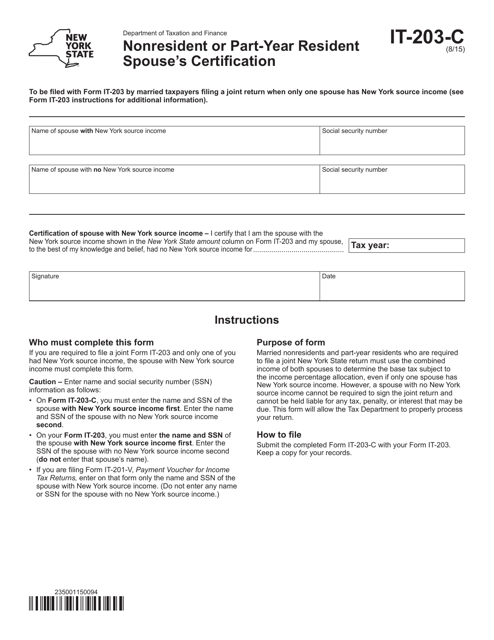

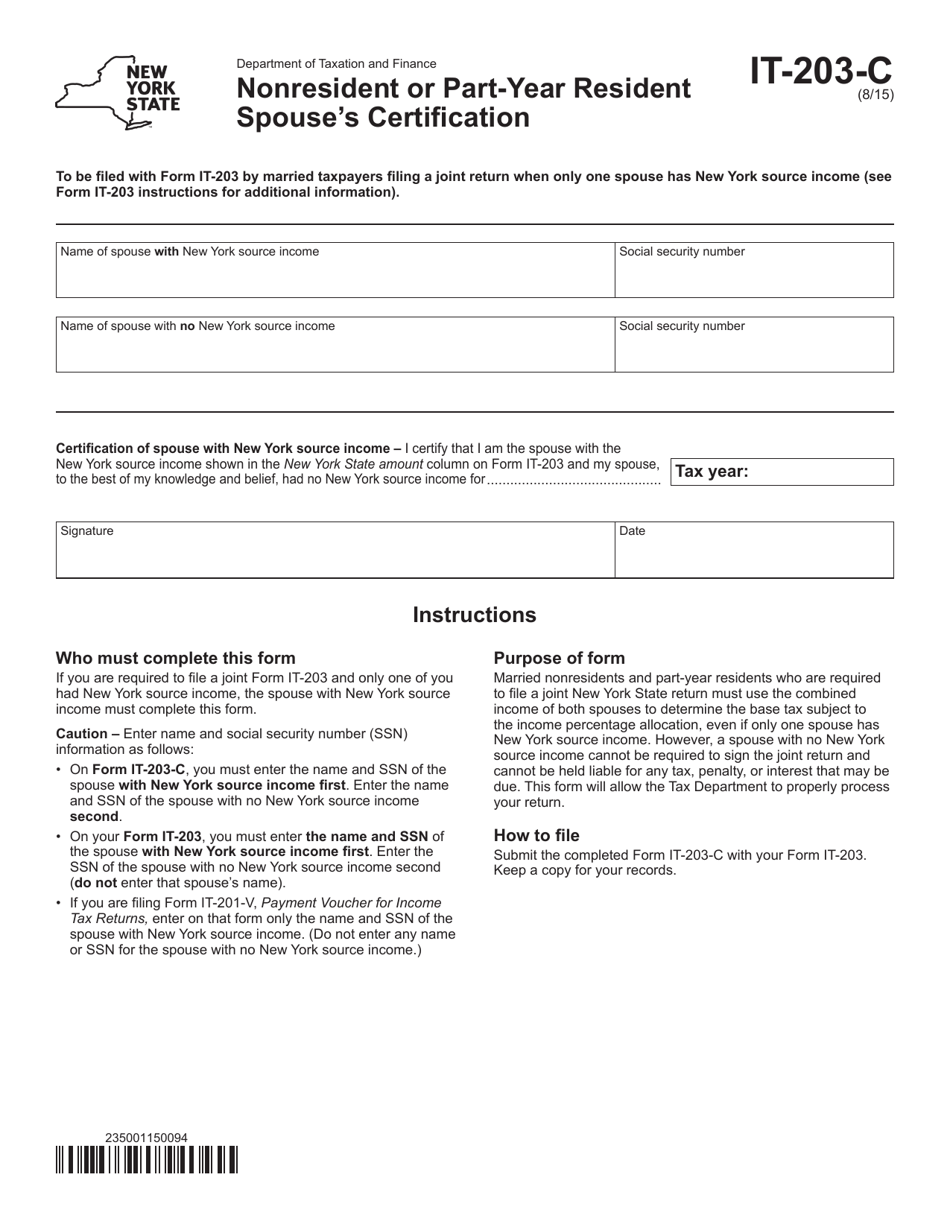

Form IT-203-C Nonresident or Part-Year Resident Spouse's Certification - New York

What Is Form IT-203-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-C?

A: Form IT-203-C is a certification form for nonresident or part-year resident spouses in New York.

Q: Who needs to file Form IT-203-C?

A: Form IT-203-C must be filed by nonresident or part-year resident spouses in New York.

Q: What is the purpose of Form IT-203-C?

A: The purpose of Form IT-203-C is to certify that the nonresident or part-year resident spouse will not claim a New York State tax credit.

Q: When should Form IT-203-C be filed?

A: Form IT-203-C should be filed along with the nonresident or part-year resident spouse's individual income tax return.

Q: Is Form IT-203-C mandatory?

A: Yes, Form IT-203-C is mandatory for nonresident or part-year resident spouses in New York.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.