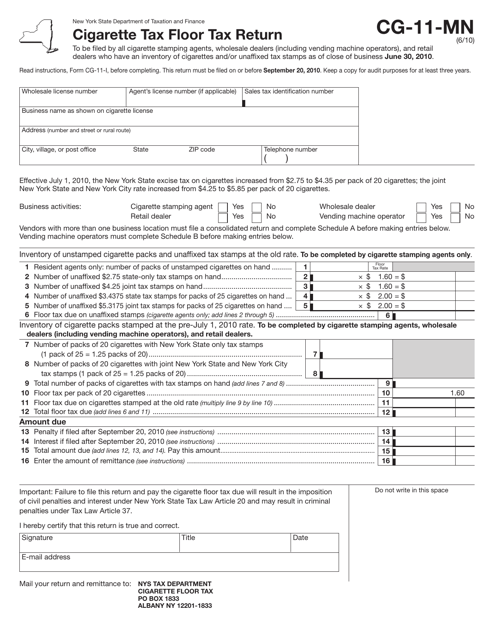

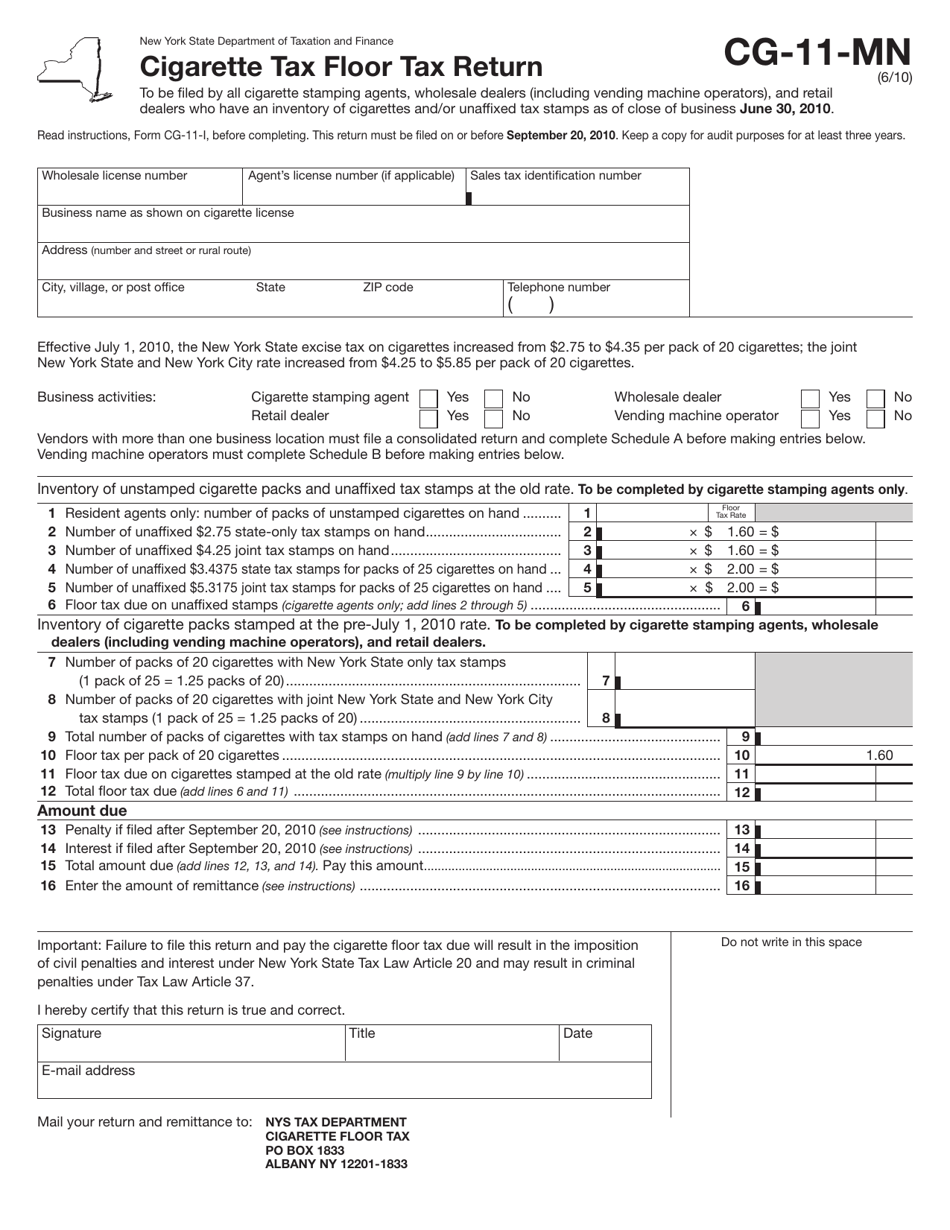

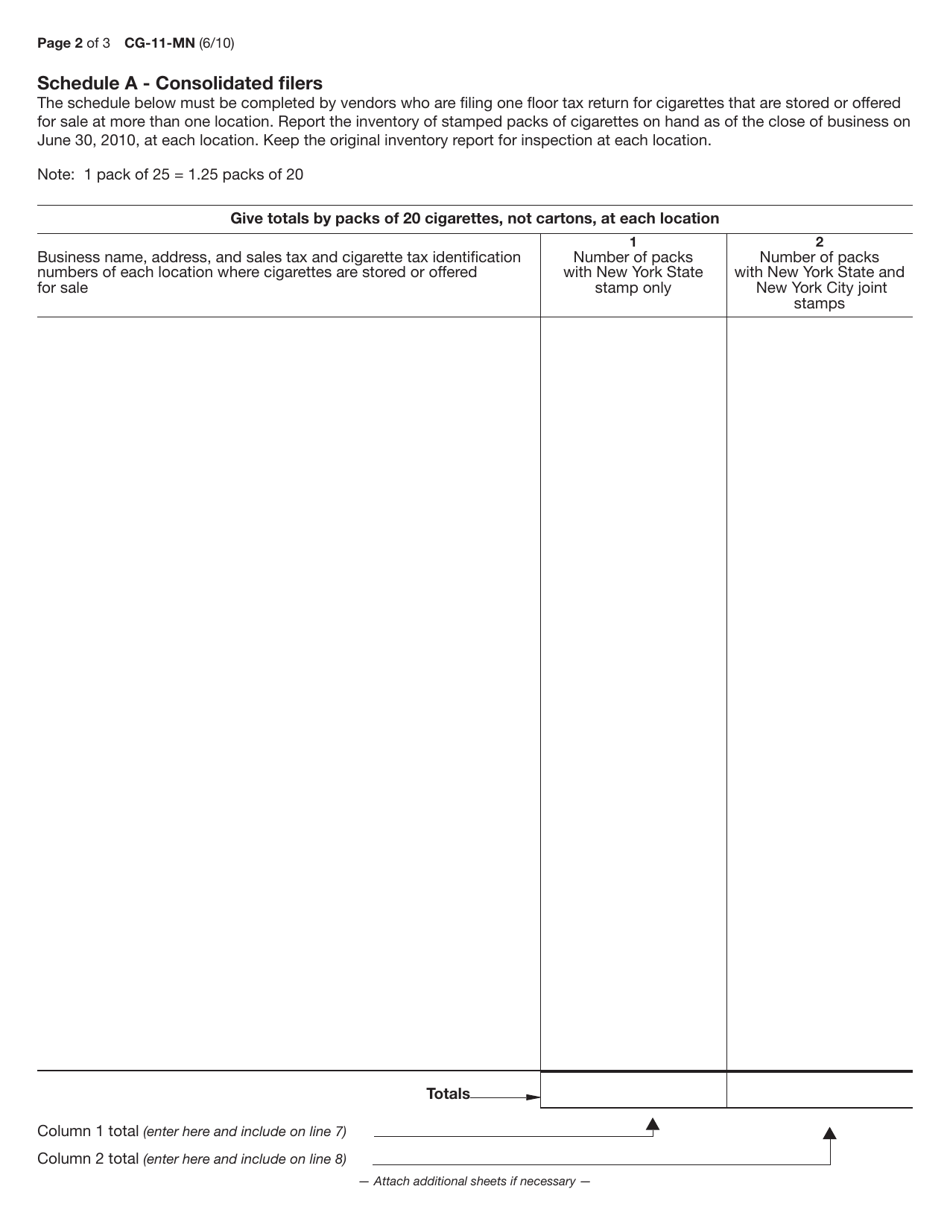

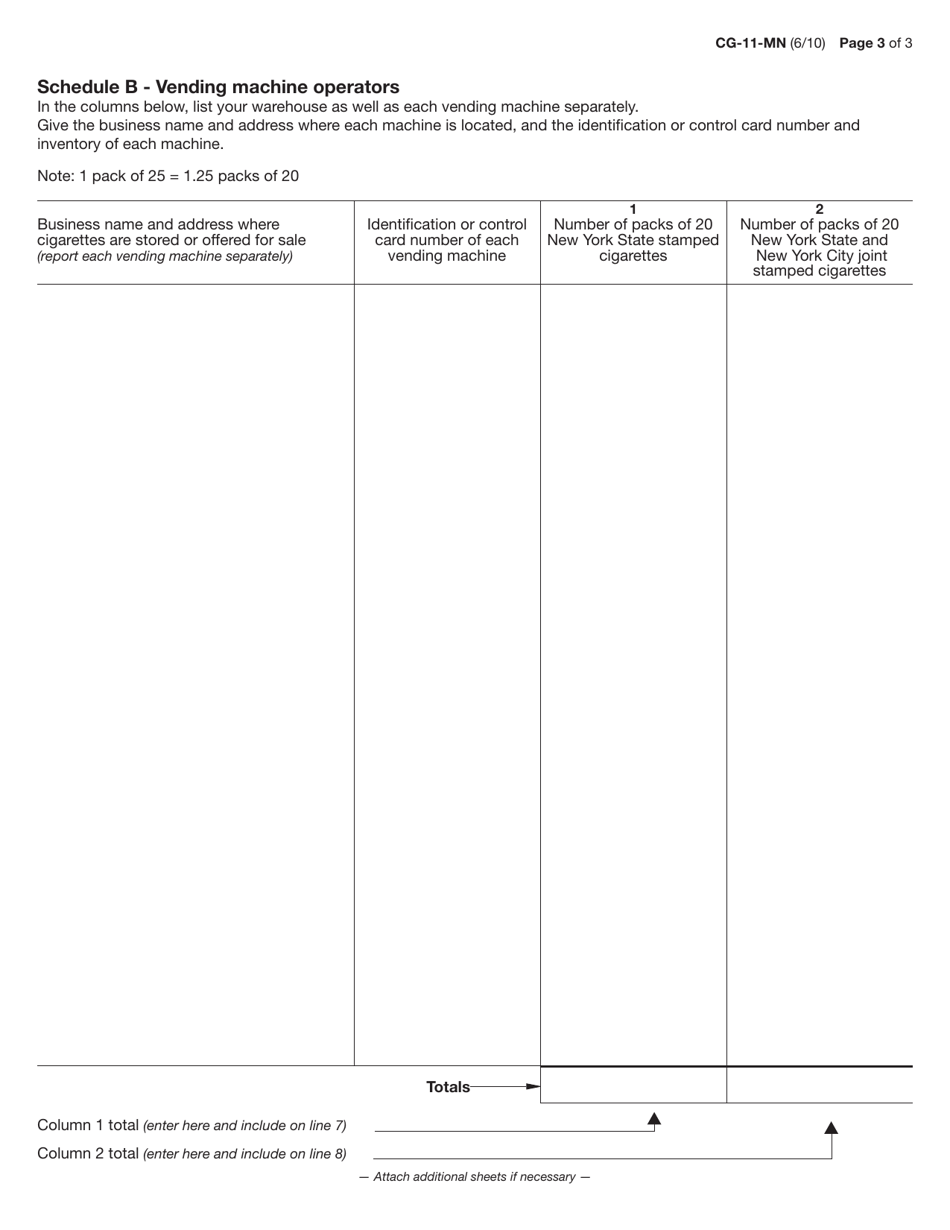

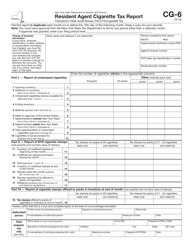

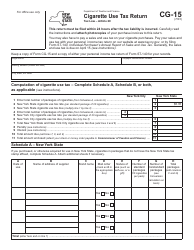

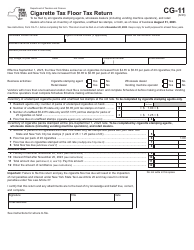

Form CG-11-MN Cigarette Tax Floor Tax Return - New York

What Is Form CG-11-MN?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CG-11-MN?

A: Form CG-11-MN is the Cigarette Tax Floor Tax Return for New York.

Q: What is the purpose of Form CG-11-MN?

A: The purpose of Form CG-11-MN is to report and pay the floor tax on cigarettes in New York.

Q: Who needs to file Form CG-11-MN?

A: Any person or business that sells cigarettes in New York and is subject to the floor tax must file Form CG-11-MN.

Q: What is the floor tax on cigarettes?

A: The floor tax on cigarettes is an additional tax imposed on the inventory of unstamped or untaxed cigarettes held by a distributor or dealer on the effective date of a cigarette tax increase.

Q: How often do I need to file Form CG-11-MN?

A: Form CG-11-MN must be filed within 24 hours after the effective date of a cigarette tax increase.

Q: Are there any penalties for late or incorrect filing of Form CG-11-MN?

A: Yes, there are penalties for late or incorrect filing of Form CG-11-MN. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on June 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-11-MN by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.