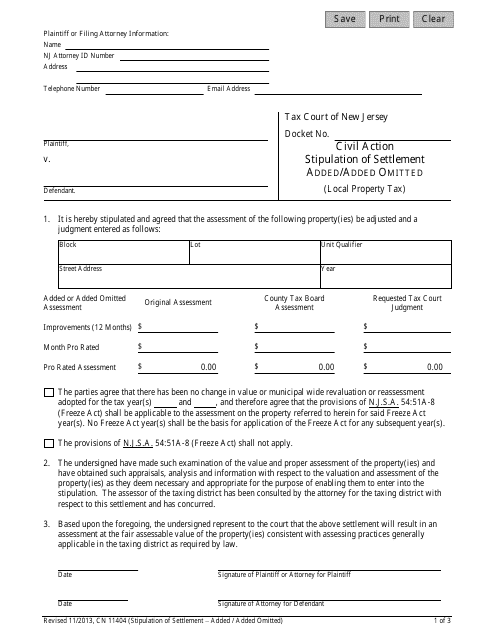

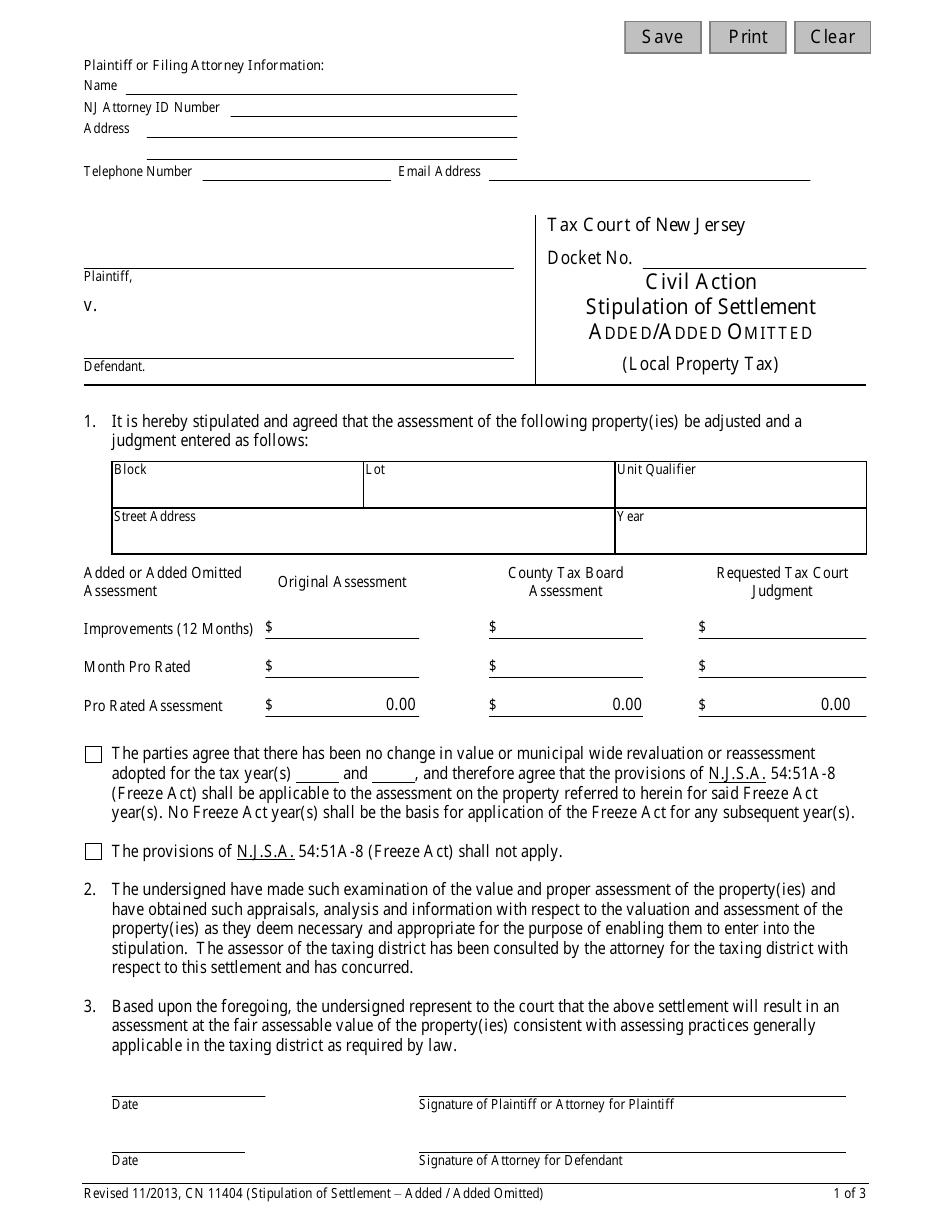

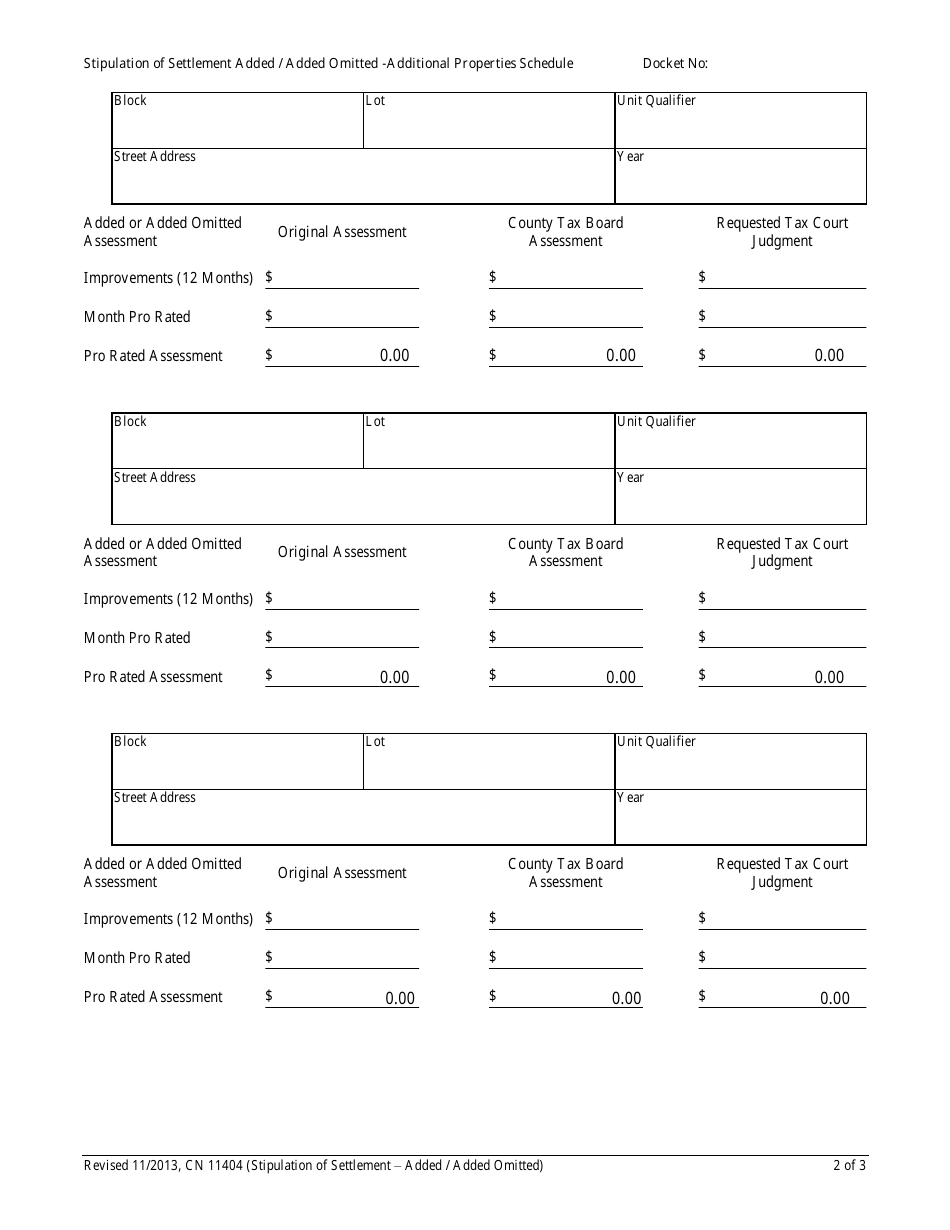

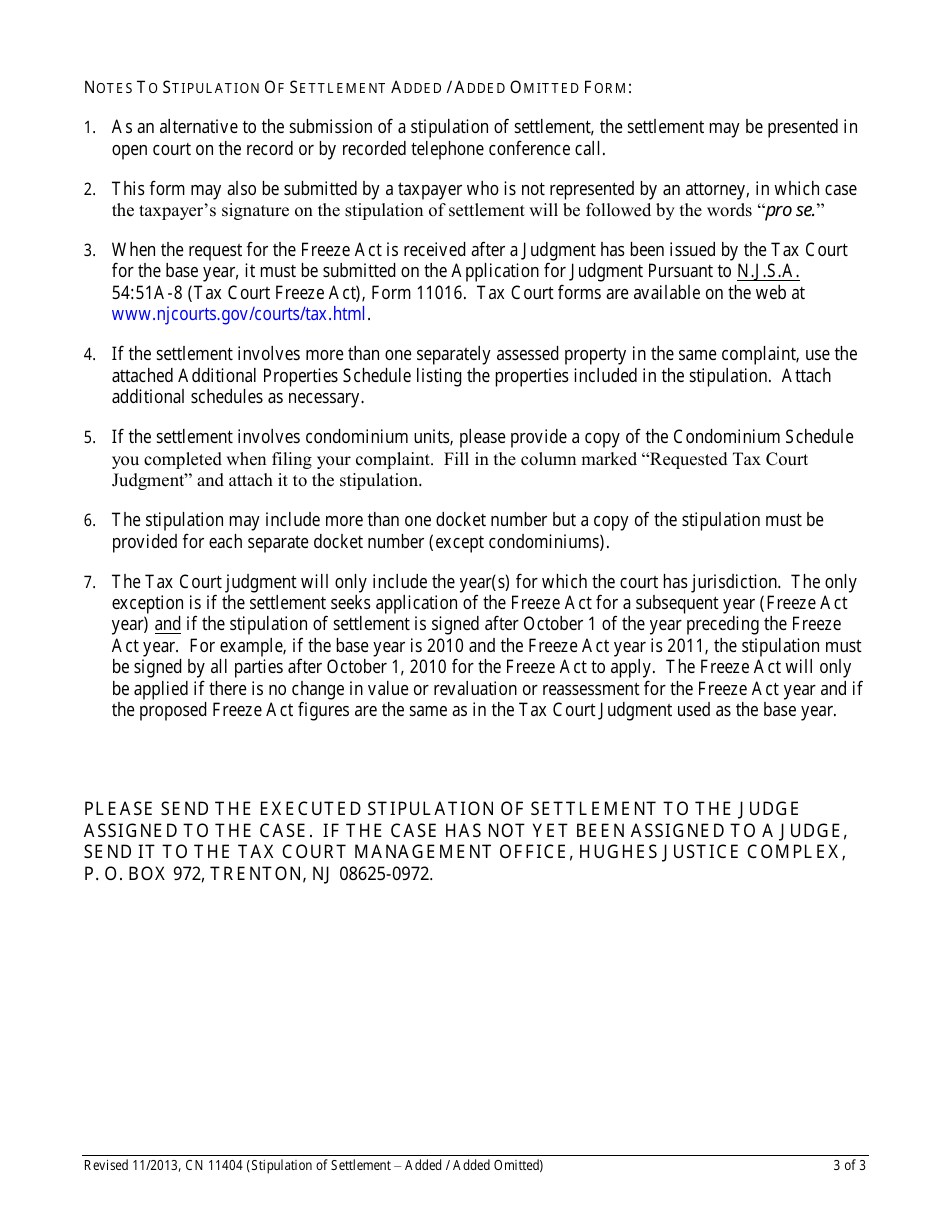

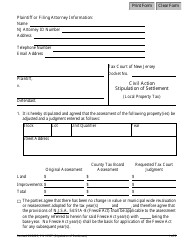

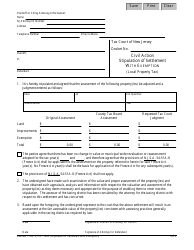

Form 11404 Stipulation of Settlement Added / Added Omitted (Local Property Tax) - New Jersey

What Is Form 11404?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 11404?

A: Form 11404 is a Stipulation of Settlement Added/Added Omitted for Local Property Tax in New Jersey.

Q: What is the purpose of Form 11404?

A: Form 11404 is used to settle disputes related to local property tax assessments.

Q: What does 'Added/Added Omitted' mean in Form 11404?

A: 'Added/Added Omitted' refers to properties that were erroneously left out or undervalued in the original tax assessment.

Q: Who can use Form 11404?

A: Form 11404 can be used by property owners or their representatives to negotiate a settlement with the local tax assessor.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11404 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.