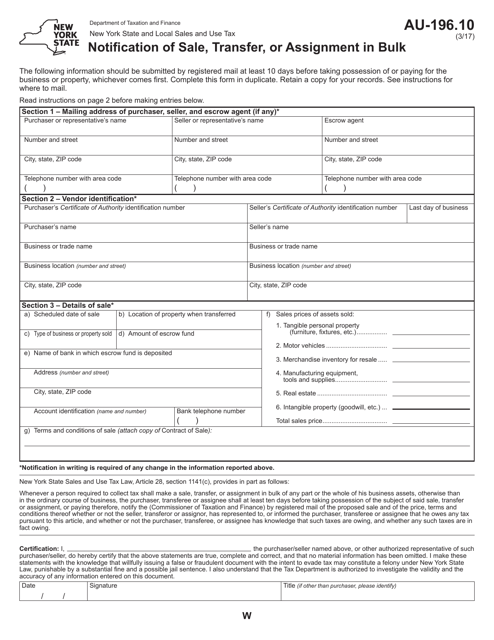

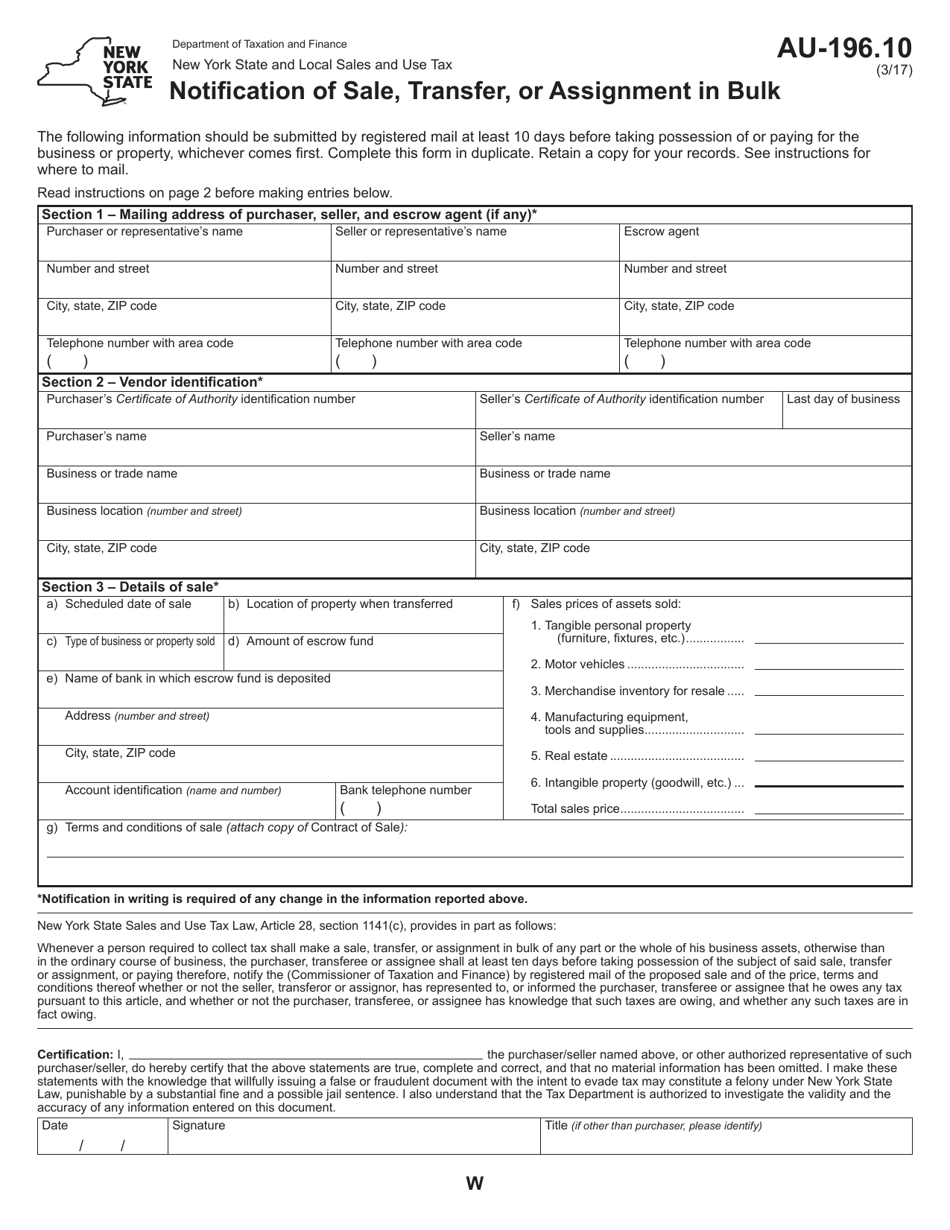

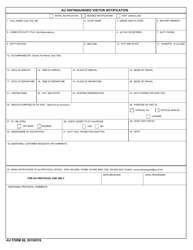

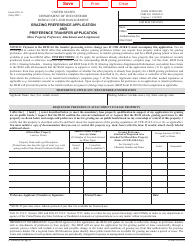

Form AU-196.10 Notification of Sale, Transfer, or Assignment in Bulk - New York

What Is Form AU-196.10?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-196.10?

A: Form AU-196.10 is a notification form used in New York to report the sale, transfer, or assignment of assets in bulk.

Q: Who is required to complete Form AU-196.10?

A: The party selling or transferring assets in bulk is required to complete Form AU-196.10.

Q: What information is required on Form AU-196.10?

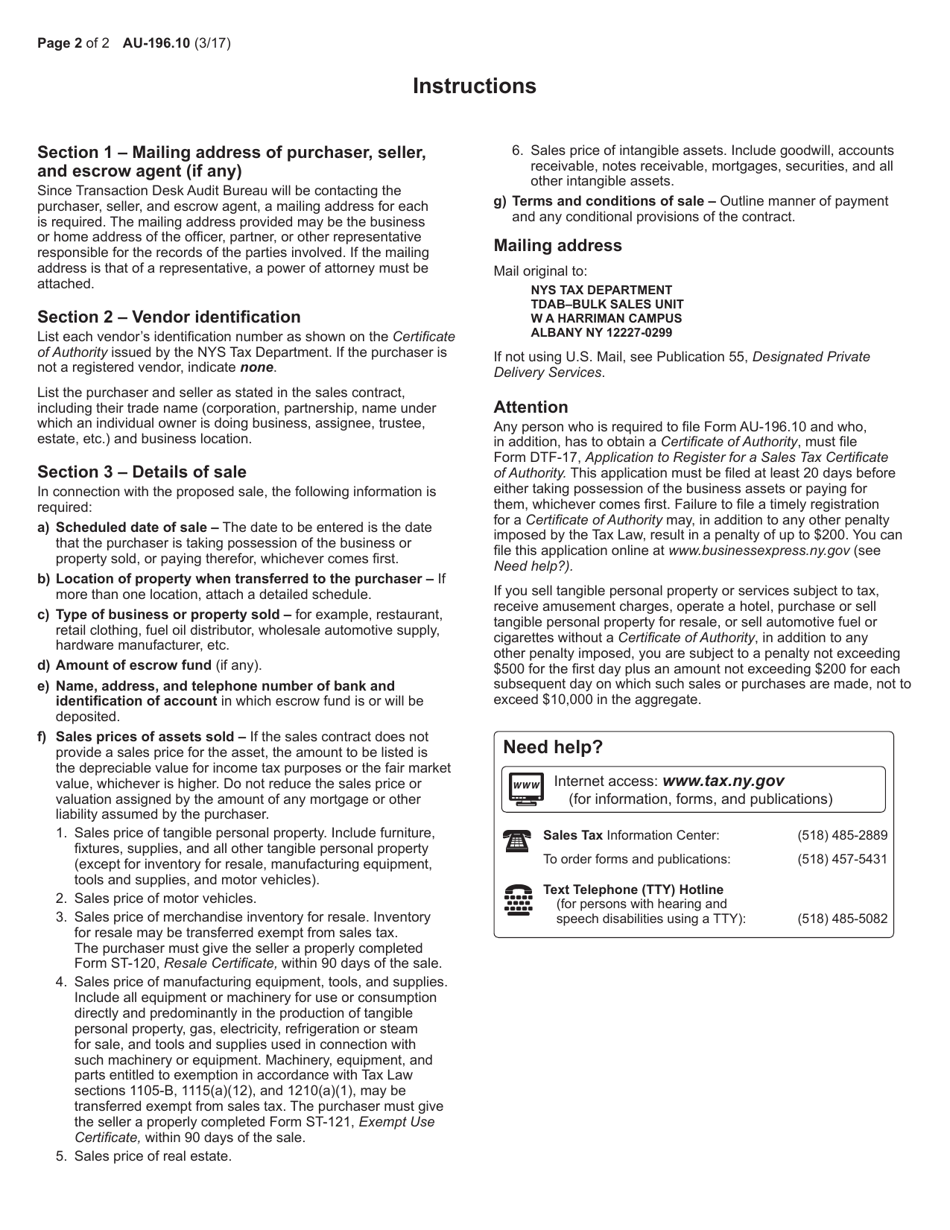

A: Form AU-196.10 requires information such as the buyer and seller's names and addresses, a description of the assets being sold, and the purchase price.

Q: Is there a deadline for submitting Form AU-196.10?

A: Yes, Form AU-196.10 must be filed with the New York State Department of Taxation and Finance at least 10 days prior to the sale or transfer of assets in bulk.

Q: Are there any fees associated with filing Form AU-196.10?

A: Yes, there is a $25 filing fee for submitting Form AU-196.10.

Q: What happens after I submit Form AU-196.10?

A: After submitting Form AU-196.10, the New York State Department of Taxation and Finance will review the information and may contact you for additional documentation or clarification.

Q: Are there any penalties for not filing Form AU-196.10?

A: Yes, failing to file Form AU-196.10 can result in penalties and interest charges imposed by the New York State Department of Taxation and Finance.

Q: Can I use Form AU-196.10 for transfers of real property?

A: No, Form AU-196.10 is specifically for reporting the sale, transfer, or assignment of assets other thanreal property.

Q: Is Form AU-196.10 required for all bulk asset transfers in New York?

A: Yes, all bulk asset transfers in New York are required to be reported on Form AU-196.10, unless otherwise exempted by law.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-196.10 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.