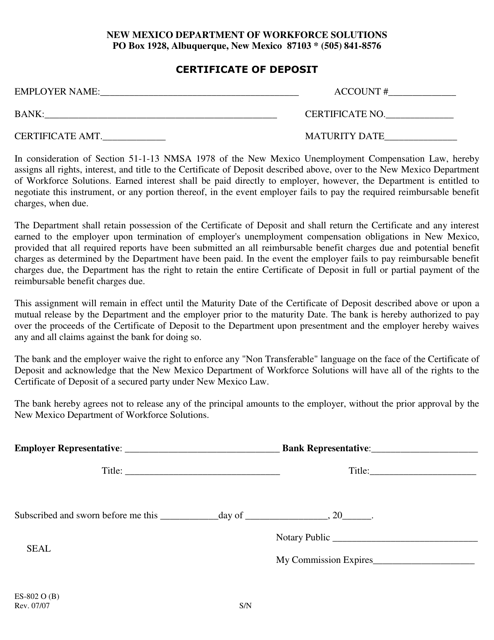

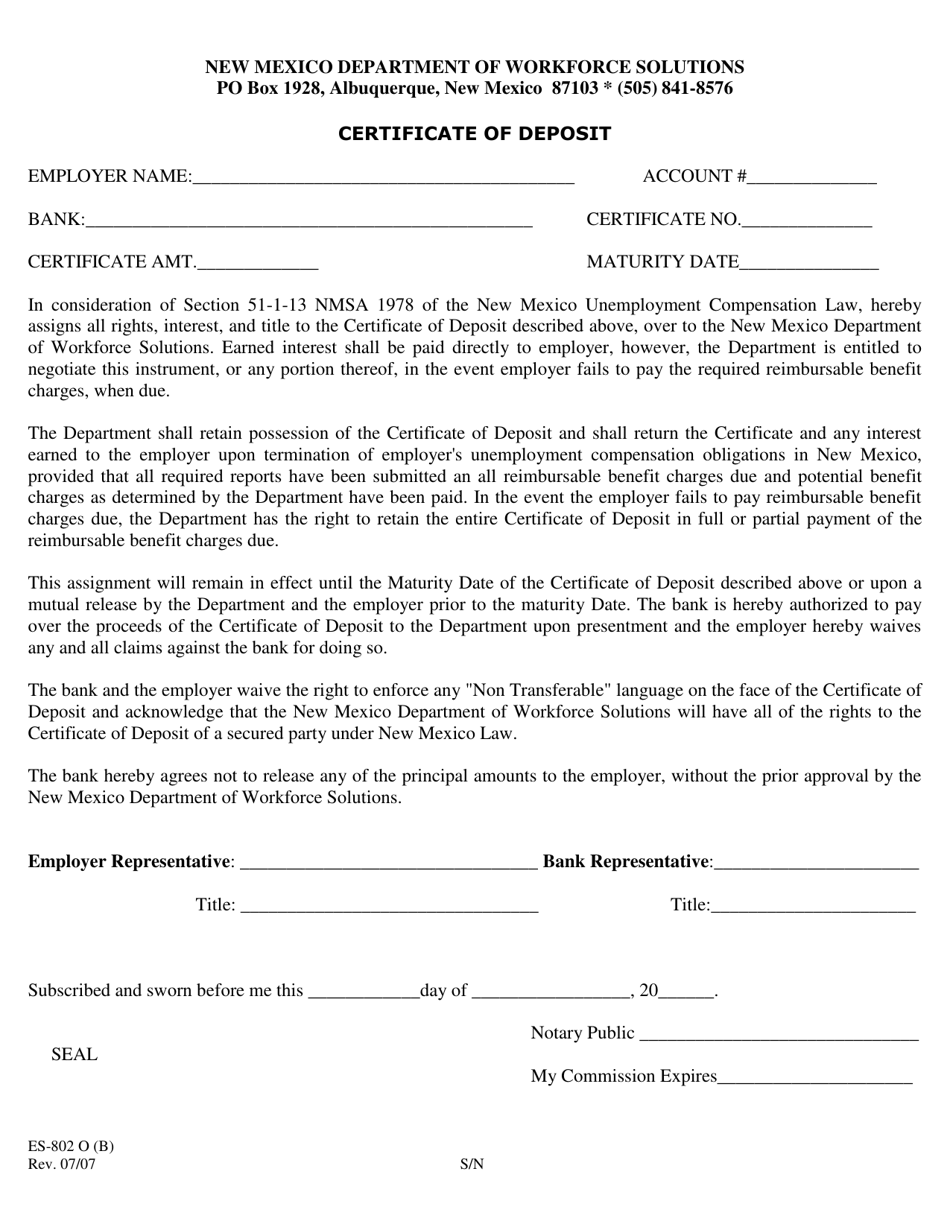

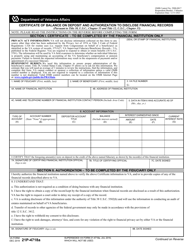

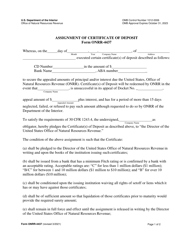

Form ES-802 O(B) Certificate of Deposit - New Mexico

What Is Form ES-802 O(B)?

This is a legal form that was released by the New Mexico Department of Workforce Solutions - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ES-802 O(B)?

A: Form ES-802 O(B) is a Certificate of Deposit form used in New Mexico.

Q: What is the purpose of Form ES-802 O(B)?

A: Form ES-802 O(B) is used to report information about a certificate of deposit owned by a non-resident of New Mexico.

Q: Who needs to fill out Form ES-802 O(B)?

A: Form ES-802 O(B) needs to be filled out by non-residents of New Mexico who own a certificate of deposit.

Q: What information should be provided in Form ES-802 O(B)?

A: Form ES-802 O(B) requires information such as the name and address of the owner, details of the certificate of deposit, and income earned from it.

Q: Are there any deadlines for filing Form ES-802 O(B)?

A: Yes, Form ES-802 O(B) should be filed by the due date specified by the New Mexico Taxation and Revenue Department.

Q: Is Form ES-802 O(B) applicable to both individuals and businesses?

A: Yes, Form ES-802 O(B) is applicable to both individuals and businesses who are non-residents of New Mexico and own a certificate of deposit.

Q: What should I do with Form ES-802 O(B) after filling it out?

A: After filling out Form ES-802 O(B), you should submit it to the New Mexico Taxation and Revenue Department along with any required attachments or payments.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the New Mexico Department of Workforce Solutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ES-802 O(B) by clicking the link below or browse more documents and templates provided by the New Mexico Department of Workforce Solutions.