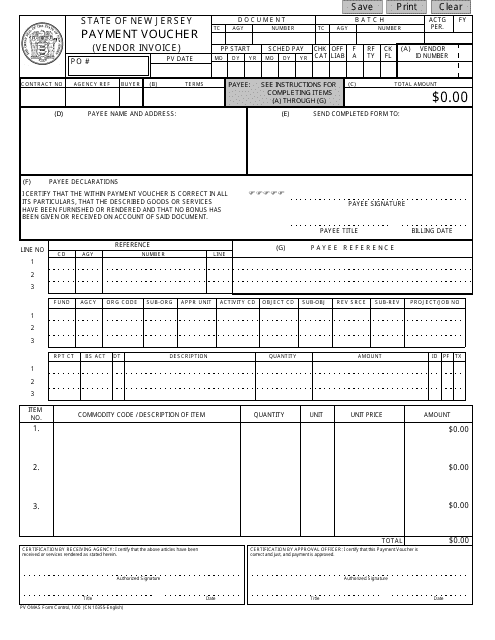

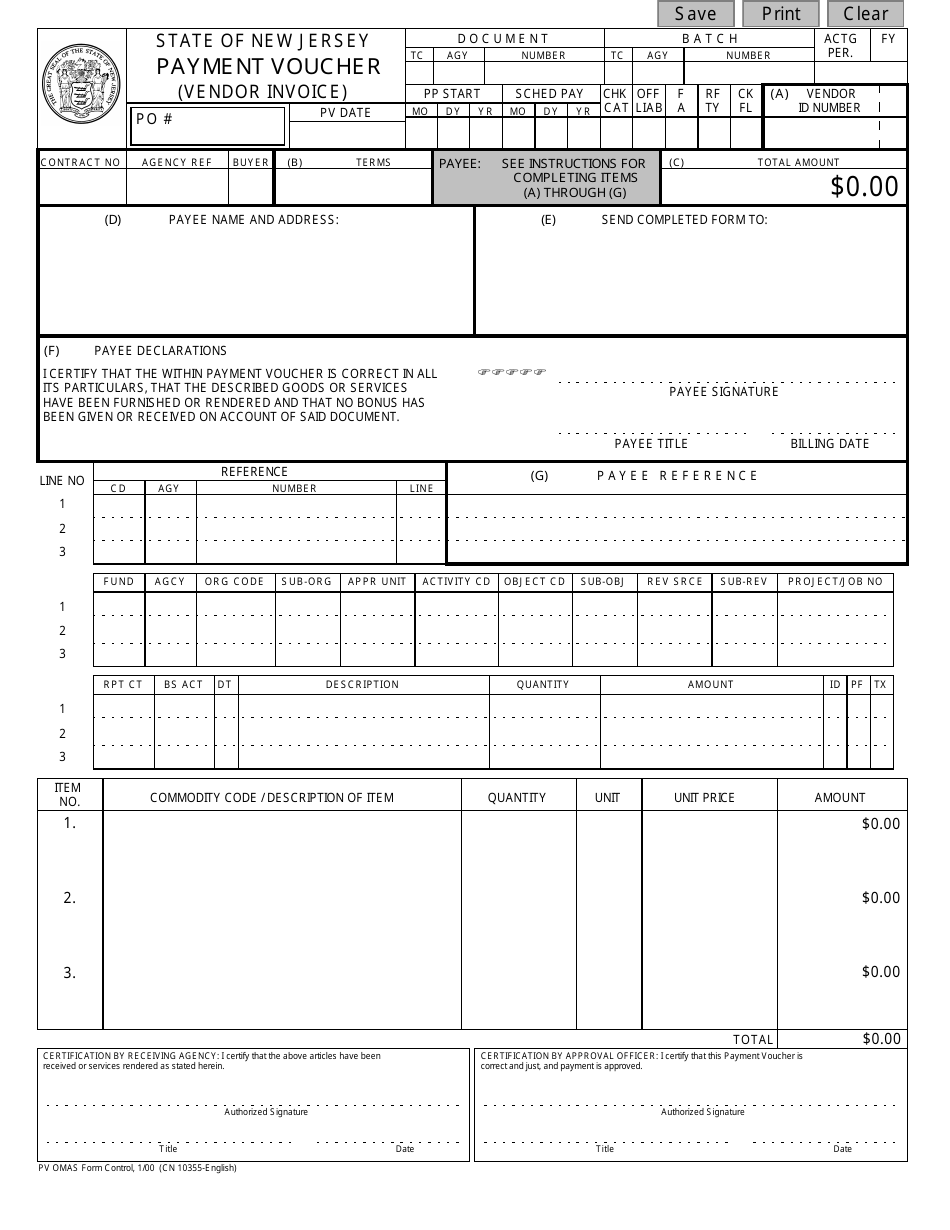

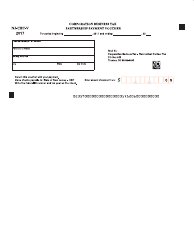

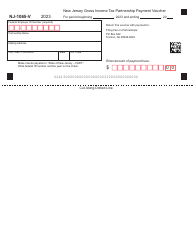

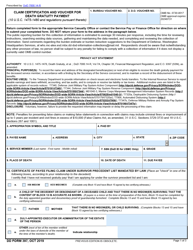

Form 10355 Payment Voucher - New Jersey

What Is Form 10355?

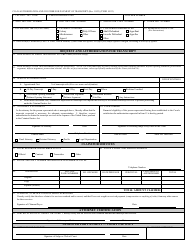

This is a legal form that was released by the New Jersey Judiciary Court System - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 10355 Payment Voucher?

A: Form 10355 Payment Voucher is a form used in New Jersey to make payments for various taxes.

Q: What is the purpose of Form 10355 Payment Voucher?

A: The purpose of Form 10355 Payment Voucher is to provide a means to make payments for various taxes in New Jersey.

Q: What taxes can be paid using Form 10355 Payment Voucher?

A: Form 10355 Payment Voucher can be used to pay various taxes in New Jersey, including income tax, sales and use tax, corporate business tax, and many others.

Q: Do I need to include Form 10355 Payment Voucher with my tax return?

A: It depends on the type of tax and the filing method. Some tax forms require inclusion of Form 10355 Payment Voucher, while others may not. It's best to consult the specific instructions for the tax form you are filing.

Q: Are there any penalties for late payment?

A: Yes, late payment penalties may apply for certain taxes if payments are not made by the due date. It's important to review the specific instructions and guidelines for each tax to avoid penalties.

Q: Can I use Form 10355 Payment Voucher for federal taxes?

A: No, Form 10355 Payment Voucher is specific to the state of New Jersey and cannot be used for federal taxes. Separate payment vouchers are available for federal tax payments.

Q: What should I do if I have questions about Form 10355 Payment Voucher?

A: If you have any questions or need assistance with Form 10355 Payment Voucher, you can contact the New Jersey Division of Taxation or consult with a tax professional.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the New Jersey Judiciary Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10355 by clicking the link below or browse more documents and templates provided by the New Jersey Judiciary Court System.