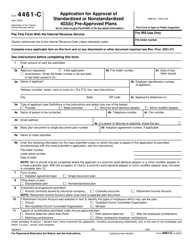

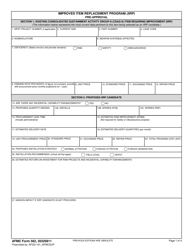

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

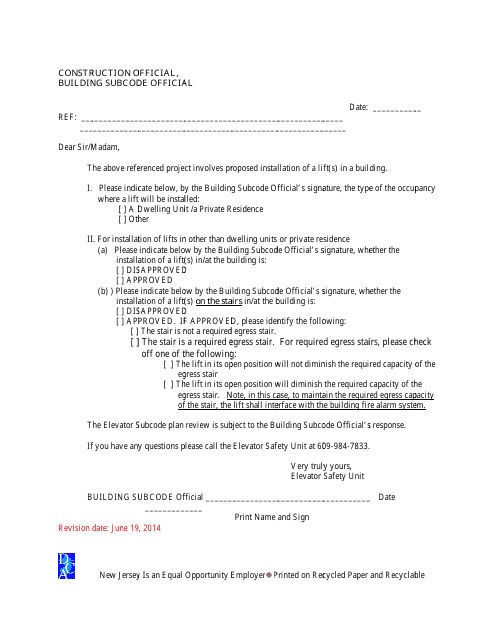

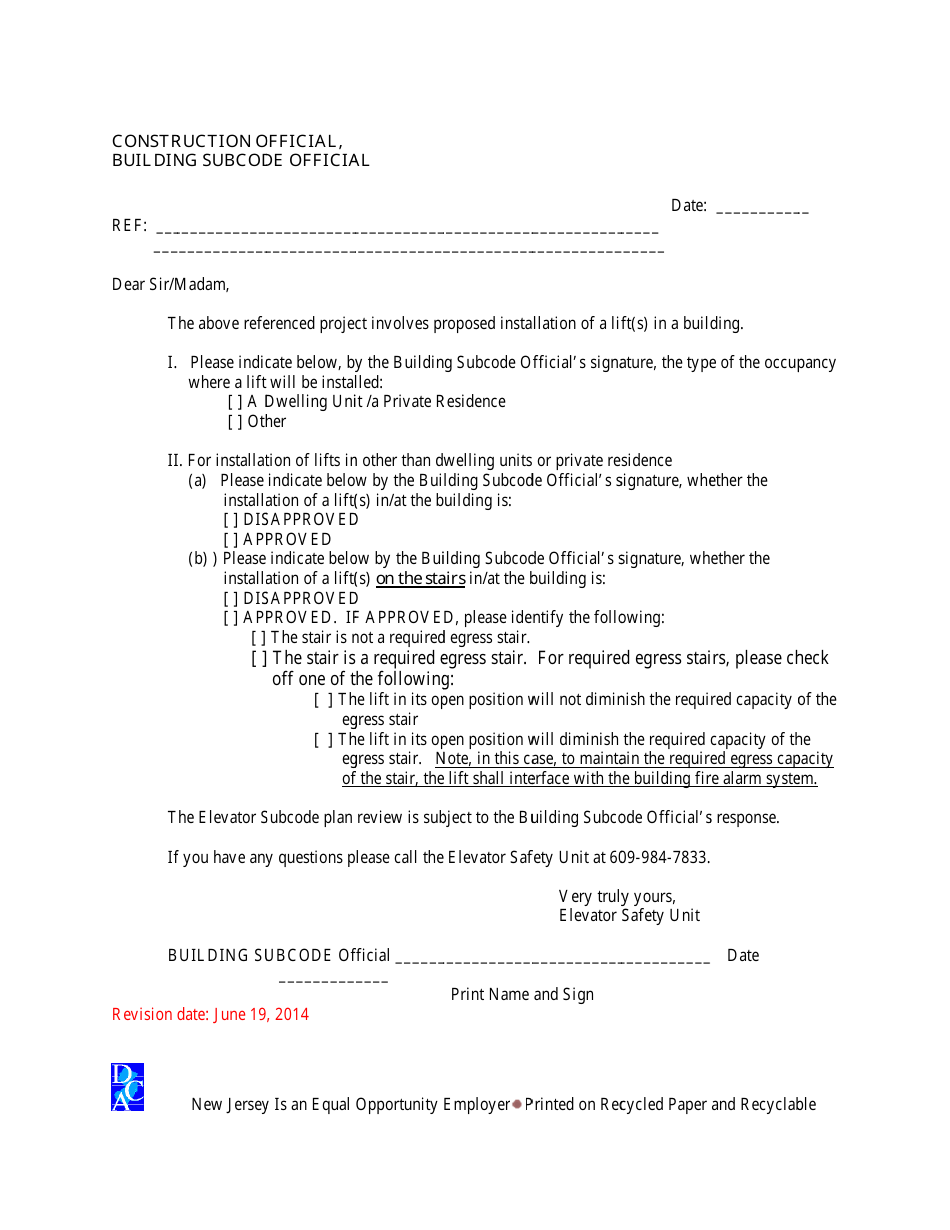

Lifts Pre-approval Letter Form - New Jersey

Lifts Pre-approval Letter Form is a legal document that was released by the New Jersey Department of Community Affairs - a government authority operating within New Jersey.

FAQ

Q: What is a pre-approval letter?

A: A pre-approval letter is a document provided by a lender that states the amount of money a person is approved to borrow for a mortgage.

Q: Why is a pre-approval letter important?

A: A pre-approval letter is important because it shows sellers that a buyer is serious and financially able to purchase a home.

Q: How do I obtain a pre-approval letter?

A: To obtain a pre-approval letter, you should contact a lender and provide them with your financial information, such as income, assets, and credit history.

Q: What information is needed to obtain a pre-approval letter?

A: Lenders will typically require information about your income, employment history, assets, debts, and credit score to assess your eligibility for a pre-approval letter.

Q: How long is a pre-approval letter valid?

A: The validity of a pre-approval letter may vary depending on the lender, but it is typically valid for about 60 to 90 days.

Q: Can a pre-approval letter guarantee that I will get a mortgage?

A: No, a pre-approval letter is not a guarantee that you will get a mortgage. It is an indication of your creditworthiness and the maximum amount you can borrow.

Q: Do I need a pre-approval letter before looking at homes?

A: While not required, it is highly recommended to obtain a pre-approval letter before looking at homes to have a better understanding of your budget and to make a stronger offer.

Q: Can I use a pre-approval letter from a different state in New Jersey?

A: It is generally best to obtain a pre-approval letter specifically for the state you are buying in, as different states may have different requirements and regulations.

Q: Can I get more than one pre-approval letter?

A: Yes, you can get multiple pre-approval letters from different lenders to compare mortgage offers and choose the best option for you.

Q: Does a pre-approval letter guarantee the interest rate for a mortgage?

A: No, a pre-approval letter does not guarantee the interest rate for a mortgage. Interest rates are typically determined at the time of the mortgage application.

Form Details:

- Released on June 19, 2014;

- The latest edition currently provided by the New Jersey Department of Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Community Affairs.