This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

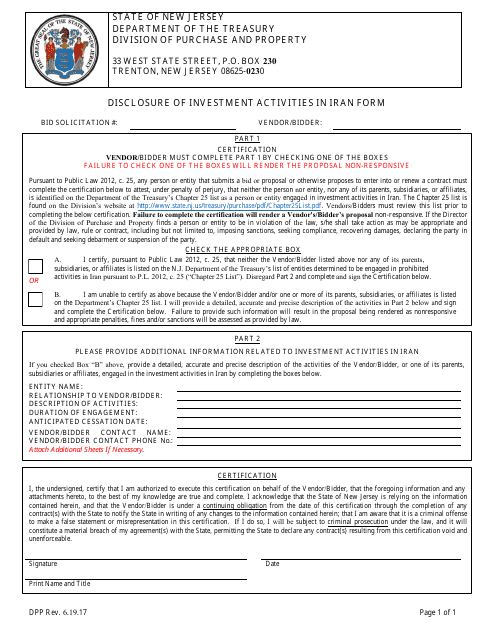

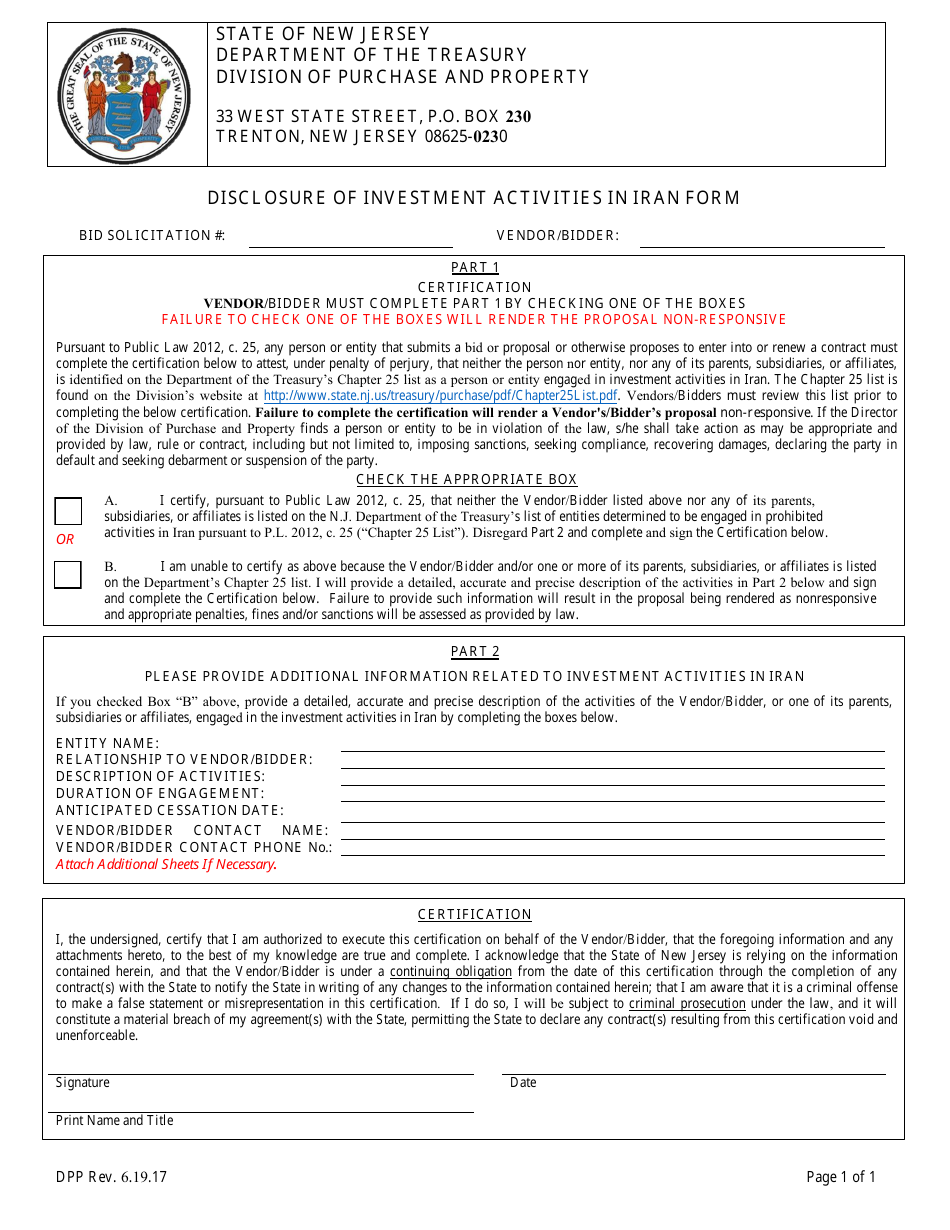

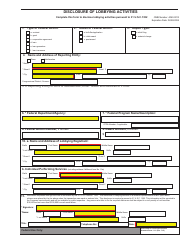

Disclosure of Investment Activities in Iran Form - New Jersey

Disclosure of Investment Activities in Iran Form is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Disclosure of Investment Activities in Iran Form?

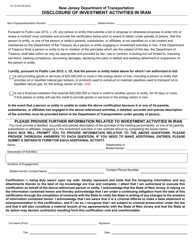

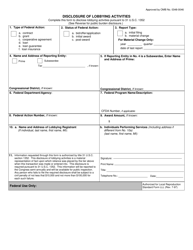

A: The Disclosure of Investment Activities in Iran Form is a document required by the state of New Jersey to disclose any investments or business activities conducted in Iran.

Q: Who needs to file the Disclosure of Investment Activities in Iran Form?

A: Any individual or business entity that has investments or conducts business activities in Iran and is registered or required to register with the New Jersey Division of Investment must file this form.

Q: What information is required in the form?

A: The form requires information about the nature and extent of investments or business activities in Iran, including the names of individuals or entities involved, the type of investments or activities, and the value of the investments.

Q: How often do I need to file this form?

A: The Disclosure of Investment Activities in Iran Form must be filed annually, or within 30 days of any new investments or business activities in Iran.

Q: What are the consequences of not filing this form?

A: Failure to file the Disclosure of Investment Activities in Iran Form may result in penalties, fines, or other legal consequences as determined by the State of New Jersey.

Form Details:

- Released on June 19, 2017;

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.