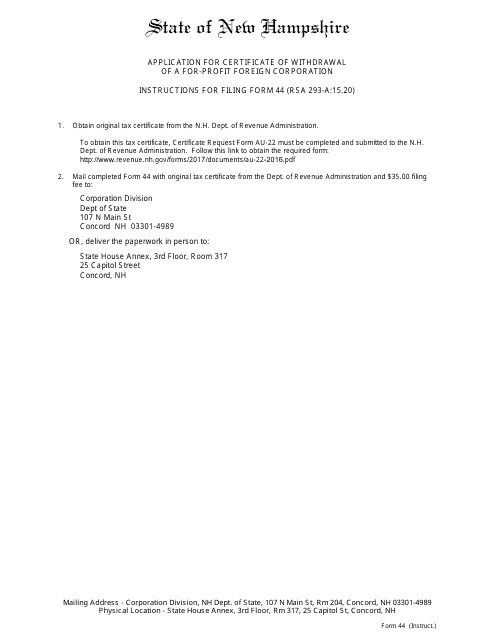

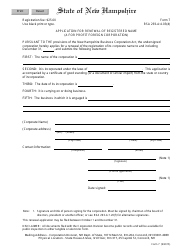

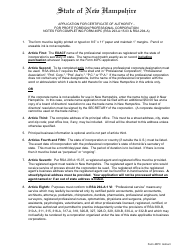

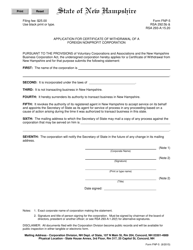

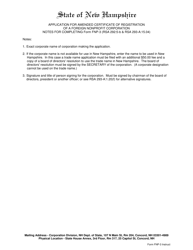

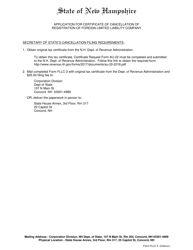

Form 44 Application for Certificate of Withdrawal of a for-Profit Foreign Corporation - New Hampshire

What Is Form 44?

This is a legal form that was released by the New Hampshire Secretary of State - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

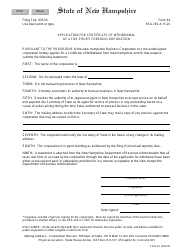

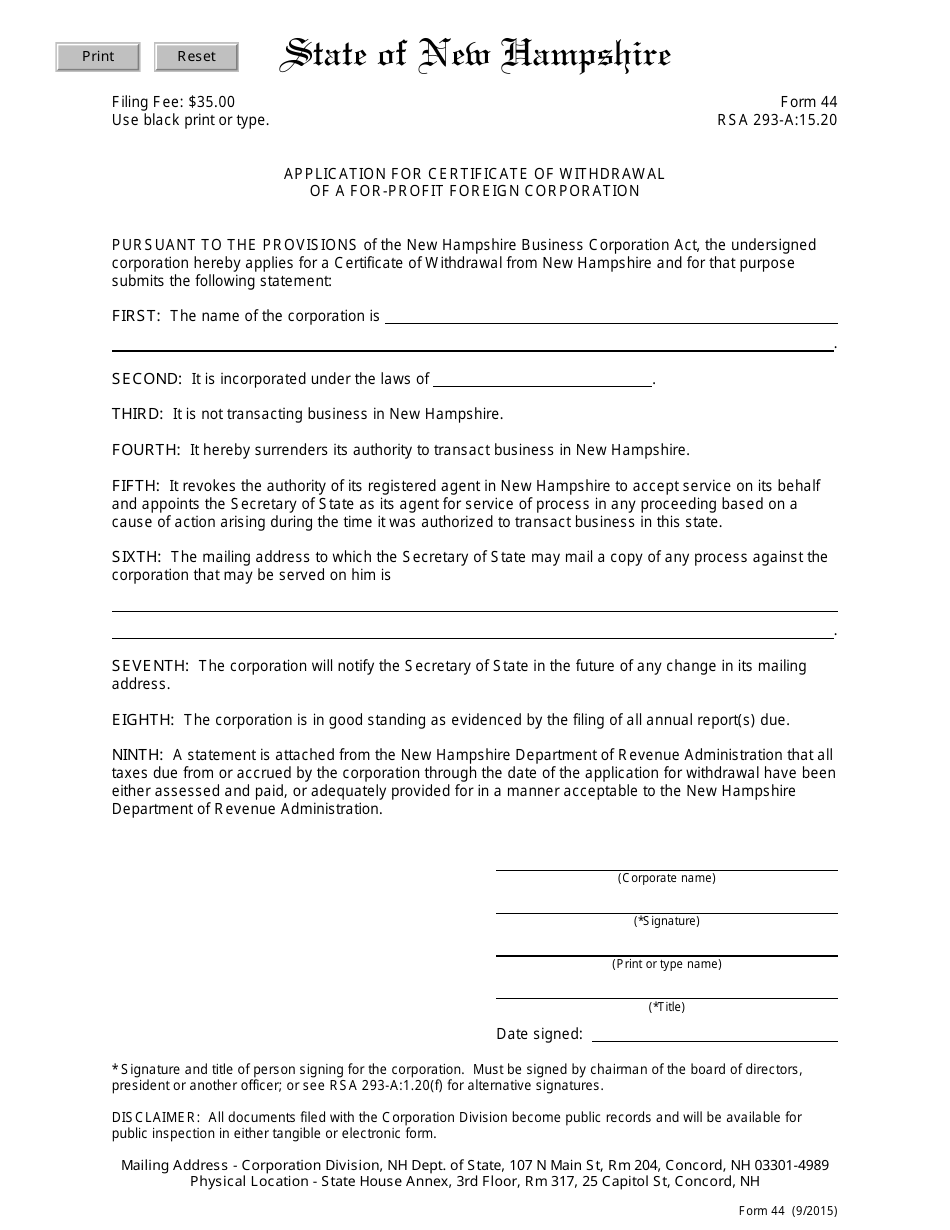

Q: What is Form 44?

A: Form 44 is an application for a Certificate of Withdrawal of a for-profit foreign corporation in New Hampshire.

Q: Who needs to file Form 44?

A: Form 44 should be filed by a for-profit foreign corporation that wishes to withdraw from doing business in New Hampshire.

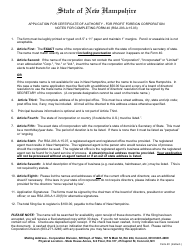

Q: What information is required on Form 44?

A: Form 44 requires information such as the corporation's name, date of incorporation, principal office address, and a statement of withdrawal.

Q: Is there a deadline for filing Form 44?

A: There is no specific deadline for filing Form 44, but it is recommended to file it as soon as the decision to withdraw has been made.

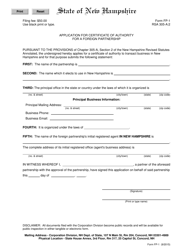

Q: What happens after Form 44 is filed?

A: After Form 44 is filed and approved, the foreign corporation will be considered withdrawn from doing business in New Hampshire.

Q: Can I restore my corporation's status after filing Form 44?

A: Yes, you may be able to restore your corporation's status by filing additional forms and paying any required fees.

Q: Can I get a refund of the filing fee if my Form 44 is denied?

A: No, the filing fee for Form 44 is non-refundable even if the application is denied.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the New Hampshire Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 44 by clicking the link below or browse more documents and templates provided by the New Hampshire Secretary of State.