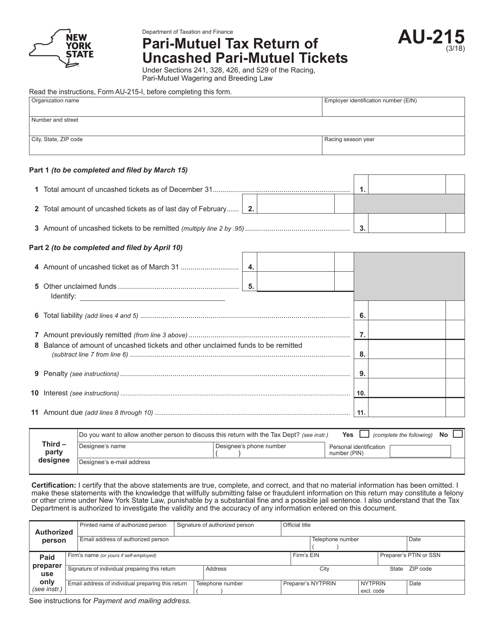

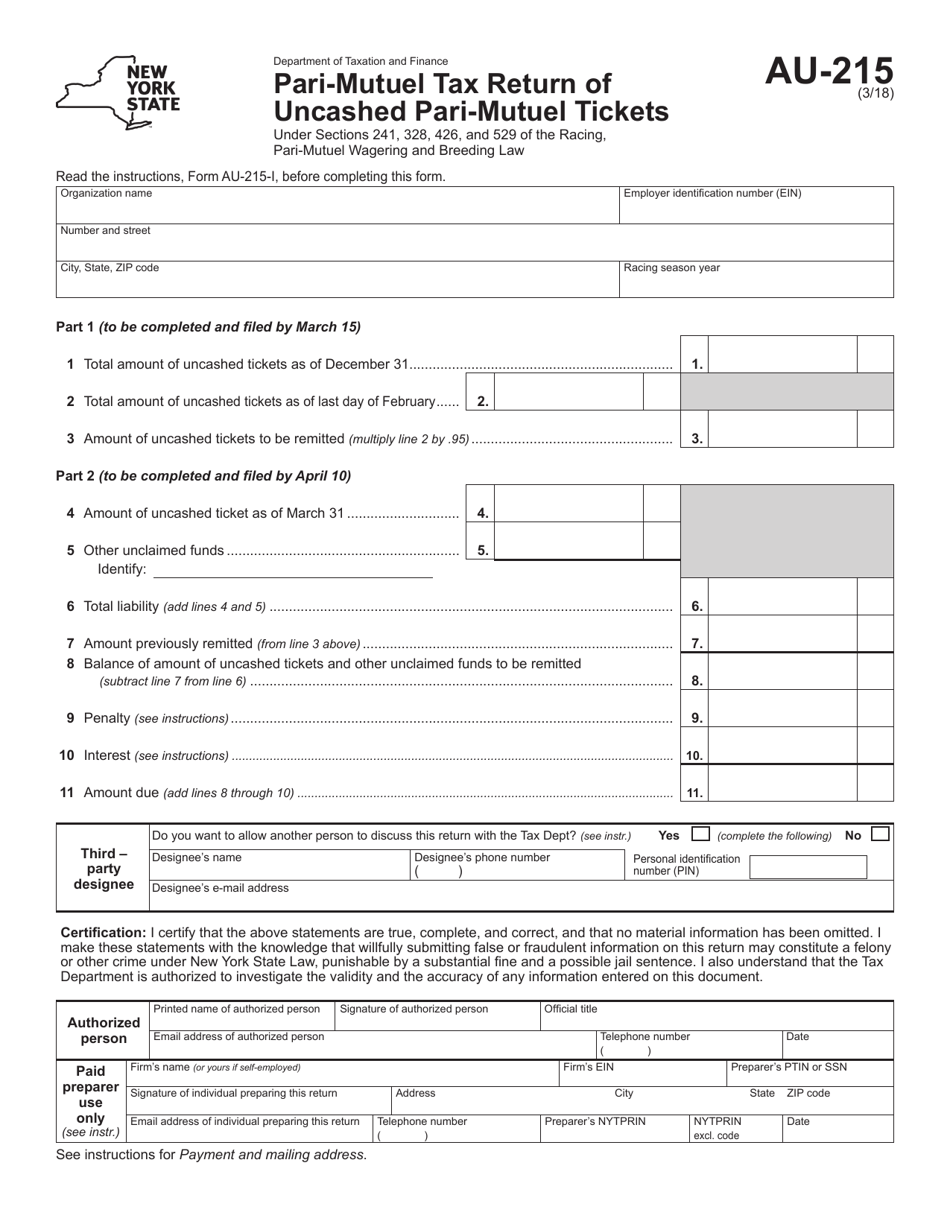

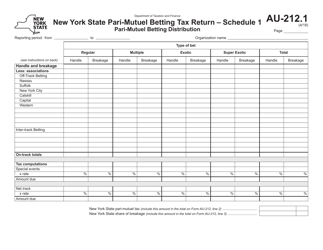

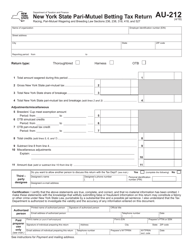

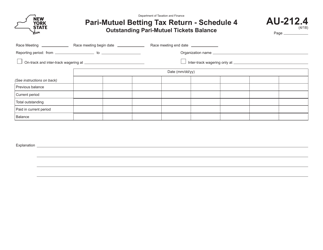

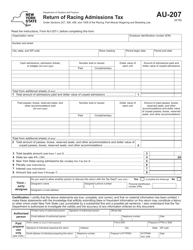

Form AU-215 Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets - New York

What Is Form AU-215?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AU-215?

A: Form AU-215 is the Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets.

Q: Who needs to file Form AU-215?

A: Individuals or entities that operate a pari-mutuel wagering facility in New York and have uncashed pari-mutuel tickets need to file Form AU-215.

Q: What is a pari-mutuel wagering facility?

A: A pari-mutuel wagering facility is a place where individuals can bet on the outcome of horse races, harness races, or other similar events.

Q: Why do I need to file Form AU-215?

A: Form AU-215 is used to report and pay taxes on uncashed pari-mutuel tickets from your wagering facility.

Q: When is Form AU-215 due?

A: Form AU-215 is due on or before the last day of the month following the calendar quarter in which the uncashed ticket was issued.

Q: What information do I need to include on Form AU-215?

A: You need to provide details about the uncashed pari-mutuel tickets, including the date issued, ticket serial number, face value, and any applicable taxes withheld.

Q: Are there any penalties for late filing of Form AU-215?

A: Yes, there are penalties for late filing and late payment of taxes due on uncashed pari-mutuel tickets. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-215 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.