This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-203-A

for the current year.

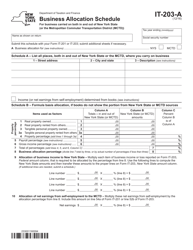

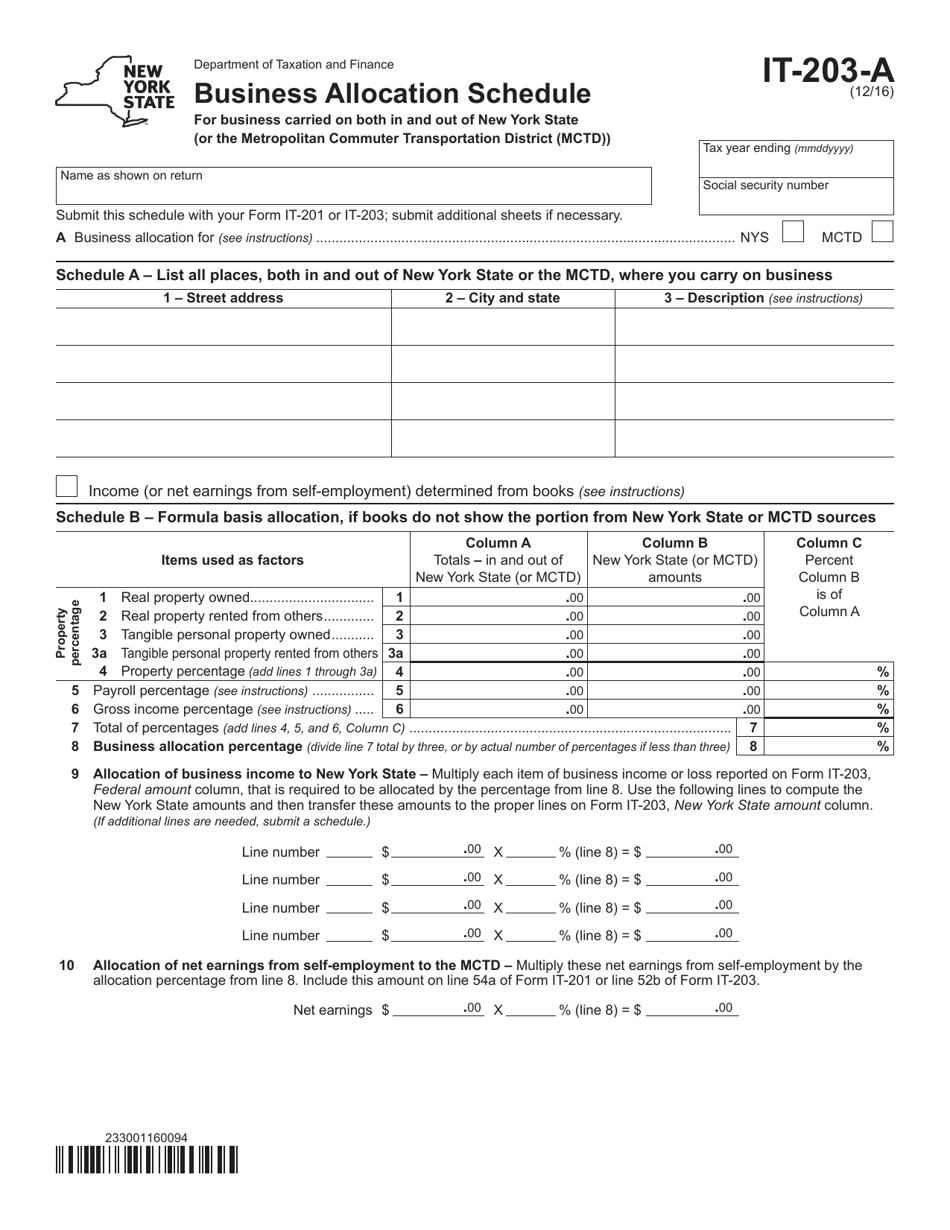

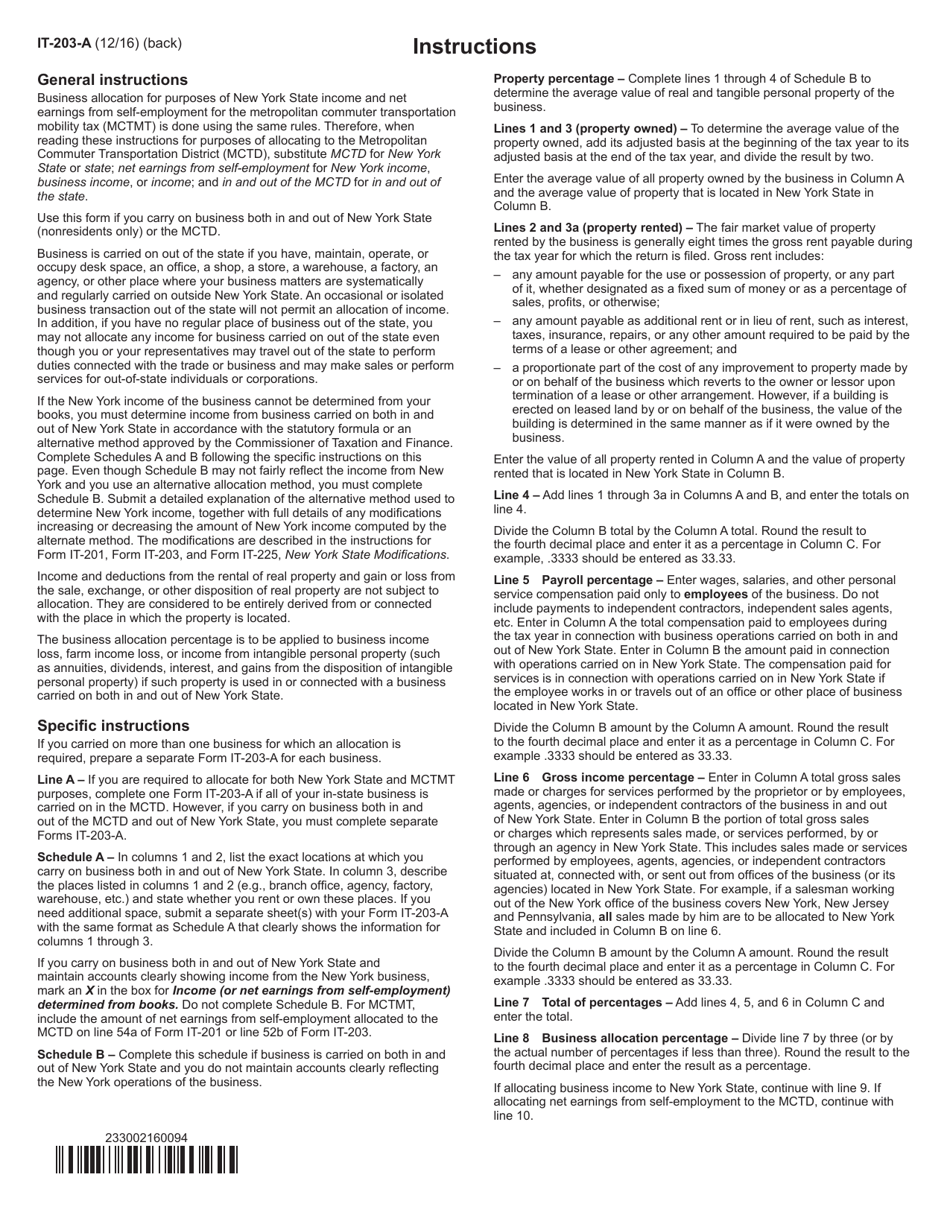

Form IT-203-A Business Allocation Schedule - New York

What Is Form IT-203-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT-203-A?

A: The Form IT-203-A is the Business Allocation Schedule used in New York.

Q: What is the purpose of Form IT-203-A?

A: The purpose of Form IT-203-A is to allocate income and deductions among different businesses in New York.

Q: Who needs to file Form IT-203-A?

A: Individuals who have multiple businesses in New York need to file Form IT-203-A.

Q: What information is required on Form IT-203-A?

A: Form IT-203-A requires information such as business income, expenses, and deductions for each business.

Q: When is the deadline to file Form IT-203-A?

A: The deadline to file Form IT-203-A is the same as the deadline to file your New York State income tax return, which is generally April 15th.

Q: What happens if I don't file Form IT-203-A?

A: If you have multiple businesses in New York and don't file Form IT-203-A, your income and deductions may not be properly allocated, which could result in errors on your tax return.

Q: Are there any additional forms or schedules related to Form IT-203-A?

A: Yes, you may need to file other forms or schedules, such as Form IT-203-B for nonresident partners or shareholders, or Form IT-212 for farm business income.

Q: Can I e-file Form IT-203-A?

A: Yes, you can e-file Form IT-203-A using approved tax software or through a professional tax preparer.

Q: Can I amend my Form IT-203-A?

A: Yes, if you need to make changes to your allocation of income and deductions, you can file an amended Form IT-203-A.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.