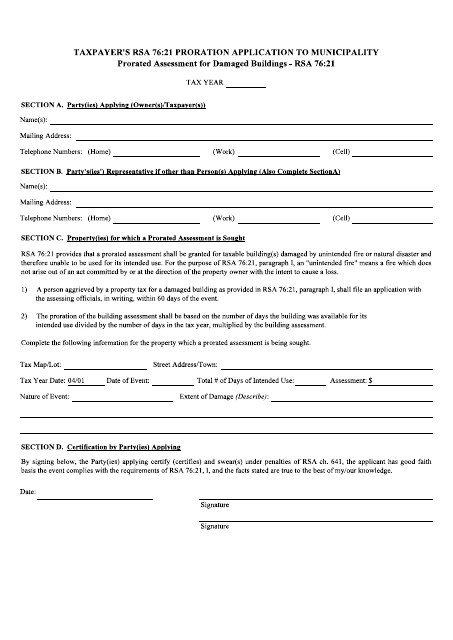

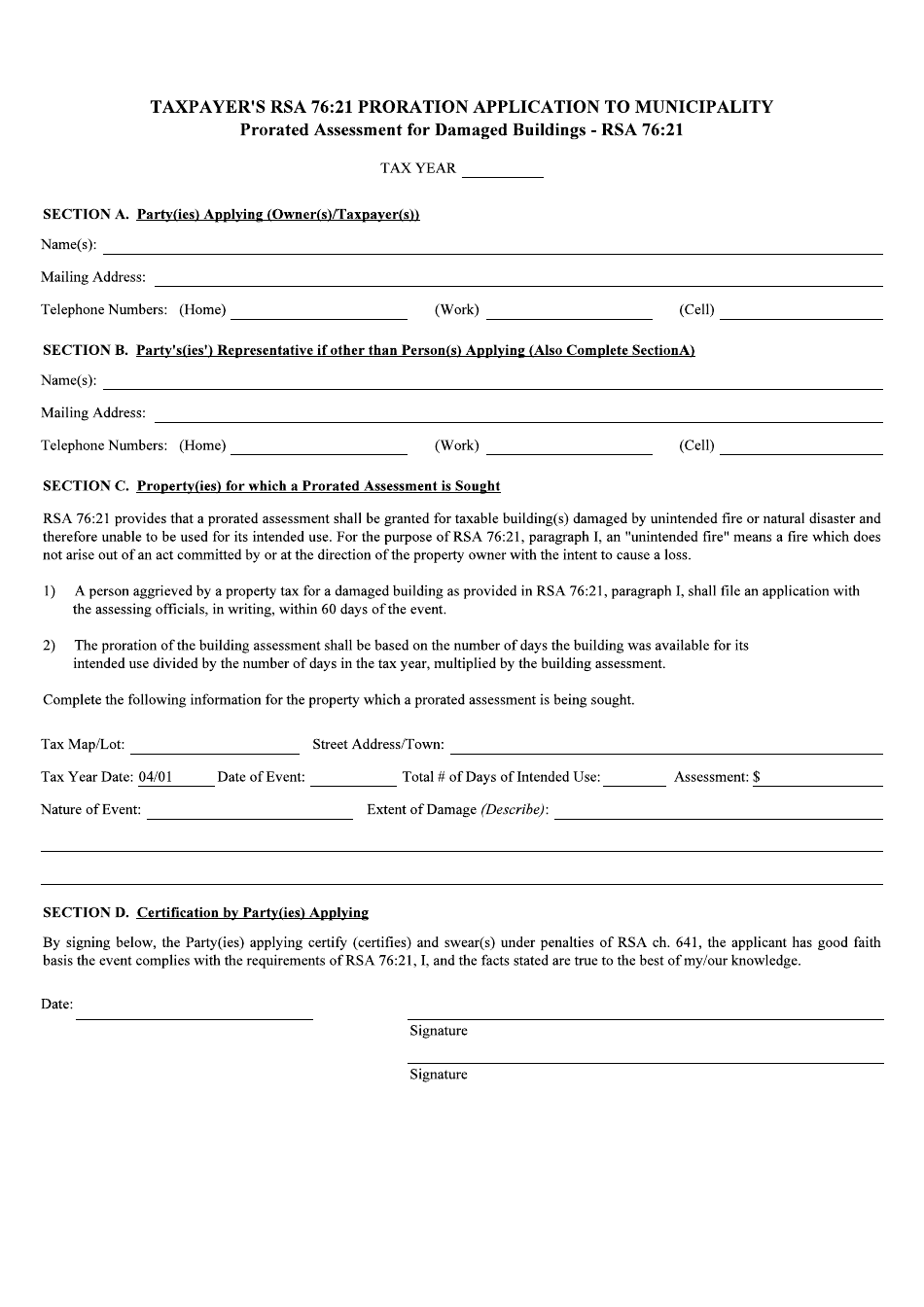

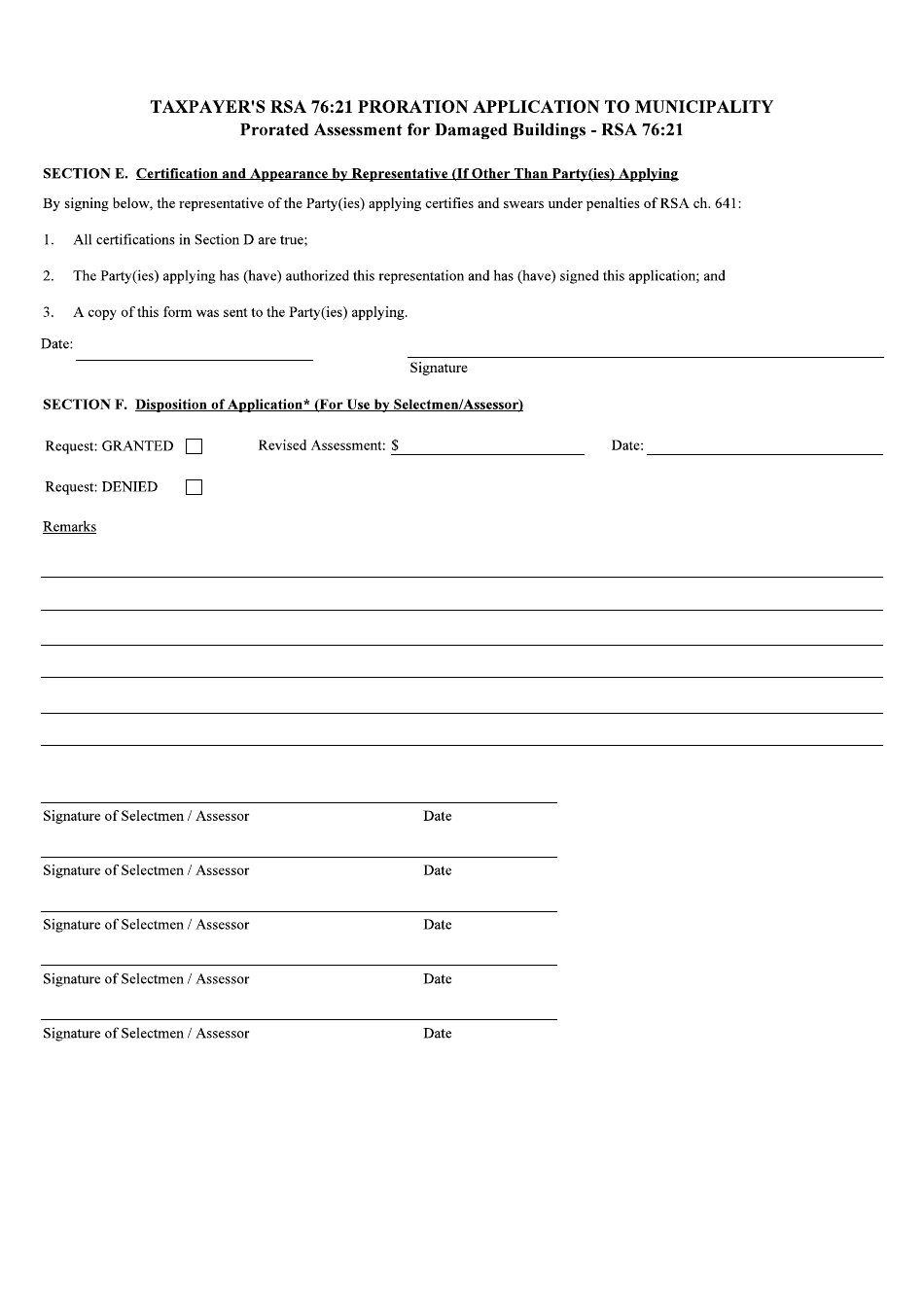

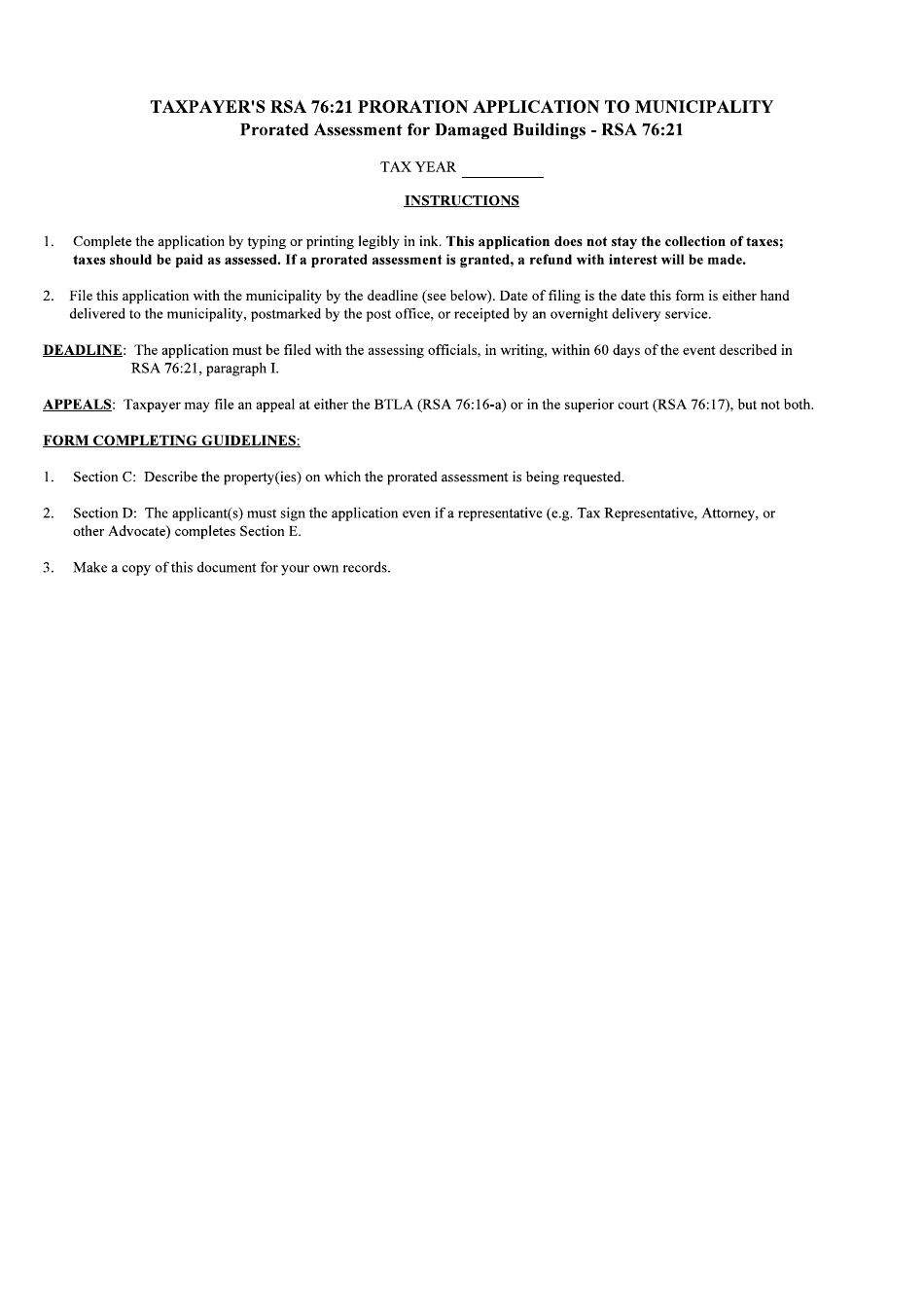

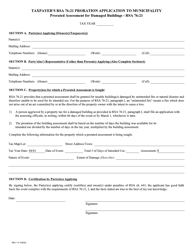

Rsa 76:21 Proration Application to Municipality - Prorated Assessment for Damaged Buildings - New Hampshire

Rsa 76:21 Proration Application to Municipality - Prorated Assessment for Damaged Buildings is a legal document that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire.

FAQ

Q: What does RSA 76:21 refer to?

A: RSA 76:21 refers to a specific statute in New Hampshire law.

Q: What does proration application to municipality mean?

A: Proration application to municipality means applying prorated assessments to the municipality.

Q: What is prorated assessment for damaged buildings?

A: Prorated assessment for damaged buildings is a method of determining the property tax assessment for buildings that have been damaged.

Q: How does prorated assessment for damaged buildings work?

A: Prorated assessment for damaged buildings works by adjusting the property tax assessment based on the extent of the damage.

Q: Is prorated assessment for damaged buildings specific to New Hampshire?

A: Yes, prorated assessment for damaged buildings is specific to New Hampshire law.

Q: What is the purpose of prorated assessment for damaged buildings?

A: The purpose of prorated assessment for damaged buildings is to fairly determine the property tax assessment for buildings that have been damaged in order to account for their reduced value.

Form Details:

- The latest edition currently provided by the New Hampshire Department of Revenue Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.