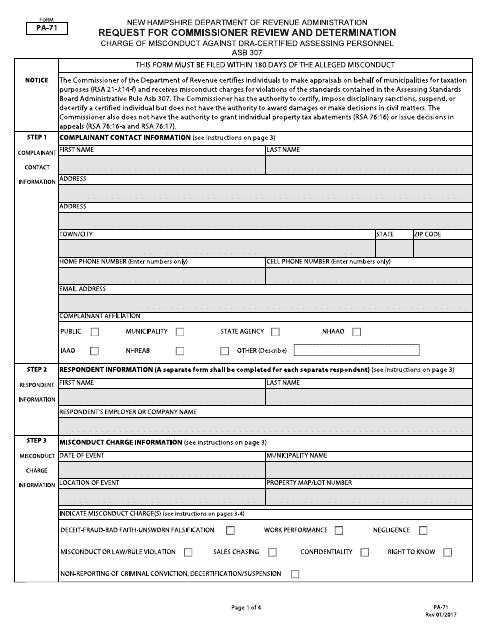

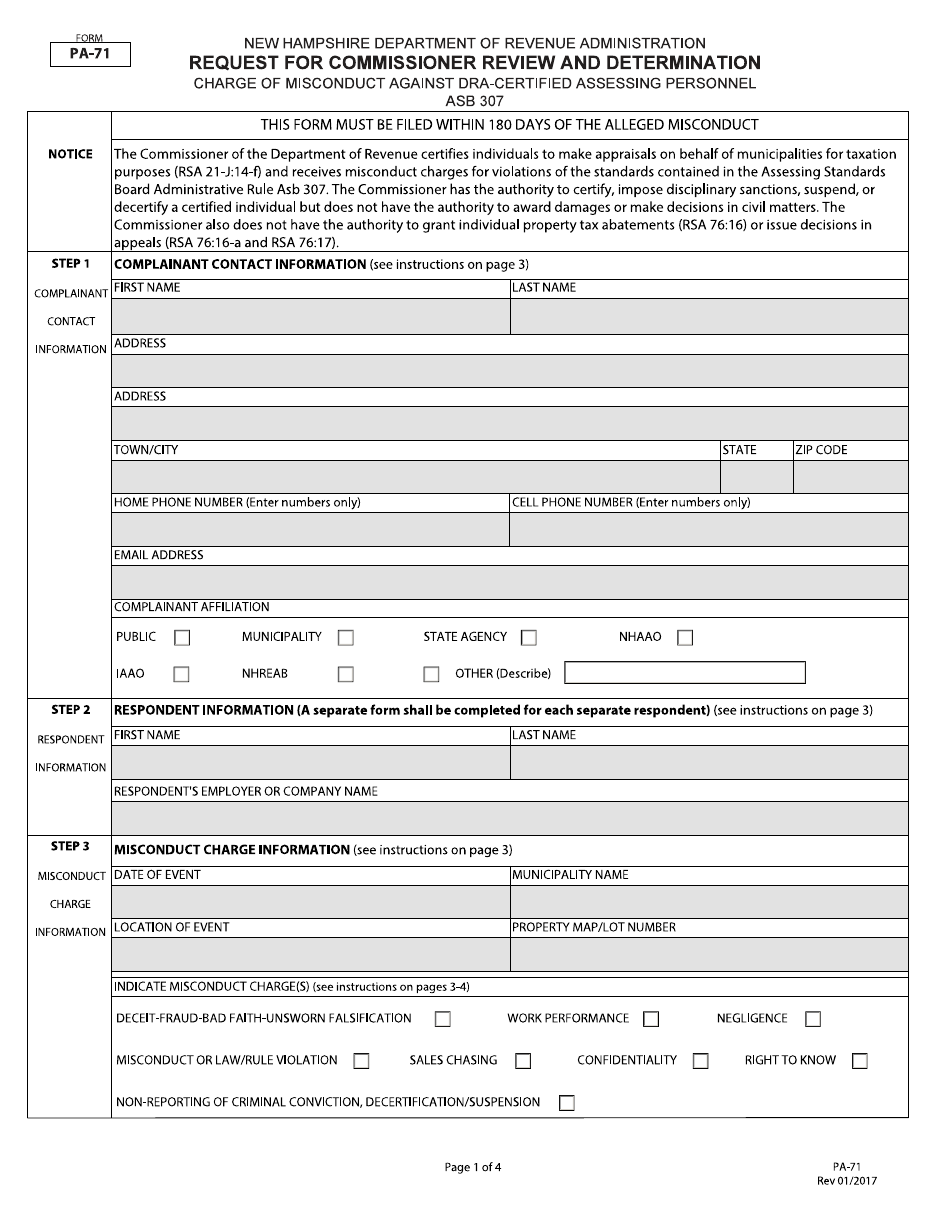

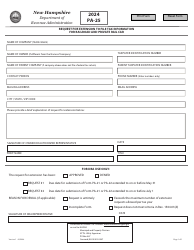

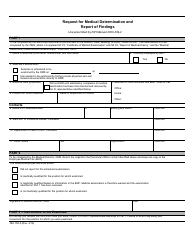

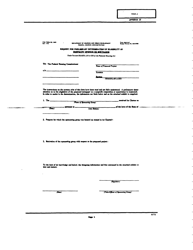

Form PA-71 Request for Commissioner Review and Determination - New Hampshire

What Is Form PA-71?

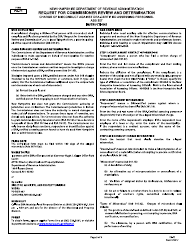

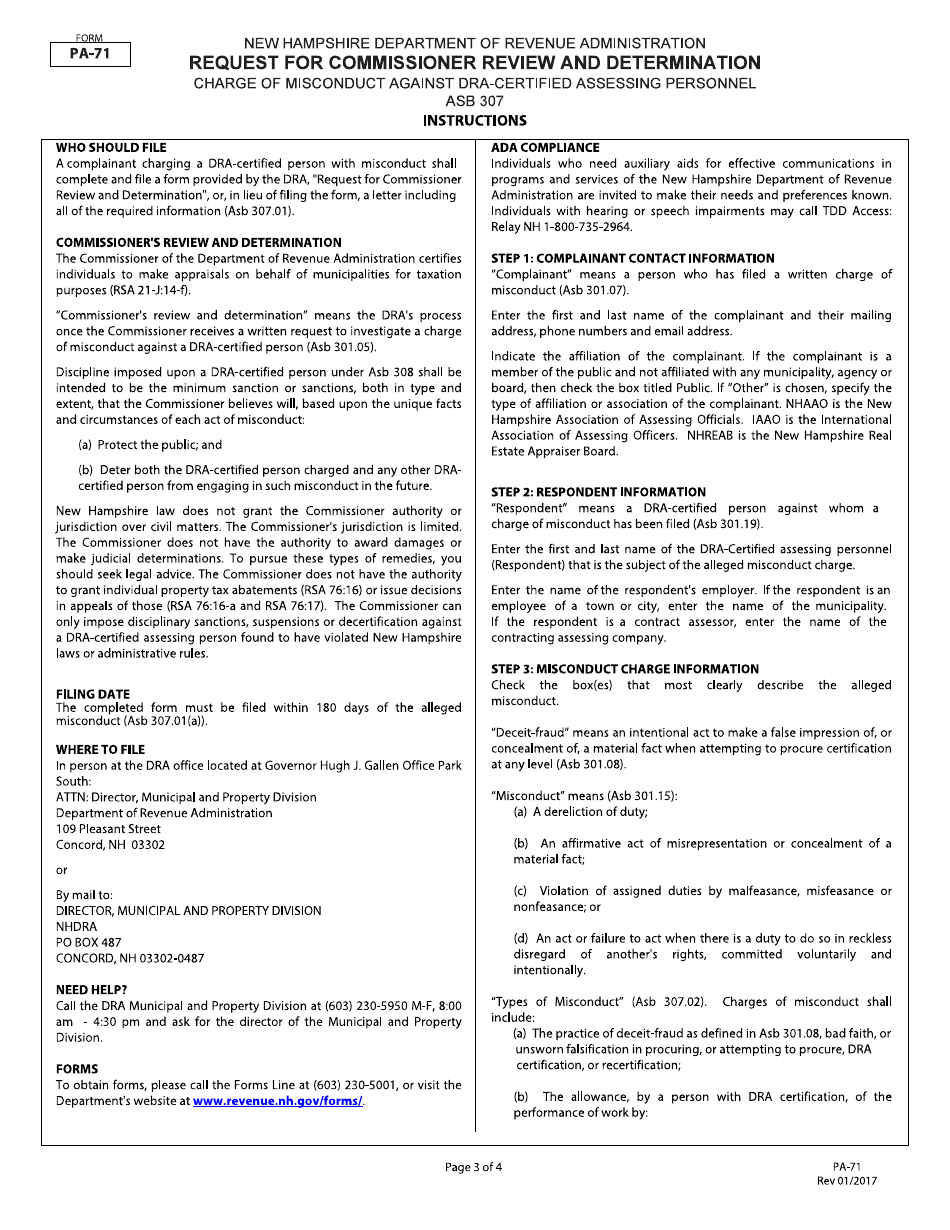

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-71 Request for Commissioner Review and Determination?

A: PA-71 is a form used in New Hampshire to request a review and determination by the Commissioner.

Q: Who can use PA-71?

A: Any individual or business in New Hampshire who wants to request a review and determination by the Commissioner can use PA-71.

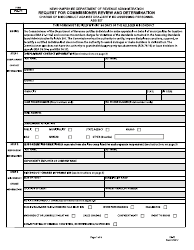

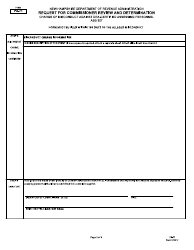

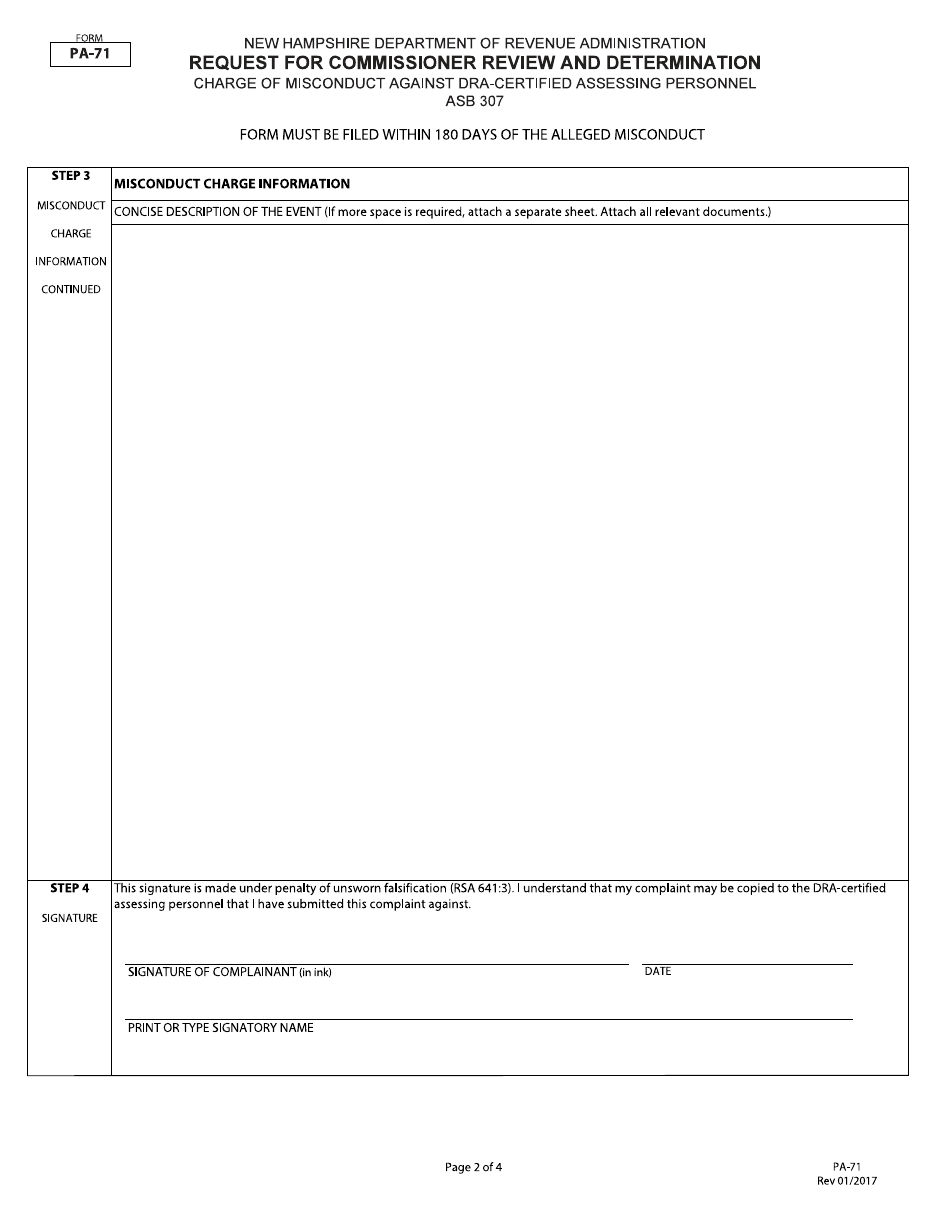

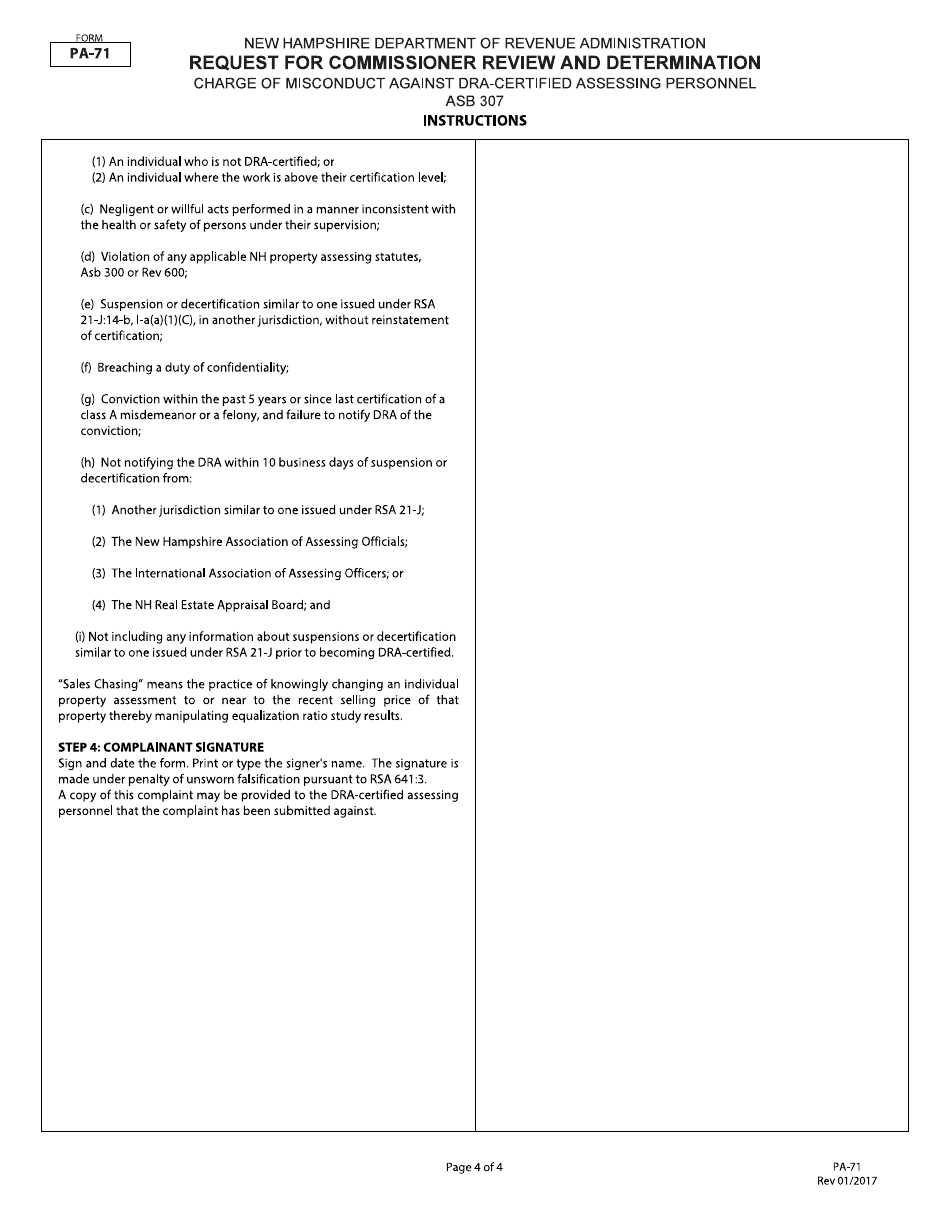

Q: What information do I need to provide on PA-71?

A: On PA-71, you will need to provide your contact information, a description of the issue or dispute, supporting documentation, and any other relevant information.

Q: Is there a deadline to submit PA-71?

A: Yes, PA-71 must be submitted within 60 days from the date of the final determination by the Department.

Q: What happens after I submit PA-71?

A: After you submit PA-71, the Commissioner will review your request and make a determination based on the information provided.

Q: Can I appeal the Commissioner's determination?

A: Yes, if you disagree with the Commissioner's determination, you have the right to appeal to the New Hampshire Board of Tax and Land Appeals.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-71 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.