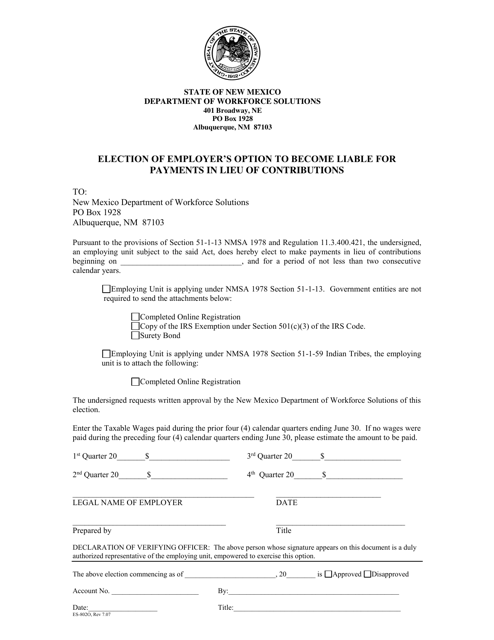

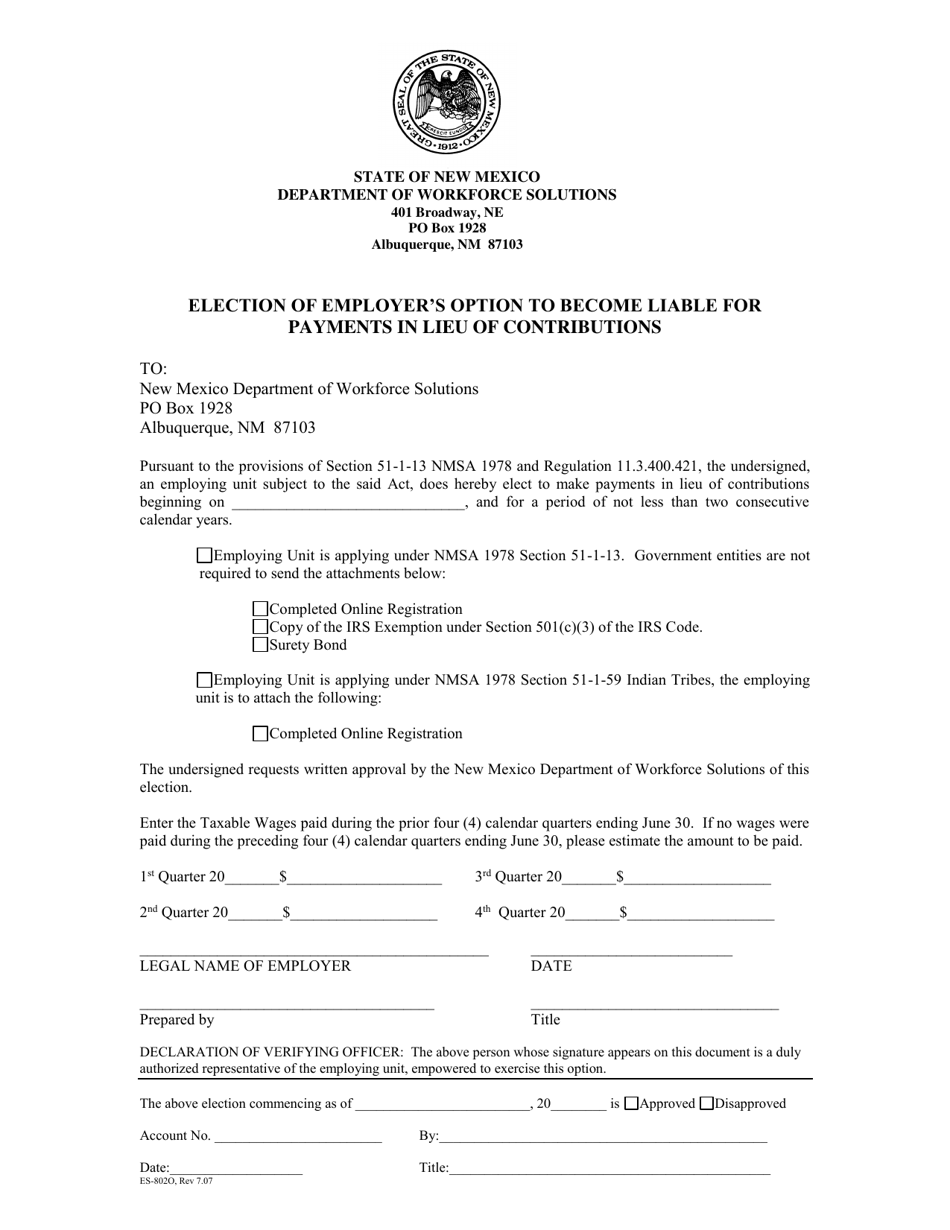

Form ES-802O Election of Employer's Option to Become Liable for Payments in Lieu of Contributions - New Mexico

What Is Form ES-802O?

This is a legal form that was released by the New Mexico Department of Workforce Solutions - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ES-802O?

A: Form ES-802O is the Election of Employer's Option to Become Liable for Payments in Lieu of Contributions.

Q: What is the purpose of form ES-802O?

A: The purpose of this form is for employers in New Mexico to elect to become liable for payments in lieu of contributions for their employees.

Q: Who should use form ES-802O?

A: Employers in New Mexico who want to become liable for payments in lieu of contributions should use this form.

Q: Are there any deadlines for filing form ES-802O?

A: Yes, the form must be filed with the New Mexico DWS within 30 days after the election is made.

Q: What are payments in lieu of contributions?

A: Payments in lieu of contributions are payments made by employers to the New Mexico Unemployment Insurance Fund instead of paying unemployment insurance tax.

Q: What are the benefits of becoming liable for payments in lieu of contributions?

A: By becoming liable for payments in lieu of contributions, employers can potentially save money on unemployment insurance taxes and have greater control over their unemployment insurance costs.

Q: Are there any eligibility requirements for electing to become liable for payments in lieu of contributions?

A: Yes, employers must meet certain eligibility requirements outlined by the New Mexico DWS to be eligible for this election.

Q: Can an employer change their election after submitting form ES-802O?

A: Once an employer elects to become liable for payments in lieu of contributions, the election cannot be changed or revoked except under specific circumstances.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the New Mexico Department of Workforce Solutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ES-802O by clicking the link below or browse more documents and templates provided by the New Mexico Department of Workforce Solutions.