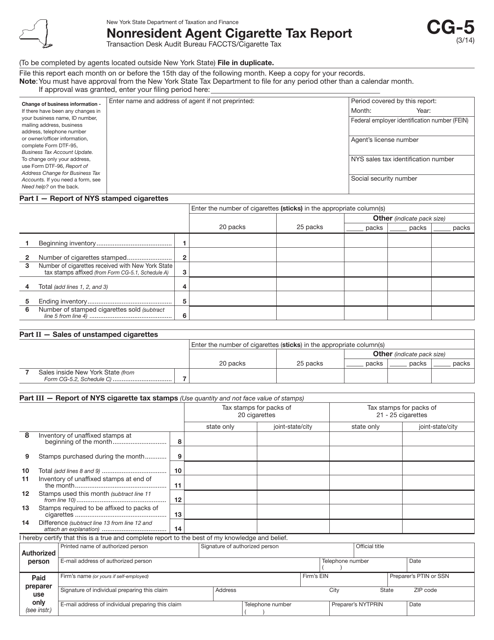

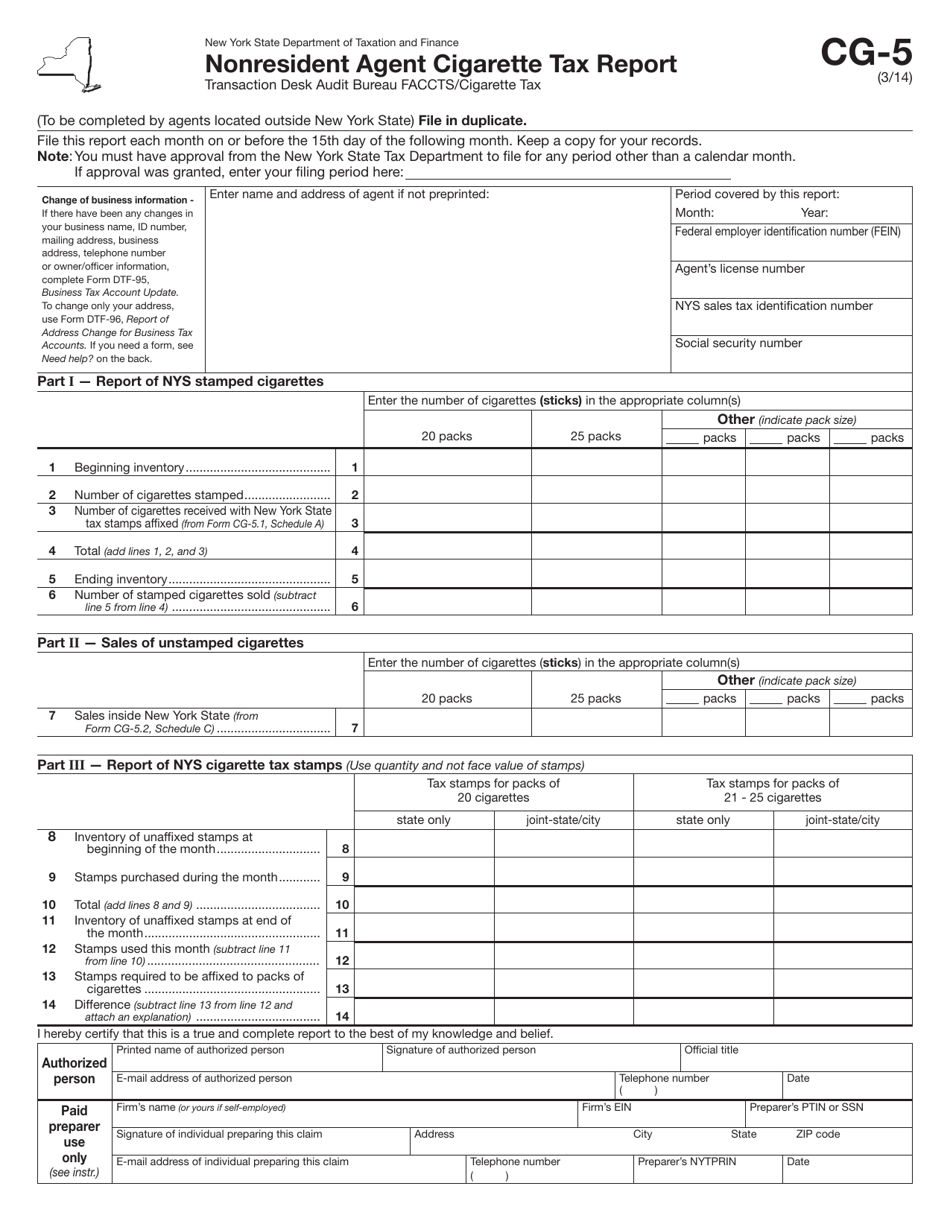

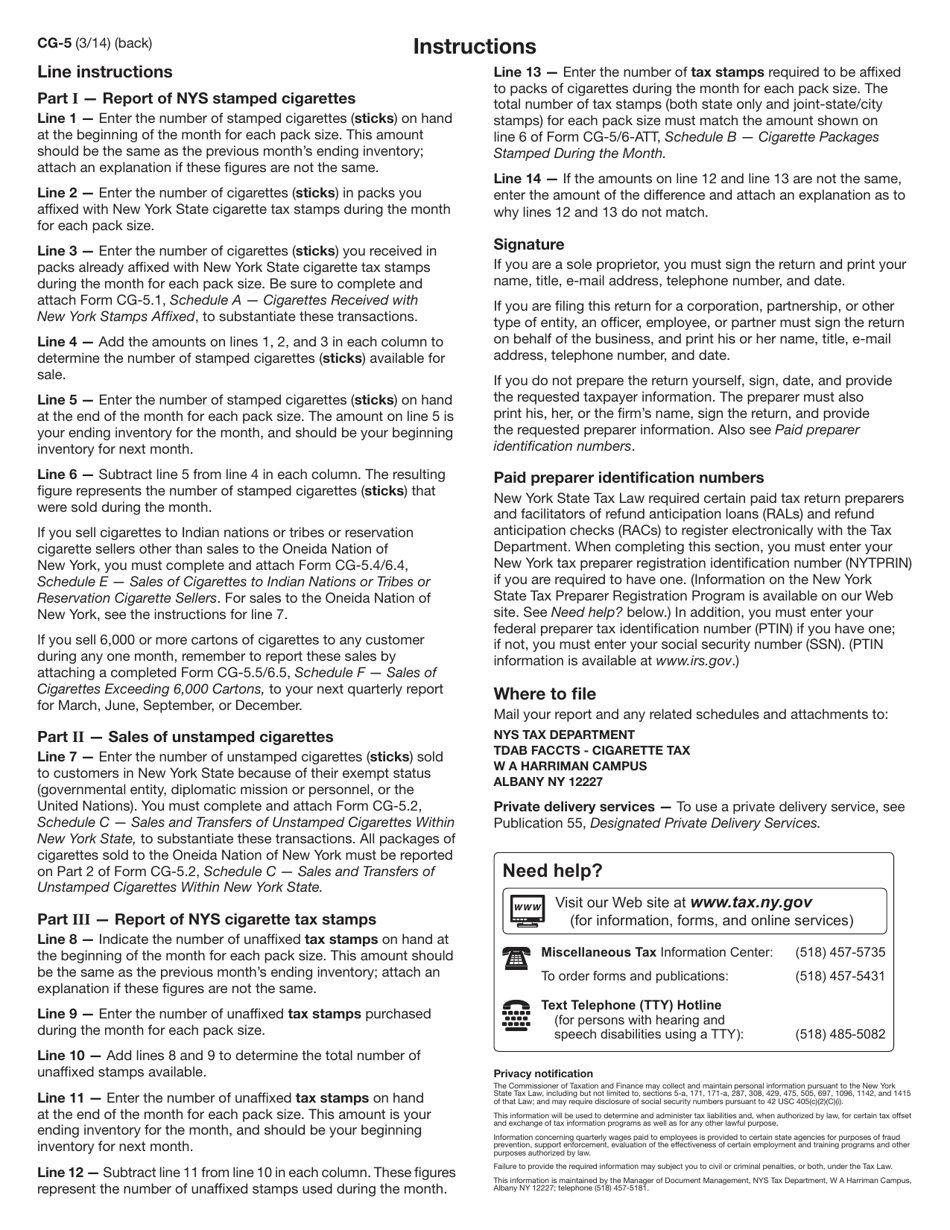

Form CG-5 Nonresident Agent Cigarette Tax Report - New York

What Is Form CG-5?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CG-5?

A: The Form CG-5 is the Nonresident Agent Cigarette Tax Report for the state of New York.

Q: Who needs to file Form CG-5?

A: Nonresident agents engaged in the sale or delivery of cigarettes into New York are required to file Form CG-5.

Q: What is the purpose of Form CG-5?

A: Form CG-5 is used to report the sale and delivery of cigarettes into New York by nonresident agents, and to calculate and remit the applicable cigarette tax.

Q: When is Form CG-5 due?

A: Form CG-5 is due on a quarterly basis, and the due dates are specified on the form.

Q: Are there any penalties for late filing or non-filing of Form CG-5?

A: Yes, there are penalties for late filing or non-filing of Form CG-5. It is important to file the form and remit the tax on time to avoid penalties.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-5 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.