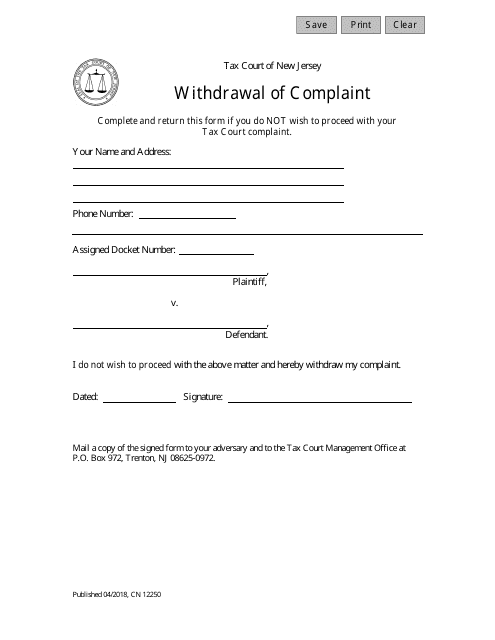

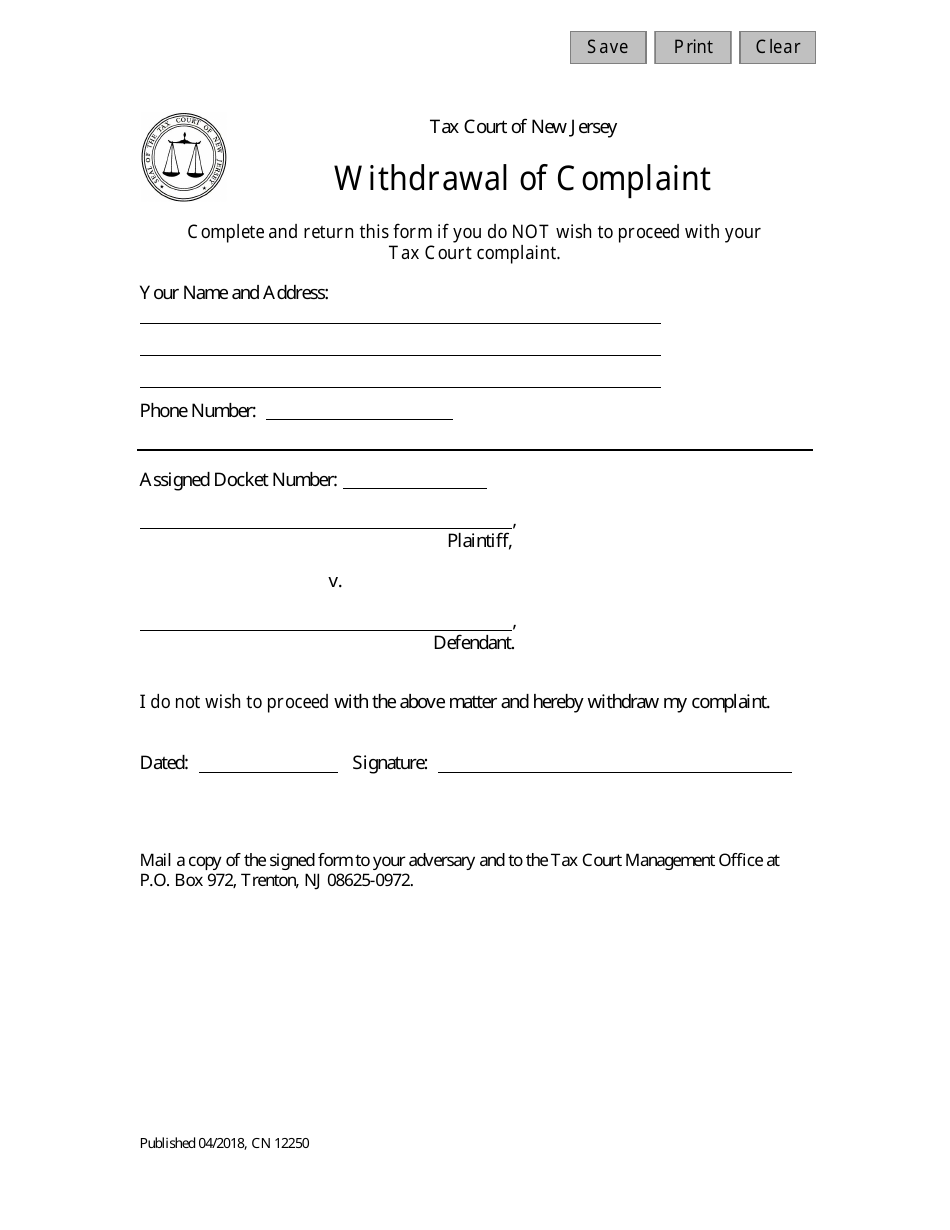

Form 12250 Withdrawal of Complaint - New Jersey

What Is Form 12250?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 12250?

A: Form 12250 is a document used in New Jersey to withdraw a complaint.

Q: What is the purpose of Form 12250?

A: The purpose of Form 12250 is to officially withdraw a complaint that has been filed in New Jersey.

Q: Who can use Form 12250?

A: Anyone who has filed a complaint in New Jersey can use Form 12250 to withdraw it.

Q: Do I need to provide a reason for withdrawing the complaint?

A: No, you are not required to provide a reason for withdrawing the complaint on Form 12250.

Q: Is there a deadline for submitting Form 12250?

A: There is no specific deadline for submitting Form 12250 to withdraw a complaint in New Jersey.

Q: Are there any fees associated with submitting Form 12250?

A: There are no fees associated with submitting Form 12250 to withdraw a complaint in New Jersey.

Q: Can I use Form 12250 to withdraw a complaint filed in another state?

A: No, Form 12250 is specific to New Jersey and cannot be used to withdraw complaints filed in other states.

Q: What should I do after submitting Form 12250?

A: After submitting Form 12250, you should keep a copy for your records and notify any relevant parties that the complaint has been withdrawn.

Q: Can I file a new complaint after withdrawing the previous one using Form 12250?

A: Yes, you can file a new complaint after withdrawing the previous one using Form 12250, if needed.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 12250 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.