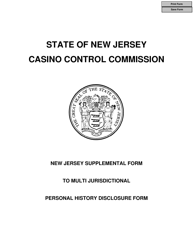

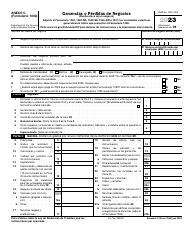

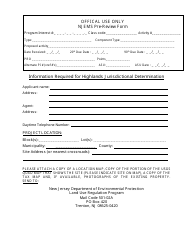

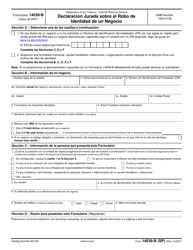

Form 29 Muti-Jurisdictional Business Form - New Jersey

What Is Form 29?

This is a legal form that was released by the New Jersey Department of Law and Public Safety - Office of The Attorney General - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 29?

A: Form 29 is the Muti-Jurisdictional Business Form.

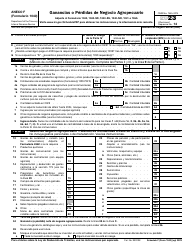

Q: What is the purpose of Form 29?

A: The purpose of Form 29 is to report income earned in other jurisdictions.

Q: Who needs to file Form 29?

A: Anyone who earns income in multiple jurisdictions and is a resident of New Jersey needs to file Form 29.

Q: When is the deadline to file Form 29?

A: The deadline to file Form 29 is April 15th of each year.

Q: Is there a fee to file Form 29?

A: No, there is no fee to file Form 29.

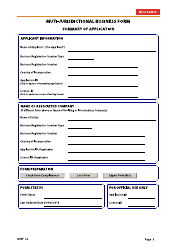

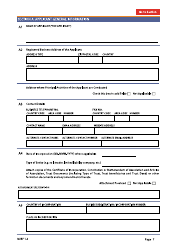

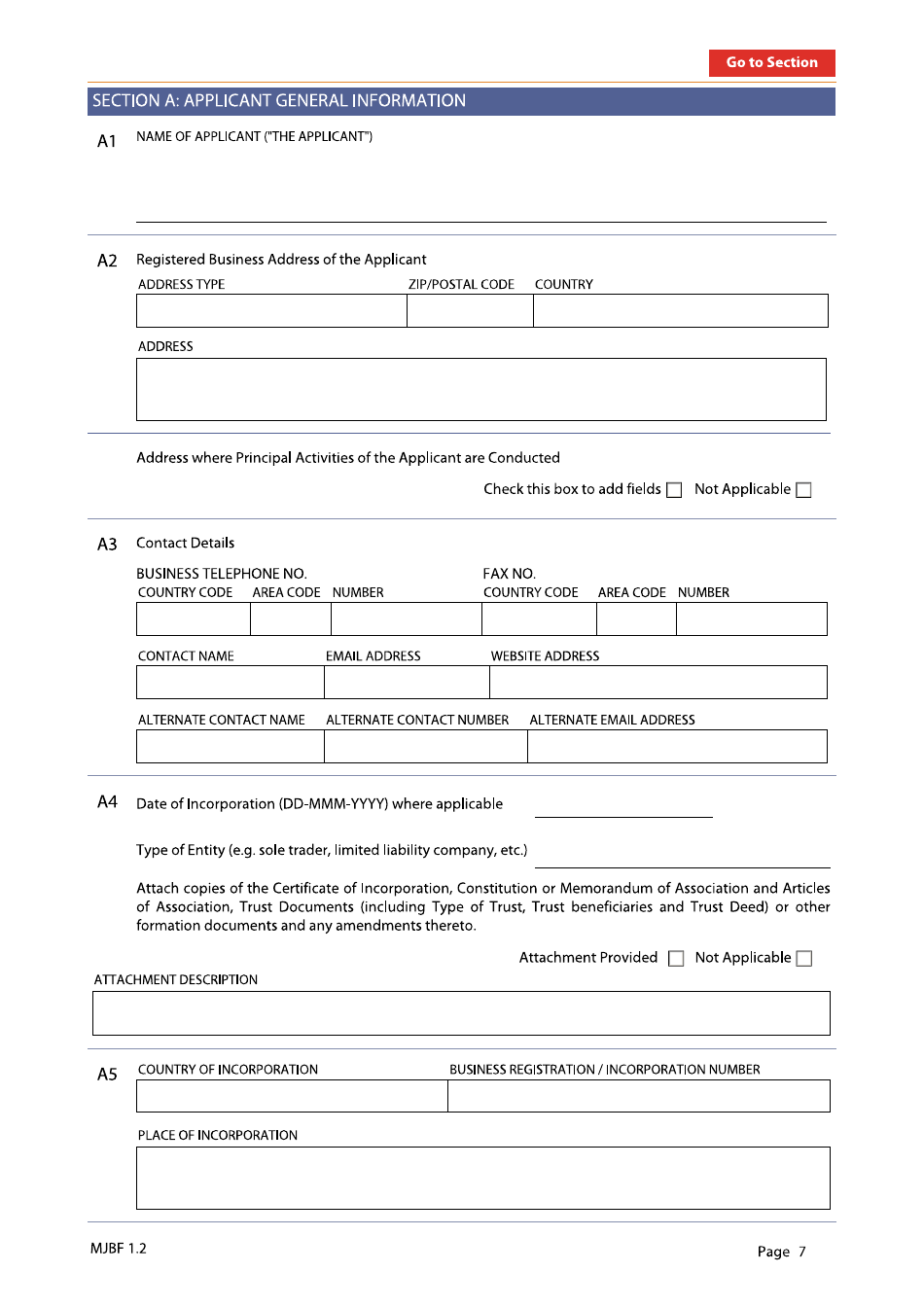

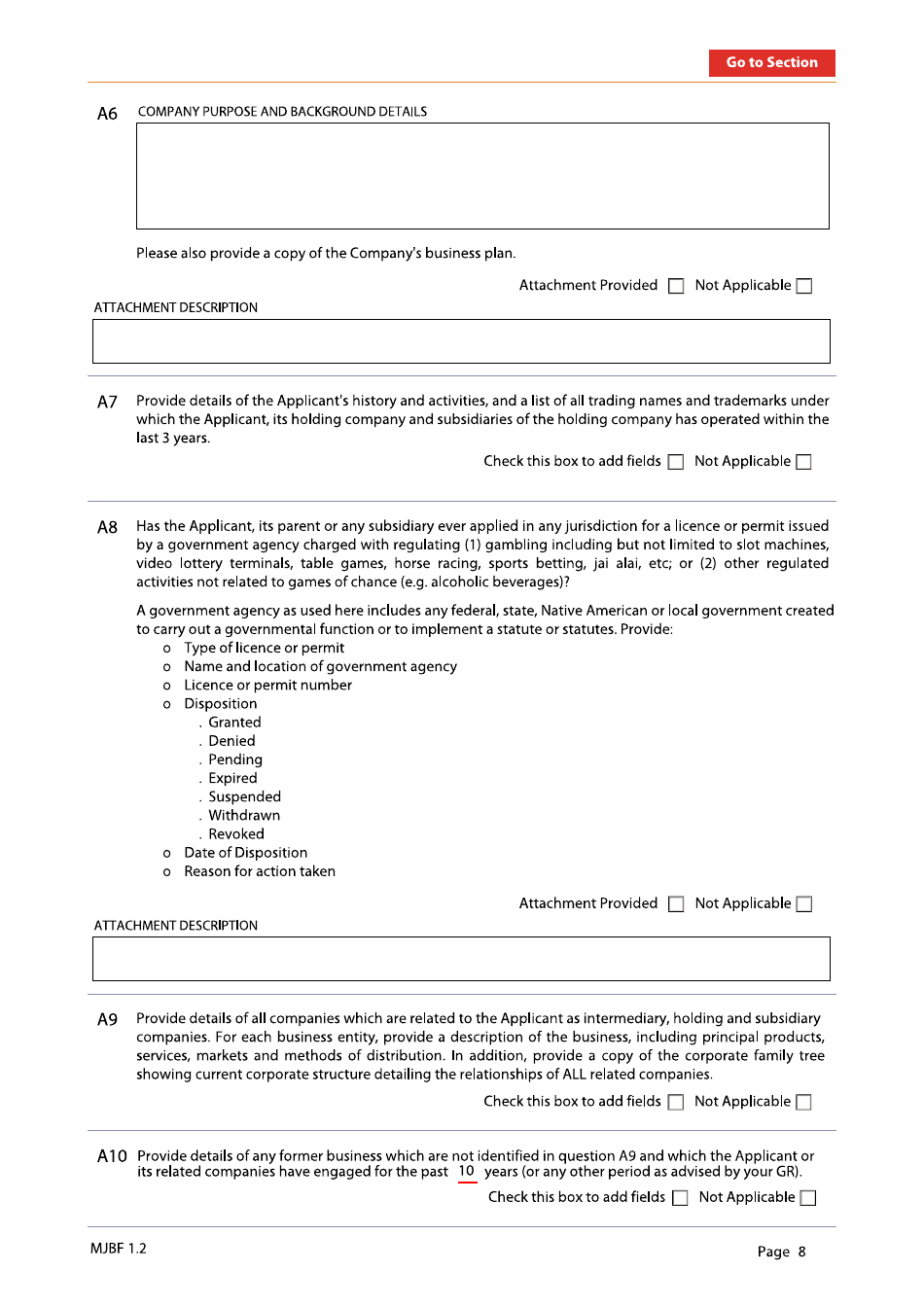

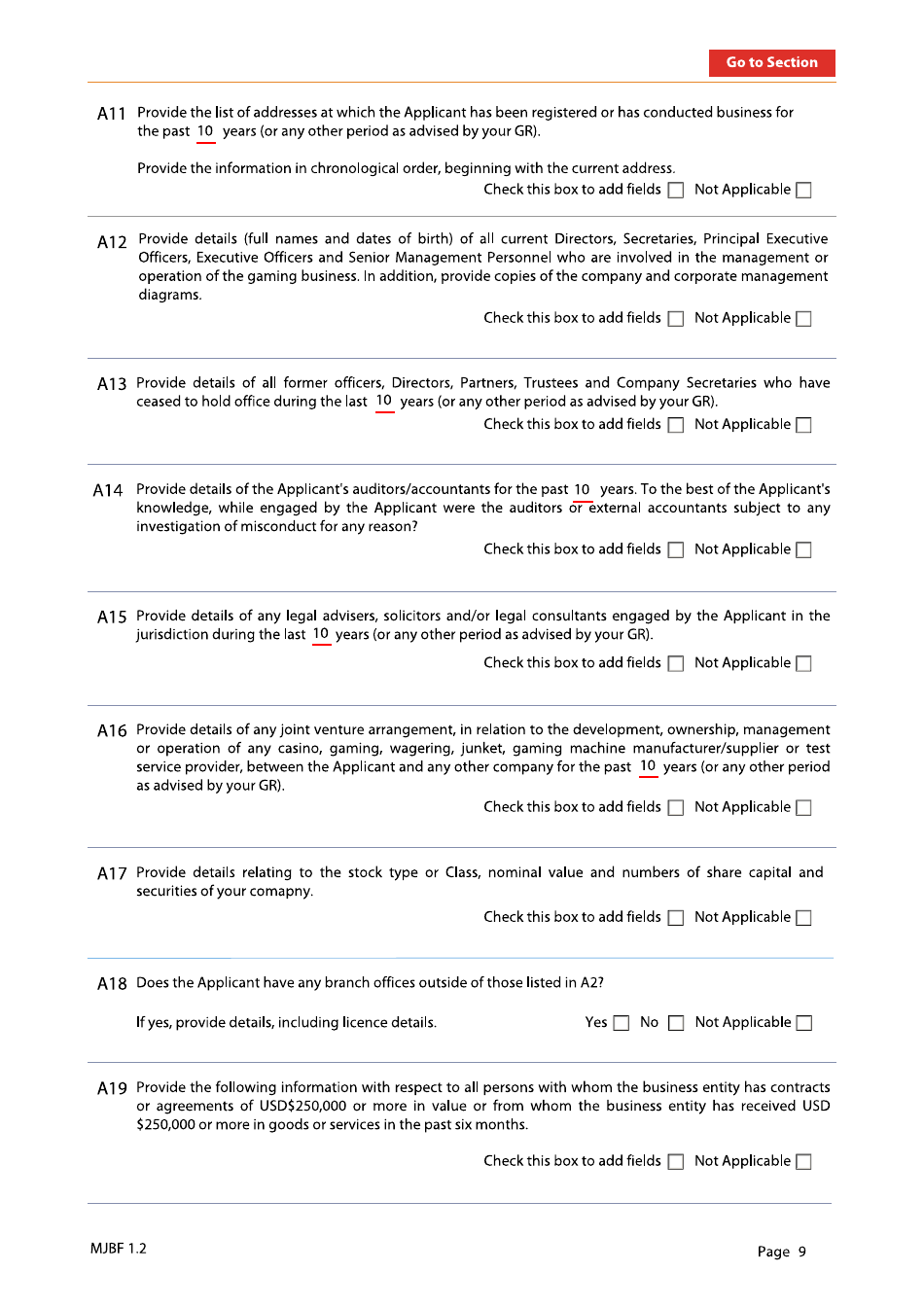

Q: What information do I need to complete Form 29?

A: You will need information about your income earned in other jurisdictions, including any taxes paid.

Q: What happens if I don't file Form 29?

A: If you don't file Form 29, you may be subject to penalties and interest.

Q: Can I amend my Form 29 if I made an error?

A: Yes, you can file an amended Form 29 if you made an error on your original filing.

Form Details:

- The latest edition provided by the New Jersey Department of Law and Public Safety - Office of The Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 29 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Law and Public Safety - Office of The Attorney General.