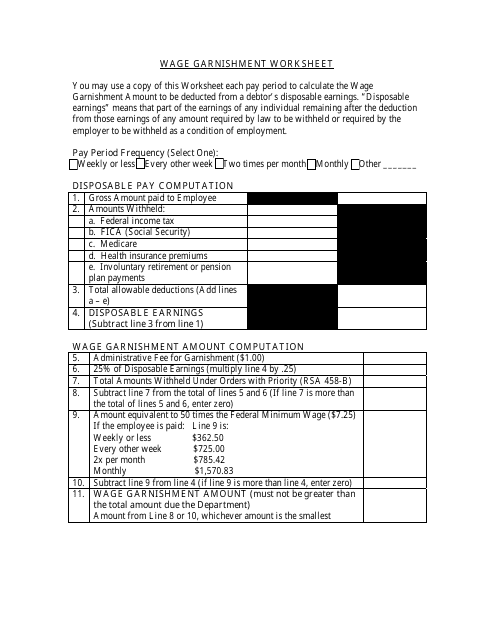

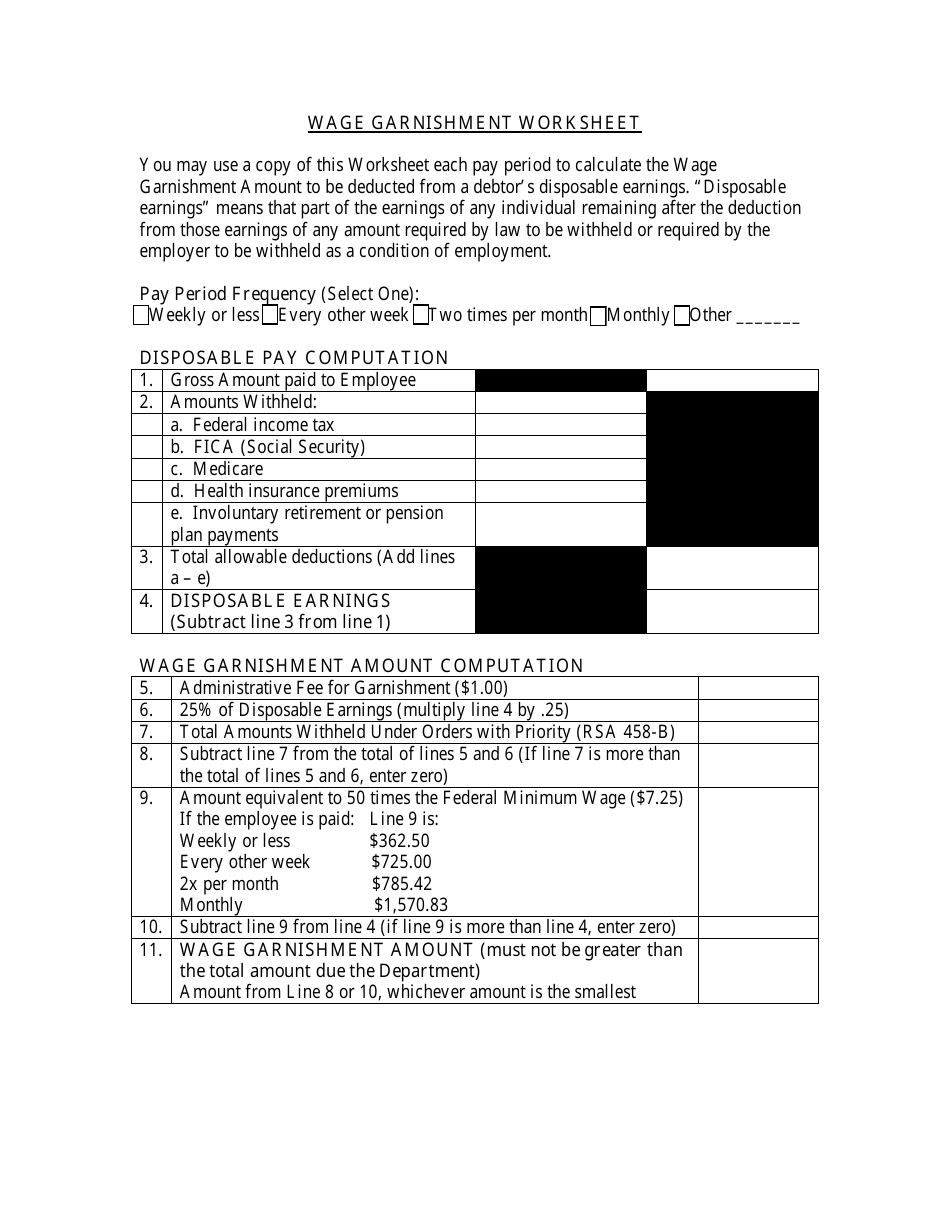

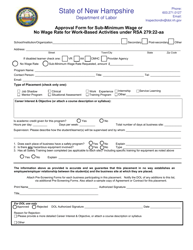

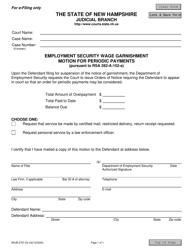

Wage Garnishment Worksheet - New Hampshire

Wage Garnishment Worksheet is a legal document that was released by the New Hampshire Employment Security - a government authority operating within New Hampshire.

FAQ

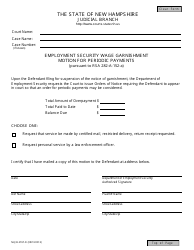

Q: What is a wage garnishment?

A: A wage garnishment is a legal process in which a creditor can collect money from your wages to repay a debt.

Q: Can my wages be garnished in New Hampshire?

A: Yes, your wages can be garnished in New Hampshire, but only under specific circumstances.

Q: What are the circumstances under which wages can be garnished in New Hampshire?

A: Wages can be garnished in New Hampshire for reasons such as unpaid taxes, child support arrearage, or court-ordered debts.

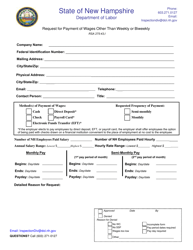

Q: How much of my wages can be garnished in New Hampshire?

A: The maximum amount that can be garnished from your wages in New Hampshire is 25% of disposable earnings, or the amount by which your weekly disposable earnings exceed 30 times the federal minimum wage.

Q: What is considered disposable earnings?

A: Disposable earnings are the amount of your wages remaining after deductions required by law, such as income taxes and Social Security.

Q: Is there a limit to the number of garnishments that can be applied to my wages in New Hampshire?

A: No, there is no limit to the number of garnishments that can be applied to your wages in New Hampshire.

Q: Can my employer fire me for having my wages garnished?

A: No, your employer cannot fire you solely because your wages are being garnished.

Q: How can I stop a wage garnishment in New Hampshire?

A: To stop a wage garnishment in New Hampshire, you may need to negotiate a repayment plan with the creditor or seek legal assistance.

Q: Can I challenge a wage garnishment in court?

A: Yes, you can challenge a wage garnishment in court if you believe it is unfair or incorrect.

Form Details:

- The latest edition currently provided by the New Hampshire Employment Security;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Employment Security.