This version of the form is not currently in use and is provided for reference only. Download this version of

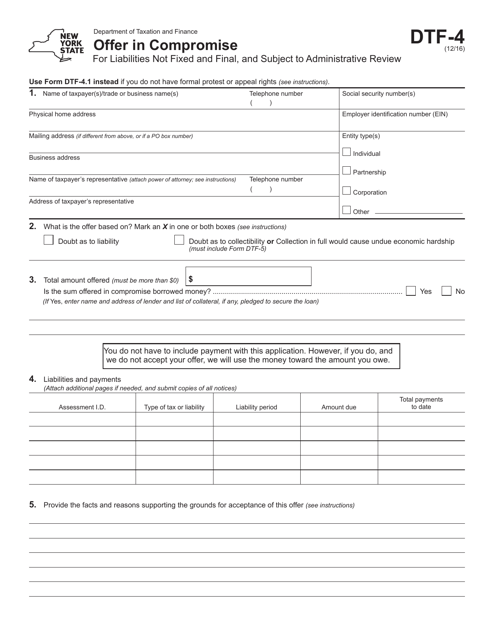

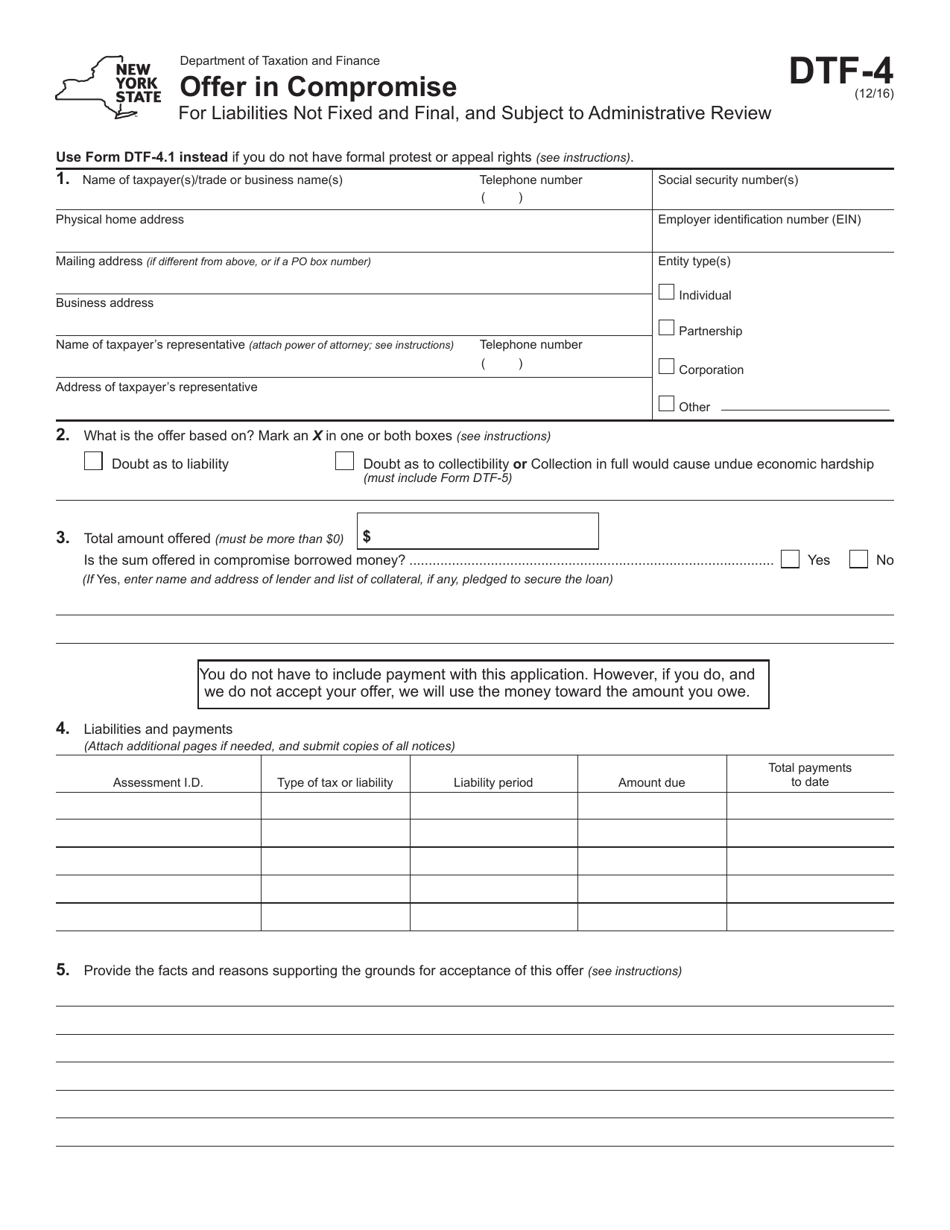

Form DTF-4

for the current year.

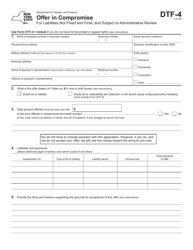

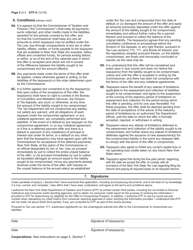

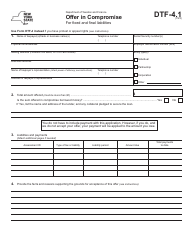

Form DTF-4 Offer in Compromise for Liabilities Not Fixed and Final, and Subject to Administrative Review - New York

What Is Form DTF-4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-4?

A: Form DTF-4 is an Offer in Compromise for liabilities that are not fixed and final, and subject to administrative review in New York.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows you to settle your tax debt for less than the full amount owed.

Q: What does it mean for liabilities to be not fixed and final?

A: Liabilities that are not fixed and final means that they are still under review and have not been determined as a final amount.

Q: What is administrative review?

A: Administrative review is the process by which the tax authority reviews the taxpayer's request for a reduction in their tax liability.

Q: Who is eligible to use Form DTF-4?

A: Taxpayers in New York who have liabilities that are not fixed and final and are subject to administrative review are eligible to use Form DTF-4.

Q: What is the purpose of Form DTF-4?

A: The purpose of Form DTF-4 is to make an offer to settle your tax liabilities that are not fixed and final, and are under administrative review.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

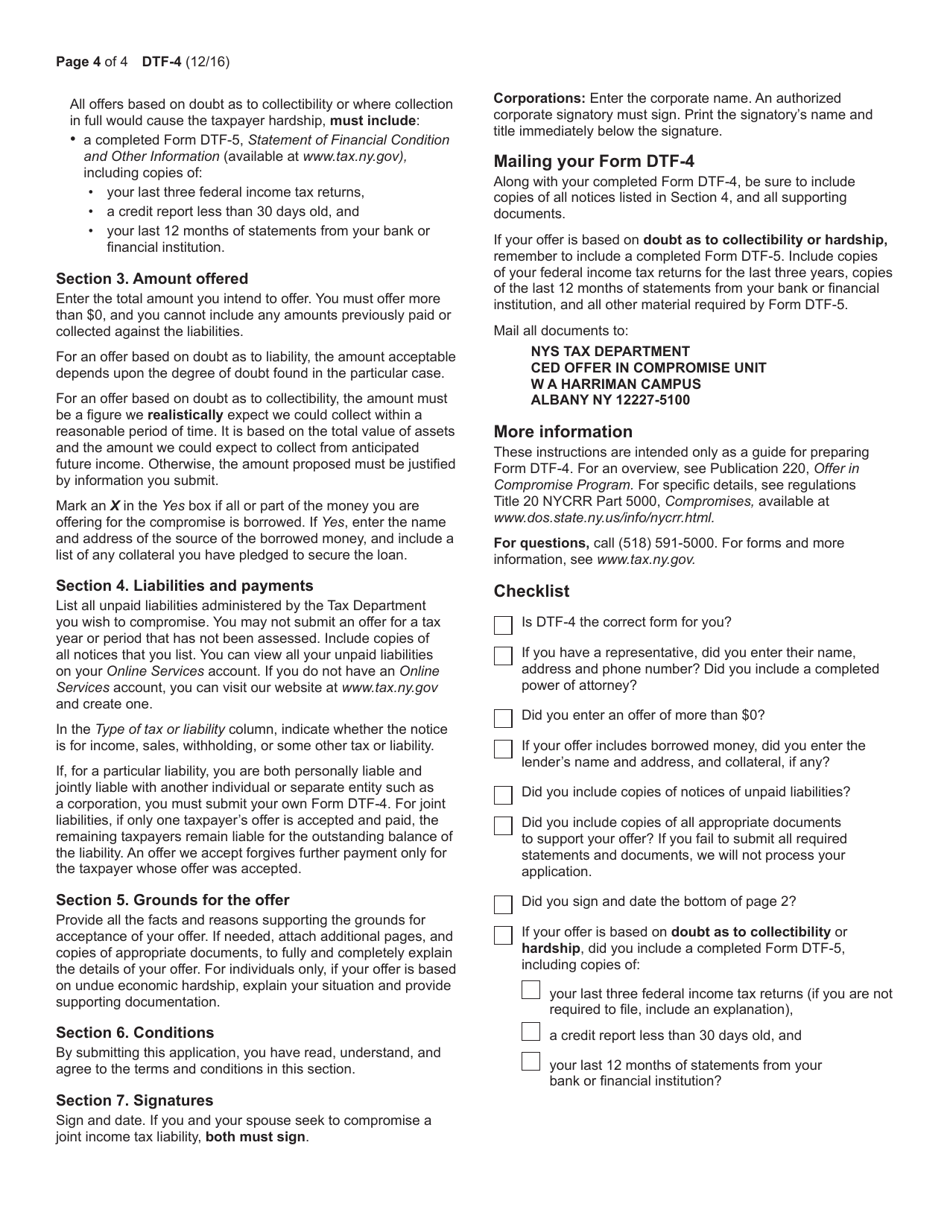

Download a fillable version of Form DTF-4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.