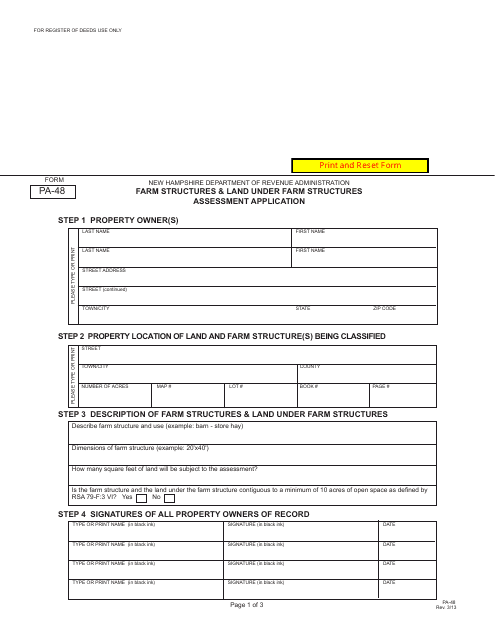

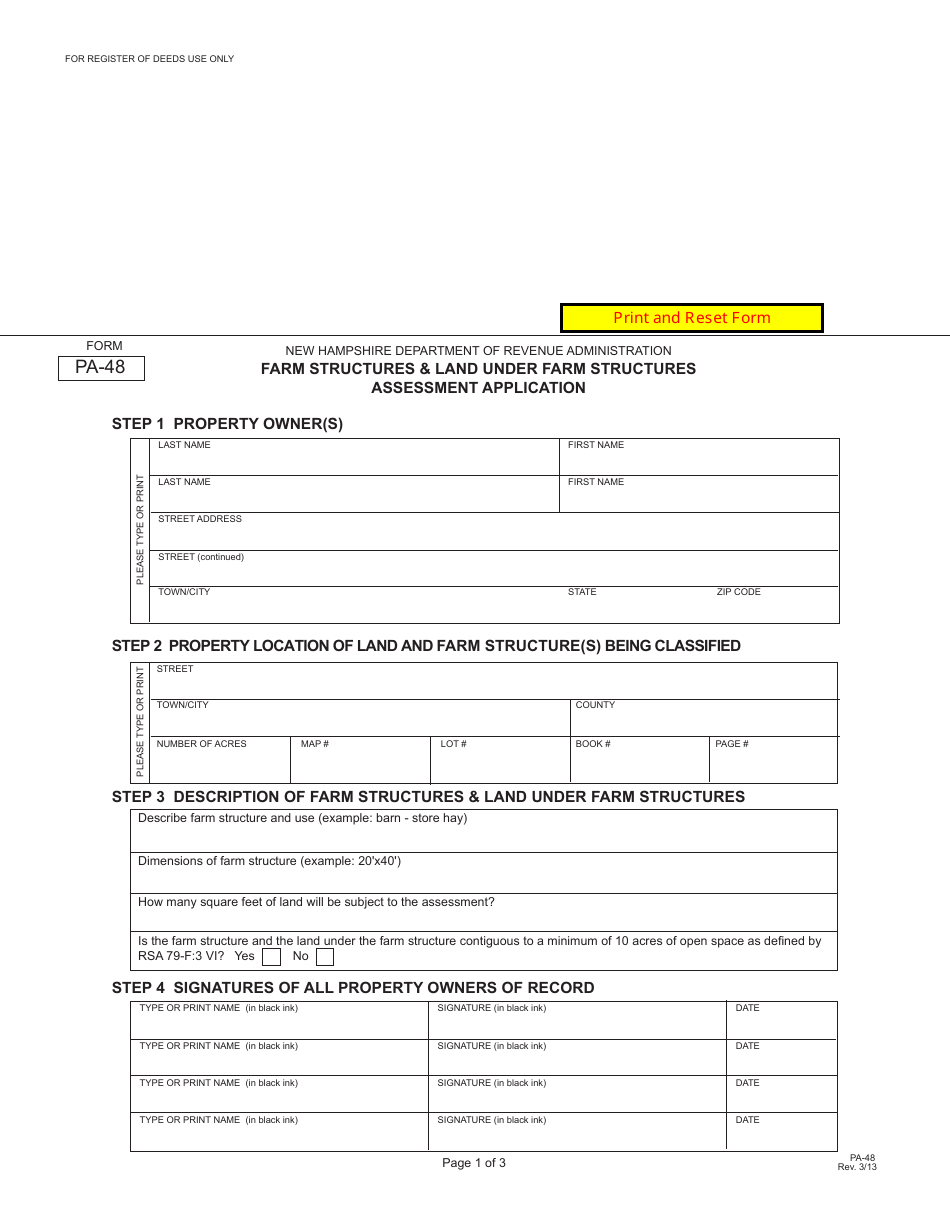

Form PA-48 Farm Structures & Land Under Farm Structures Assessment Application - New Hampshire

What Is Form PA-48?

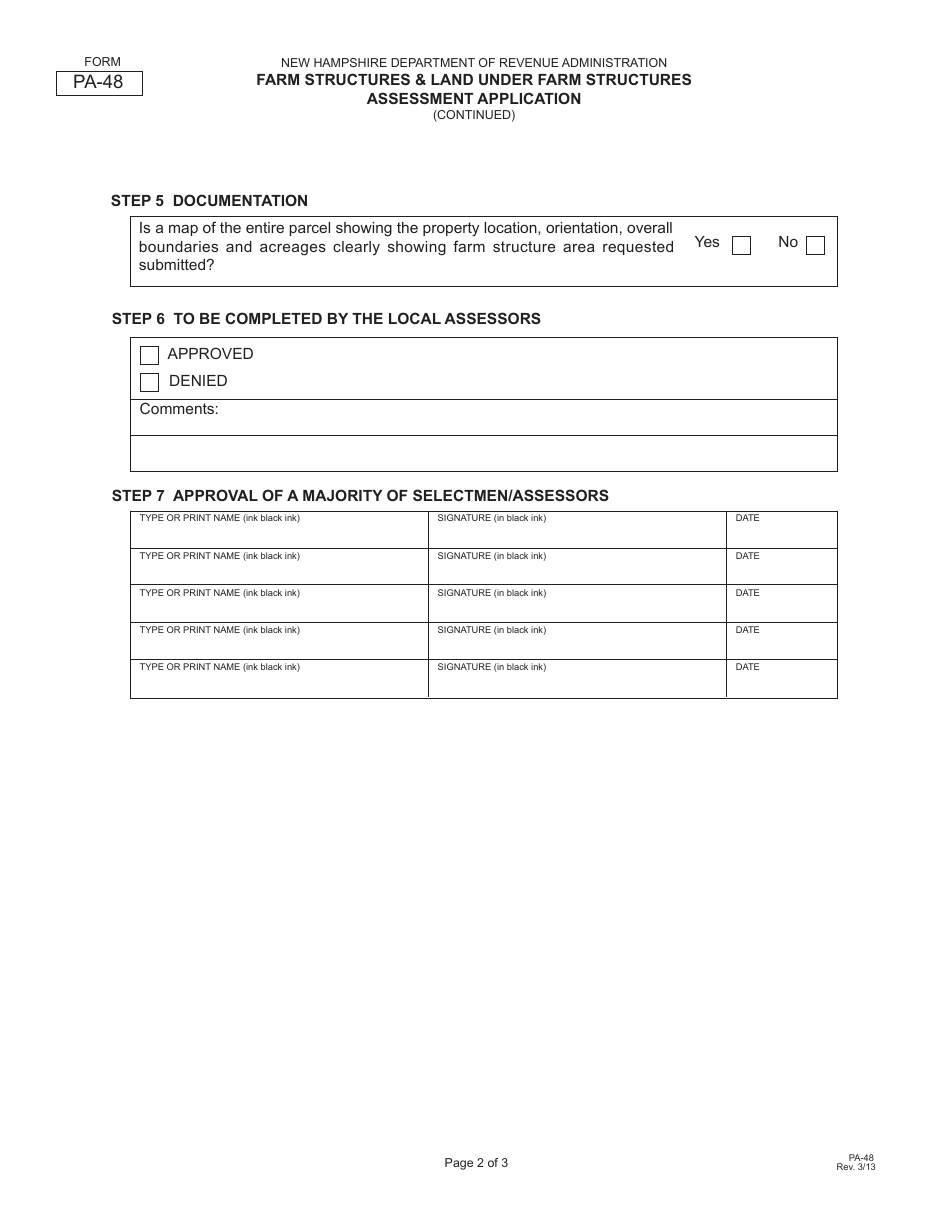

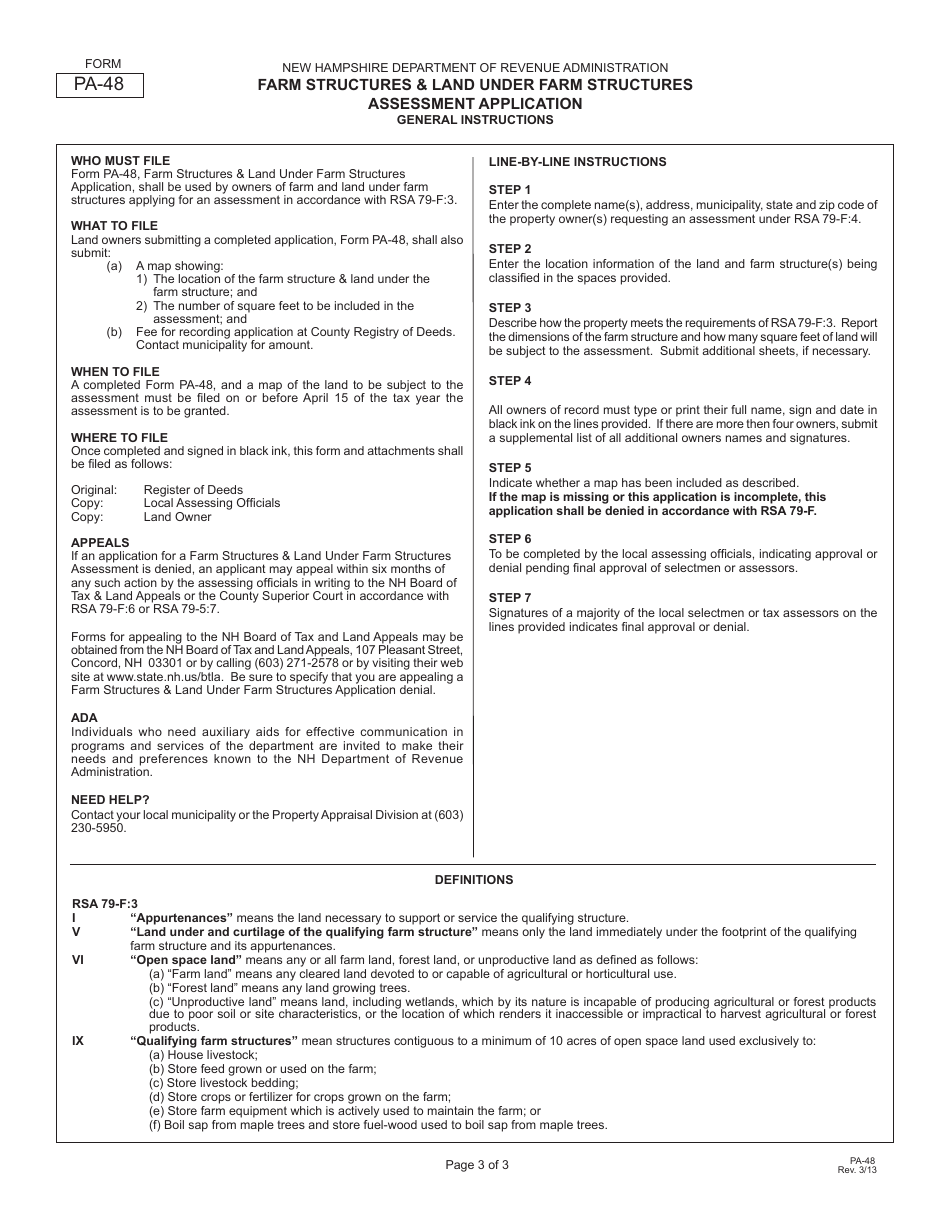

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PA-48?

A: Form PA-48 is the Farm Structures & Land Under Farm Structures Assessment Application in New Hampshire.

Q: What is the purpose of Form PA-48?

A: The purpose of Form PA-48 is to apply for assessment of farm structures and land under farm structures.

Q: Who needs to fill out Form PA-48?

A: Farm owners or operators in New Hampshire who have farm structures and land under farm structures need to fill out Form PA-48.

Q: How can I obtain Form PA-48?

A: You can obtain Form PA-48 from the local assessing officials or the New Hampshire Department of Revenue Administration.

Q: Is Form PA-48 mandatory?

A: Yes, farm owners or operators with farm structures and land under farm structures in New Hampshire are required to fill out Form PA-48.

Q: When is the deadline to submit Form PA-48?

A: The deadline to submit Form PA-48 is April 15th each year.

Q: What information is required on Form PA-48?

A: Form PA-48 requires information such as the farm owner's name, farm location, description of farm structures and land under farm structures, and other relevant details.

Q: Are there any penalties for late submission of Form PA-48?

A: Yes, late submission of Form PA-48 may result in penalties, including loss of the farm structures assessment.

Q: Can I appeal the assessment made on Form PA-48?

A: Yes, if you disagree with the assessment made on Form PA-48, you can appeal to the local board of tax and land appeals.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-48 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.