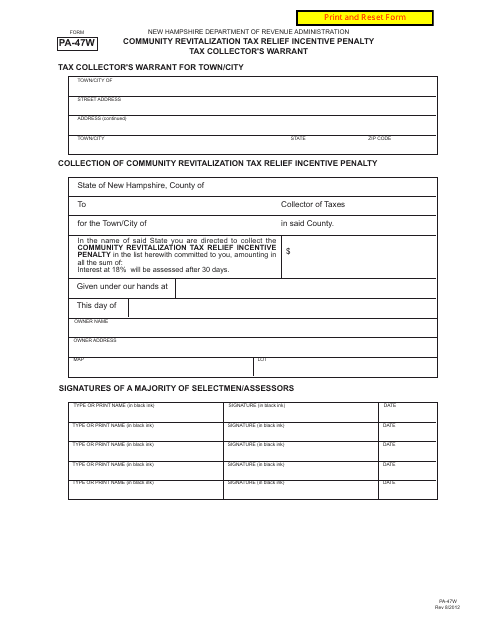

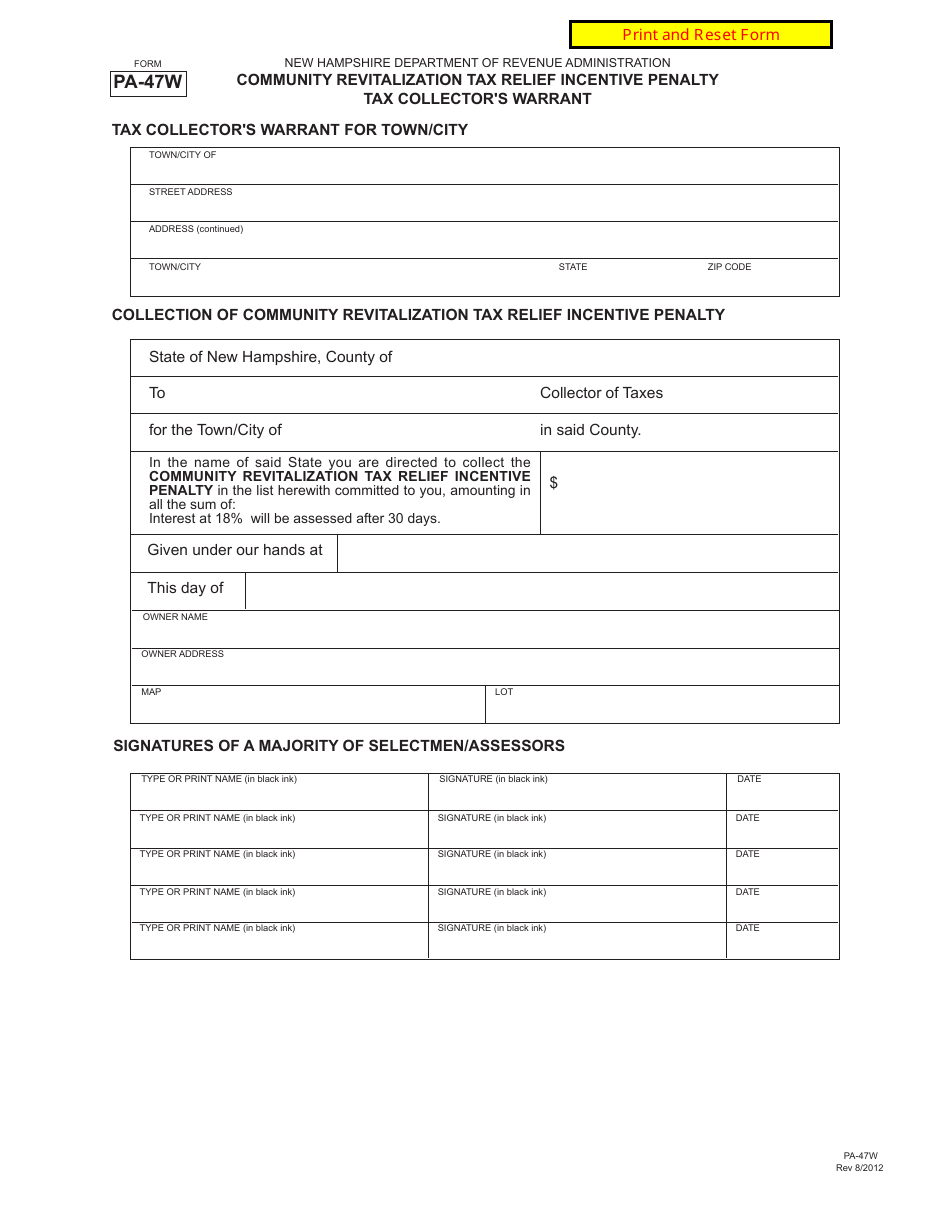

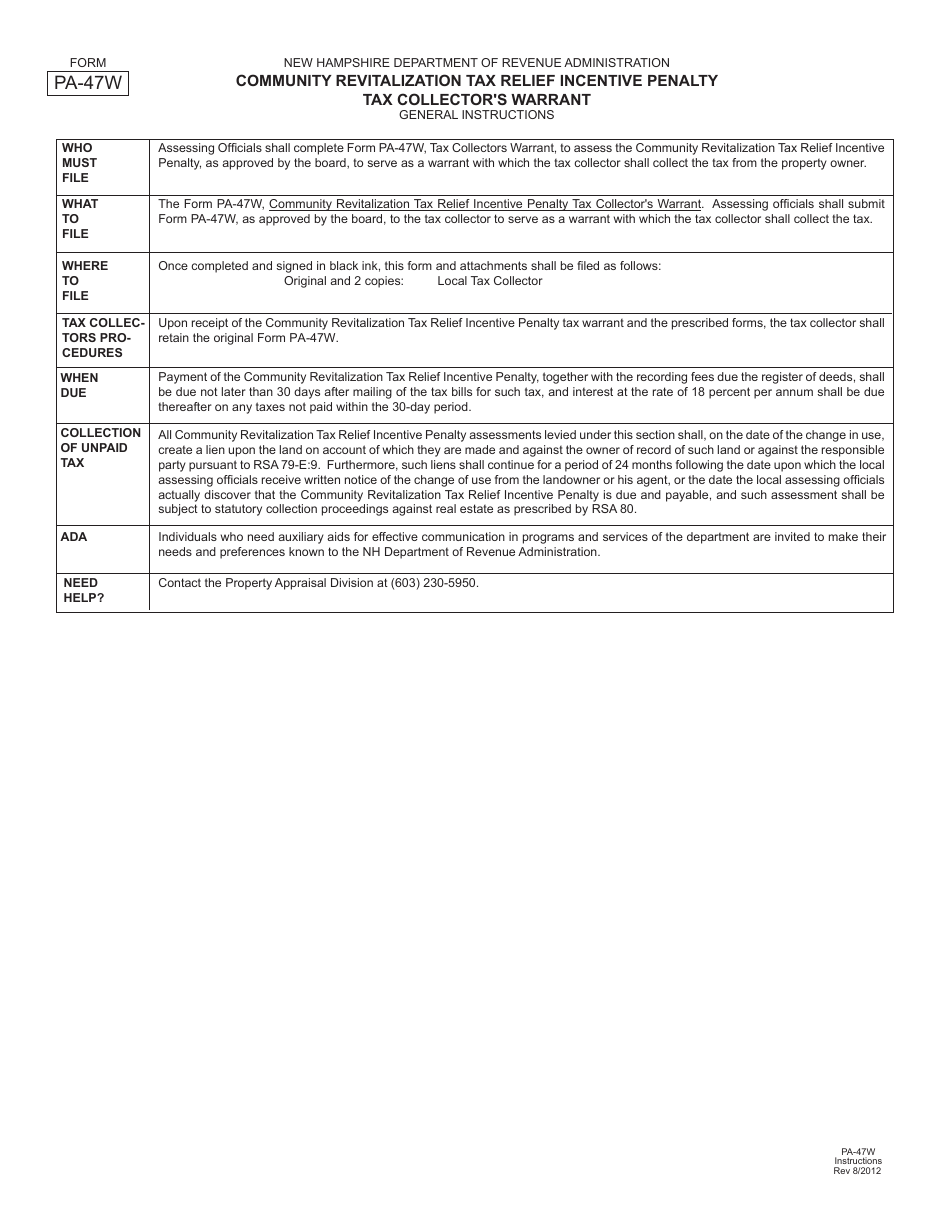

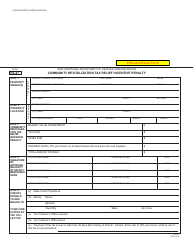

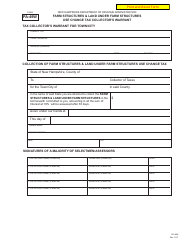

Form PA-47W Community Revitalization Tax Relief Incentive Penalty - Tax Collector's Warrant - New Hampshire

What Is Form PA-47W?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PA-47W form?

A: The PA-47W form is an application for Community Revitalization Tax Relief Incentive Penalty in New Hampshire.

Q: What is the purpose of the Community Revitalization Tax Relief Incentive Penalty?

A: The purpose of the Community Revitalization Tax Relief Incentive Penalty is to encourage revitalization and redevelopment in designated areas.

Q: Who needs to fill out the PA-47W form?

A: Property owners who are seeking tax relief incentives for community revitalization in New Hampshire need to fill out the PA-47W form.

Q: What does the Tax Collector's Warrant refer to?

A: The Tax Collector's Warrant is a document issued by the tax collector which authorizes the collection of taxes.

Q: Is the PA-47W form specific to New Hampshire?

A: Yes, the PA-47W form is specific to New Hampshire and is used for tax relief incentives in the state.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-47W by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.