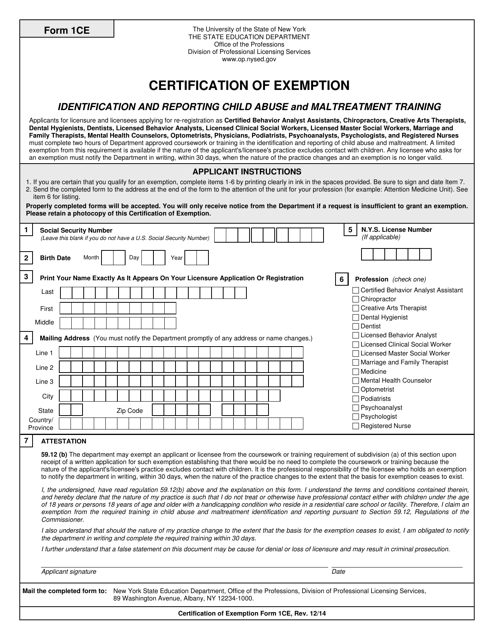

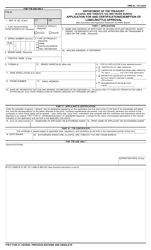

Form 1CE Certification of Exemption - New York

What Is Form 1CE?

This is a legal form that was released by the New York State Education Department - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 1CE?

A: Form 1CE is a Certification of Exemption in New York.

Q: Who needs to fill out Form 1CE?

A: Certain individuals or entities in New York may need to fill out Form 1CE if they qualify for an exemption from various taxes.

Q: What taxes does Form 1CE cover?

A: Form 1CE covers exemptions from sales tax, use tax, and certain other taxes in New York.

Q: How do I know if I qualify for an exemption?

A: You should refer to the instructions on Form 1CE or consult with a tax professional to determine if you qualify for an exemption.

Q: Is there a deadline to submit Form 1CE?

A: The deadline to submit Form 1CE varies depending on the specific exemption you are claiming. Refer to the instructions on the form or consult with a tax professional for more information.

Q: What happens after I submit Form 1CE?

A: After you submit Form 1CE, the New York State Department of Taxation and Finance will review your application and determine if you qualify for the exemption.

Q: Can I appeal if my exemption is denied?

A: Yes, you can appeal if your exemption is denied. Refer to the instructions on Form 1CE or consult with a tax professional for more information on the appeals process.

Q: Do I need to renew my exemption?

A: Some exemptions may require renewal. Refer to the instructions on Form 1CE or consult with a tax professional to determine if you need to renew your exemption.

Q: Are there any penalties for false or fraudulent claims?

A: Yes, there are penalties for false or fraudulent claims. It is important to provide accurate and truthful information when filling out Form 1CE.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the New York State Education Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1CE by clicking the link below or browse more documents and templates provided by the New York State Education Department.