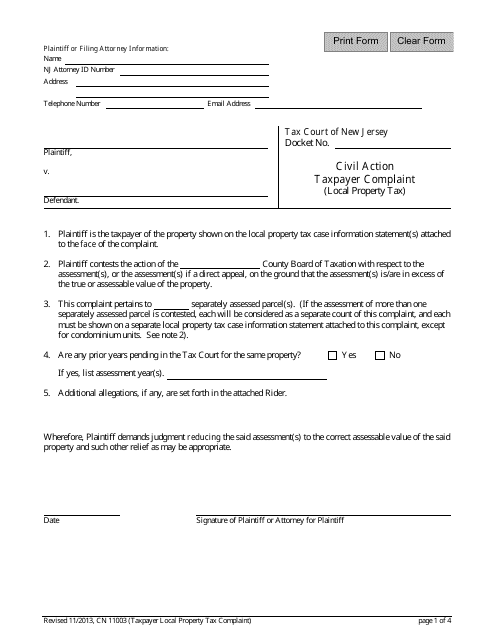

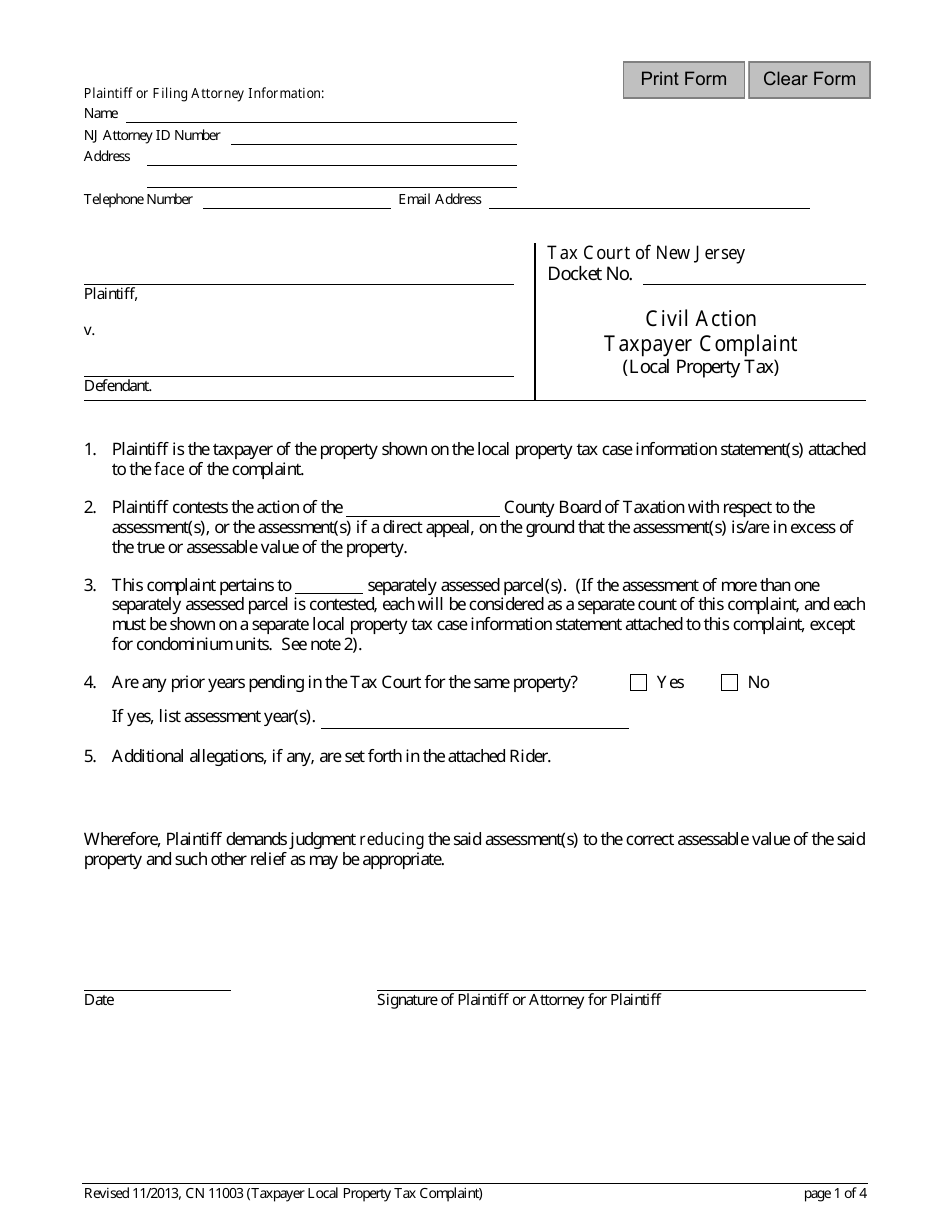

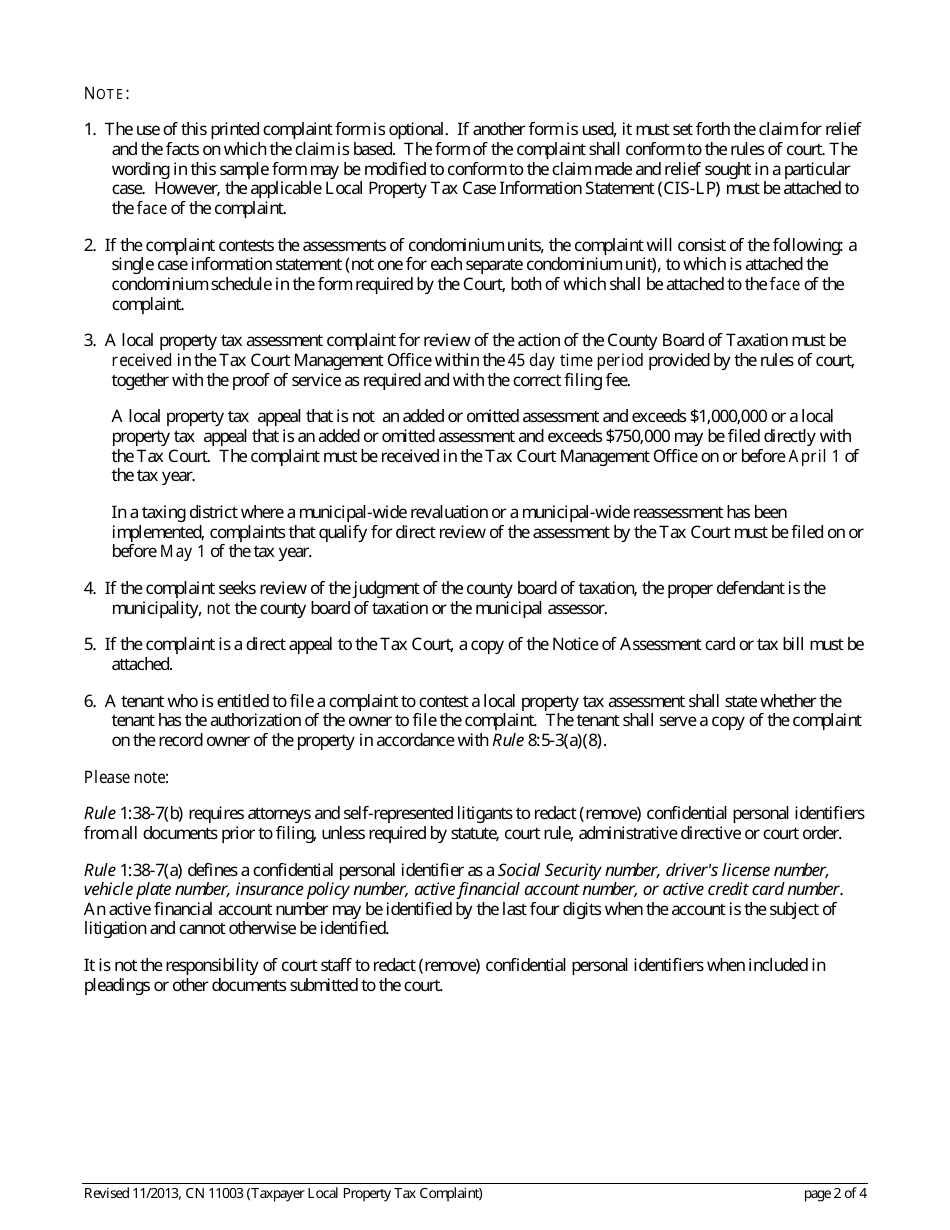

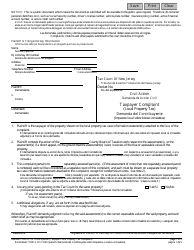

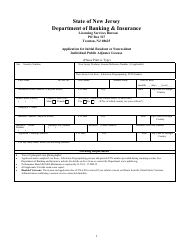

Form 11003 Taxpayer Complaint (Local Property Tax) - New Jersey

What Is Form 11003?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

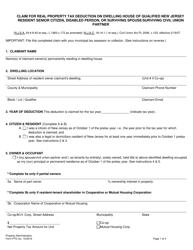

Q: What is Form 11003?

A: Form 11003 is a taxpayer complaint form specifically for local property tax in New Jersey.

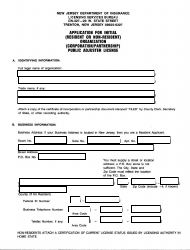

Q: Who can use Form 11003?

A: Any taxpayer in New Jersey who wants to file a complaint related to their local property tax can use Form 11003.

Q: What can be complained about using Form 11003?

A: Form 11003 can be used to complain about issues such as the assessed value of a property, classification, exemption, or any other local property tax matter.

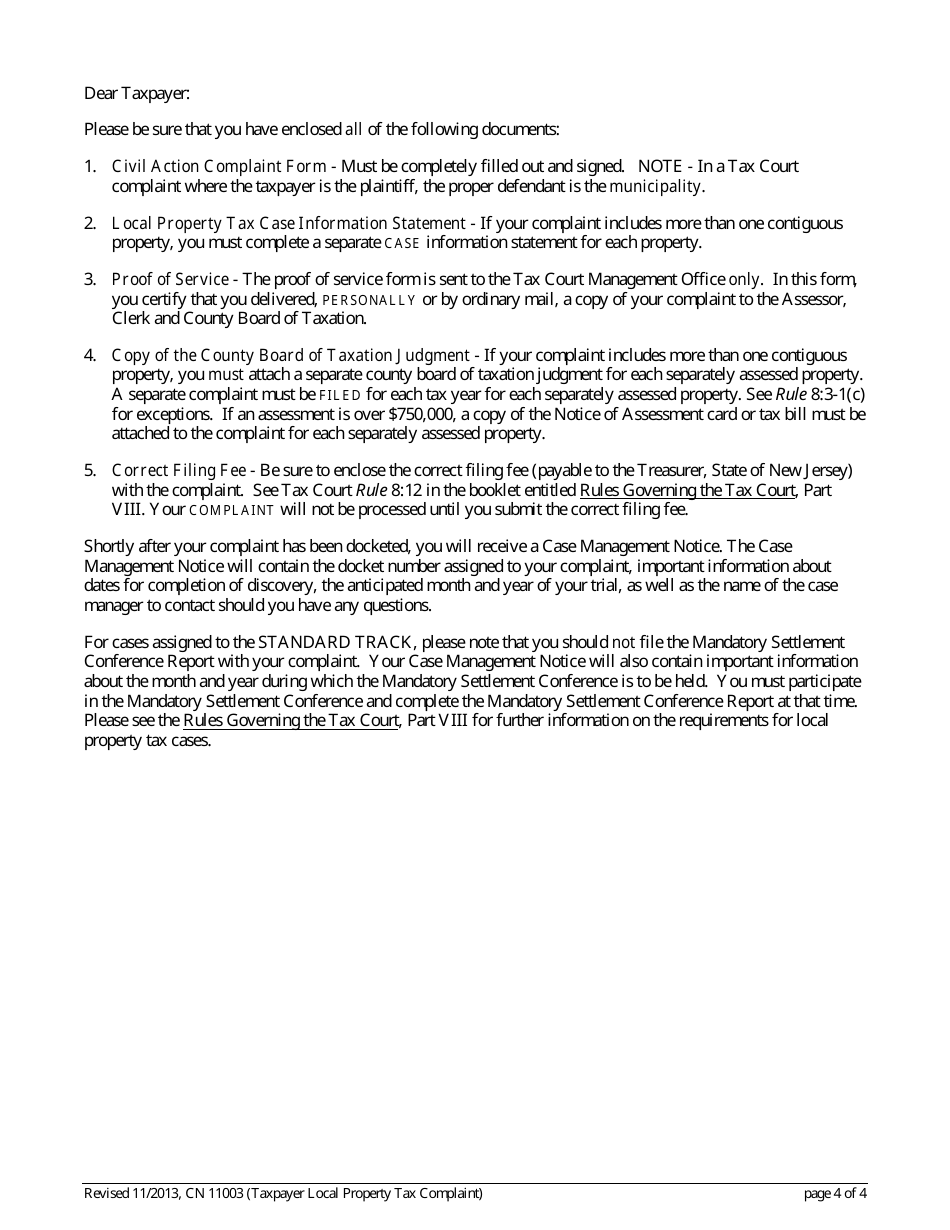

Q: What should I do with completed Form 11003?

A: After completing Form 11003, you should submit it to the tax assessor's office in the municipality where your property is located.

Q: Are there any fees associated with filing Form 11003?

A: No, there are no fees associated with filing Form 11003. It is a free service provided to taxpayers in New Jersey.

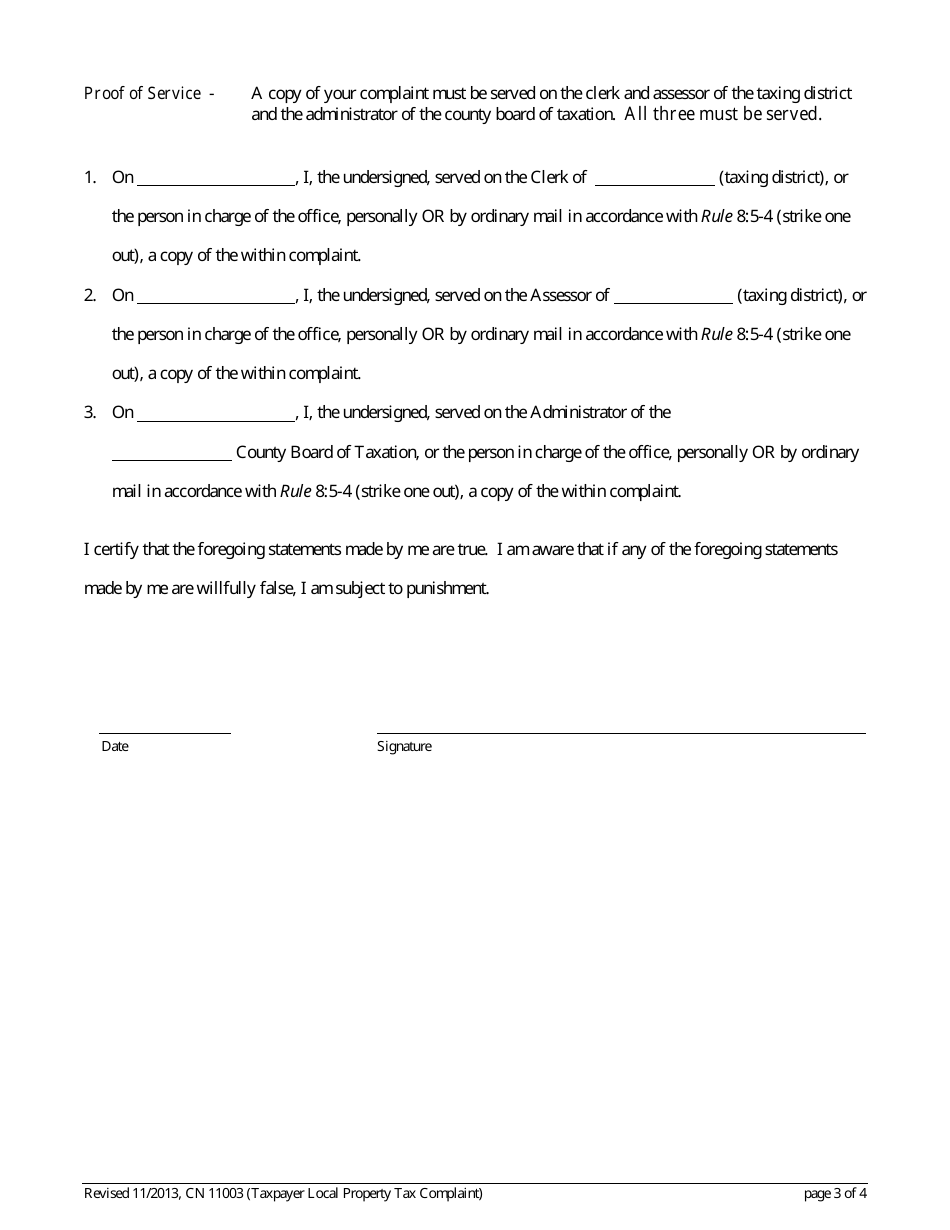

Q: Is there a deadline for filing Form 11003?

A: Yes, there is a deadline for filing Form 11003. The deadline is typically April 1st of the tax year or 45 days after the date of the bulk mailing of assessment notices, whichever is later.

Q: What happens after I file Form 11003?

A: After you file Form 11003, the tax assessor's office will review your complaint and may schedule an informal hearing to discuss the issue. You will be notified of the final decision regarding your complaint.

Q: Can I appeal the decision made based on my Form 11003 complaint?

A: Yes, if you disagree with the decision made based on your Form 11003 complaint, you have the right to appeal it to the county tax board or the New Jersey Tax Court.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

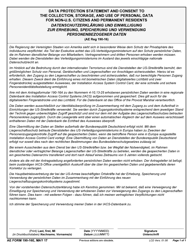

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11003 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.