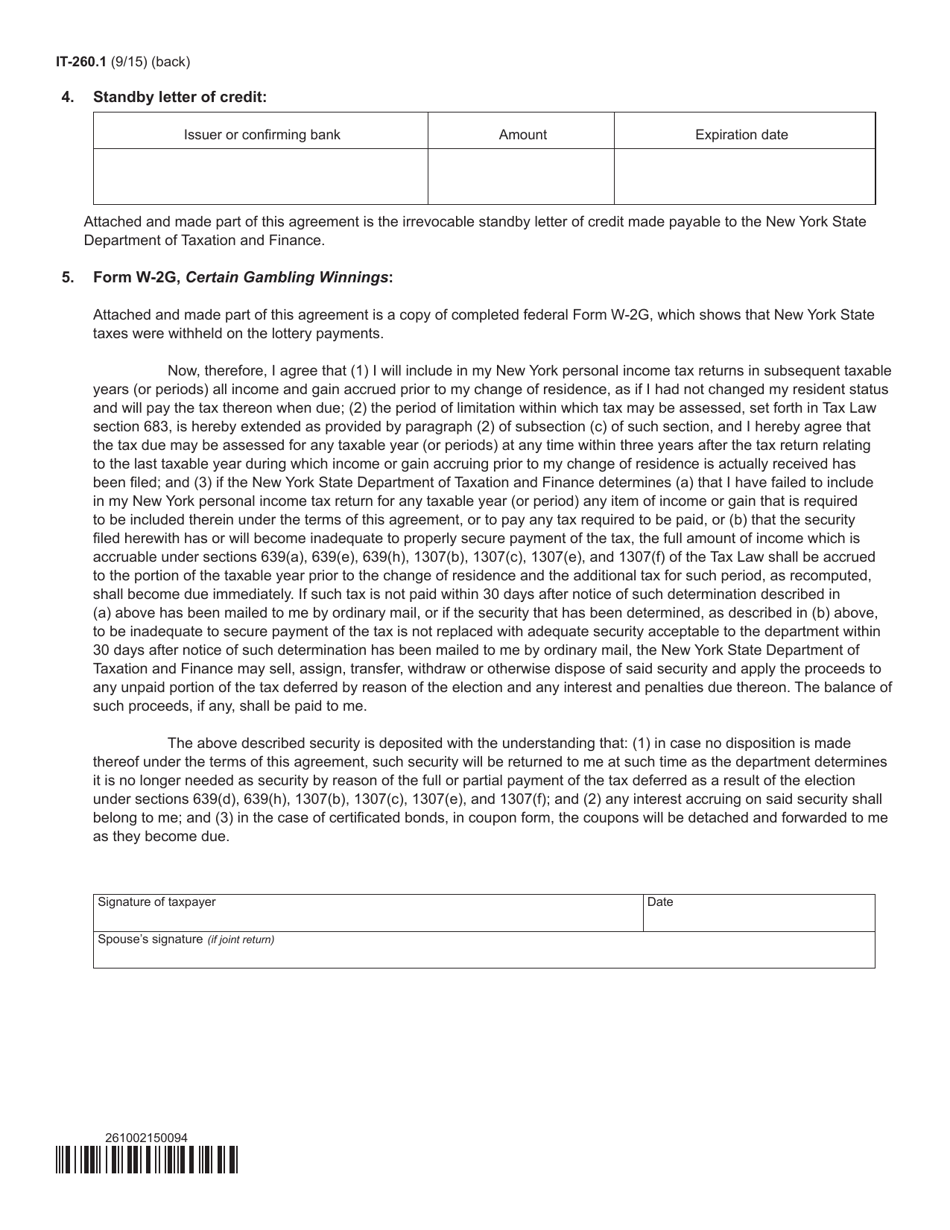

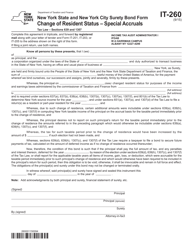

Form IT-260.1 Change of Resident Status " Special Accruals - New York

What Is Form IT-260.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-260.1?

A: Form IT-260.1 is a tax form used to report a change in resident status in New York.

Q: What is considered a change in resident status?

A: A change in resident status refers to a change in where you live for tax purposes.

Q: Who needs to file Form IT-260.1?

A: Anyone who experienced a change in their resident status in New York needs to file Form IT-260.1.

Q: What information is required on Form IT-260.1?

A: Form IT-260.1 requires information about your previous and current resident status, including dates and locations.

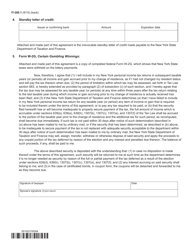

Q: Are there any special accruals related to Form IT-260.1?

A: Yes, there are special accruals that need to be reported on Form IT-260.1.

Q: Are special accruals specific to New York?

A: No, special accruals can apply to any state or jurisdiction.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-260.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.