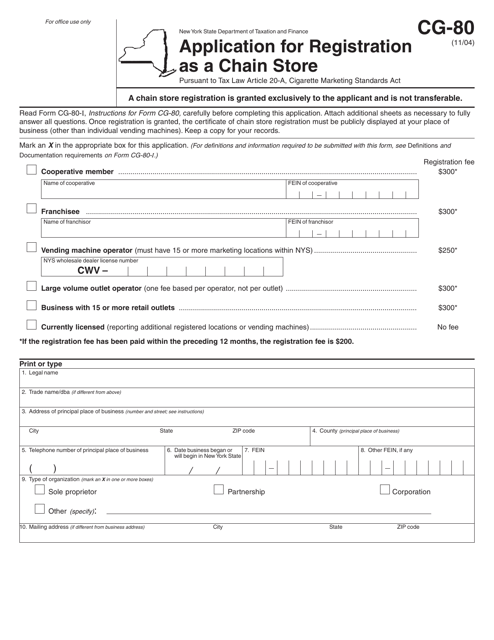

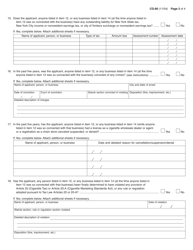

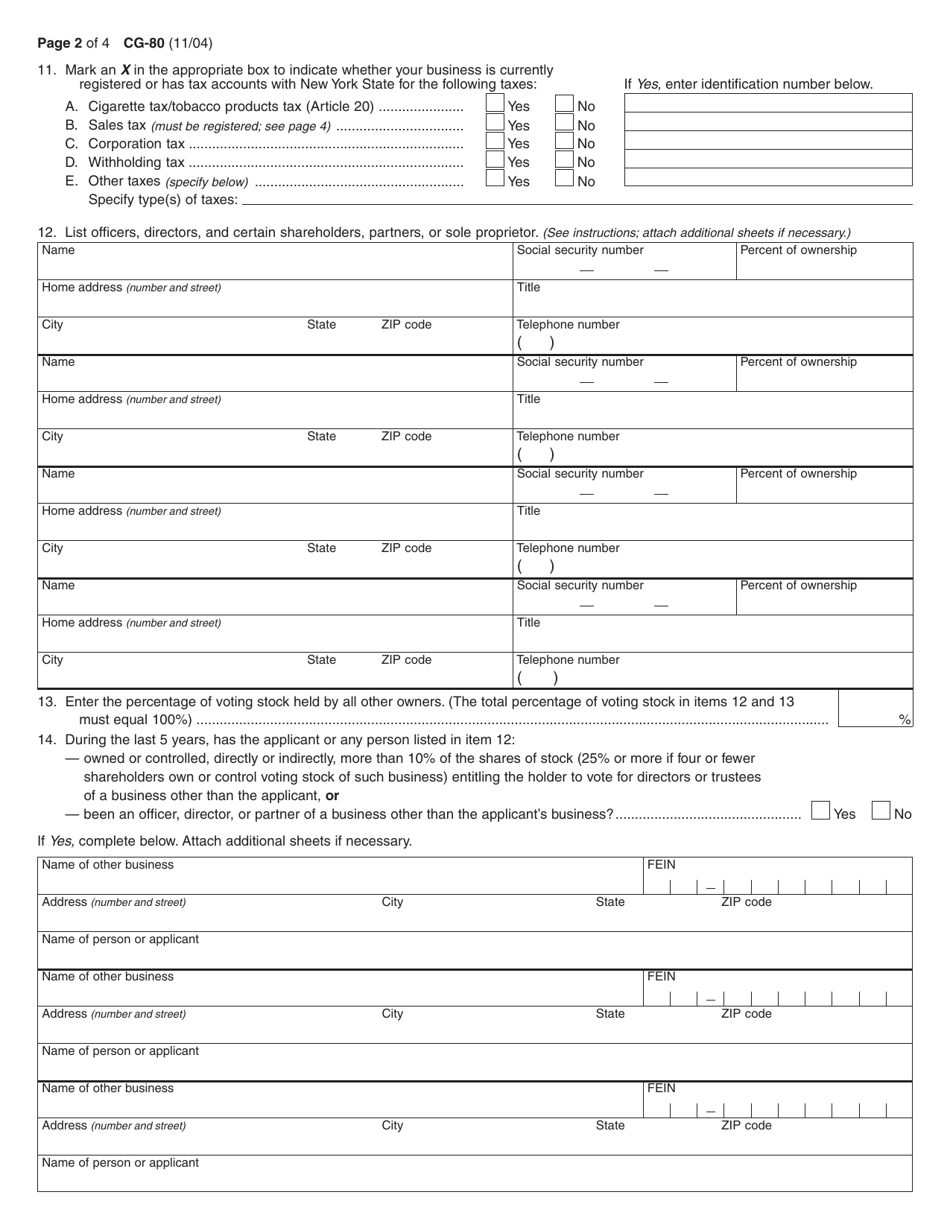

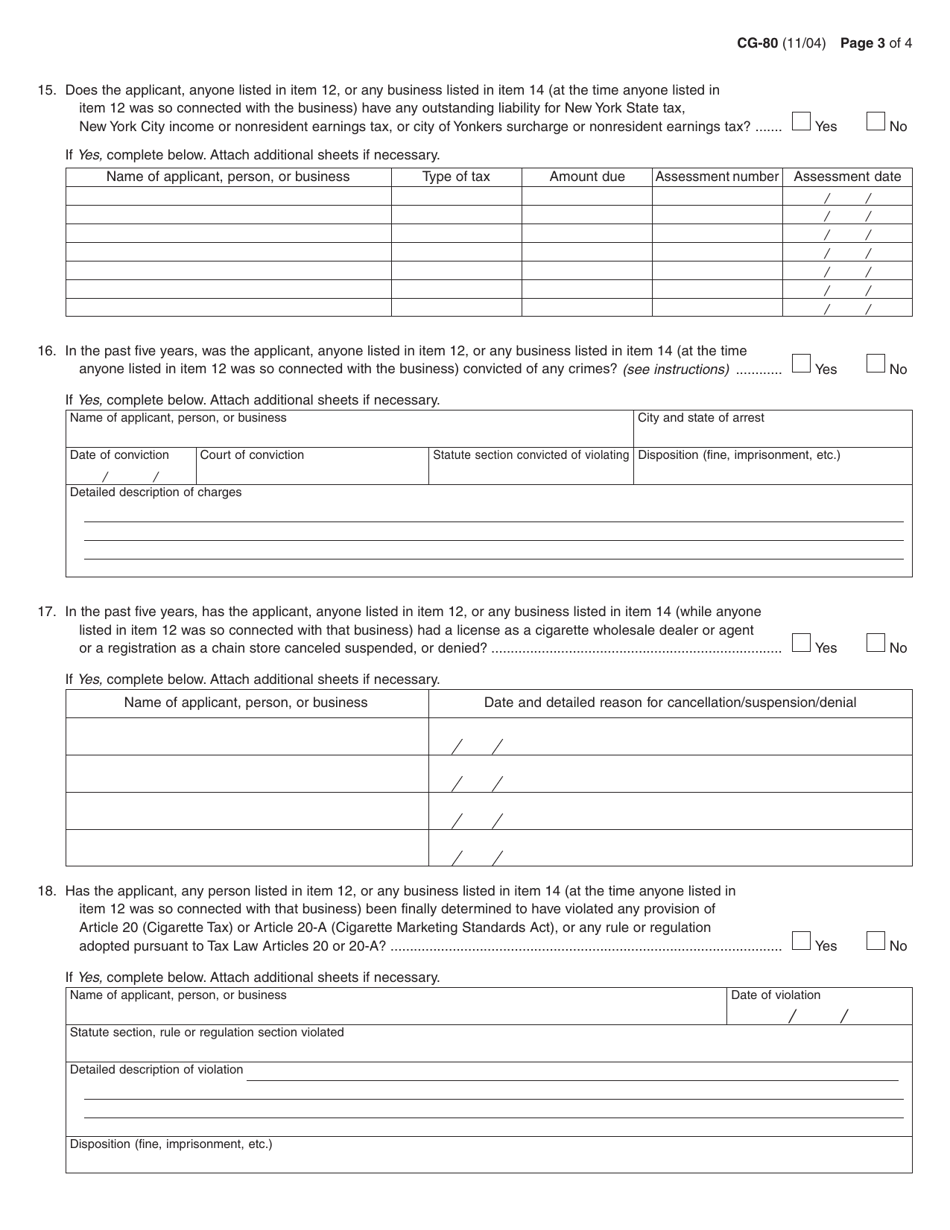

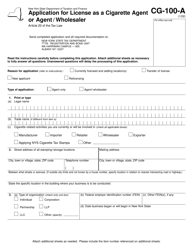

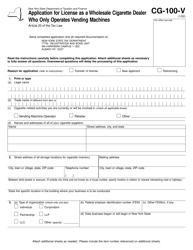

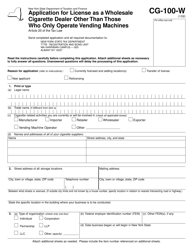

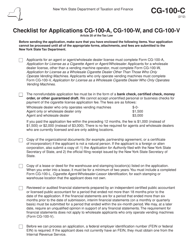

Form CG-80 Application for Registration as a Chain Store - New York

What Is Form CG-80?

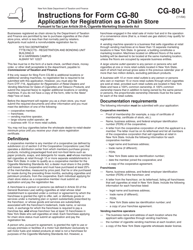

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CG-80?

A: Form CG-80 is the Application for Registration as a Chain Store.

Q: Who needs to fill out Form CG-80?

A: Chain stores in New York need to fill out Form CG-80 to register.

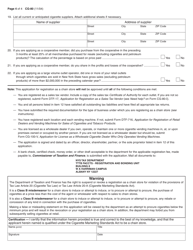

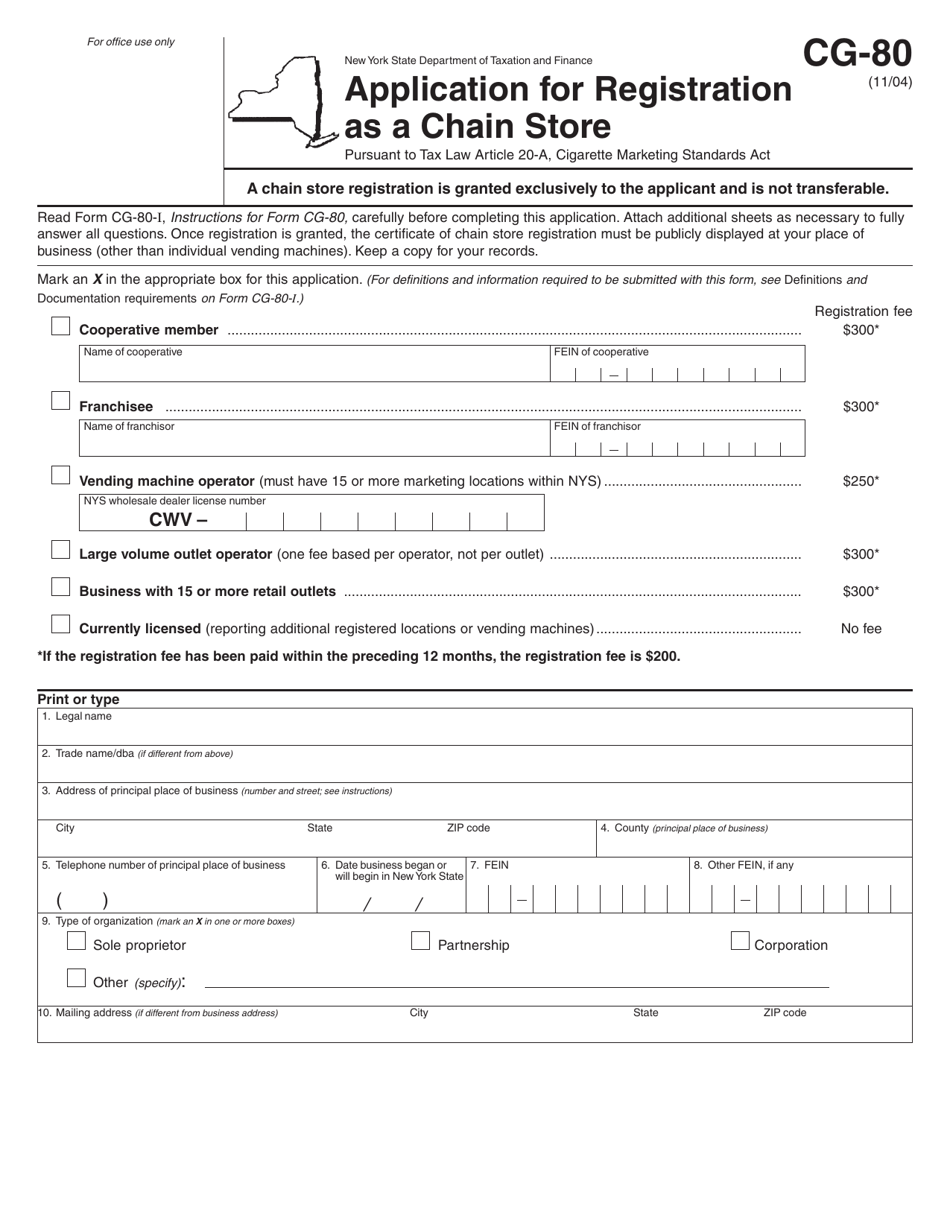

Q: What information is required in Form CG-80?

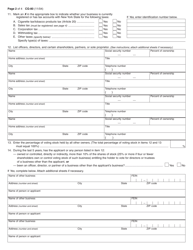

A: Form CG-80 requires information about the chain store, its owners, and its business operations.

Q: What should I do after filling out Form CG-80?

A: After filling out Form CG-80, you need to submit it to the New York Department of State along with the required fee.

Q: How long does it take to process Form CG-80?

A: The processing time for Form CG-80 can vary. You can contact the New York Department of State for more information on the current processing times.

Q: What is the purpose of registering as a chain store in New York?

A: Registering as a chain store in New York is required by law and helps the state keep track of businesses operating within its jurisdiction.

Q: Are there any penalties for not registering as a chain store in New York?

A: Yes, there can be penalties for not registering as a chain store in New York, including fines and other legal consequences.

Q: Can I mail Form CG-80 or do I have to submit it in person?

A: You can either mail Form CG-80 or submit it in person to the New York Department of State.

Q: Are there any exemptions from registering as a chain store in New York?

A: There may be certain exemptions or special circumstances that exempt certain businesses from registering as a chain store in New York. It is best to consult with the New York Department of State for specific guidance in your situation.

Q: Is Form CG-80 specific to New York?

A: Yes, Form CG-80 is specific to New York. Other states may have their own requirements and forms for chain store registration.

Q: Can I get assistance in filling out Form CG-80?

A: Yes, you can seek assistance from the New York Department of State or consult with a legal professional for help in filling out Form CG-80.

Q: Is there a deadline for submitting Form CG-80?

A: There may be a deadline for submitting Form CG-80, depending on the specific requirements set by the New York Department of State. It is important to check the instructions or contact the department for any deadline information.

Q: What happens after submitting Form CG-80?

A: After submitting Form CG-80, the New York Department of State will review your application and if approved, you will receive a certificate of registration as a chain store.

Q: Do I need to renew my chain store registration?

A: Yes, chain store registration needs to be renewed periodically. The renewal requirements and process can be obtained from the New York Department of State.

Q: Can I use Form CG-80 for multiple chain store locations?

A: Yes, you can use Form CG-80 for multiple chain store locations. You may need to provide additional information for each location.

Q: Can I obtain a copy of my chain store registration certificate?

A: Yes, you can obtain a copy of your chain store registration certificate from the New York Department of State.

Q: Can I make changes to my chain store registration?

A: Yes, you can make changes to your chain store registration. You will need to notify the New York Department of State of any changes and provide the necessary documentation.

Q: What happens if I close my chain store?

A: If you close your chain store, you should notify the New York Department of State and follow any required steps for termination or cancellation of your chain store registration.

Q: Can I transfer my chain store registration to a new owner?

A: Yes, chain store registrations can be transferred to new owners. You will need to follow the process outlined by the New York Department of State.

Form Details:

- Released on November 1, 2004;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-80 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.