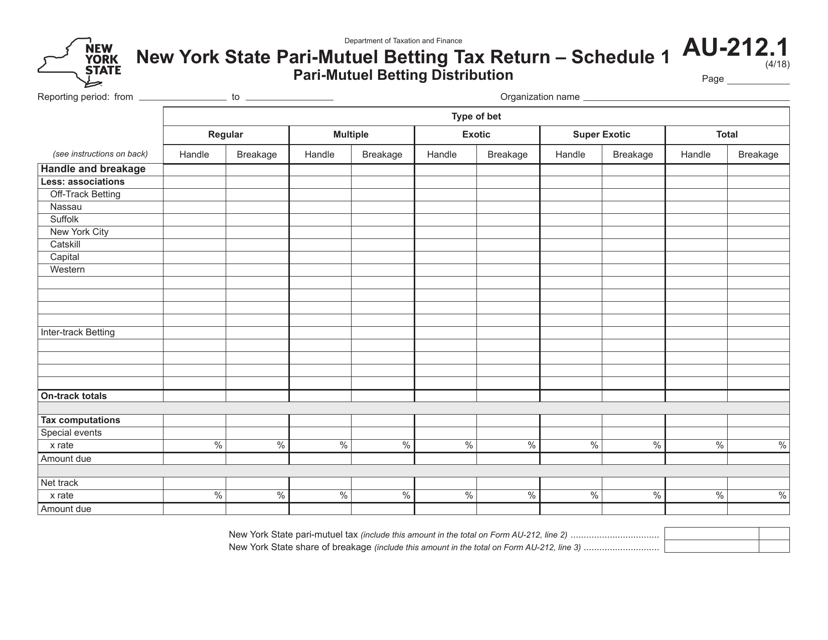

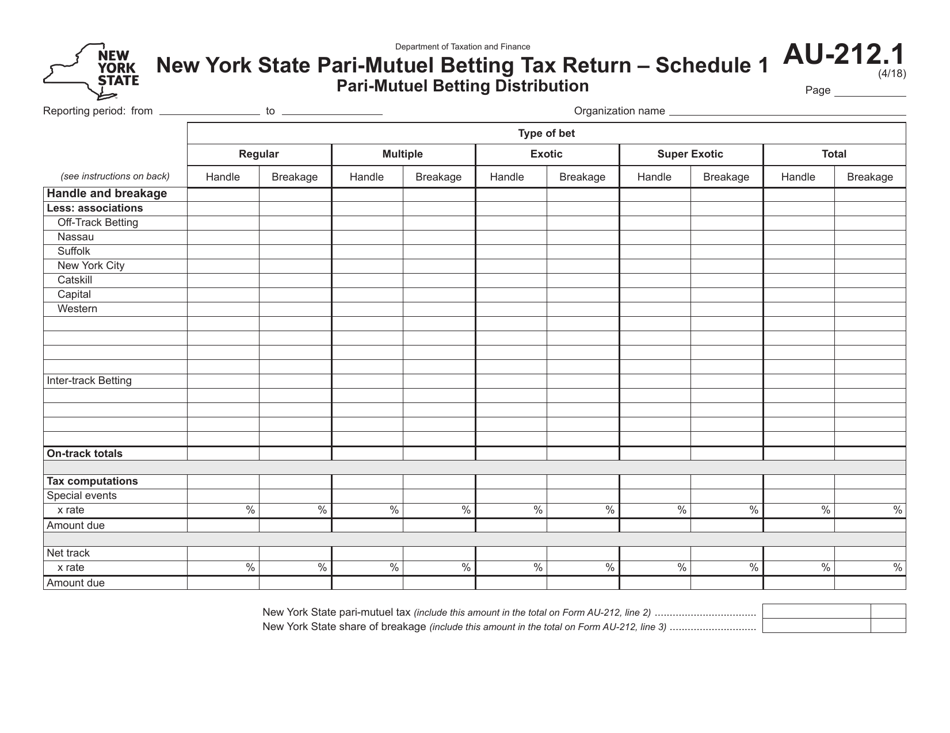

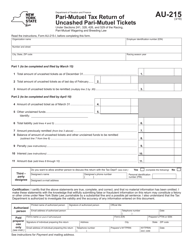

Form AU-212.1 Schedule 1 Pari-Mutuel Betting Distribution - New York

What Is Form AU-212.1 Schedule 1?

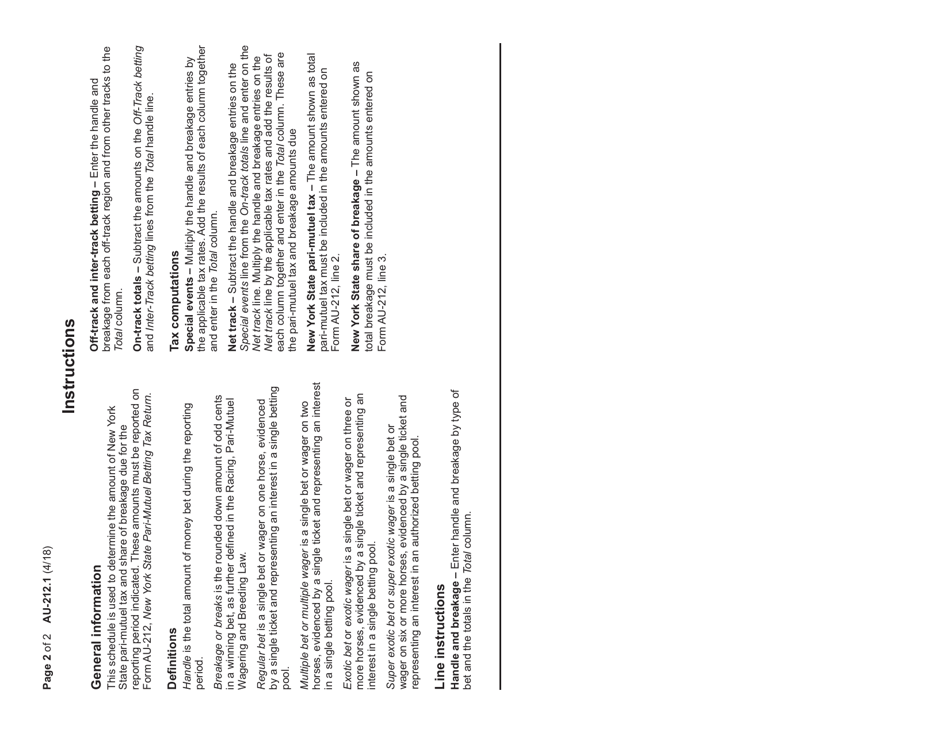

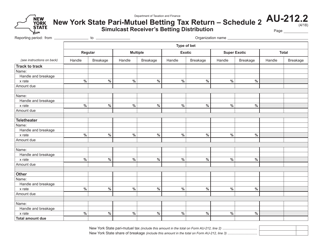

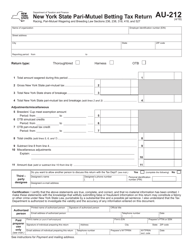

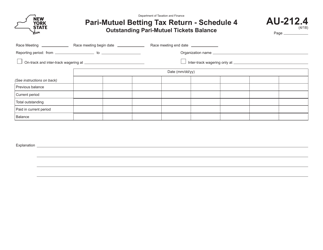

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-212.1?

A: Form AU-212.1 is a specific form used for reporting the distribution of funds from pari-mutuel betting in New York.

Q: What is pari-mutuel betting?

A: Pari-mutuel betting is a type of betting where all bets are placed together in a pool and the winners share the total amount bet, minus fees and taxes.

Q: Who needs to fill out this form?

A: This form needs to be filled out by entities involved in the distribution of funds from pari-mutuel betting in New York.

Q: What information is required on this form?

A: The form requires information such as the total amount of funds received, the amount distributed to winners, and the amount retained as fees and taxes.

Q: Are there any deadlines for submitting this form?

A: Yes, the form must be filed on a quarterly basis, with specific due dates outlined by the New York State Department of Taxation and Finance.

Q: What are the consequences for not filing this form?

A: Failure to file this form or filing it late may result in penalties and interest charges imposed by the New York State Department of Taxation and Finance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-212.1 Schedule 1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.