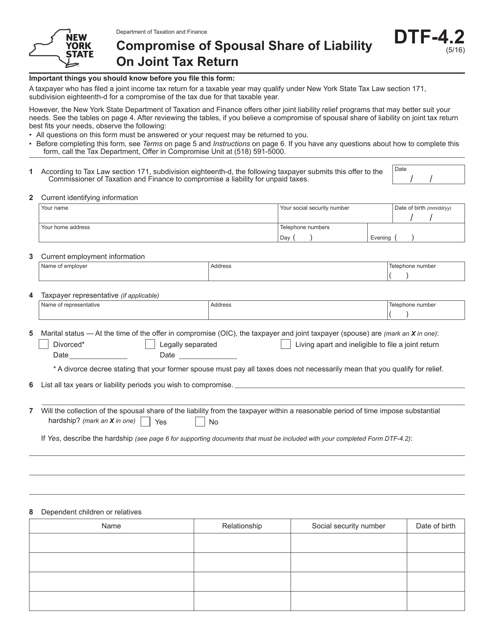

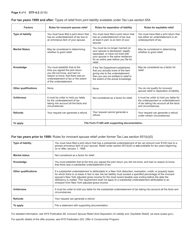

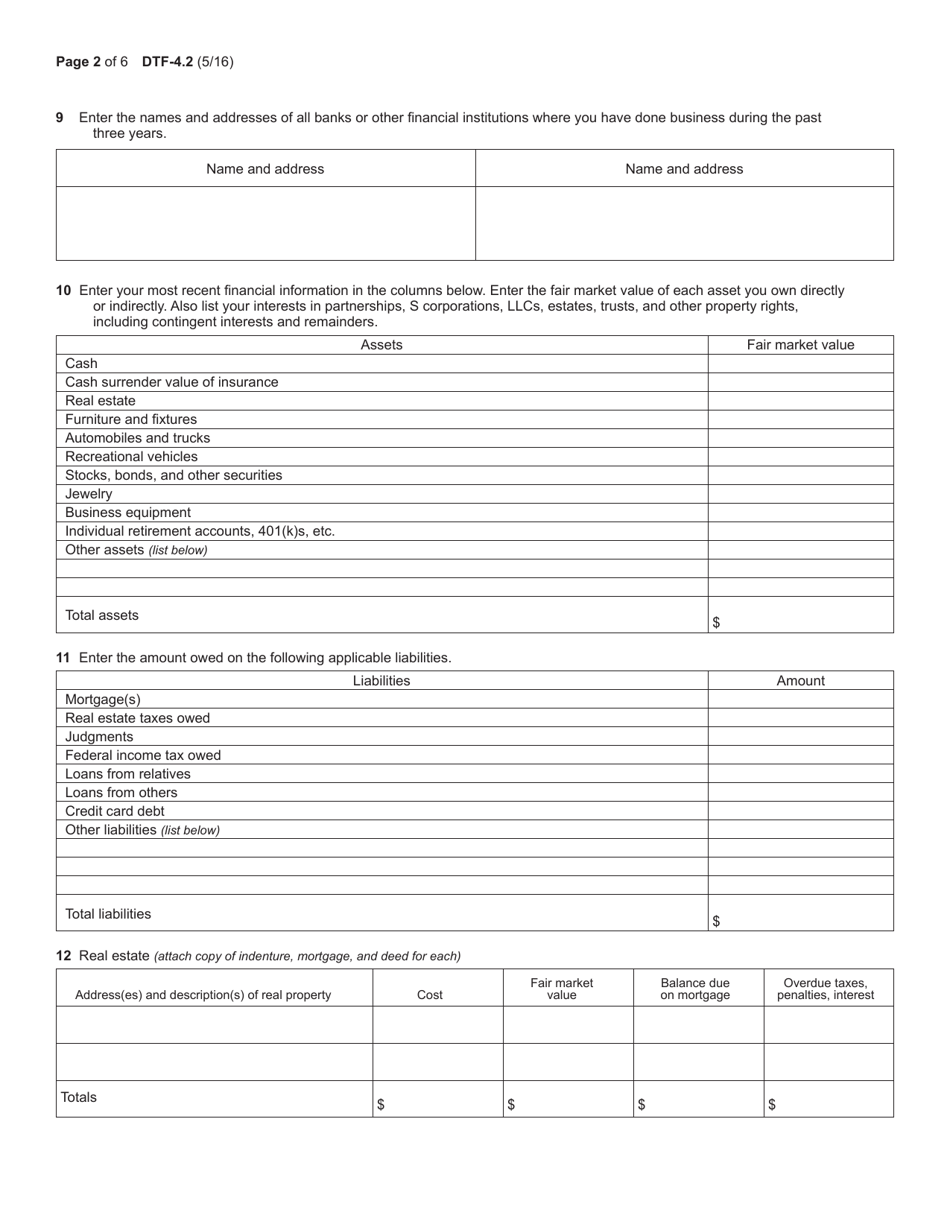

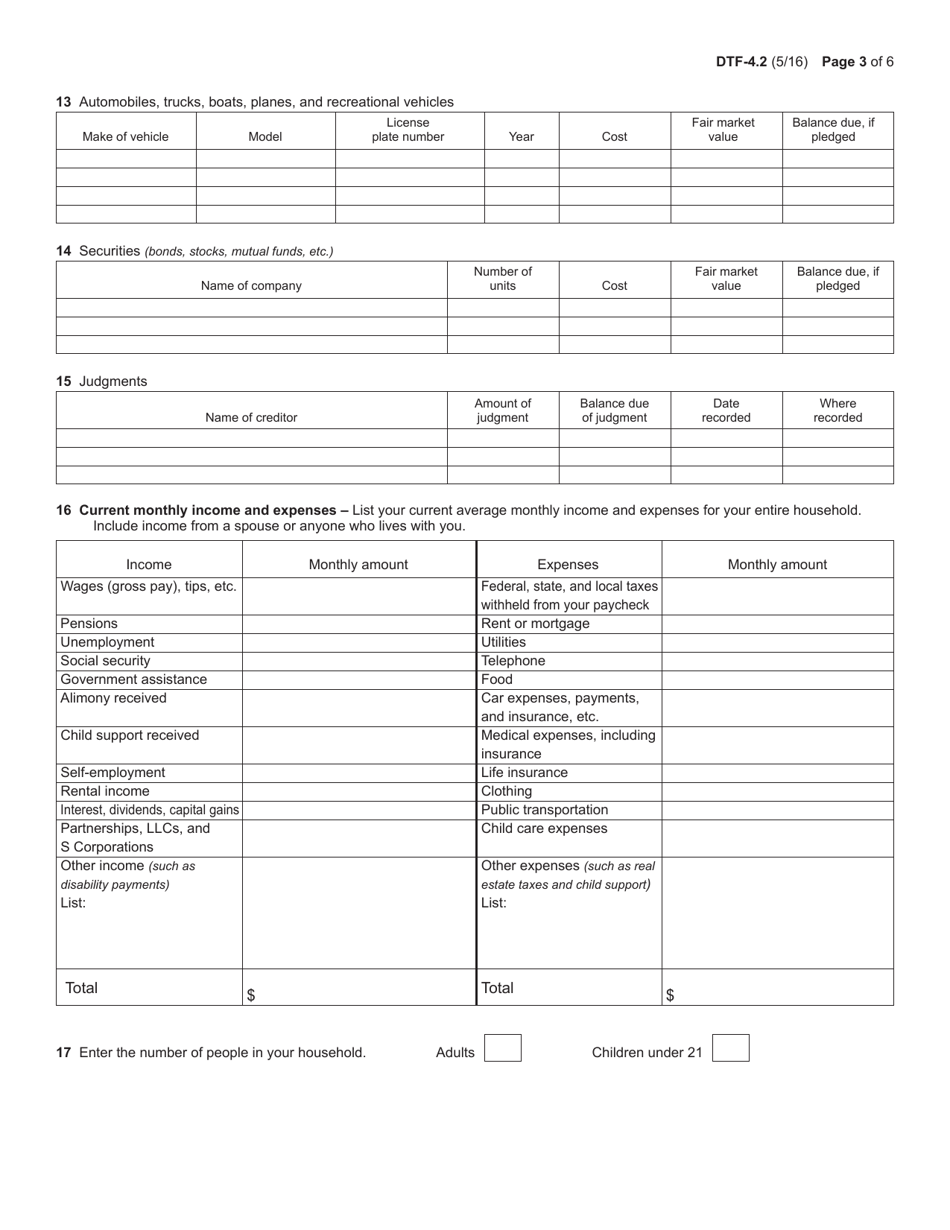

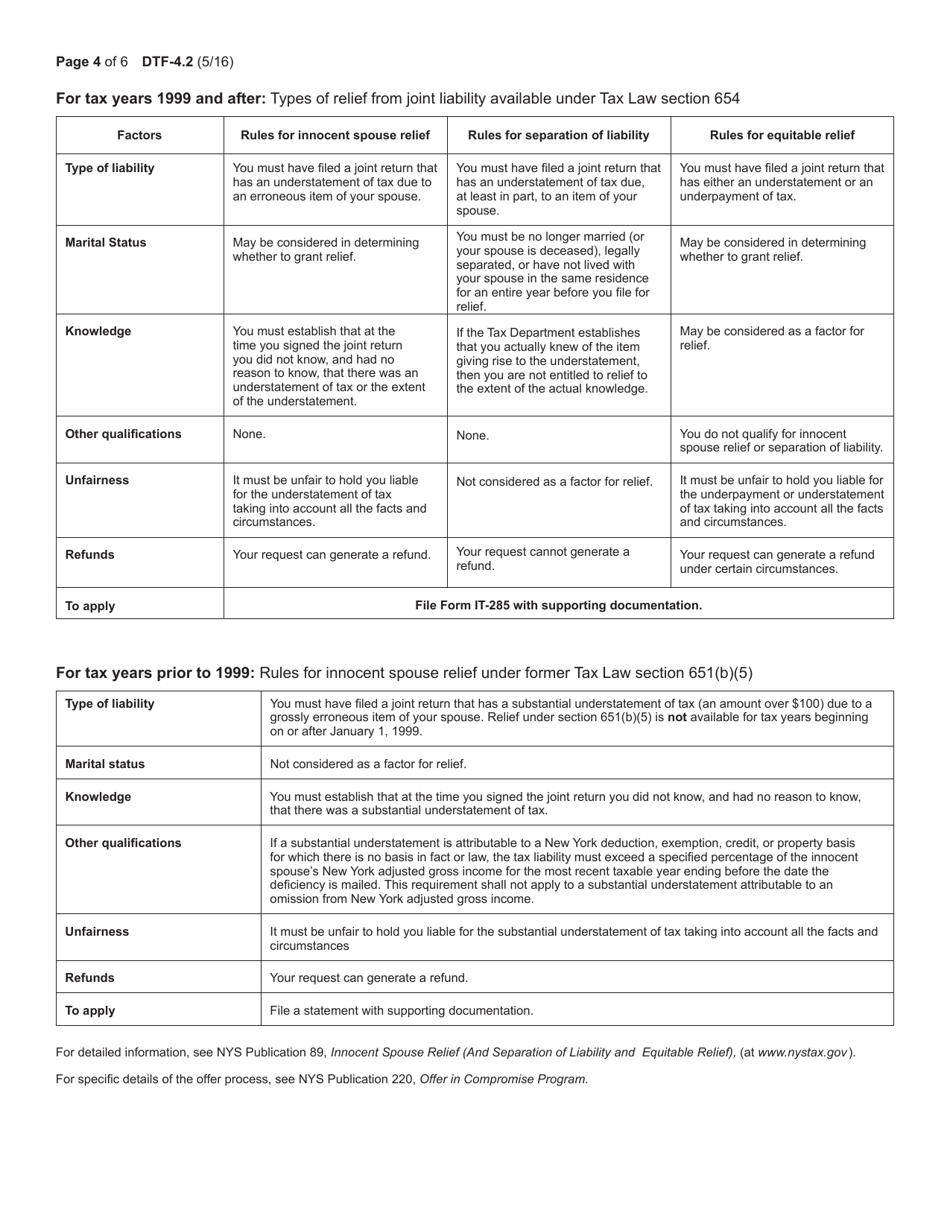

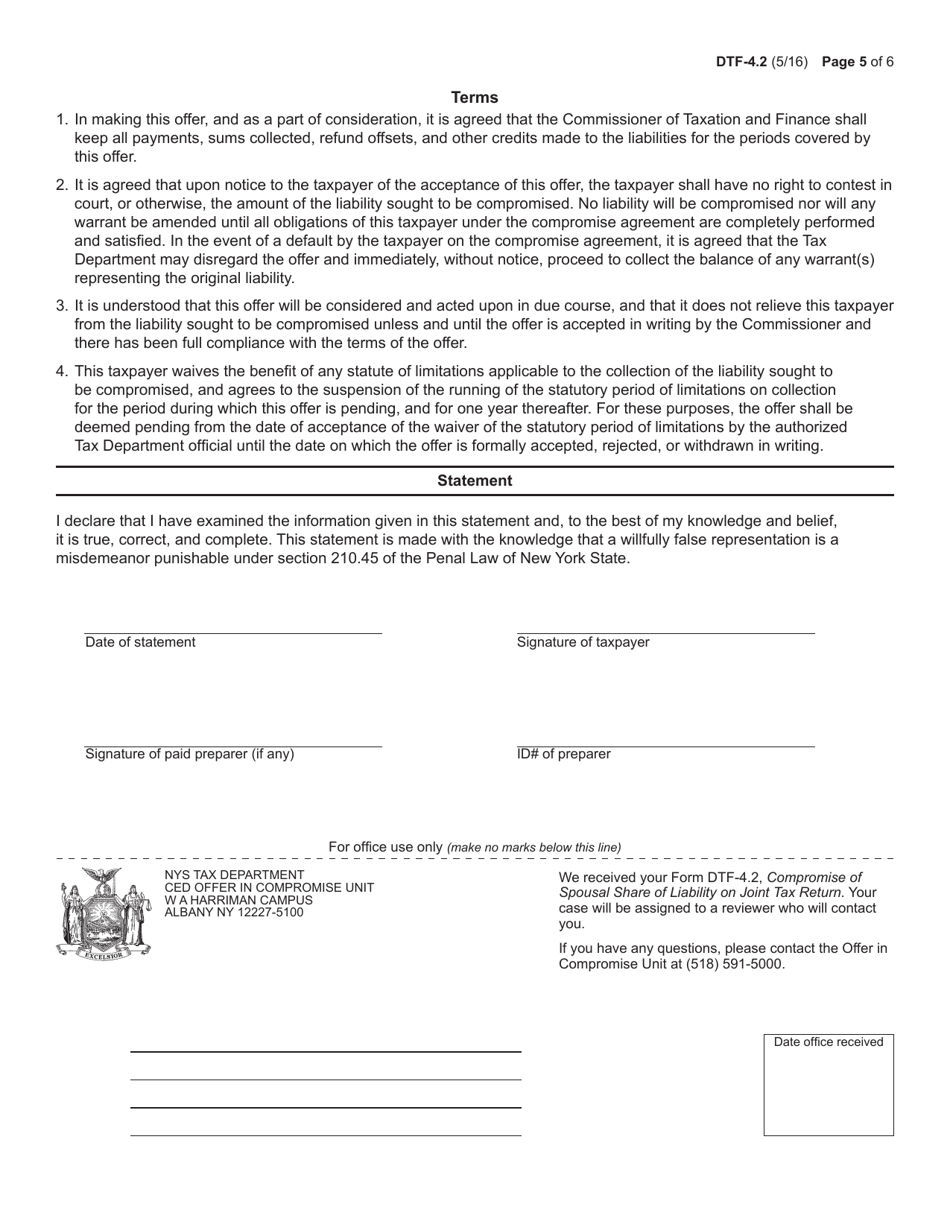

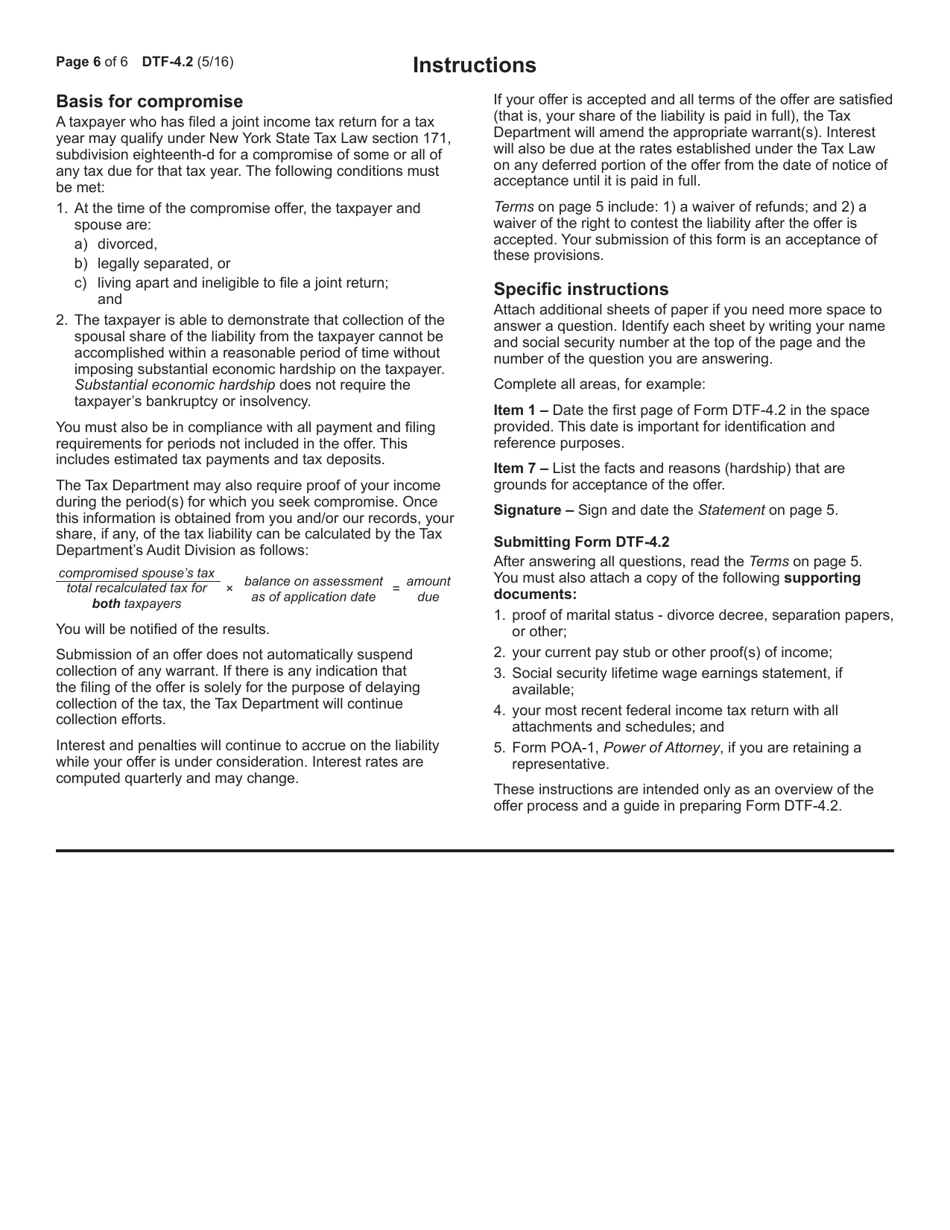

Form DTF-4.2 Compromise of Spousal Share of Liability on Joint Tax Return - New York

What Is Form DTF-4.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-4.2?

A: Form DTF-4.2 is the Compromise of Spousal Share of Liability on Joint Tax Return form in New York.

Q: What is the purpose of Form DTF-4.2?

A: The purpose of Form DTF-4.2 is to request a compromise of the spousal share of liability on a joint tax return in New York.

Q: Who should use Form DTF-4.2?

A: Form DTF-4.2 should be used by individuals who want to request a compromise of their spousal share of liability on a joint tax return in New York.

Q: Are there any fees associated with submitting Form DTF-4.2?

A: There are no fees associated with submitting Form DTF-4.2.

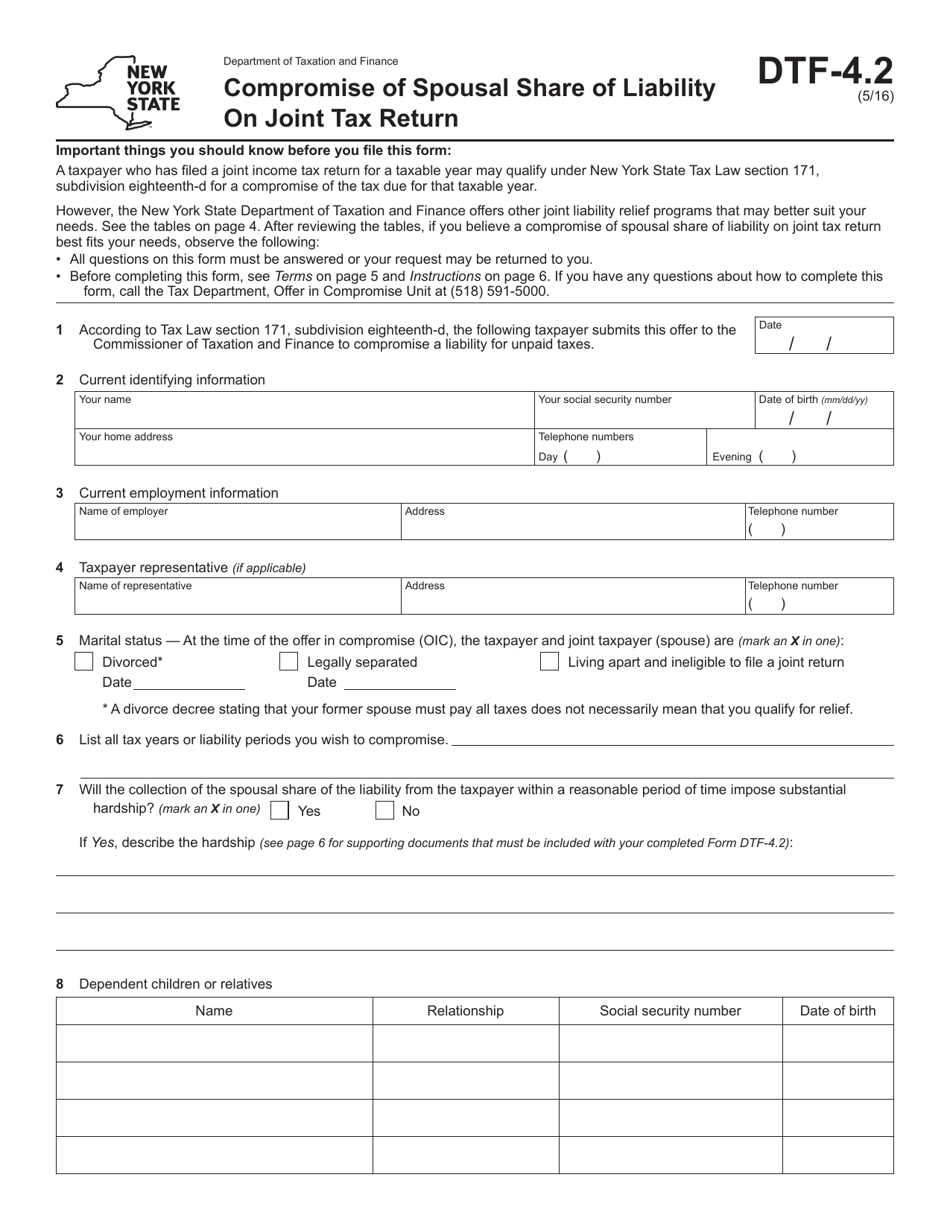

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-4.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.