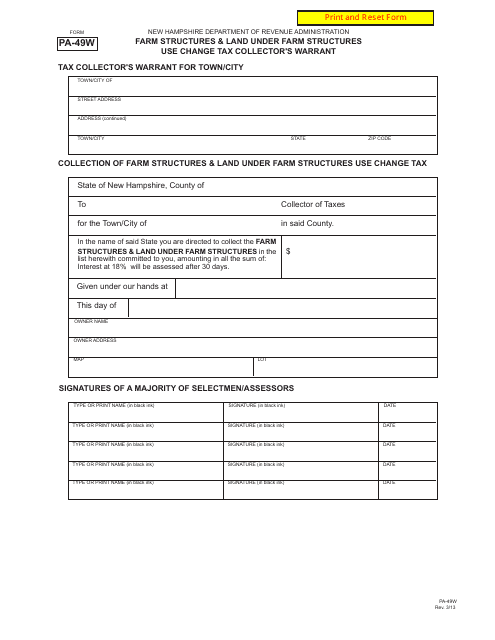

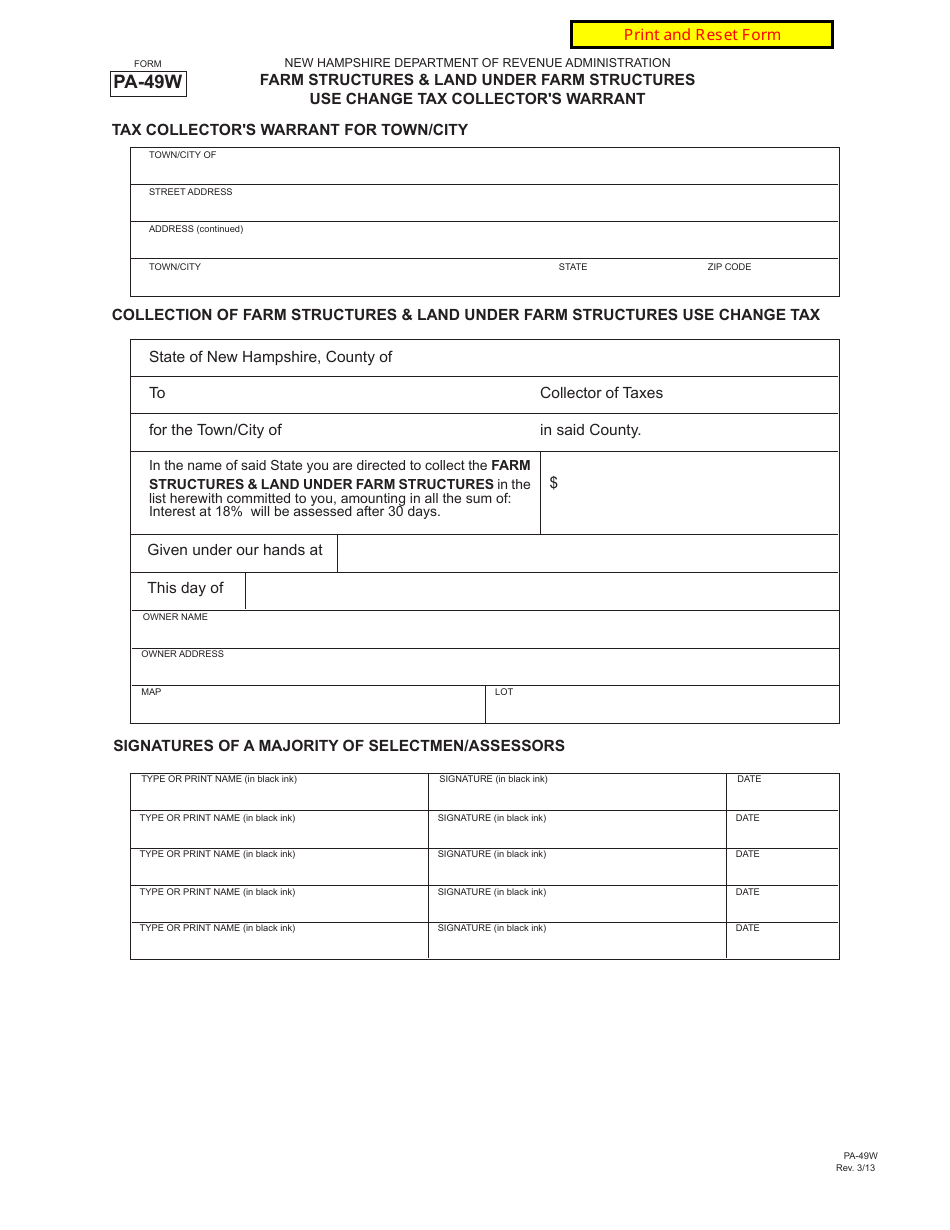

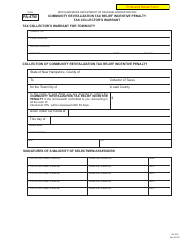

Form PA-49W Farm Structures and Land Under Farm Structures Use Change - Tax Collector's Warrant - New Hampshire

What Is Form PA-49W?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-49W?

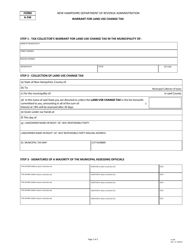

A: Form PA-49W is a tax form called 'Farm Structures and Land Under Farm Structures Use Change - Tax Collector's Warrant'.

Q: What is the purpose of Form PA-49W?

A: The purpose of Form PA-49W is to report changes in the use of farm structures and land under farm structures for tax purposes in New Hampshire.

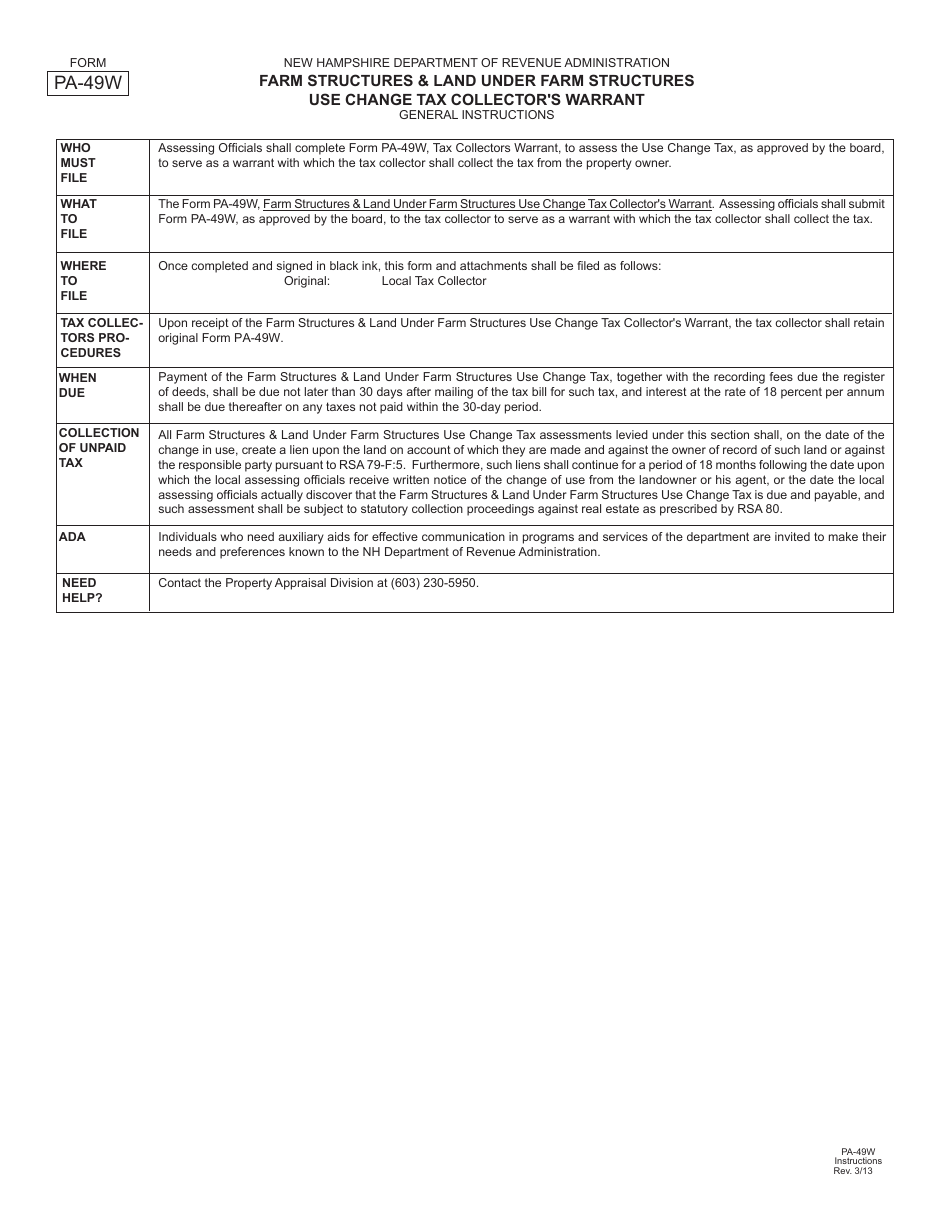

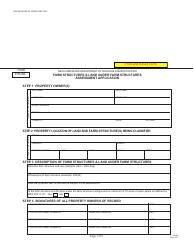

Q: Who needs to file Form PA-49W?

A: Farm owners in New Hampshire who have made changes in the use of their farm structures and land under farm structures need to file Form PA-49W.

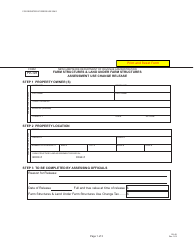

Q: What information is required on Form PA-49W?

A: Form PA-49W requires information such as the owner's name, property location, description of the change in use, and the date of the change.

Q: When is Form PA-49W due?

A: Form PA-49W is due on or before April 15th of the year following the year in which the change in use occurred.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-49W by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.