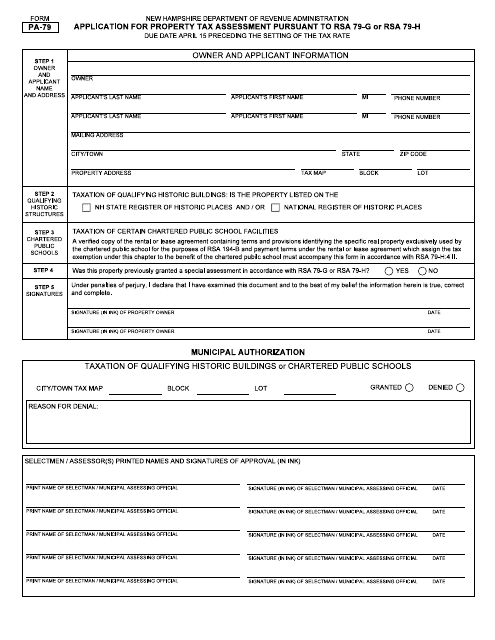

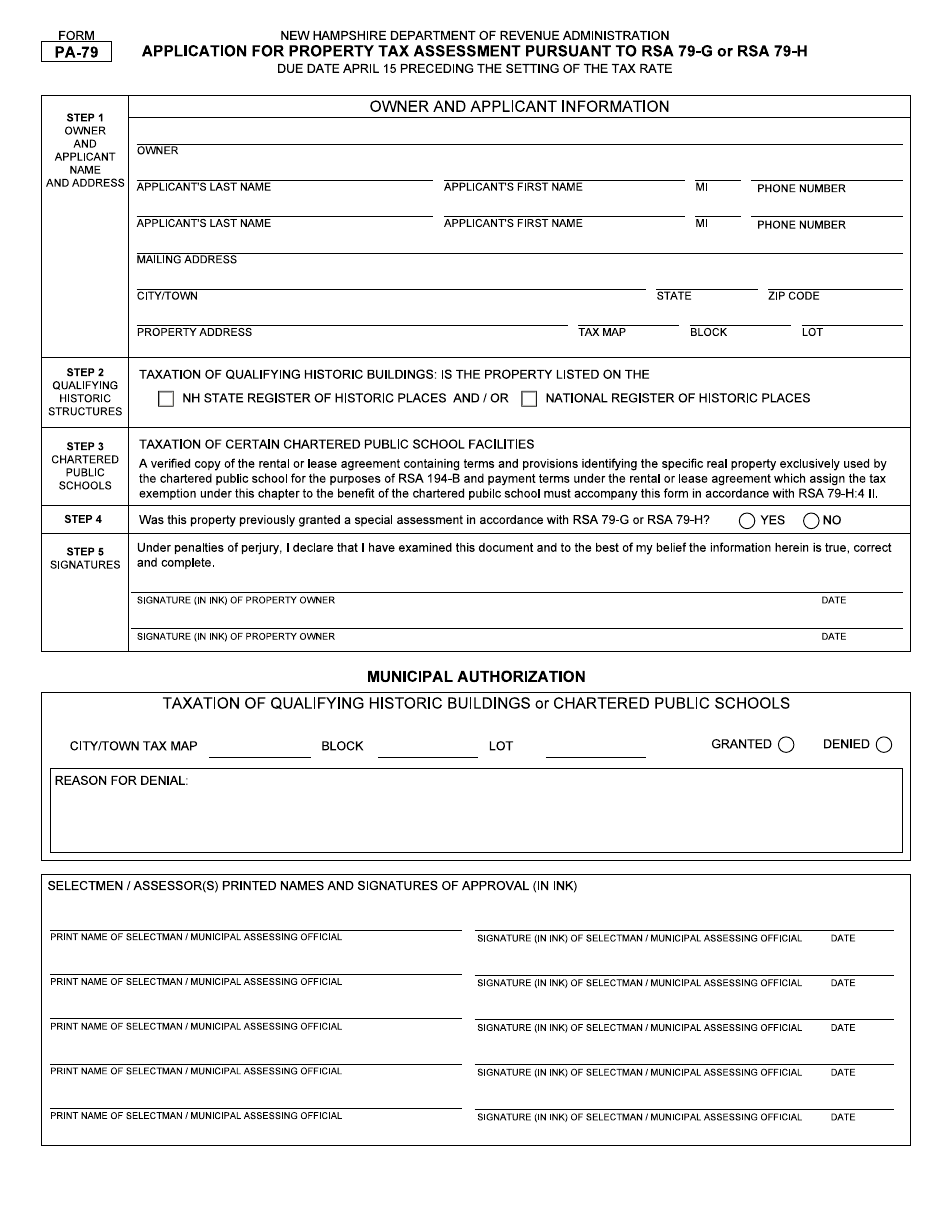

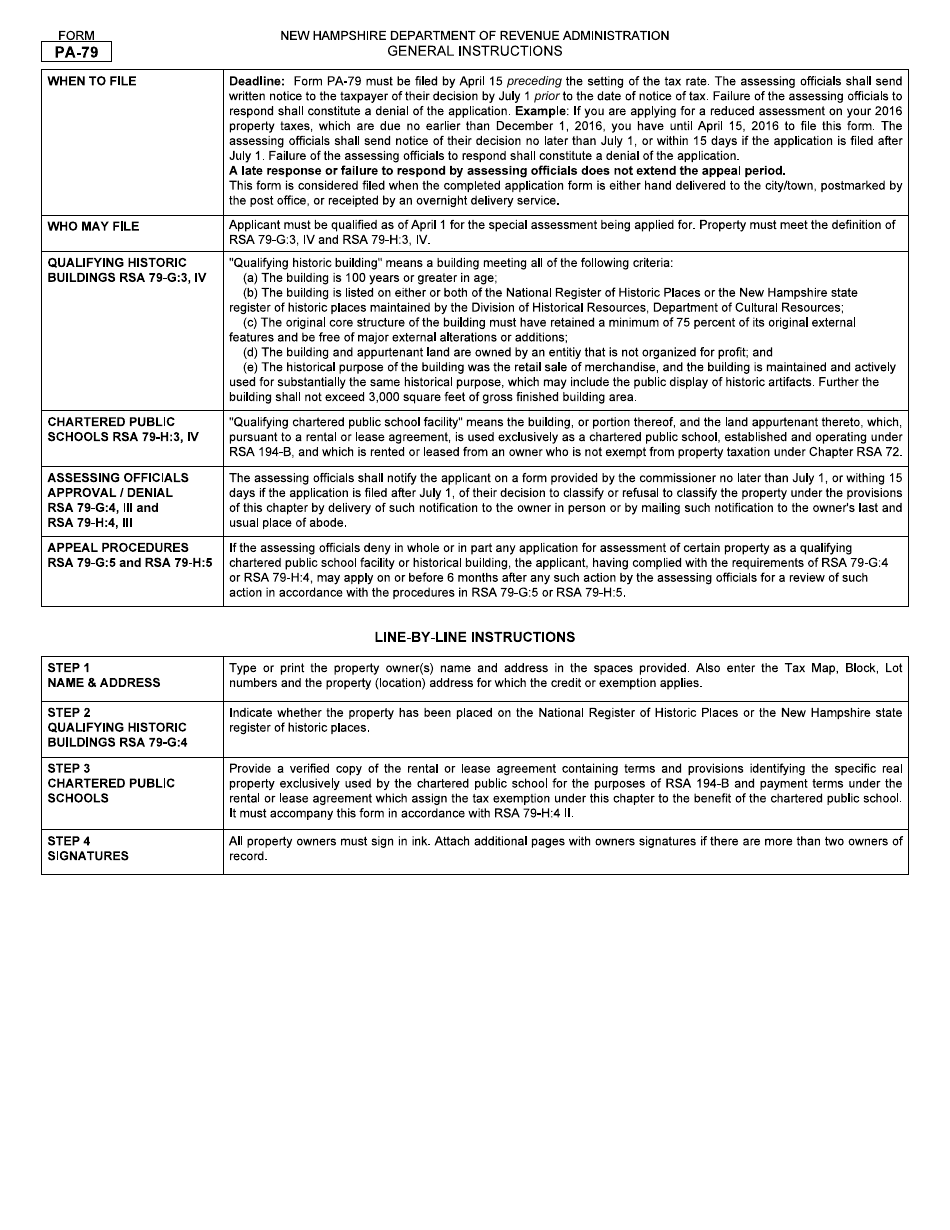

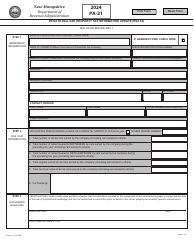

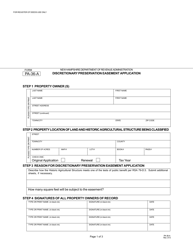

Form PA-79 Application for Property Tax Assessment Pursuant to Rsa 79-g or Rsa 79-h - New Hampshire

What Is Form PA-79?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

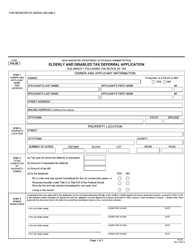

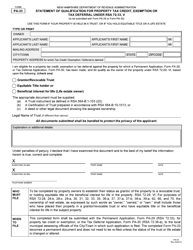

Q: What is Form PA-79?

A: Form PA-79 is an application for property tax assessment in New Hampshire.

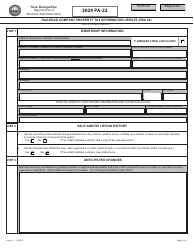

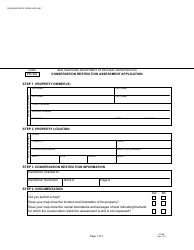

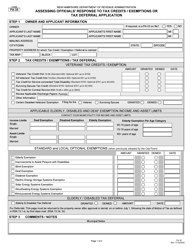

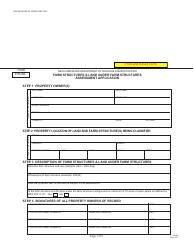

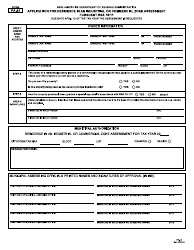

Q: What is RSA 79-g?

A: RSA 79-g is a statute in New Hampshire that provides for the assessment of certain properties at their current use value rather than fair market value.

Q: What is RSA 79-h?

A: RSA 79-h is a statute in New Hampshire that provides for the assessment of land that is subject to a current use penalty.

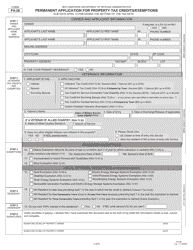

Q: Who can use Form PA-79?

A: Property owners in New Hampshire who meet the eligibility requirements for assessment under RSA 79-g or RSA 79-h can use Form PA-79.

Q: What is the purpose of Form PA-79?

A: The purpose of Form PA-79 is to apply for property tax assessment under RSA 79-g or RSA 79-h in order to potentially receive a reduced property tax assessment.

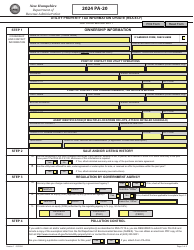

Form Details:

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-79 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.