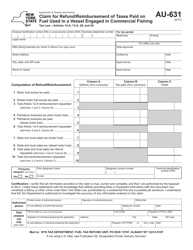

This version of the form is not currently in use and is provided for reference only. Download this version of

Form AU-630

for the current year.

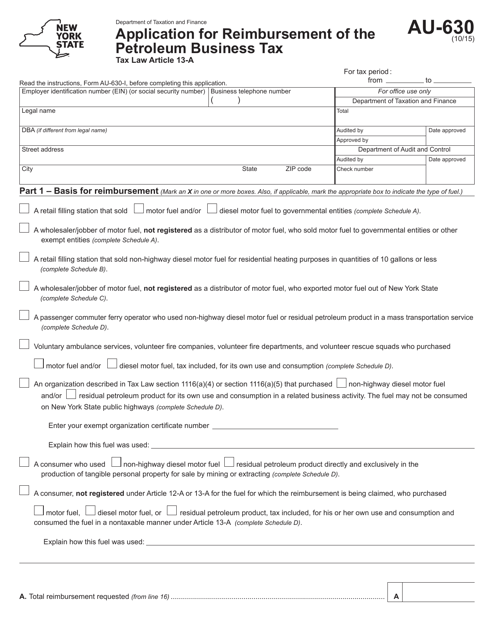

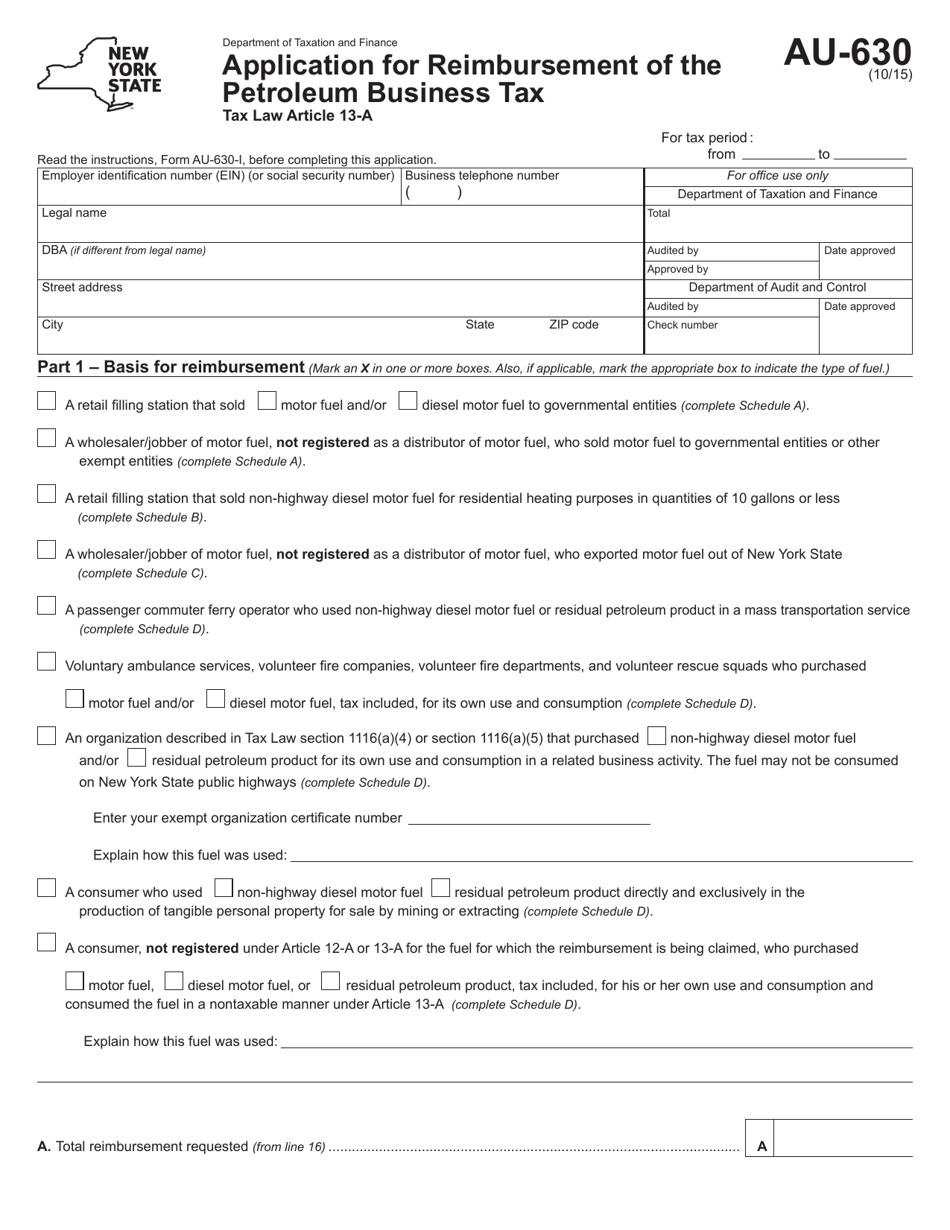

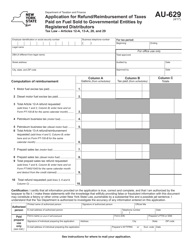

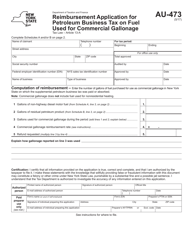

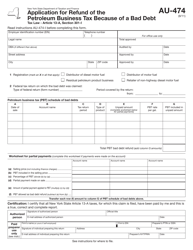

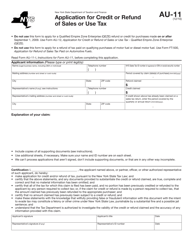

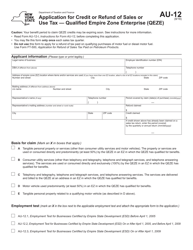

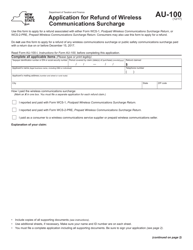

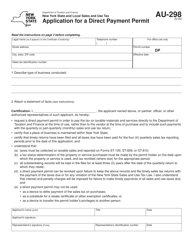

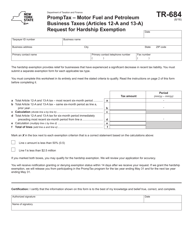

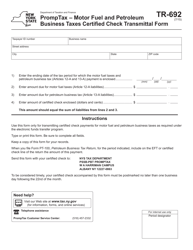

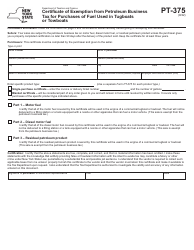

Form AU-630 Application for Reimbursement of the Petroleum Business Tax - New York

What Is Form AU-630?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AU-630?

A: Form AU-630 is an application for reimbursement of the Petroleum Business Tax in New York.

Q: Who can complete Form AU-630?

A: Any business in New York that is eligible for reimbursement of the Petroleum Business Tax can complete Form AU-630.

Q: What is the purpose of Form AU-630?

A: The purpose of Form AU-630 is to apply for reimbursement of the Petroleum Business Tax paid by eligible businesses in New York.

Q: Is Form AU-630 specific to New York only?

A: Yes, Form AU-630 is specific to businesses in New York that are subject to the Petroleum Business Tax.

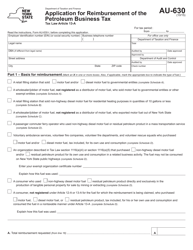

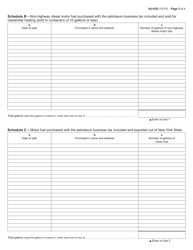

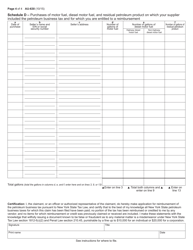

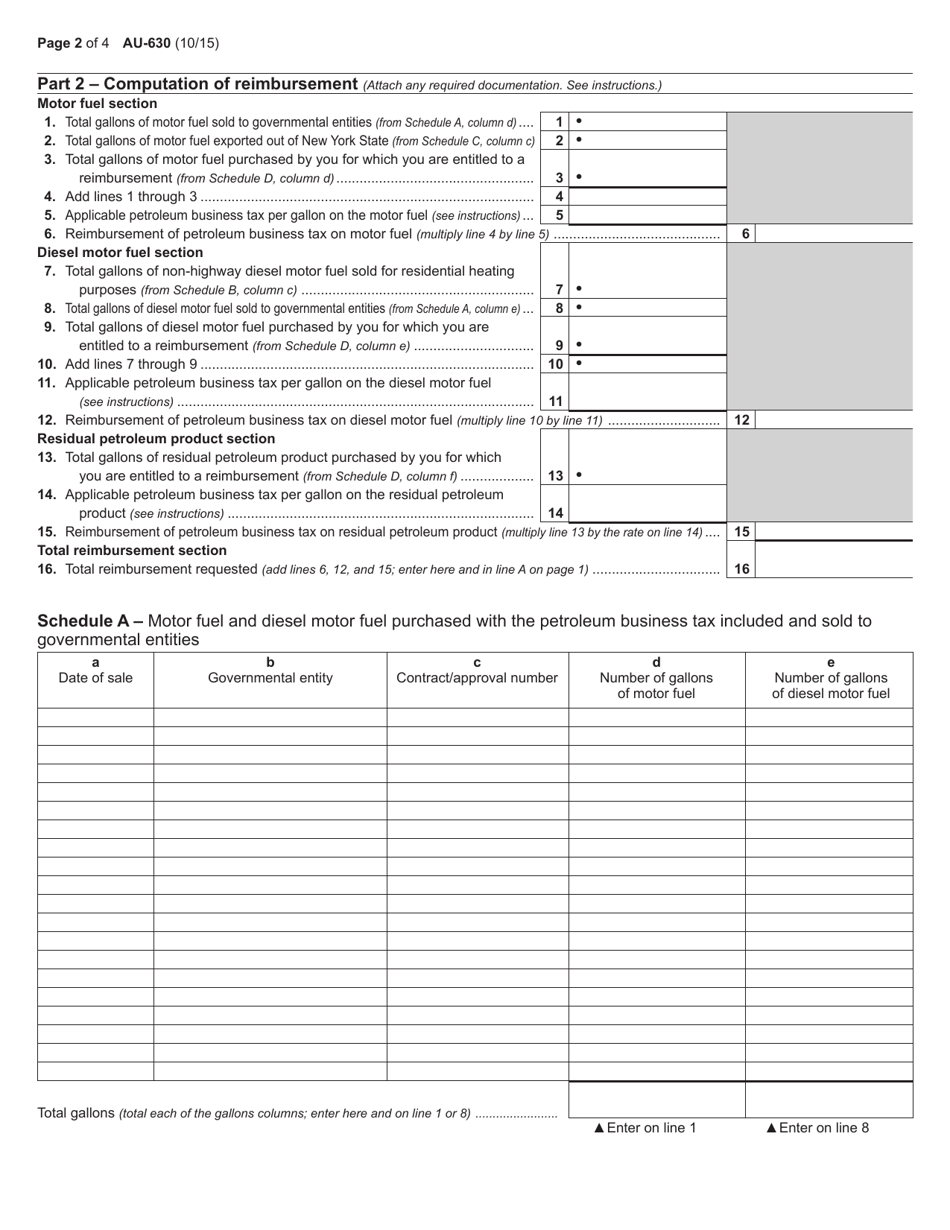

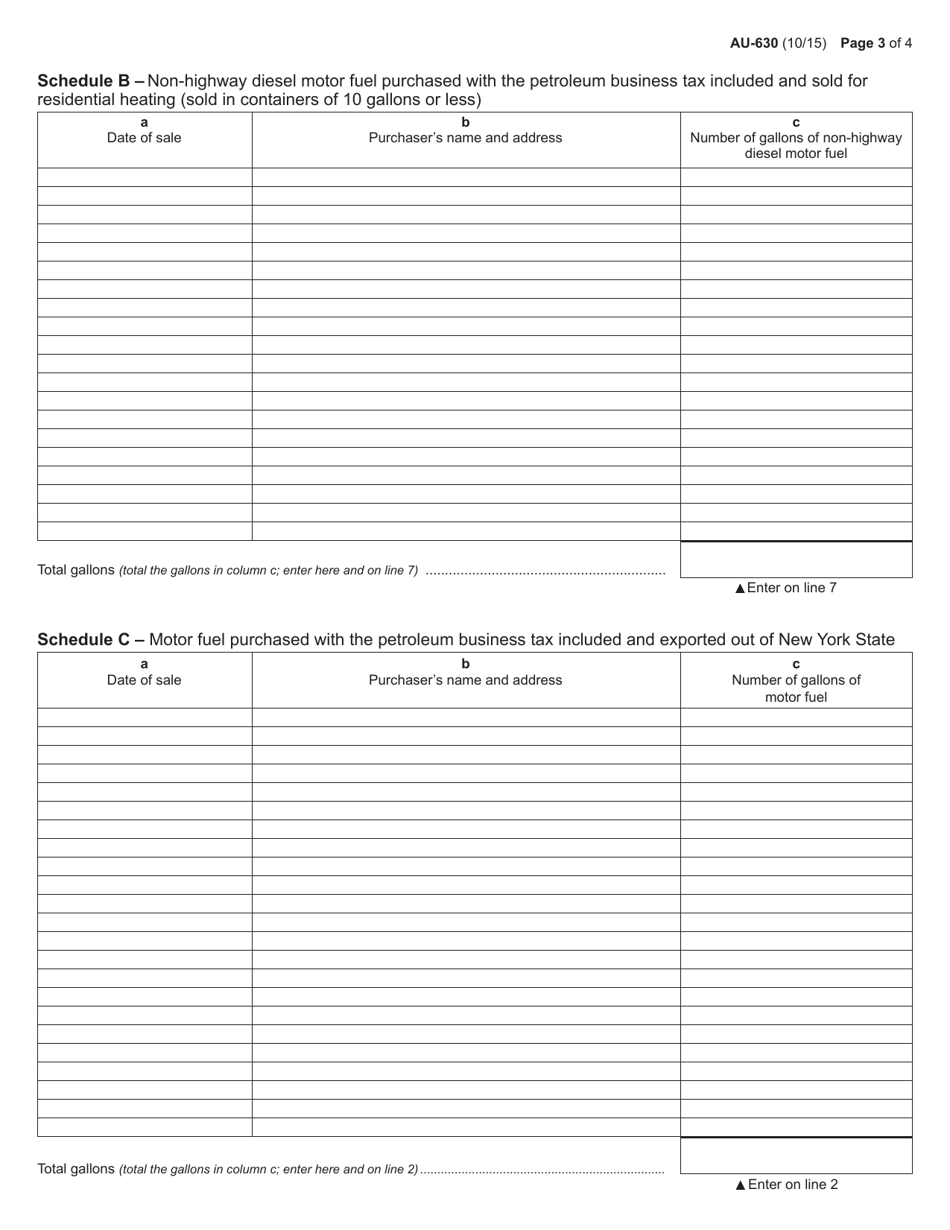

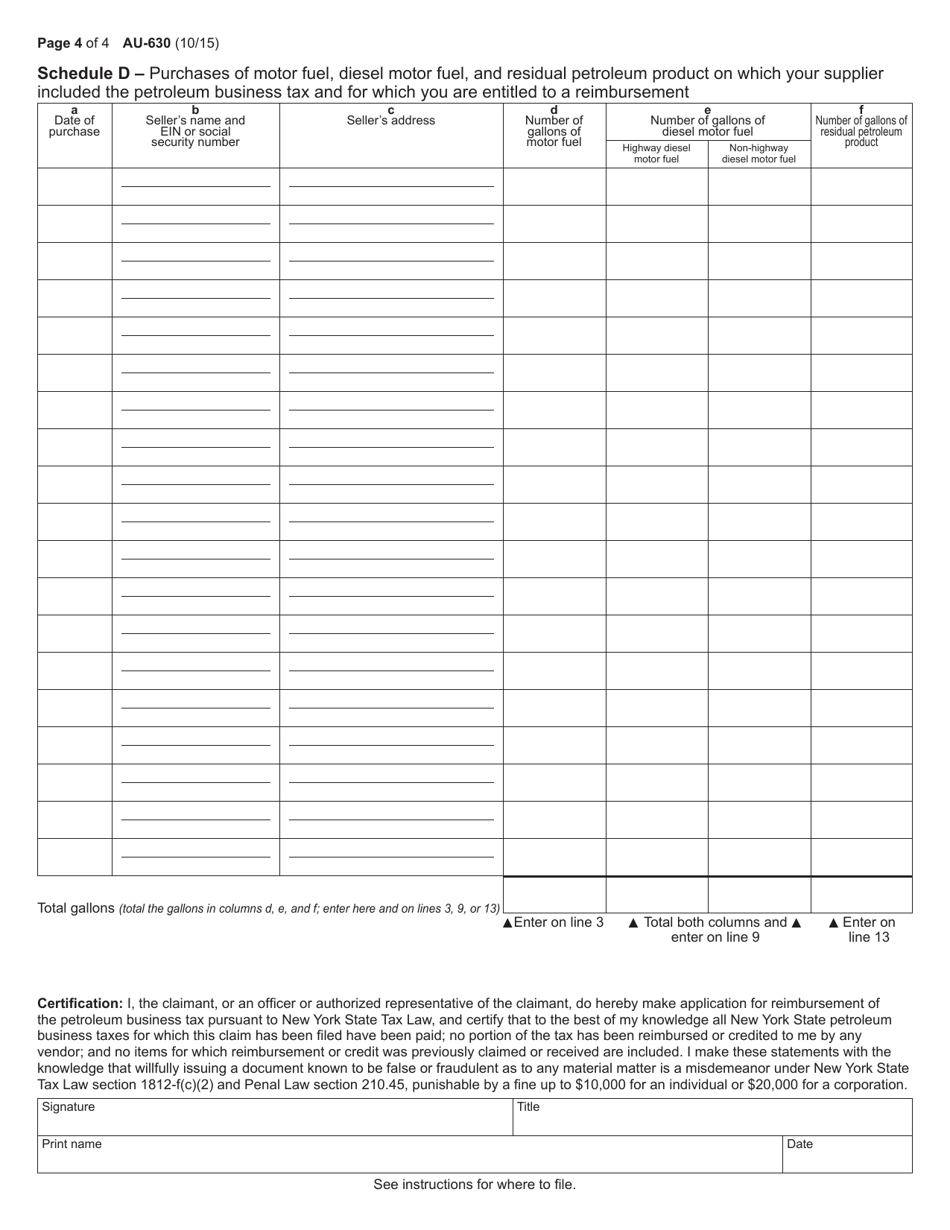

Q: What information is required on Form AU-630?

A: Form AU-630 requires information such as the taxpayer identification number, tax period, amount of tax paid, and details of the petroleum purchases.

Q: What supporting documentation is required with Form AU-630?

A: Supporting documentation such as receipts, invoices, and other records of petroleum purchases may be required to be submitted with Form AU-630.

Q: Is there a deadline for filing Form AU-630?

A: Yes, the deadline for filing Form AU-630 is typically within three years from the due date of the return or the date the tax was paid, whichever is later.

Q: Are there any fees associated with filing Form AU-630?

A: No, there are no fees associated with filing Form AU-630.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-630 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.