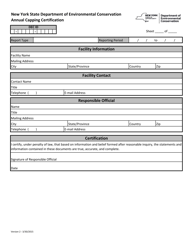

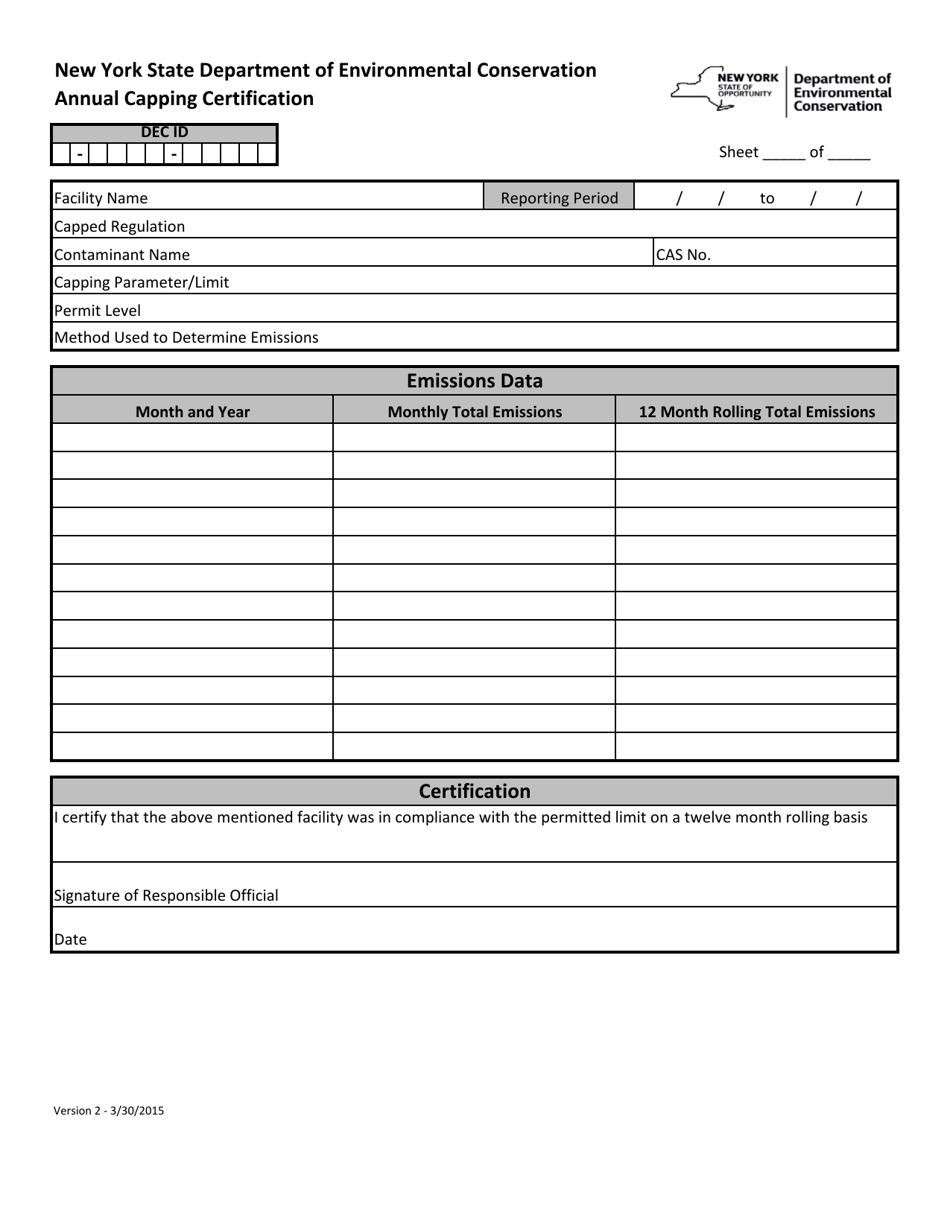

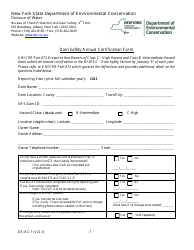

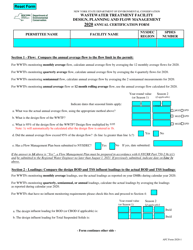

Annual Capping Certification - New York

Annual Capping Certification is a legal document that was released by the New York State Department of Environmental Conservation - a government authority operating within New York.

FAQ

Q: What is Annual Capping Certification?

A: Annual Capping Certification is a process required by the state of New York to determine the maximum amount of income that is subject to certain taxes.

Q: Who needs to complete an Annual Capping Certification?

A: Businesses and individuals who are subject to certain taxes in New York need to complete an Annual Capping Certification.

Q: What taxes are subject to the Annual Capping Certification?

A: The Annual Capping Certification applies to taxes such as the corporation tax, personal income tax, and the MTA surcharge.

Q: When is the deadline to complete the Annual Capping Certification?

A: The deadline to complete the Annual Capping Certification is typically March 15th of each year.

Q: What happens if I don't complete the Annual Capping Certification?

A: Failure to complete the Annual Capping Certification may result in penalties or additional taxes being assessed by the state of New York.

Q: Are there any exemptions from the Annual Capping Certification?

A: Yes, there are certain exemptions from the Annual Capping Certification based on income thresholds and types of businesses.

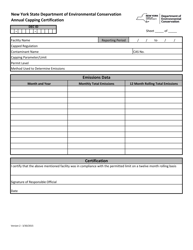

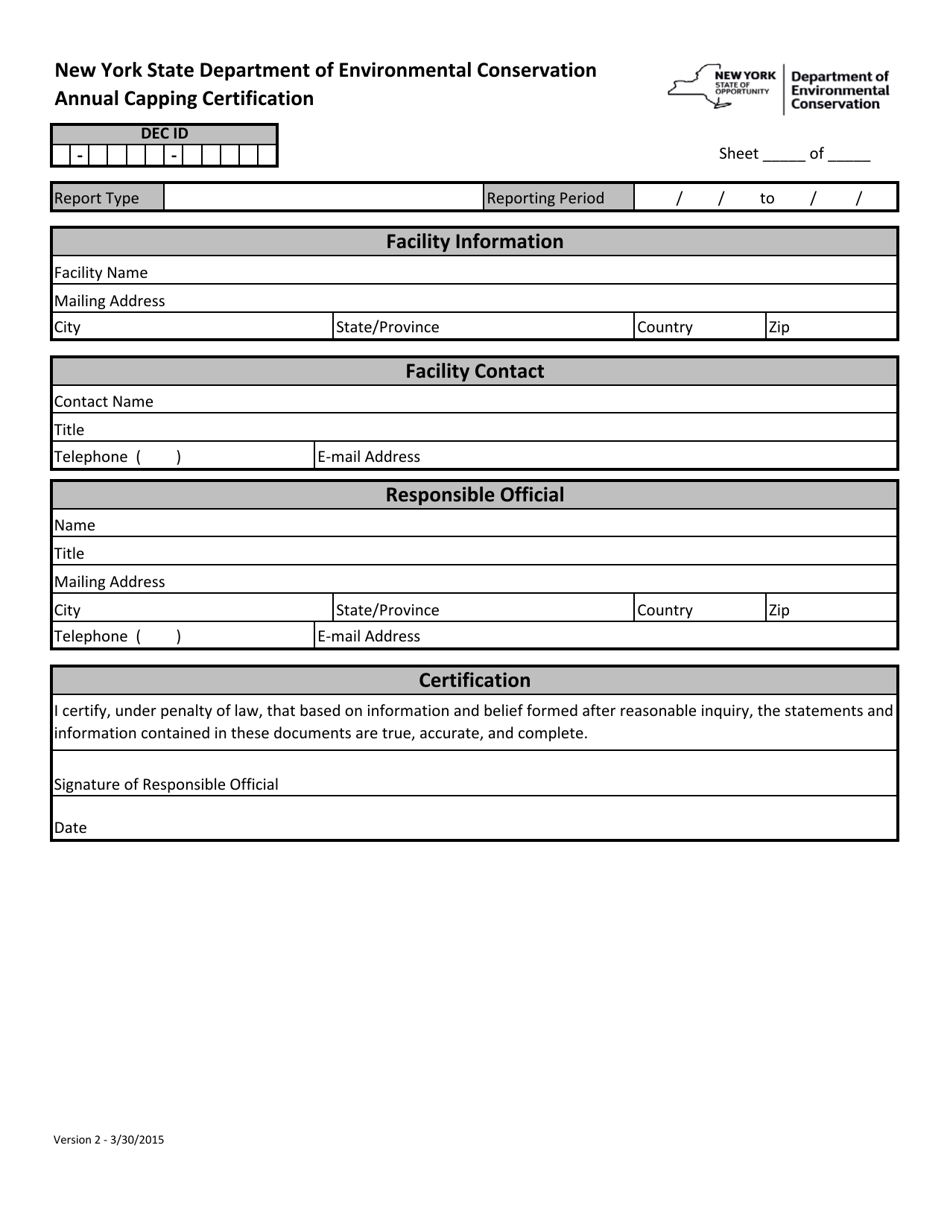

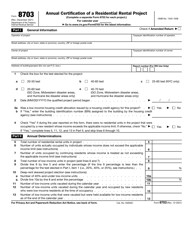

Form Details:

- Released on March 30, 2015;

- The latest edition currently provided by the New York State Department of Environmental Conservation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Environmental Conservation.