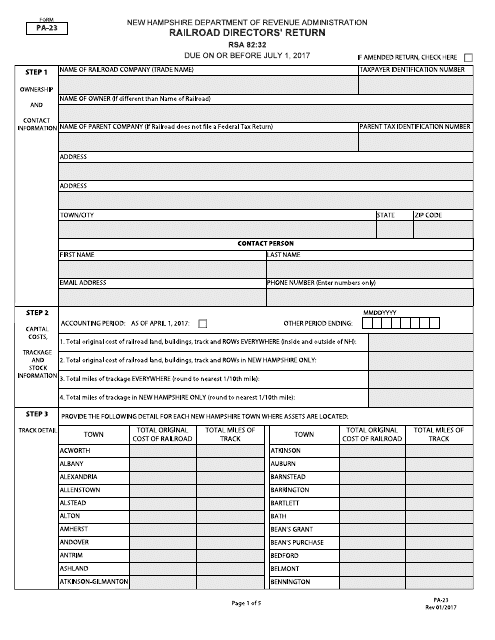

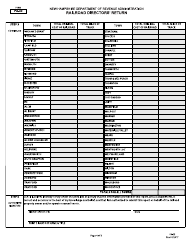

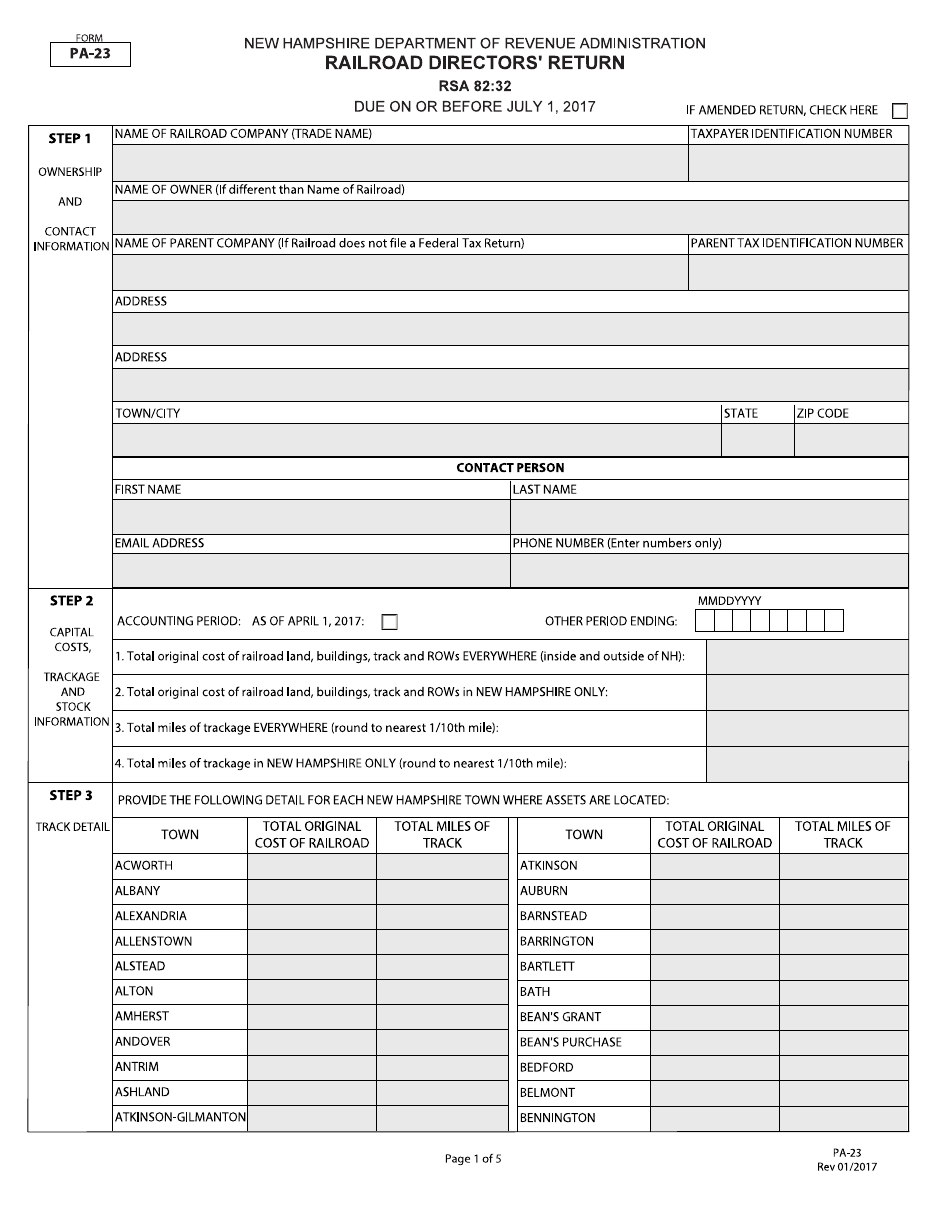

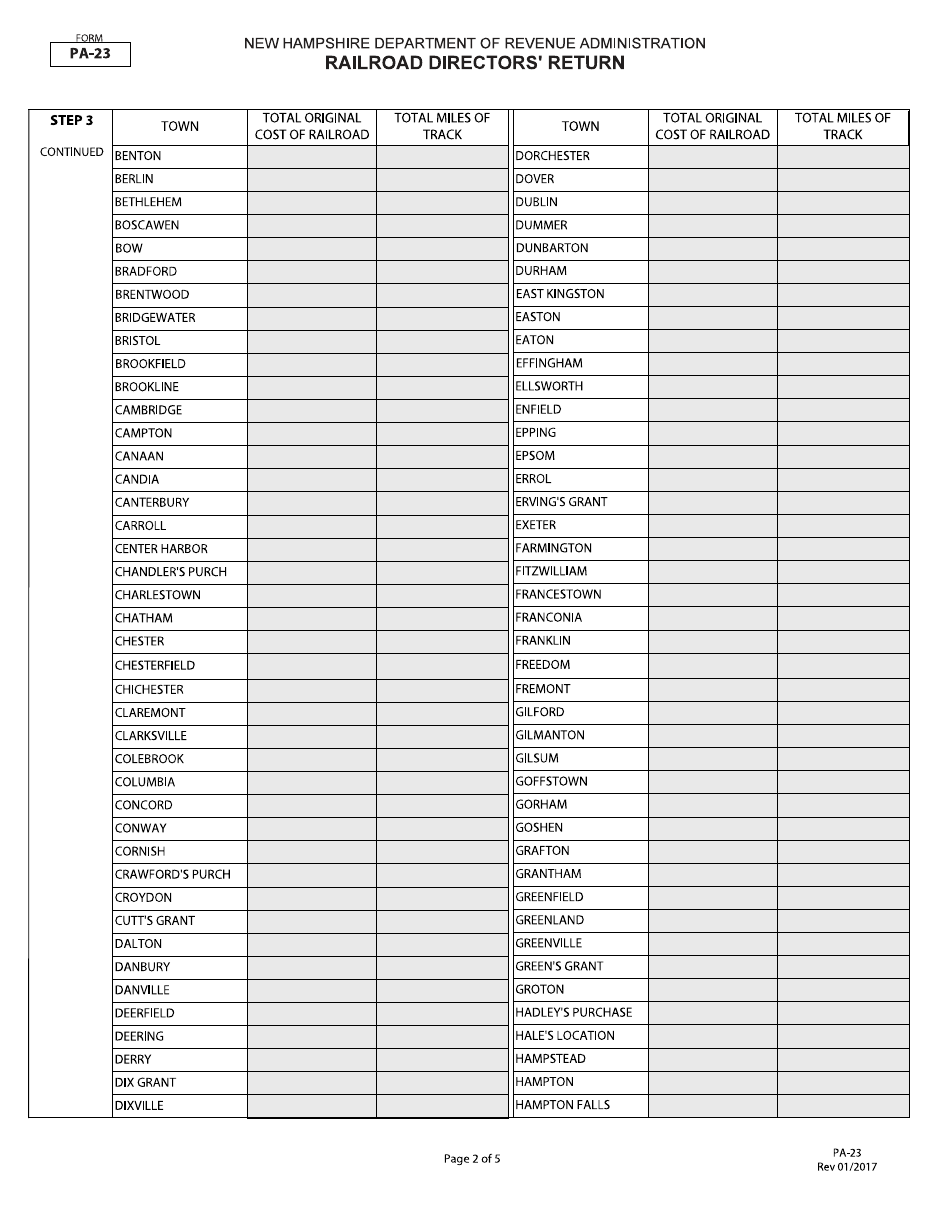

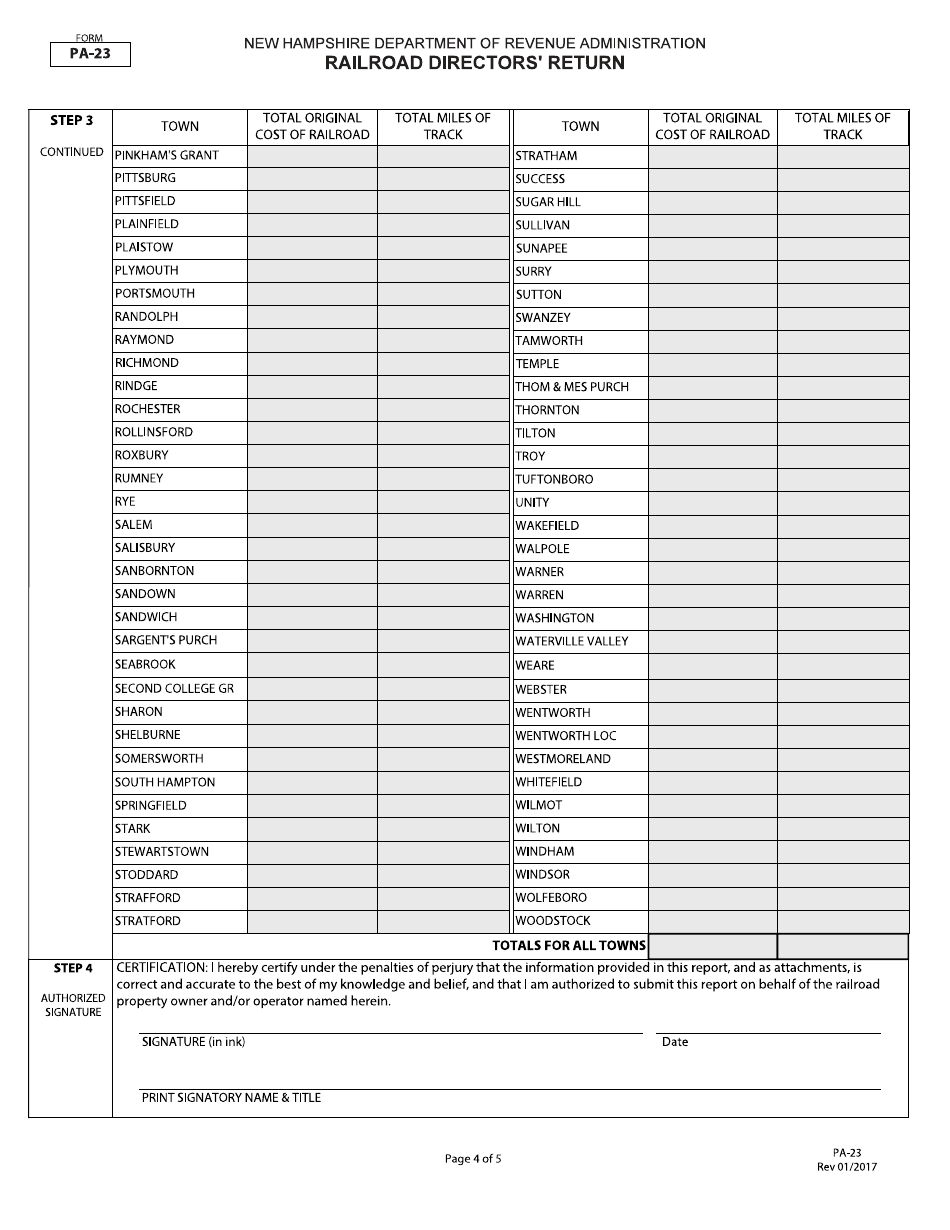

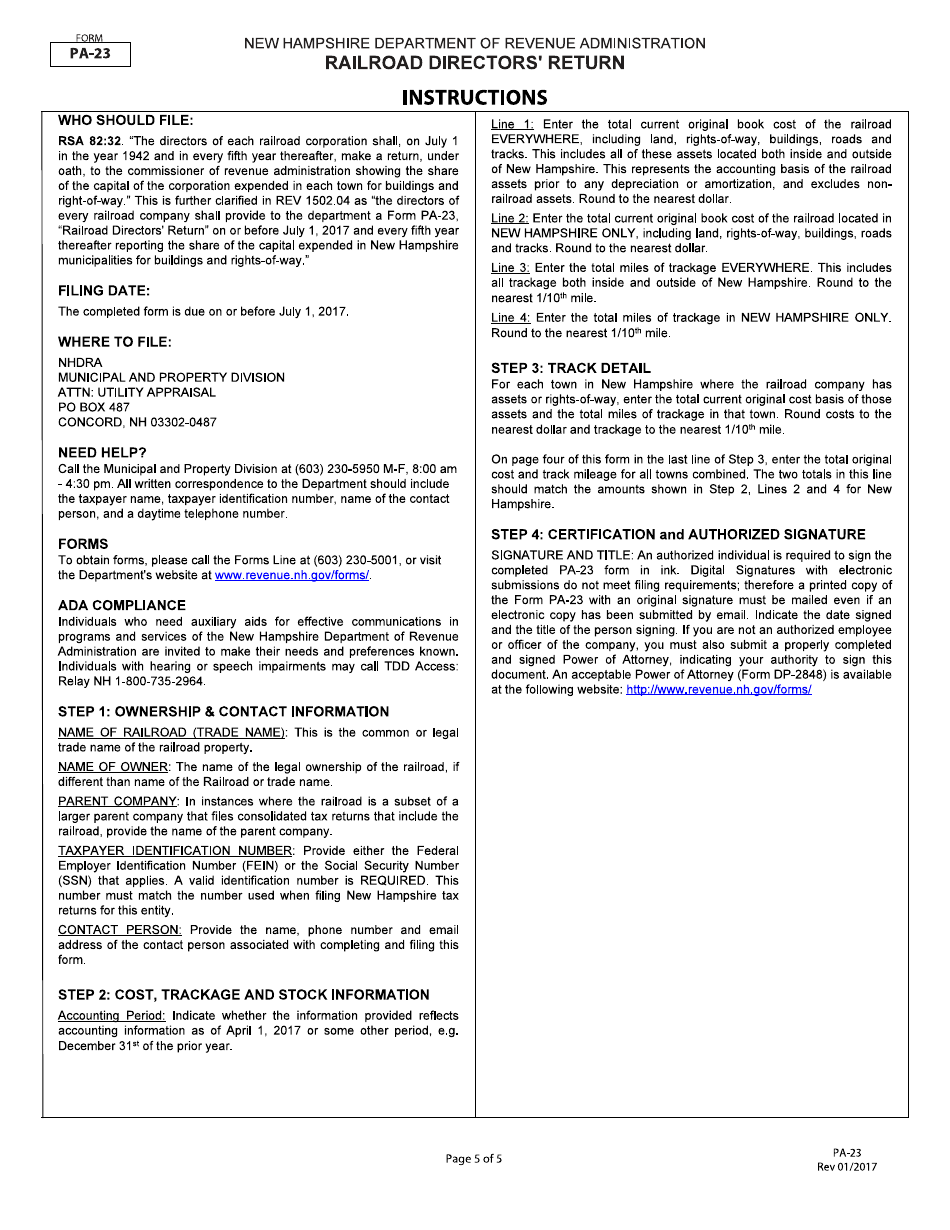

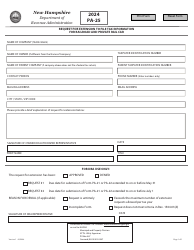

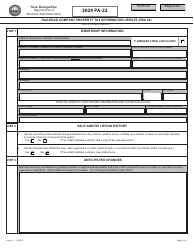

Form PA-23 Railroad Directors' Return - New Hampshire

What Is Form PA-23?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-23?

A: Form PA-23 is the Railroad Directors' Return in New Hampshire.

Q: Who needs to file Form PA-23?

A: Railroad directors in New Hampshire need to file Form PA-23.

Q: What is the purpose of Form PA-23?

A: The purpose of Form PA-23 is to report and pay taxes on railroad property in New Hampshire.

Q: When is the deadline to file Form PA-23?

A: The deadline to file Form PA-23 is usually April 15th.

Q: Are there any penalties for late filing of Form PA-23?

A: Yes, there may be penalties for late filing of Form PA-23, and interest may also be charged on any unpaid taxes.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-23 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.