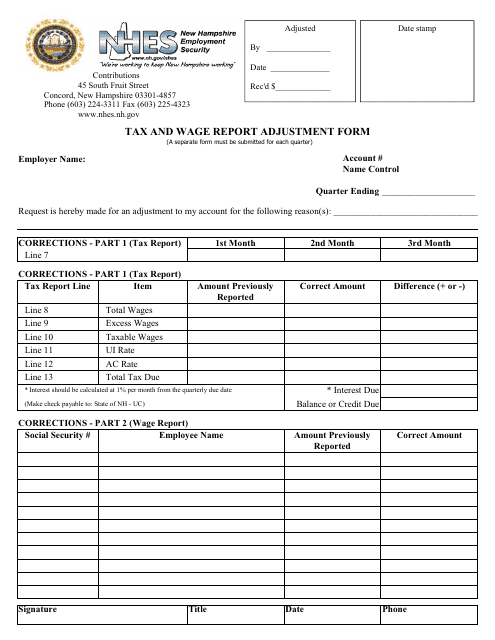

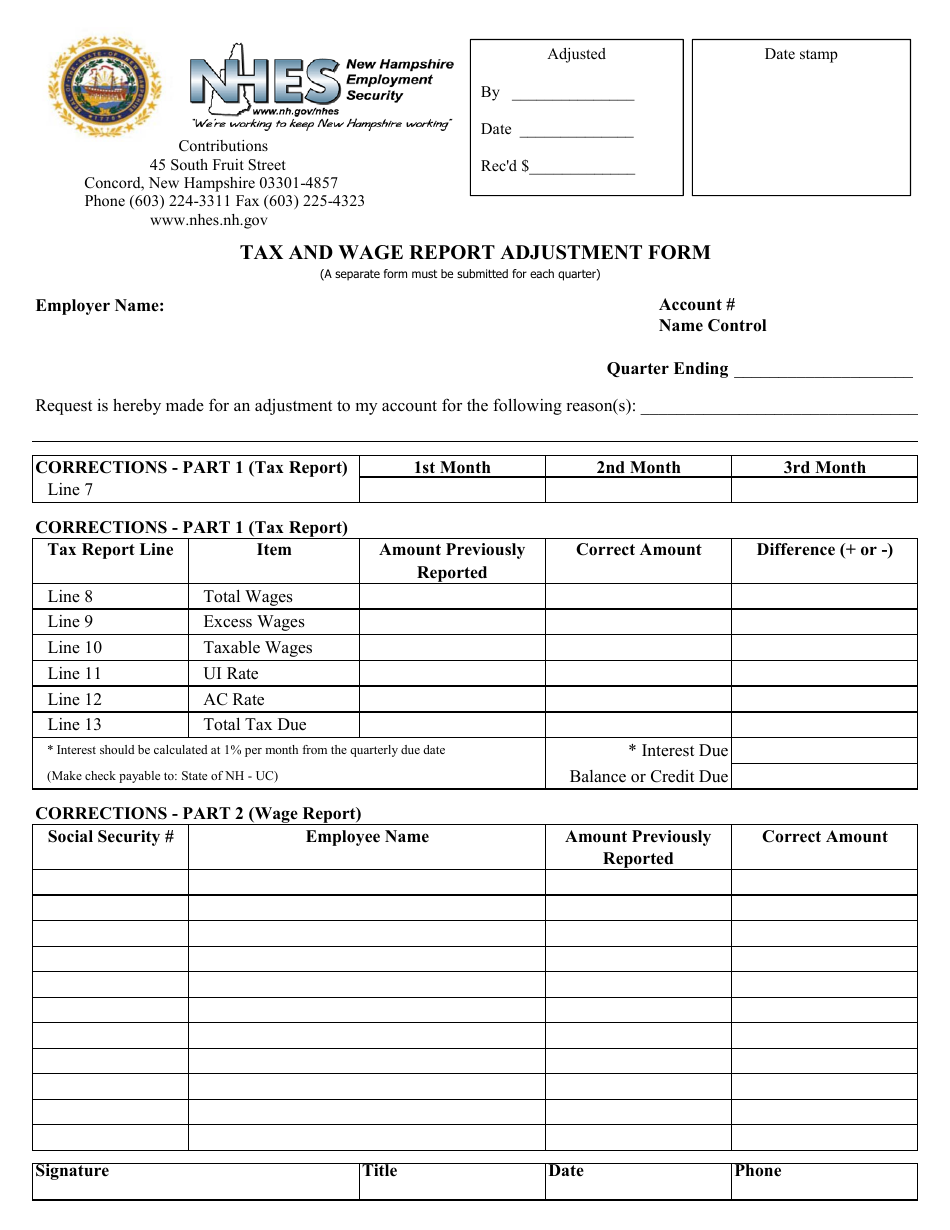

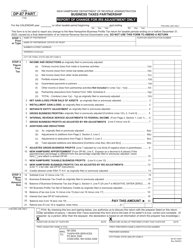

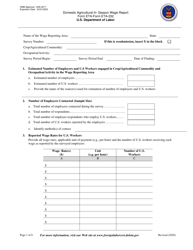

Tax and Wage Report Adjustment Form - New Hampshire

Tax and Wage Report Adjustment Form is a legal document that was released by the New Hampshire Employment Security - a government authority operating within New Hampshire.

FAQ

Q: What is the Tax and Wage Report Adjustment Form?

A: The Tax and Wage Report Adjustment Form is a form used in New Hampshire to make adjustments to previously filed tax and wage reports.

Q: Why would I need to use the Tax and Wage Report Adjustment Form?

A: You would need to use the Tax and Wage Report Adjustment Form if you need to correct any errors or make changes to a previously filed tax and wage report in New Hampshire.

Q: How do I fill out the Tax and Wage Report Adjustment Form?

A: To fill out the Tax and Wage Report Adjustment Form, you will need to provide your business information, details of the adjustment, and any supporting documentation.

Q: Are there any fees to submit the Tax and Wage Report Adjustment Form?

A: No, there are no fees to submit the Tax and Wage Report Adjustment Form in New Hampshire.

Q: What is the deadline to submit the Tax and Wage Report Adjustment Form?

A: The deadline to submit the Tax and Wage Report Adjustment Form in New Hampshire is within 30 days of discovering the error or need for adjustment.

Q: What should I do if I have questions or need assistance with the Tax and Wage Report Adjustment Form?

A: If you have questions or need assistance with the Tax and Wage Report Adjustment Form, you can contact the New Hampshire Department of Employment Security for guidance.

Form Details:

- The latest edition currently provided by the New Hampshire Employment Security;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Employment Security.