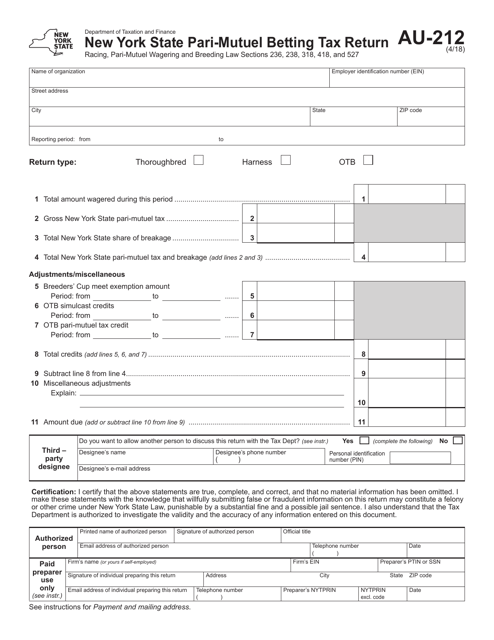

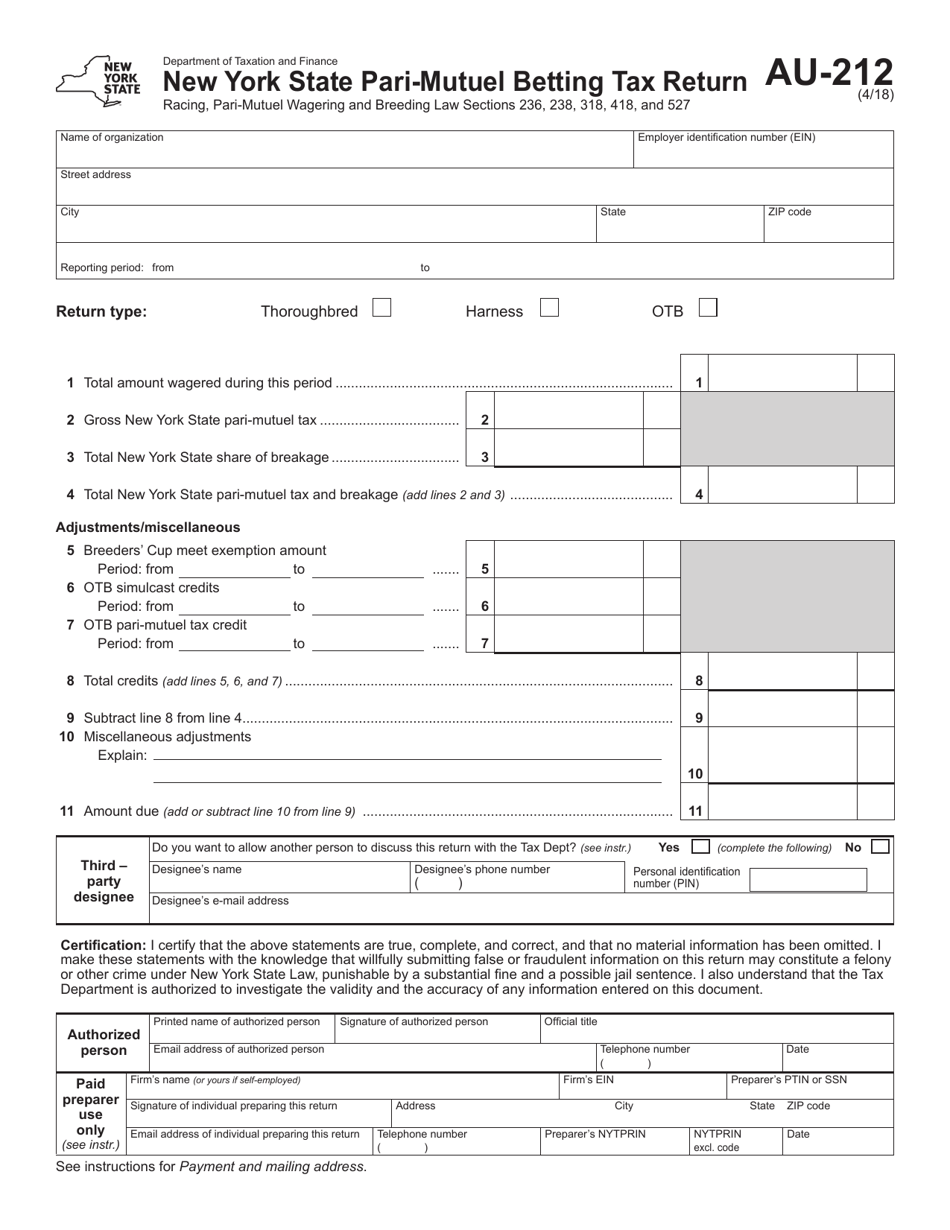

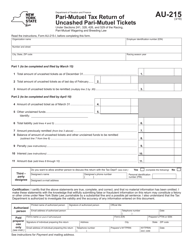

Form AU-212 New York State Pari-Mutuel Betting Tax Return - New York

What Is Form AU-212?

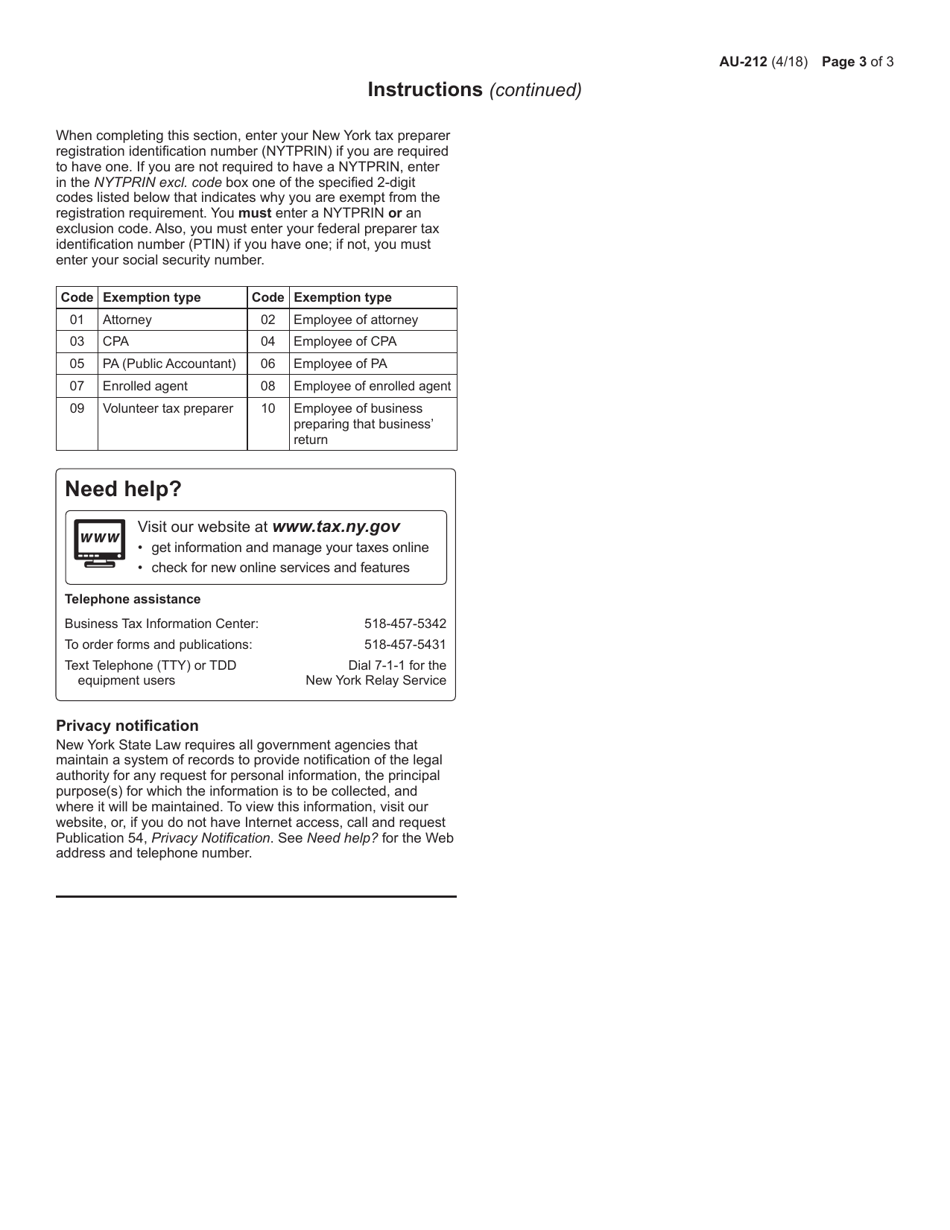

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-212?

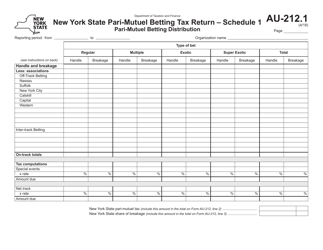

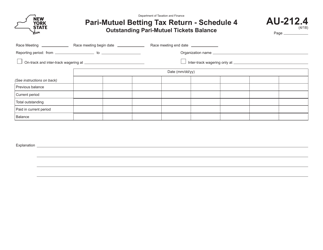

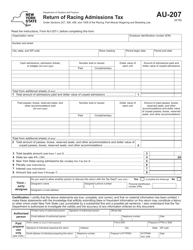

A: Form AU-212 is the New York State Pari-Mutuel Betting Tax Return.

Q: Who needs to file Form AU-212?

A: Individuals or businesses engaged in pari-mutuel betting in New York State need to file Form AU-212.

Q: What is pari-mutuel betting?

A: Pari-mutuel betting is a form of betting where all bets are placed together in a pool and then distributed proportionately among the winners after deducting taxes and fees.

Q: What information is required on Form AU-212?

A: Form AU-212 requires the reporting of total wagers received, total wagers paid out, and the calculation of the pari-mutuel betting tax.

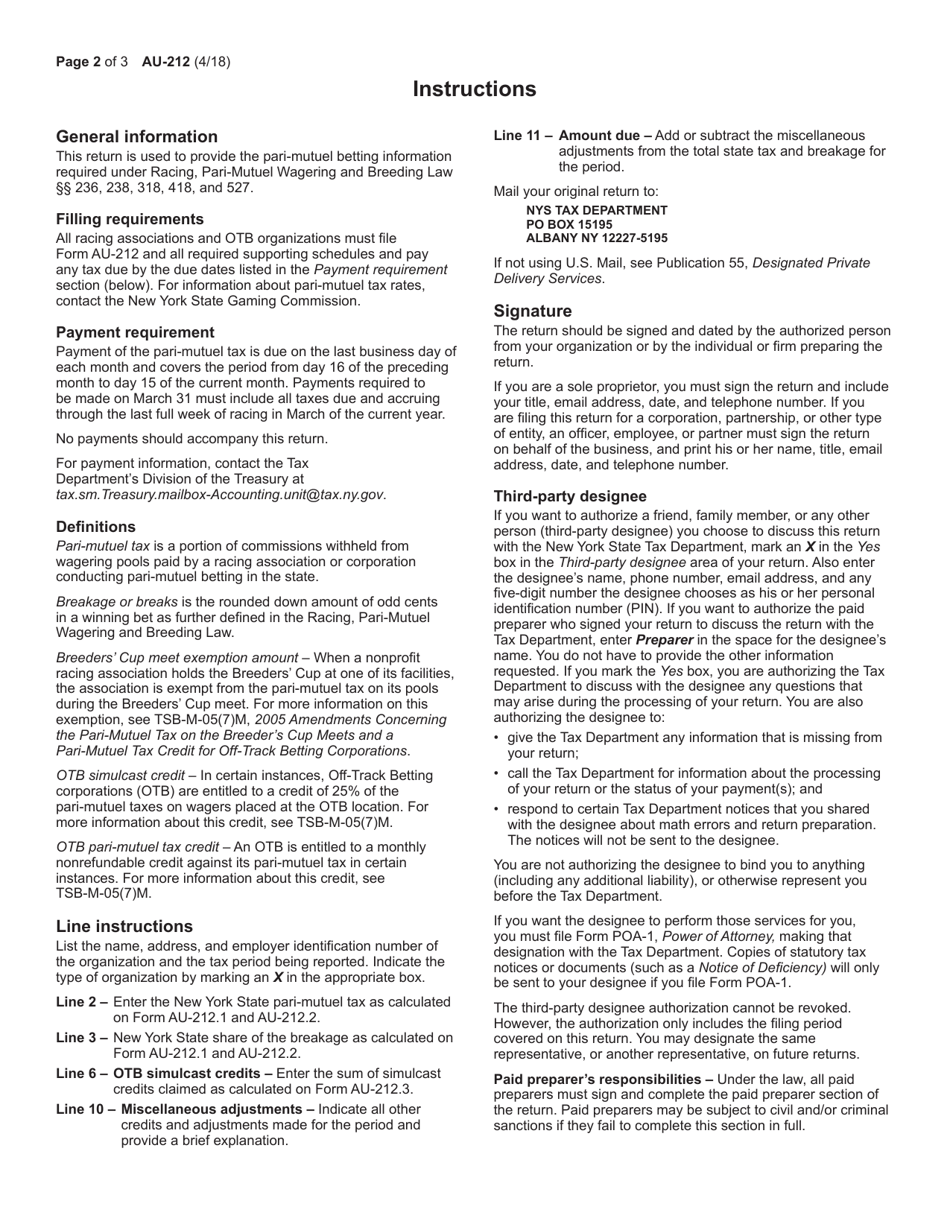

Q: When is Form AU-212 due?

A: Form AU-212 is due on a quarterly basis, with deadlines falling on the last day of the month following the end of the quarter.

Q: Is there a penalty for not filing Form AU-212?

A: Yes, there may be penalties for failure to file Form AU-212 or for late filing. It's important to file the form by the due date to avoid penalties.

Q: Are there any exemptions or deductions available for pari-mutuel betting?

A: Yes, there are certain exemptions and deductions available for pari-mutuel betting. It is recommended to consult the instructions for Form AU-212 or a tax professional for specific details.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-212 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.