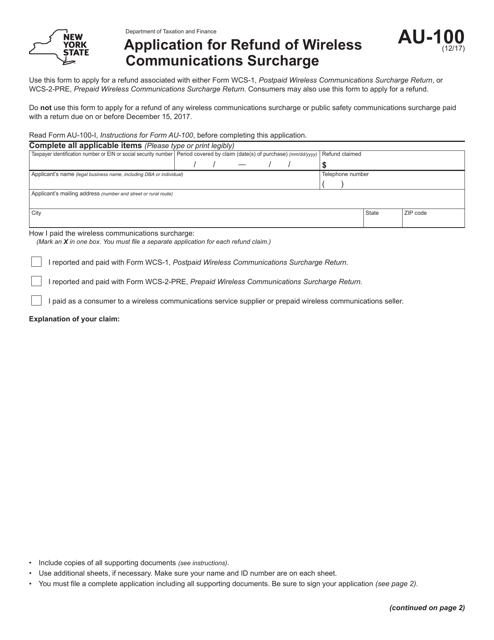

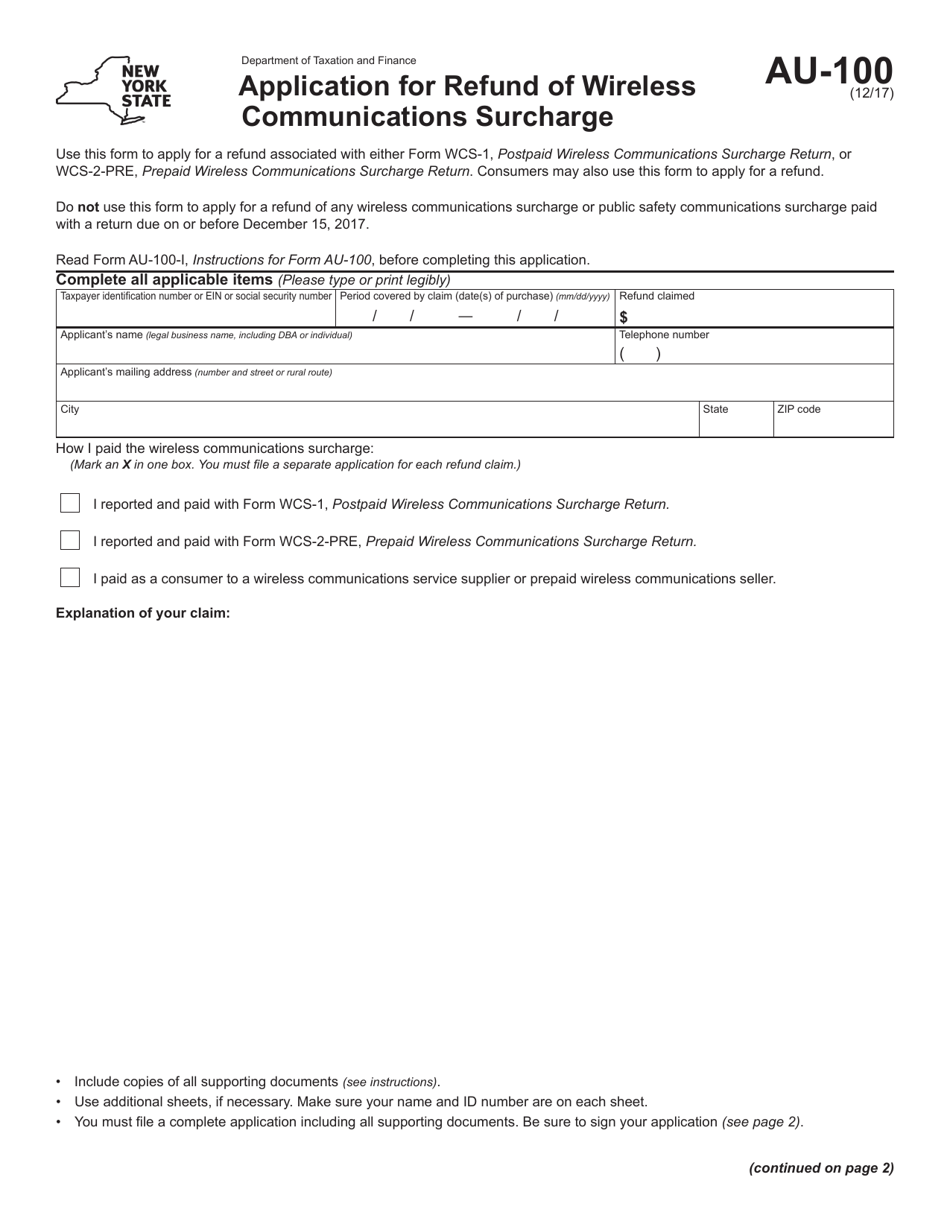

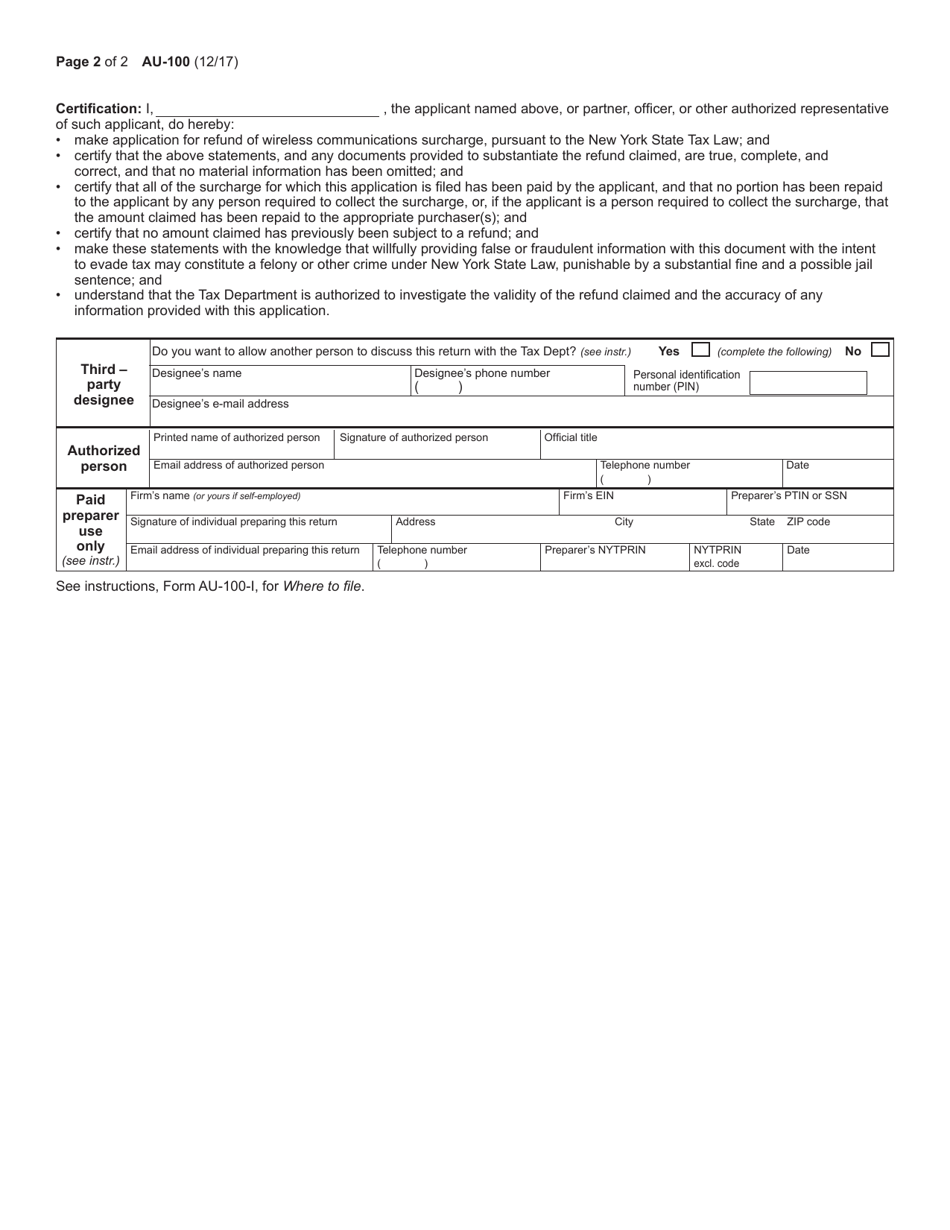

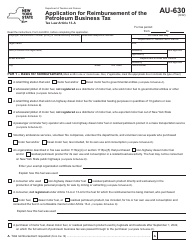

Form AU-100 Application for Refund of Wireless Communications Surcharge - New York

What Is Form AU-100?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form AU-100?

A: Form AU-100 is an Application for Refund of Wireless Communications Surcharge in New York.

Q: Who can fill out form AU-100?

A: Anyone who wants to apply for a refund of the wireless communications surcharge in New York can fill out form AU-100.

Q: What is the purpose of form AU-100?

A: The purpose of form AU-100 is to request a refund of the wireless communications surcharge paid in New York.

Q: What information is required on form AU-100?

A: Form AU-100 requires personal information, including name, address, and social security number, as well as details about the wireless service provider and the surcharge paid.

Q: How long does it take to process form AU-100?

A: The processing time for form AU-100 varies, but it generally takes a few weeks to receive a refund.

Q: Is there a deadline to submit form AU-100?

A: Yes, there is a deadline to submit form AU-100. The form must be filed within three years from the date the surcharge was paid.

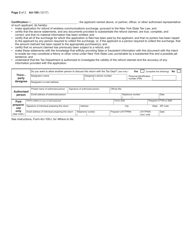

Q: Do I need to include supporting documents with form AU-100?

A: Yes, you may need to include supporting documents, such as copies of wireless service bills and proof of payment, with form AU-100.

Q: Who should I contact for more information about form AU-100?

A: For more information about form AU-100, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-100 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.