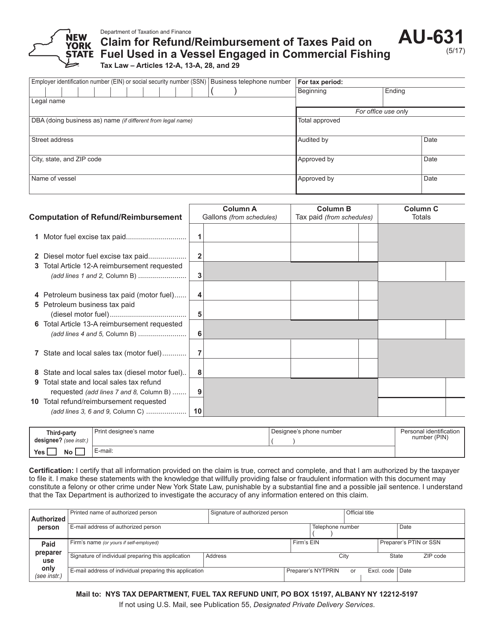

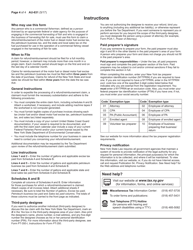

Form AU-631 Claim for Refund / Reimbursement of Taxes Paid on Fuel Used in a Vessel Engaged in Commercial Fishing - New York

What Is Form AU-631?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AU-631?

A: Form AU-631 is a claim for refund/reimbursement of taxes paid on fuel used in a vessel engaged in commercial fishing in New York.

Q: Who can use form AU-631?

A: Form AU-631 can be used by individuals or businesses engaged in commercial fishing in New York.

Q: What is the purpose of form AU-631?

A: The purpose of form AU-631 is to claim a refund or reimbursement of taxes paid on fuel used in a vessel engaged in commercial fishing.

Q: What taxes can be claimed on form AU-631?

A: Form AU-631 can be used to claim a refund or reimbursement of New York state and local sales taxes and compensating use taxes paid on fuel used in a vessel engaged in commercial fishing.

Q: How do I submit form AU-631?

A: Form AU-631 should be submitted to the New York State Department of Taxation and Finance.

Q: Is there a deadline for submitting form AU-631?

A: Yes, form AU-631 must be filed within 6 months from the date of purchase or use of the fuel.

Q: Are there any documentation requirements for form AU-631?

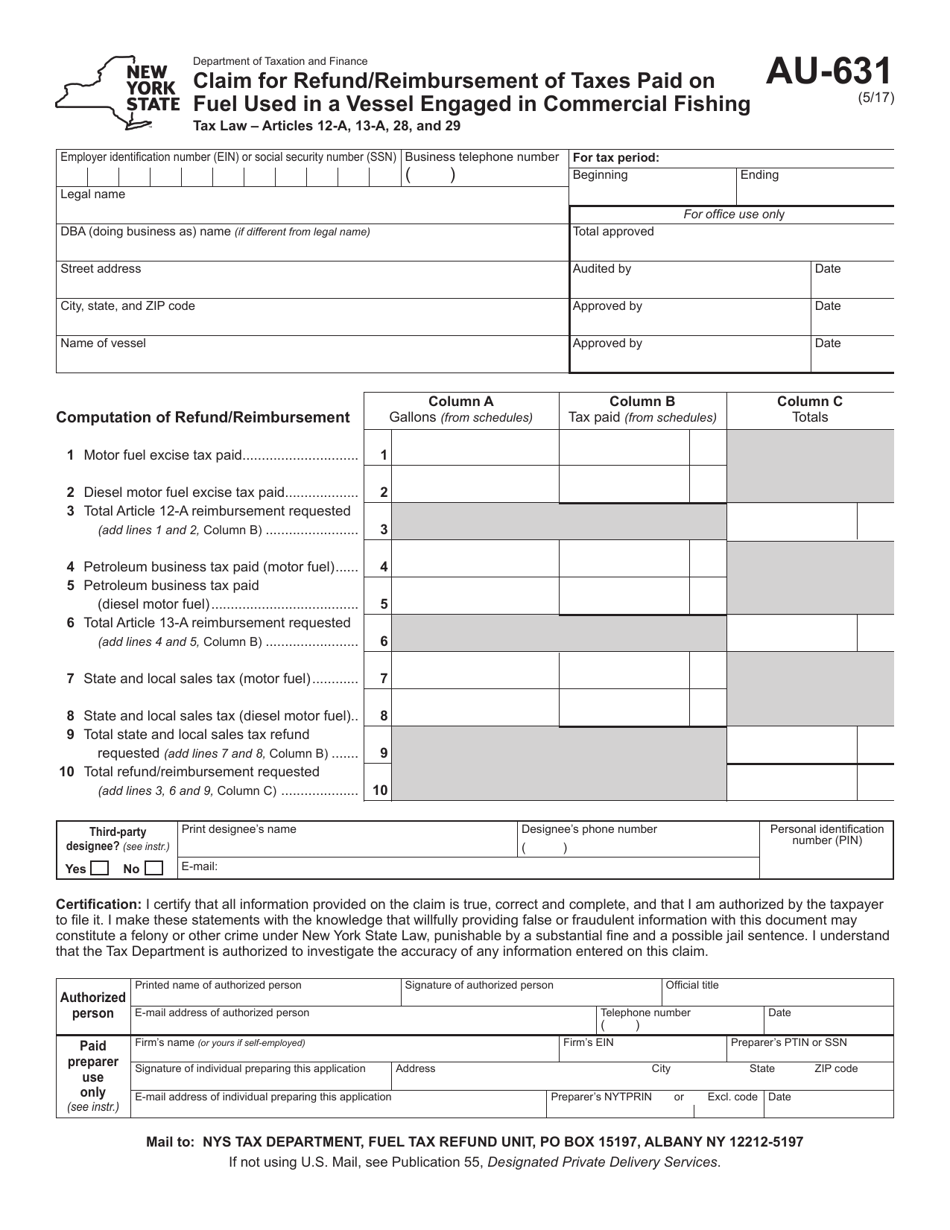

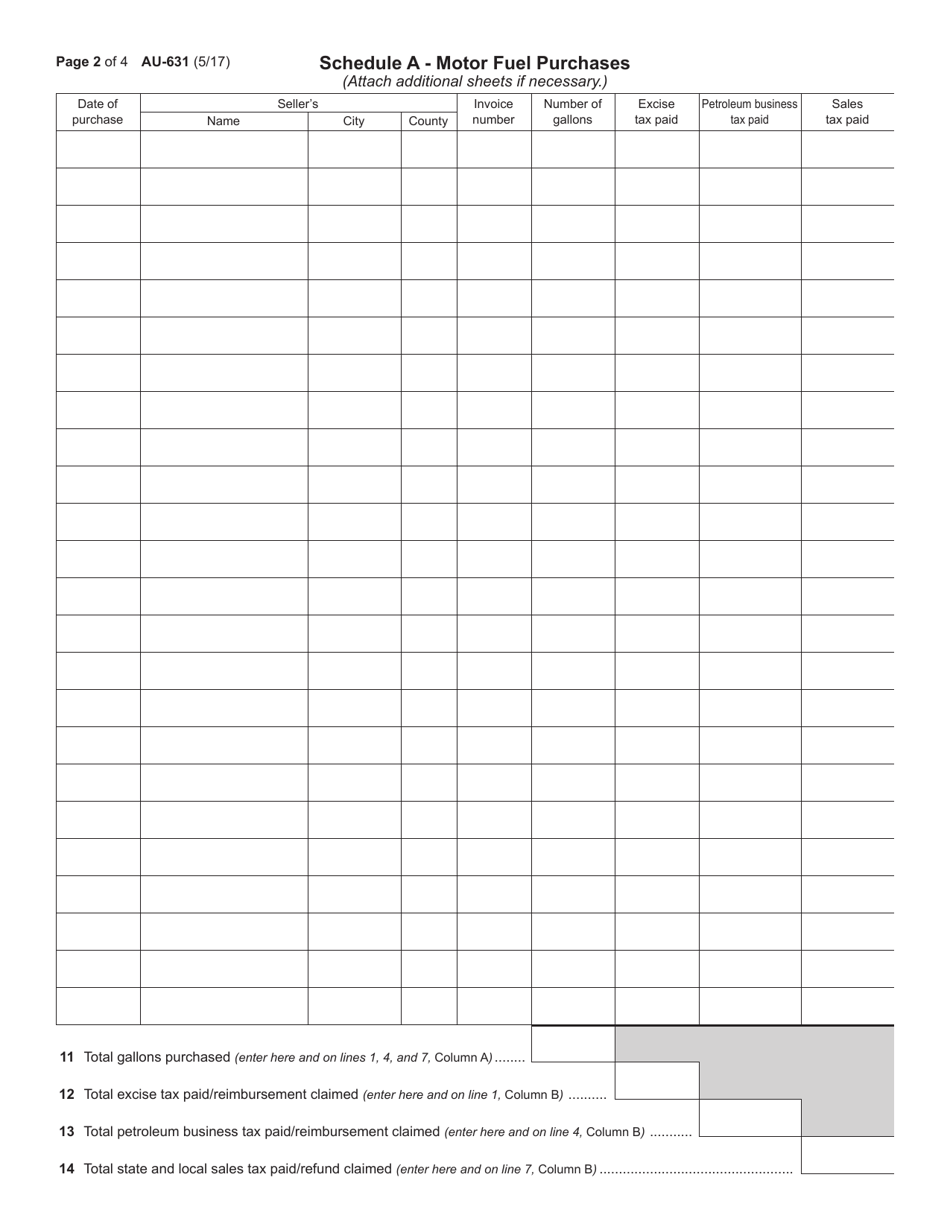

A: Yes, supporting documentation such as invoices, receipts, and proof of payment should be included with the form.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-631 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.