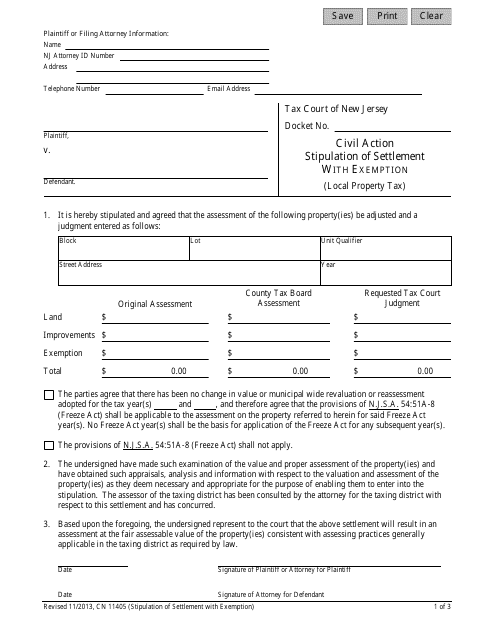

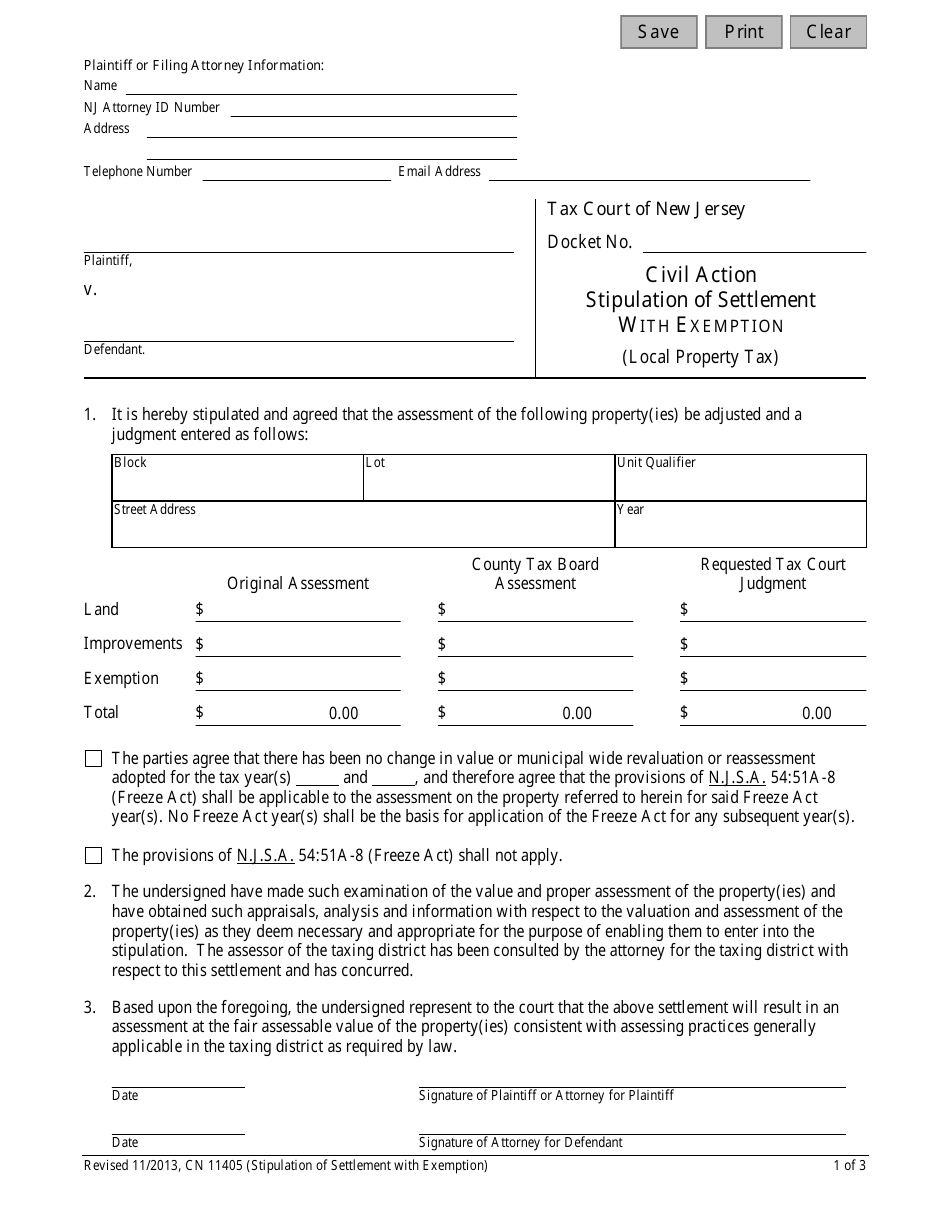

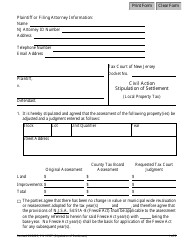

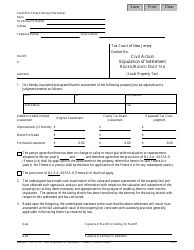

Form 11405 Stipulation of Settlement With Exemption - New Jersey

What Is Form 11405?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 11405?

A: Form 11405 is a Stipulation of Settlement With Exemption used in New Jersey.

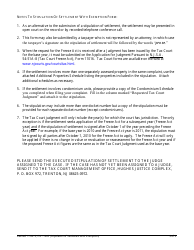

Q: What is a Stipulation of Settlement?

A: A Stipulation of Settlement is a legal agreement between parties to resolve a dispute or case.

Q: What is an exemption?

A: An exemption is a legal provision that allows certain assets or income to be protected from being taken or used to satisfy a debt or judgment.

Q: Who can use Form 11405?

A: Form 11405 can be used by parties involved in a legal case in New Jersey who have reached a settlement agreement and are seeking an exemption.

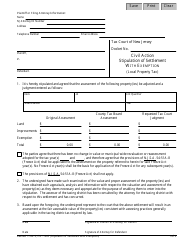

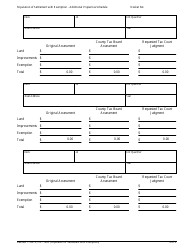

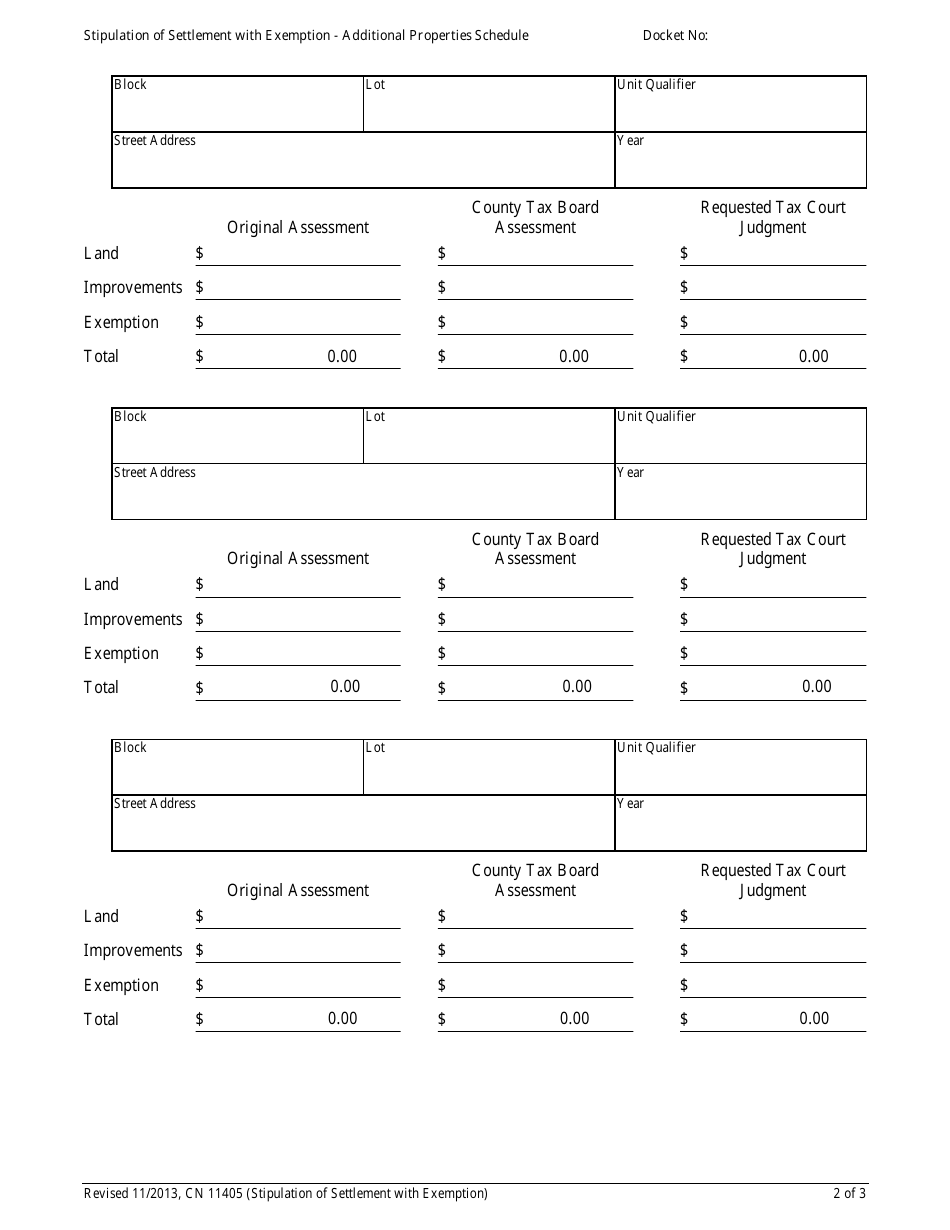

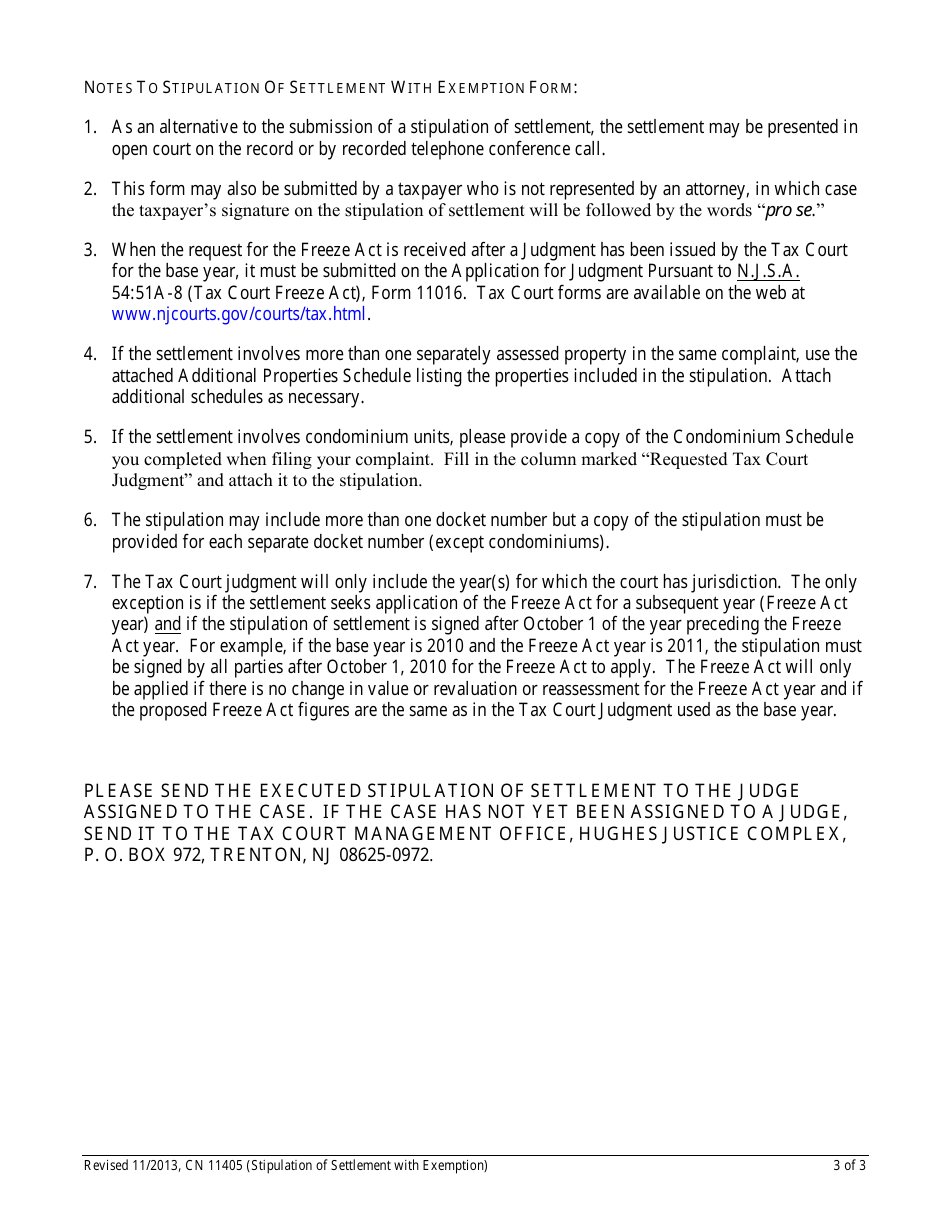

Q: What information is required in Form 11405?

A: Form 11405 requires information about the parties involved, details of the settlement agreement, and the basis for claiming an exemption.

Q: Do I need a lawyer to use Form 11405?

A: It is recommended to consult with a lawyer to ensure the proper use of Form 11405 and to understand your legal rights and obligations.

Q: Can Form 11405 be used in other states?

A: No, Form 11405 is specific to New Jersey and may not be valid or recognized in other states.

Q: What should I do after completing Form 11405?

A: After completing Form 11405, it should be filed with the appropriate court and served on the other party to the settlement agreement.

Q: Can Form 11405 be modified?

A: Form 11405 can be modified with the agreement of all parties involved or as directed by the court.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11405 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.