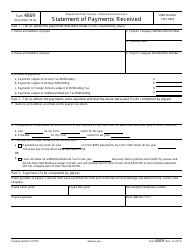

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

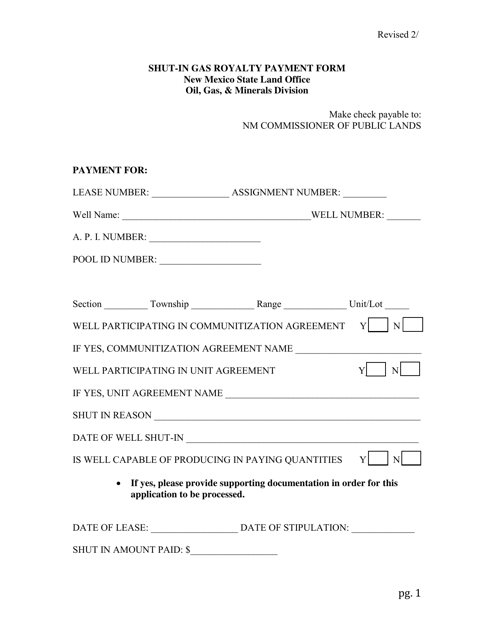

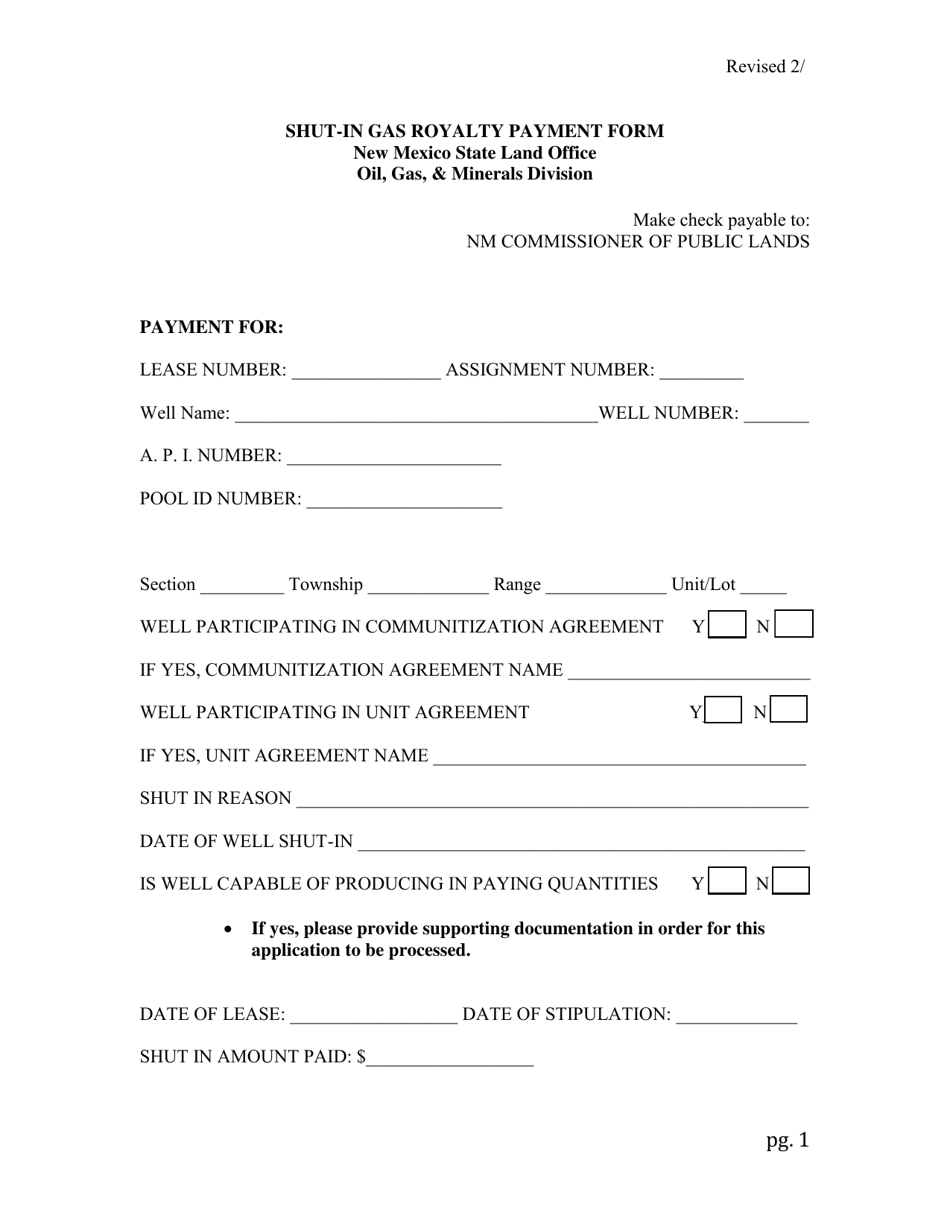

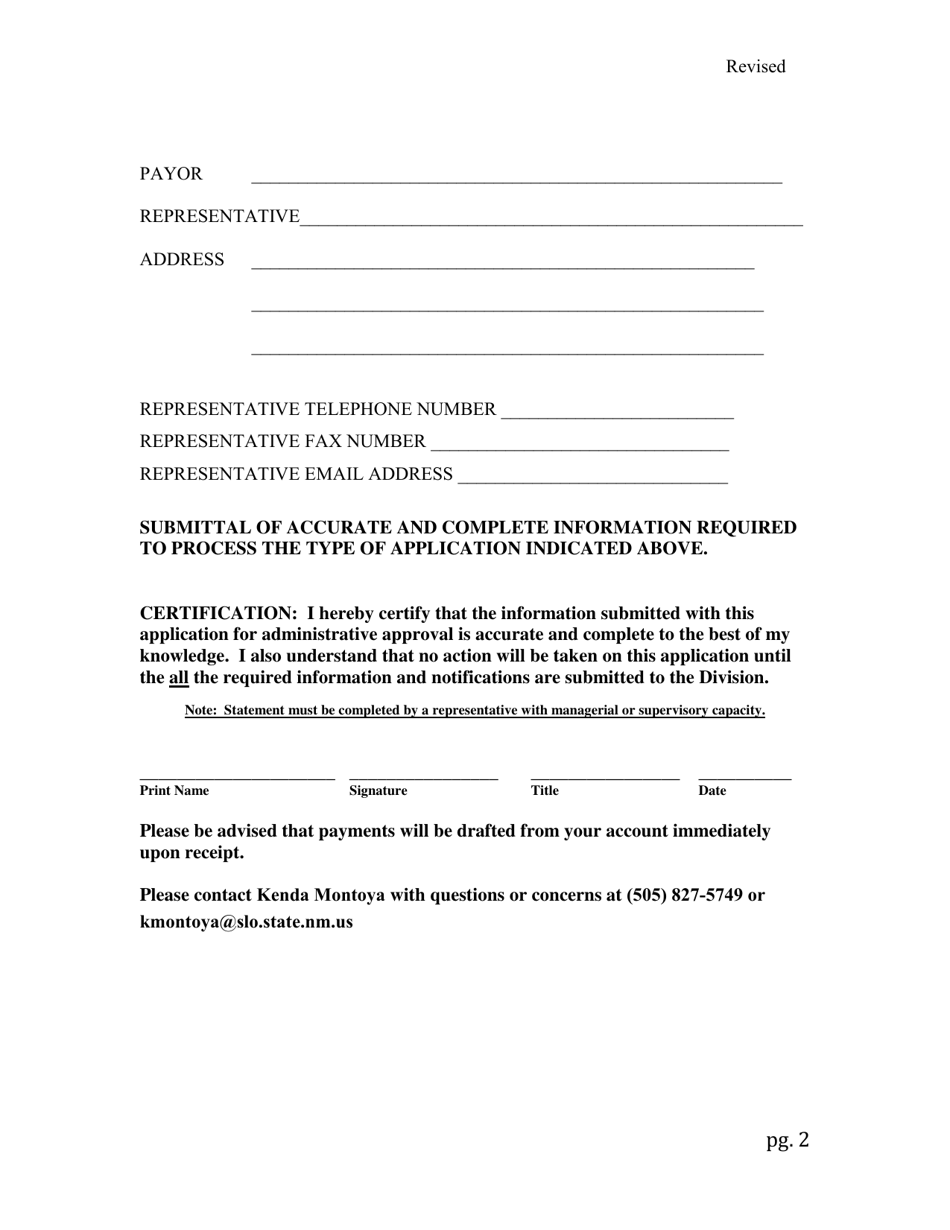

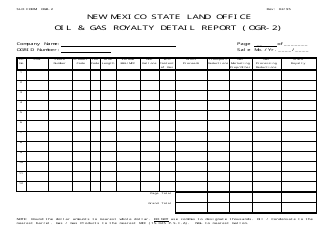

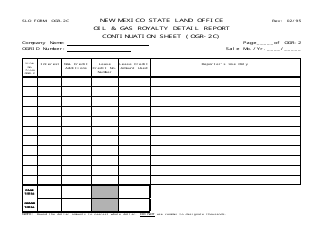

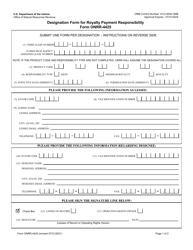

Shut-In Gas Royalty Payment Form - New Mexico

Shut-In Gas Royalty Payment Form is a legal document that was released by the New Mexico State Land Office - a government authority operating within New Mexico.

FAQ

Q: What is the Shut-In Gas Royalty Payment Form?

A: The Shut-In Gas Royalty Payment Form is a form used in New Mexico to report and pay royalties for shut-in gas wells.

Q: Who needs to file the Shut-In Gas Royalty Payment Form?

A: Operators of shut-in gas wells in New Mexico are required to file the Shut-In Gas Royalty Payment Form.

Q: When is the Shut-In Gas Royalty Payment Form due?

A: The Shut-In Gas Royalty Payment Form is due on or before the last day of the month following the end of the reporting period.

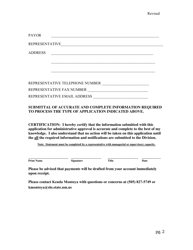

Q: What information is required on the Shut-In Gas Royalty Payment Form?

A: The Shut-In Gas Royalty Payment Form requires information such as the operator's name, well identification number, shut-in date, and the royalty payment amount.

Q: Are there any penalties for late or non-payment of royalties?

A: Yes, there are penalties for late or non-payment of royalties, including interest charges and possible legal action.

Q: Is there any exemption or waiver available for the Shut-In Gas Royalty Payment Form?

A: There may be exemptions or waivers available for the Shut-In Gas Royalty Payment Form under certain circumstances. Contact the New Mexico Oil Conservation Division for more information.

Form Details:

- Released on February 2, 2016;

- The latest edition currently provided by the New Mexico State Land Office;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico State Land Office.