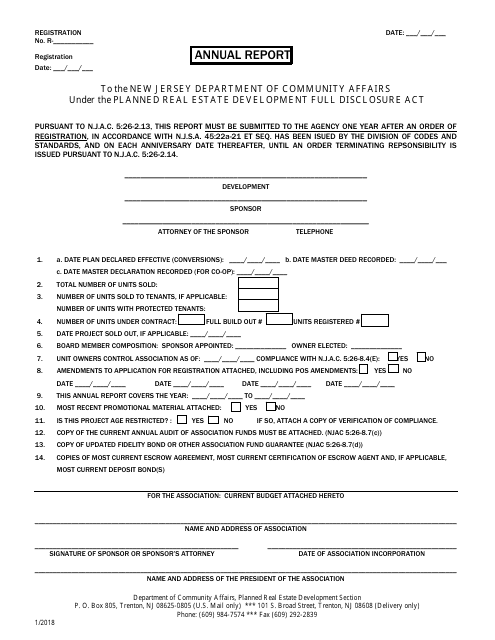

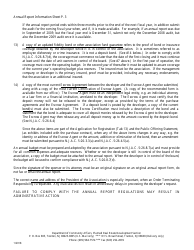

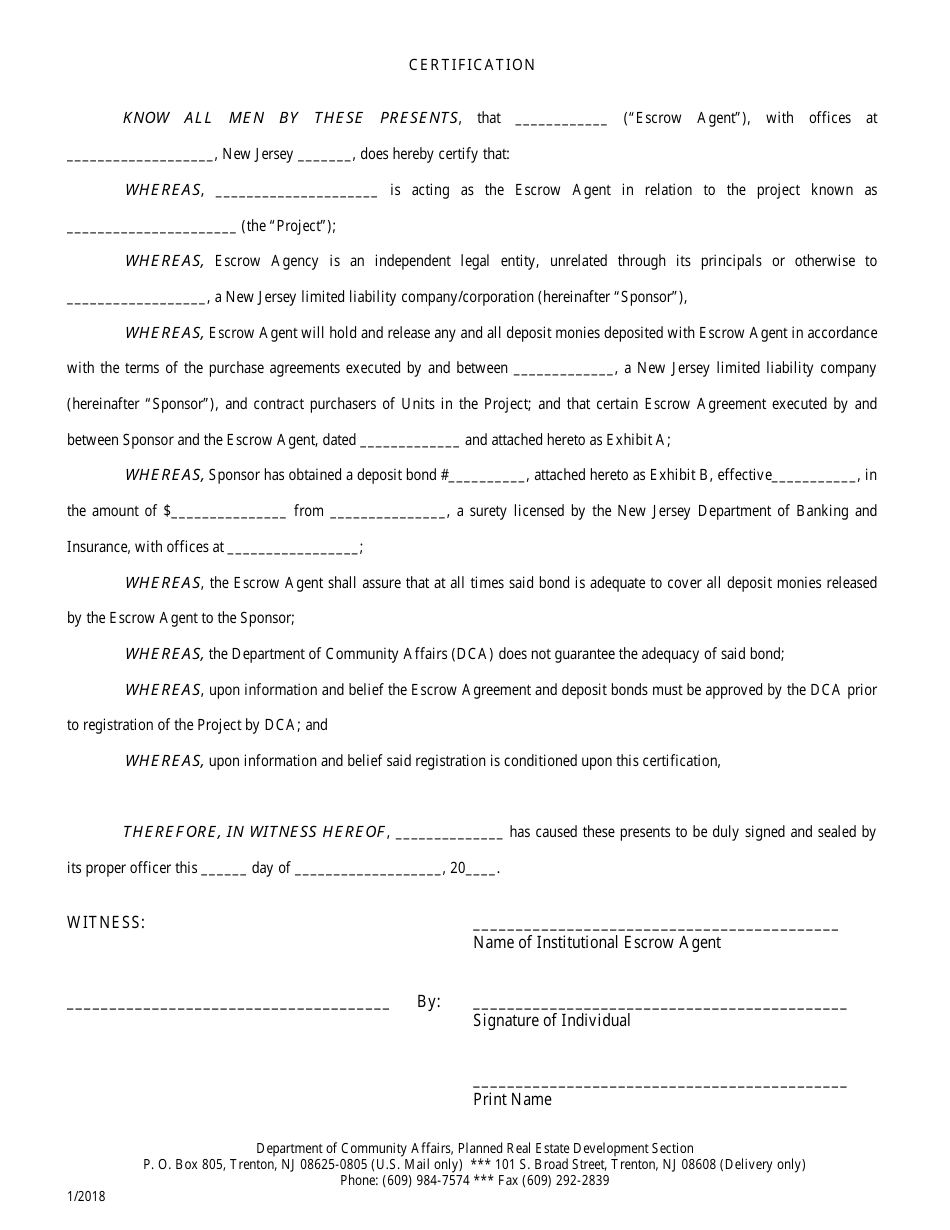

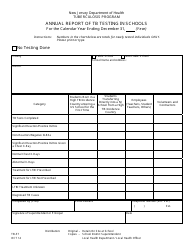

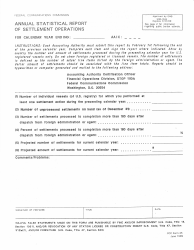

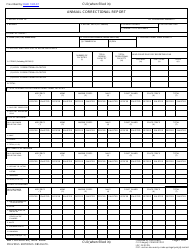

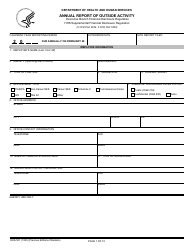

Annual Report - New Jersey

Annual Report is a legal document that was released by the New Jersey Department of Community Affairs - a government authority operating within New Jersey.

FAQ

Q: What is the Annual Report?

A: The Annual Report is a document that provides information about the activities and financial performance of a company or organization during a specific fiscal year.

Q: Why is the Annual Report important?

A: The Annual Report is important as it helps stakeholders, such as investors, employees, and the public, understand the overall health and performance of a company or organization.

Q: What information is typically included in the Annual Report?

A: The Annual Report typically includes financial statements, such as the balance sheet and income statement, as well as information about the company's operations, achievements, and future plans.

Q: Do I have to file an Annual Report for my business in New Jersey?

A: Yes, most businesses in New Jersey are required to file an Annual Report with the Division of Revenue and Enterprise Services by a specific deadline each year.

Q: What happens if I don't file my Annual Report on time?

A: If you fail to file your Annual Report on time, your business may be subject to late fees or penalties. It's important to make sure you meet the filing deadline.

Q: Is the Annual Report the same as the tax return?

A: No, the Annual Report and tax return are different documents. The Annual Report focuses on the overall performance of the company, while the tax return provides information about the company's taxable income and tax liabilities.

Q: What should I do if I have questions about the Annual Report?

A: If you have questions about the Annual Report, it is best to contact the company or organization directly, or seek professional advice from an accountant or attorney.

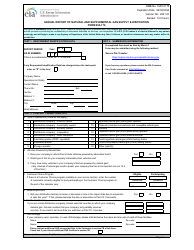

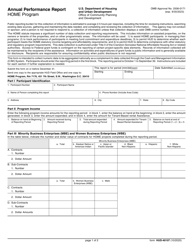

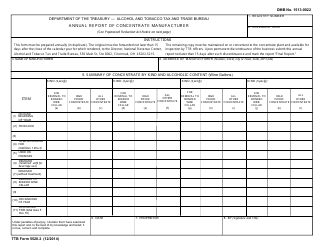

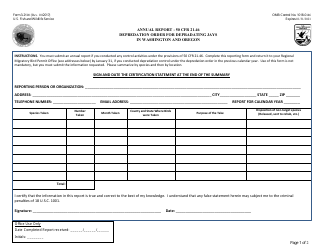

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the New Jersey Department of Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Community Affairs.