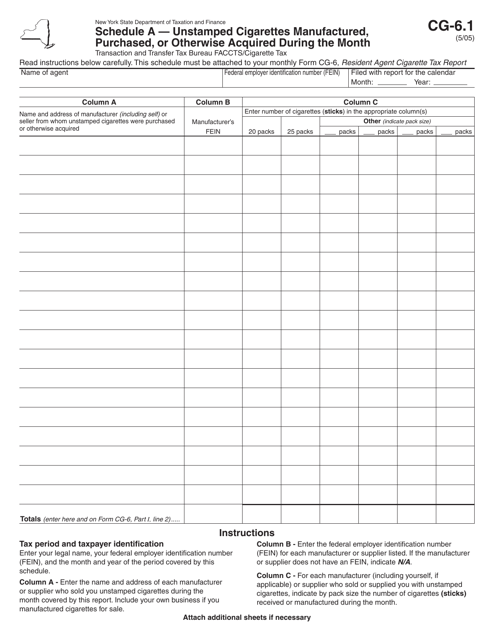

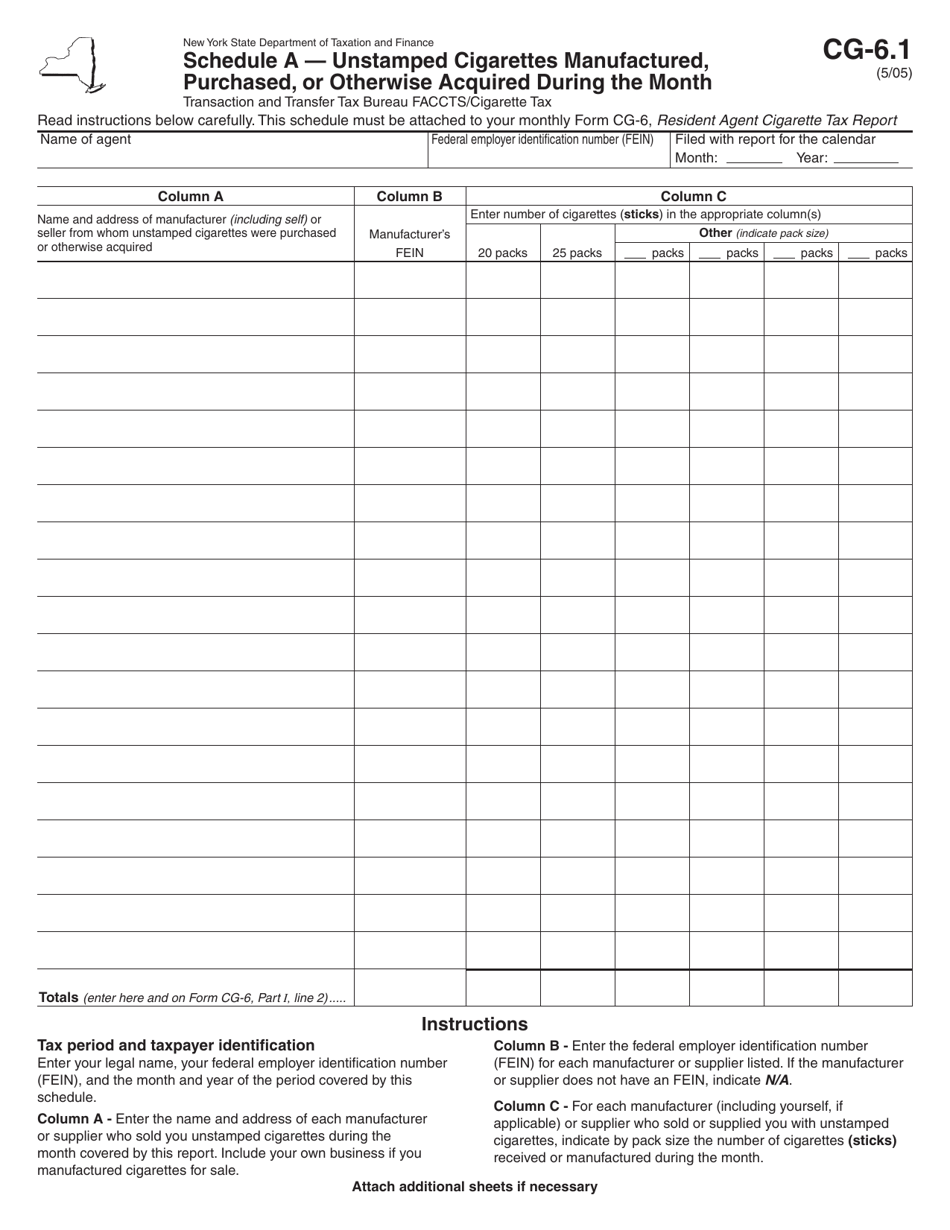

Form CG-6.1 Schedule A Unstamped Cigarettes Manufactured, Purchased, or Otherwise Acquired During the Month - New York

What Is Form CG-6.1 Schedule A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CG-6.1 Schedule A Unstamped Cigarettes?

A: Form CG-6.1 Schedule A Unstamped Cigarettes is a document related to the reporting of cigarettes in New York.

Q: Who needs to use Form CG-6.1 Schedule A Unstamped Cigarettes?

A: Any individual or business that manufactures, purchases, or acquires unstamped cigarettes in New York needs to use Form CG-6.1 Schedule A.

Q: What is the purpose of Form CG-6.1 Schedule A Unstamped Cigarettes?

A: The purpose of this form is to report the quantity of unstamped cigarettes manufactured, purchased, or acquired during the month in New York.

Q: When should Form CG-6.1 Schedule A Unstamped Cigarettes be filed?

A: Form CG-6.1 Schedule A should be filed on a monthly basis, within 20 days after the end of the reporting period.

Q: Is there a penalty for not filing Form CG-6.1 Schedule A Unstamped Cigarettes?

A: Yes, failure to file this form or filing it late may result in penalties and interest being imposed by the Department of Taxation and Finance.

Form Details:

- Released on May 1, 2005;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-6.1 Schedule A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.