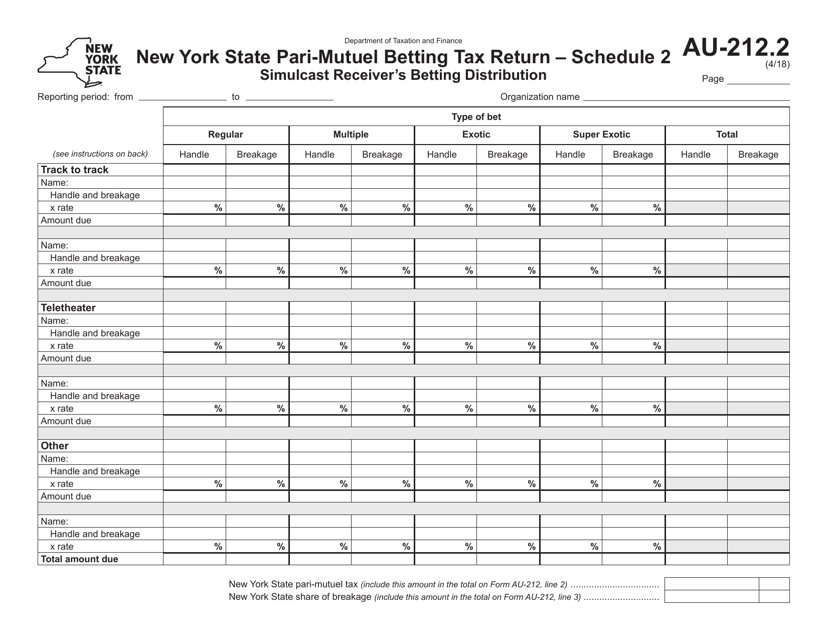

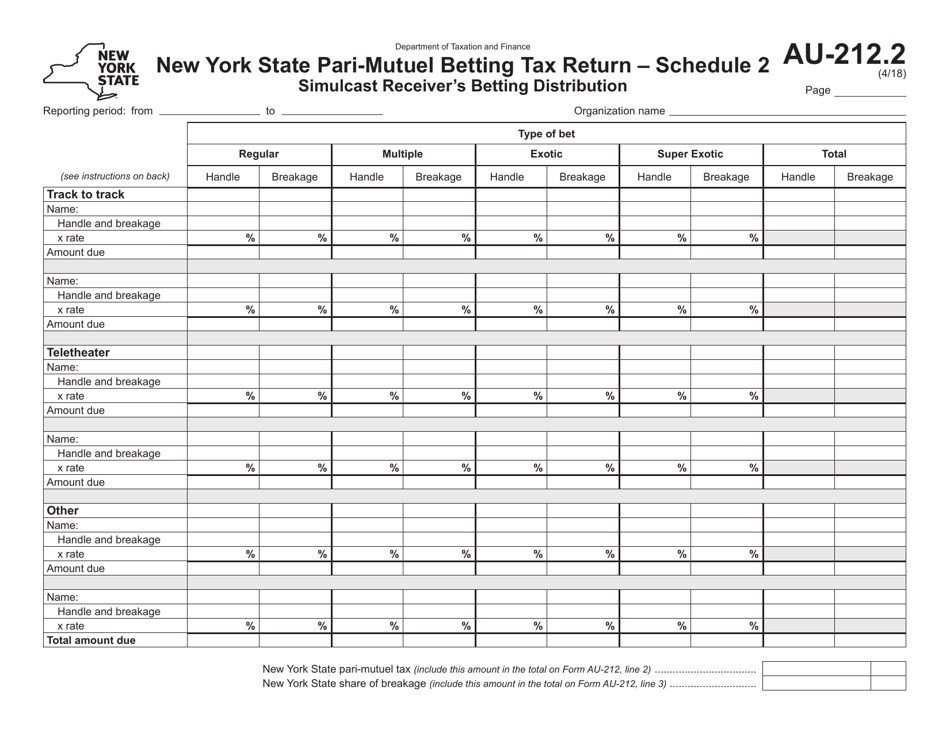

Form AU-212 Schedule AU-212.2 Simulcast Receiver's Betting Distribution - New York

What Is Form AU-212 Schedule AU-212.2?

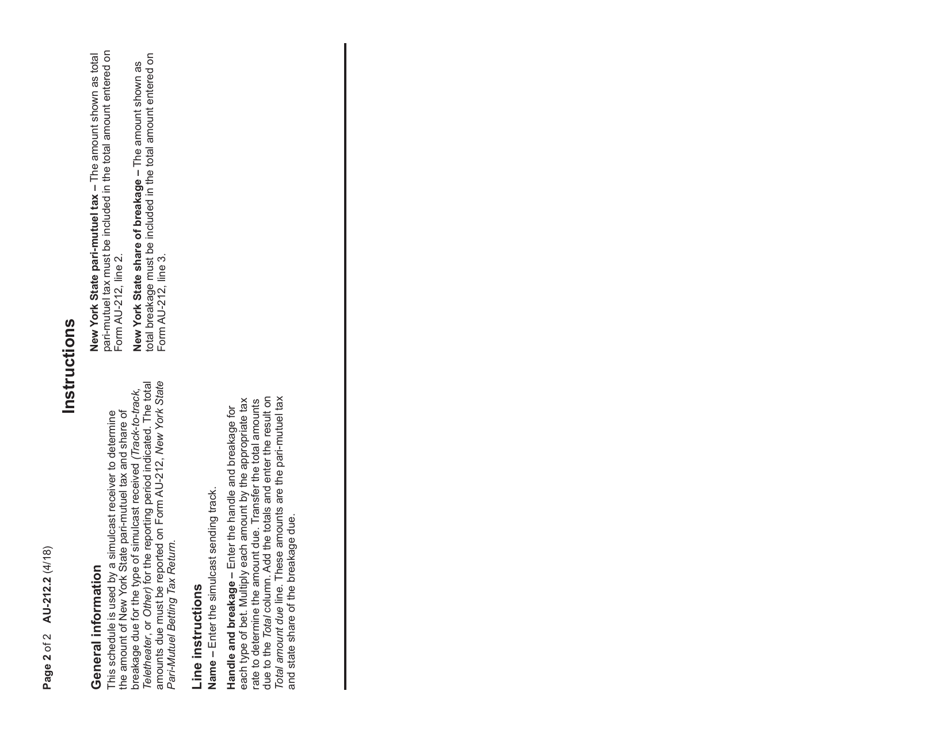

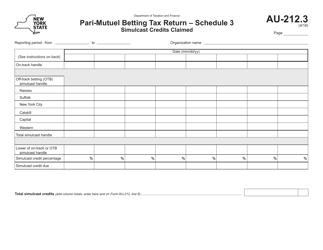

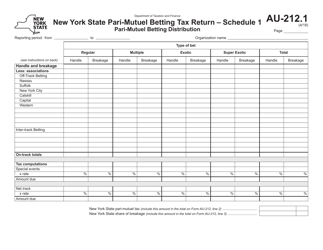

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York.The document is a supplement to Form AU-212, New York State Pari-Mutuel Betting Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-212?

A: Form AU-212 is a form used in New York for reporting Simulcast Receiver's Betting Distribution.

Q: What is Schedule AU-212.2?

A: Schedule AU-212.2 is a specific section of Form AU-212 that deals with Simulcast Receiver's Betting Distribution.

Q: What is Simulcast Receiver's Betting Distribution?

A: Simulcast Receiver's Betting Distribution refers to the money received by a simulcast receiver as a result of bets placed on horse races.

Q: Is Form AU-212 specific to New York?

A: Yes, Form AU-212 is a form used specifically in New York.

Q: Who needs to file Form AU-212?

A: Simulcast receivers in New York who receive bets on horse races need to file Form AU-212.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-212 Schedule AU-212.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.