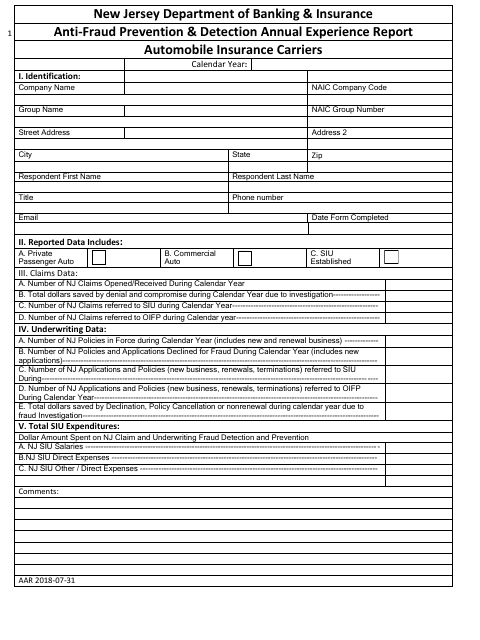

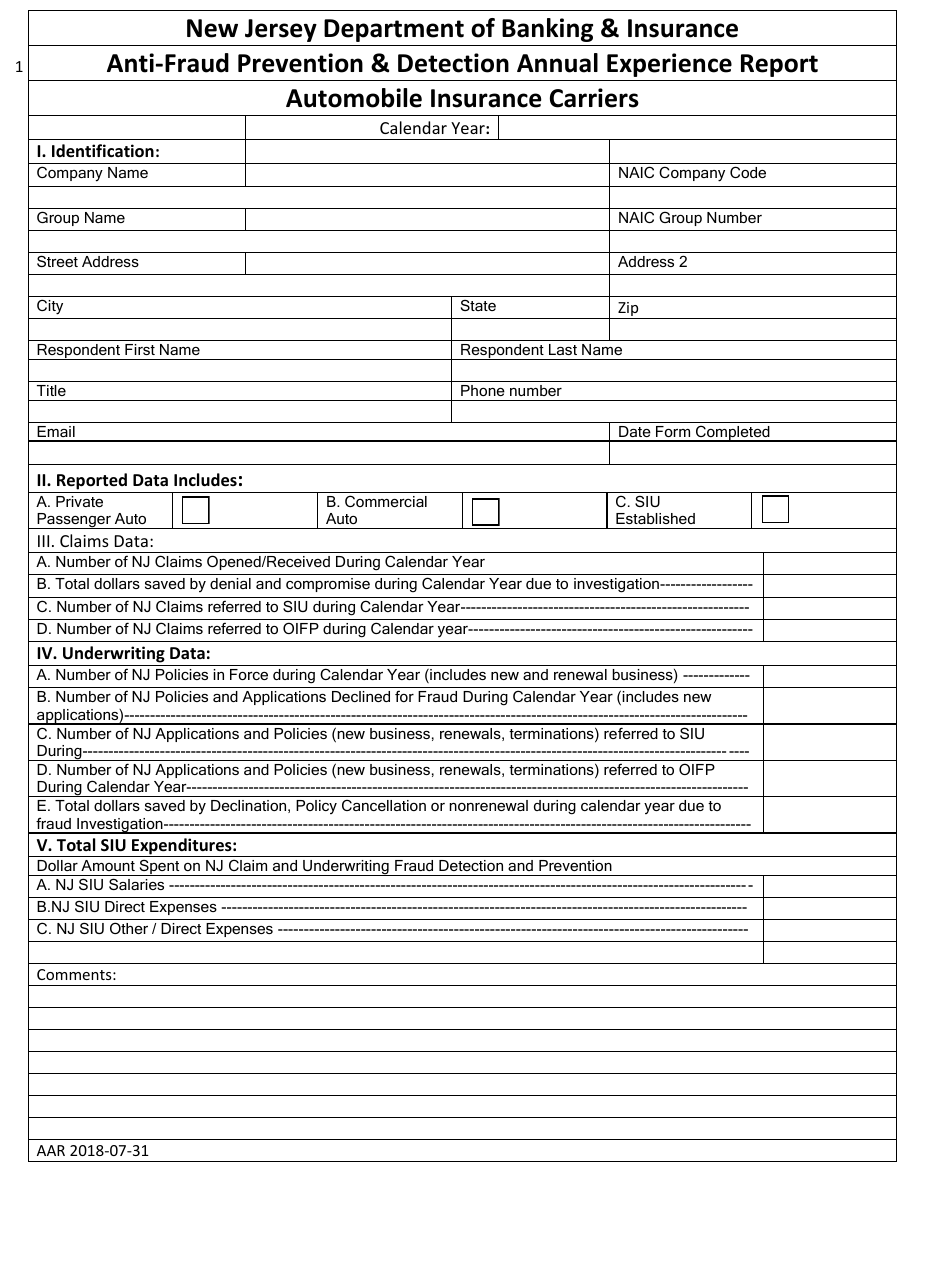

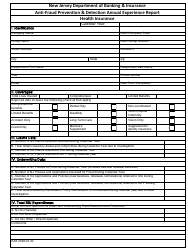

Anti-fraud Prevention & Detection Annual Experience Report - Automobile Insurance Credits - New Jersey

Anti-fraud Prevention & Detection Annual Automobile Insurance Credits is a legal document that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey.

FAQ

Q: What is the Anti-fraud Prevention & Detection Annual Experience Report?

A: The Anti-fraud Prevention & Detection Annual Experience Report is a report that provides information about fraud prevention and detection efforts in the automobile insurance industry in New Jersey.

Q: What does the report cover?

A: The report covers the use of automobile insurance credits as a tool to prevent and detect fraud.

Q: What are automobile insurance credits?

A: Automobile insurance credits are reductions in insurance premiums that are offered to policyholders who meet certain criteria, such as having a clean driving record.

Q: How do automobile insurance credits help prevent and detect fraud?

A: Automobile insurance credits help prevent and detect fraud by incentivizing policyholders to maintain good driving records and discouraging fraudulent claims.

Q: Why is fraud prevention and detection important in the automobile insurance industry?

A: Fraud in the automobile insurance industry can lead to higher insurance premiums for all policyholders. Therefore, it is important to have effective measures in place to prevent and detect fraud.

Q: Who is responsible for preparing the report?

A: The report is prepared by the New Jersey Department of Banking and Insurance.

Form Details:

- Released on July 31, 2018;

- The latest edition currently provided by the New Jersey Department of Banking and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.