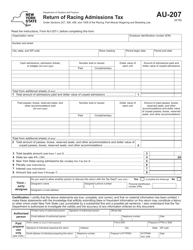

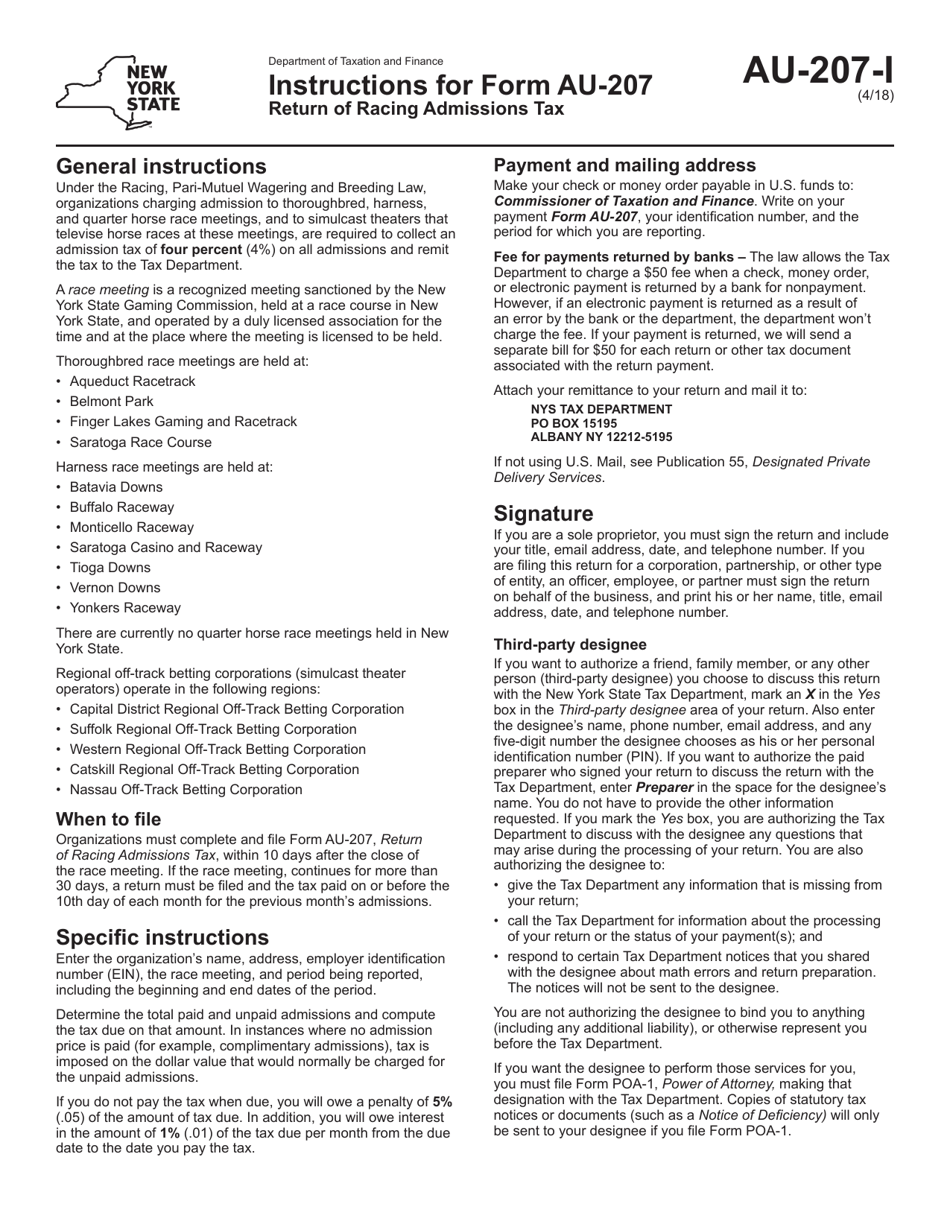

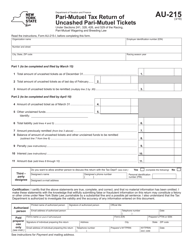

Instructions for Form AU-207 Return of Racing Admissions Tax - New York

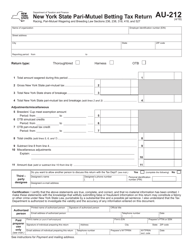

This document contains official instructions for Form AU-207 , Return of Racing Admissions Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form AU-207 is available for download through this link.

FAQ

Q: What is Form AU-207?

A: Form AU-207 is the Return of Racing Admissions Tax for New York.

Q: Who needs to file Form AU-207?

A: Any person or organization that sells admissions to a racing event in New York needs to file Form AU-207.

Q: When is Form AU-207 due?

A: Form AU-207 is due on a quarterly basis, with the due date falling on the last day of the month following the end of the quarter.

Q: What is the purpose of the Racing Admissions Tax?

A: The Racing Admissions Tax is imposed on the sale of admissions to racing events in New York, with the revenue collected used to support state and local governments.

Q: Are there any exemptions or deductions available for the Racing Admissions Tax?

A: No, there are no specific exemptions or deductions available for the Racing Admissions Tax.

Q: What happens if I don't file Form AU-207?

A: If you fail to file Form AU-207 or pay the Racing Admissions Tax on time, you may be subject to penalties and interest charges.

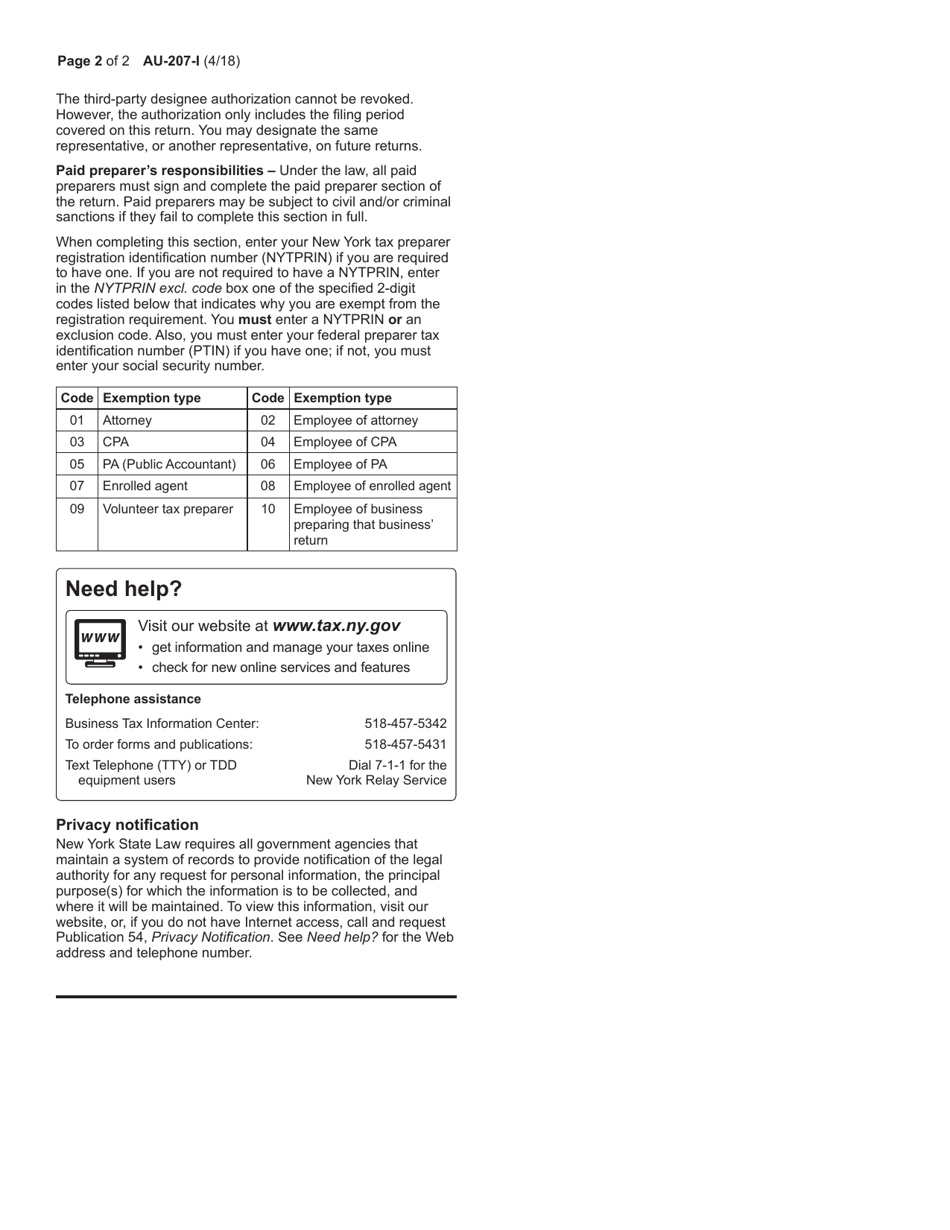

Q: Can I amend my filed Form AU-207?

A: Yes, you can amend your filed Form AU-207 by filing a corrected version of the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.